Zhonghui Bao

Aircraft lessors have been one of my favorite investments as I believe in value retention and the long-term demand for air travel that continues to increase. While I do believe in the long-term strength of aircraft lessors, I feel shares of these specialized financing companies have been underappreciated. Since the last time I wrote about Air Lease Corporation (NYSE:AL), the company’s stock increased 0.8% compared to 0.2% for the broader market. Those are not extremely strong returns but show that Air Lease Corporation is one of the companies that can outperform the market.

In this investor report, I will be analyzing the second quarter results, which I believe continue to portray why a company such as Air Lease Corporation is nice to have in your portfolio.

Air Lease Corporation Shows Strong Growth

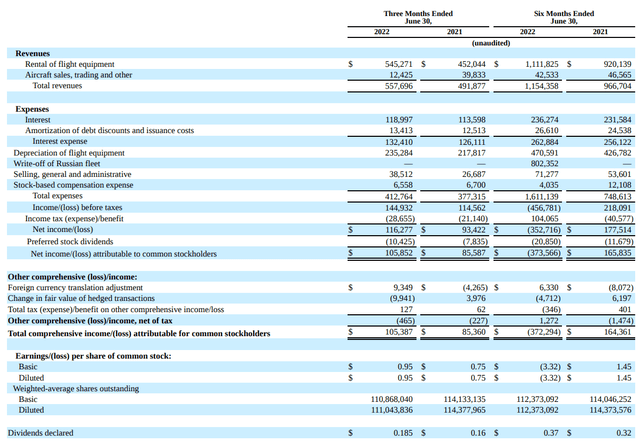

Q2 2022 results Air Lease Corporation (Air Lease Corporation )

During the quarter, Air Lease Corporation reported revenues of $558 million compared to $492 million in the comparable period last year, marking an increase of 13.4% or $65.819 million. The increase in revenue was driven by fleet growth, lower revenues accounted for on cash basis compared to last year offset by termination of the leasing activities in Russia valued $18 per quarter and $34 million in other revenues as Air Lease Corporation sold unsecured claims related to Aeromexico in Q2 2021.

During the quarter, interest expenses increased to $132.4 million as the debt balance increased and interest rates are expected to rise in the future as the debt balance continues growing and interest rates increase. Depreciation of flight equipment also increased as the fleet grew. SG&A increased from $26.7 million to $38.5 million, reflecting higher lease activity, transitions and higher insurance premiums, which, as a result of the situation in Russia, have increased by $16 million on annualized basis. Net income attributable to common stockholders increased slightly over $20 million to $105.4 million or 23%.

The consensus for Q2 2022 was $559.5 million with earnings per share of $0.79. Air Lease Corporation reported $557.7 million in revenues, basically in line with the consensus and $0.95 per share beating the estimates by 20%. So, despite some headwinds on topline and costs, the strength of the recovery in air travel demand was prominent in the Q2 2022 earnings. During the quarter, operating cash flow was $434 million, which is a 70% sequential improvement and 18% compared to last year. For the six months ended, operating cash flow improved 14%, and Air Lease Corporation expects to generate another $1 billion in cash flow in the second half of the year.

Is Air Lease Corporation Stock A Buy?

Air Lease Corporation Airbus aircraft (Airbus)

Previously, I had been a critic of management as they incorrectly assessed the situation in Russia claiming that there was no impairment risk only to walk back on that statement and announced a $802 million impairment. Management really didn’t score points there, but my analysis had already shown the impairment risk, so with me, investors were prepared for that.

Right now, Air Lease Corporation is much more conservative with regard to statements about the insurance claims in connection to Russia and that is a good thing because realistically the situation is so complex that you can not make any definite statements or forecast.

I believe that Air Lease Corporation continues to be a buy as supply chain challenges persist, meaning that Boeing (BA) and Airbus (OTCPK:EADSF) will not be able to support demand. This provides support to aircraft values, lease rates, and appetite for lease extensions, further supported by higher interest rates that make financing of aircraft more expensive for airlines. The current delays at the OEMs also allow Air Lease Corporation to review their scheduled payments for flight equipment and bring these in line with the delivery delays.

Furthermore, deliveries through 2023 are placed for 99%, 60% placed in 2024 and 25% in 2025, with some placements being as far out as five years which certainly shows the strength of the market and demand for the flight equipment that is scheduled to be delivered.

Conclusion: Air Lease Corporation To Benefit From Supply Chain Challenges

I believe that second quarter results were good and the prospect for the remainder of the year are good as well with $1 billion in cash expected to come in. We are seeing that revenue is recovering as more equipment is being leased and there is less headwind from cash accounting on rental revenues and lease restructurings. With the demand-supply imbalance of aircraft to persist in the years to come, Air Lease Corporation will see better value for their aircraft and higher lease rates which will help their business. I believe the full effect of that as well as lease extensions are not reflected in the company’s results. So, I do expect an even stronger future for companies active in the aviation finance sector.

Be the first to comment