Klaus Vedfelt

Thesis

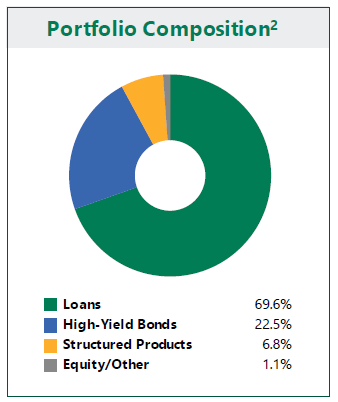

Apollo Tactical Income Fund, Inc. (NYSE:AIF) is a fixed income closed-end fund (“CEF”). The vehicle contains a mix of leveraged loans and high yield bonds with a classic 70% / 30% allocation between the asset classes. As per the fund literature:

Apollo seeks to generate current income and preservation of capital primarily by allocating the Fund’s assets among different types of credit instruments based on absolute and relative value considerations and its analysis of the credit markets. Under normal market conditions the Fund invests at least 80%of its managed assets (which includes leverage) in credit instruments and investments with similar economic characteristics.

Source: Fund Fact Sheet

The fund is on the smaller side with a $180mm AUM and sports a 9.4% yield. The fund is a typical “CLO light” fund, with a 70/30 allocation to leveraged loans and high yield bonds and a high 37% leverage ratio. The leverage ratio is on the high side for the CEF space due to the low volatility that historically has been exposed by the senior secured loan asset class.

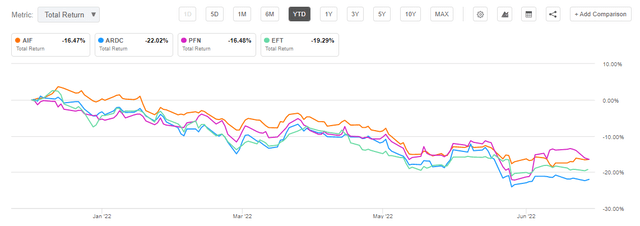

Despite its collateral being at the bottom of the credit spectrum (high concentration of “B” and “CCC” credits, which account for over 70% of the underlying portfolio), the fund has performed well in 2022, being down only -16% on a total return basis this year. This performance exceeds the one exposed by much better known names, such as the Eaton Vance Floating-Rate Income Trust (EFT) or Ares Dynamic Credit Allocation Fund Inc (ARDC).

The main driver for fund performance is composed of credit spreads. Since most of the collateral is floating rate, duration is a secondary factor. Credit spreads are particularly important due to the collateral composition (low rating) and high leverage in the fund. Credit spreads have widened and have breached the “normalized environment” range:

Credit Sprads (the Fed)

While we do not think they will revisit the 2015/2016 or Covid-19 crisis highs, there might be another 100 bps in widening to slowly occur. We feel consumer and institutional balance sheets are in much better shape that in other recessionary instances and actual default rates are not going to tick up that high during this cycle.

AIF is a good, low standard deviation vehicle to play a credit recovery. However we feel the market is not entirely done with wider credit spreads, despite the recent panic we saw in June. We have AIF at Hold for now and are keen to see an end to the interest rate hikes before moving forward with a different signal for this highly leveraged vehicle.

Analytics

AUM: $0.18 billion.

Sharpe Ratio: 0.19 (5Y).

St Deviation: 11.2 (5Y).

Yield: 9.4%.

Expense Ratio: 2.92%.

Premium/Discount to NAV: -12.8%.

Z-Stat: -1.2.

Leverage Ratio: 37%.

Current State of the Leveraged Loan Market

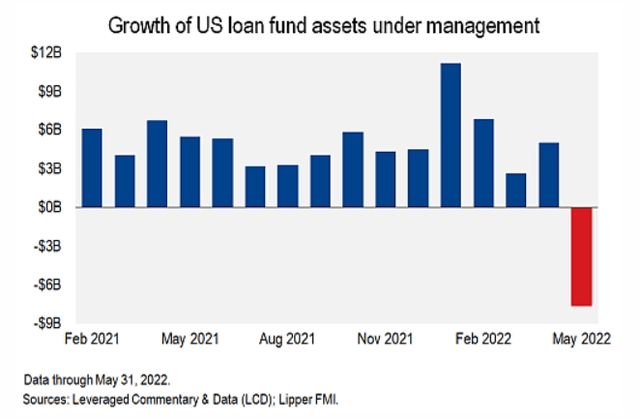

Leveraged loans have started to see significant outflows this year as well, following high yield fixed bonds:

US high yield fund outflows have reached over $33 billion this year, or nearly 10% of HY assets under management at the end of 2021. Leveraged loans, which had inflows for much of the early part of the year, have recently experienced two consecutive weeks of outflows including the largest weekly outflow since March 2020. The Credit Suisse Leveraged Loan Index is down 3.3% and the Bloomberg US High Yield 2% Issuer Capped Index is down 1.8% for the month of May (as of May 25). Year to date (as of May 25), the benchmarks are down 3.2% and 9.8%, respectively.

Source: GS

A visual representation of inflows / outflows below, courtesy of LCD:

However, the rise in risk free rates coupled with wider credit spreads have brought all-in yields in the space above 8%. This signals strong returns ahead, as per GS:

On the heels of the recent sell-off, LL yields incorporating the forward curve are now above 8% for only the fifth time since the 2008-2009 financial crisis. Historically, buying both LL and HY when yields are above 8% has generated strong forward returns.

Source: GS

Holdings

The fund holds a mix of leveraged loans, high yield bonds, and a very small allocation to CLOs:

Portfolio Composition (Fund Fact Sheet)

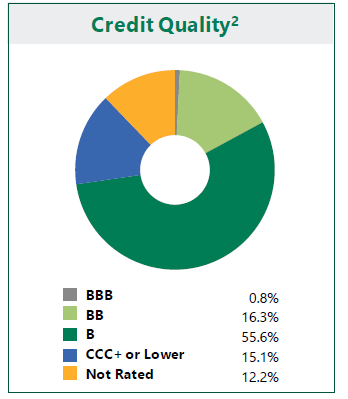

The fund tends to be focused on the lower rungs of the credit spectrum:

Credit Quality (Fund Fact Sheet)

We can see from the above table that most of the exposures sit in the single “B” bucket, while “CCC”s also have a high allocation. With a potential recession upcoming it is not ideal to run such high credit risk.

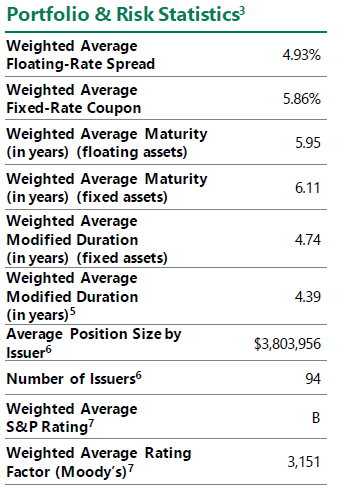

The fund runs a duration close to 5 years and has an average fixed rate coupon profile:

Portfolio Statistics (Fund Fact Sheet)

Performance

The fund is down more than -16% on a total return basis year-to-date, beating some of its more well known peers in the industry:

YTD Performance (Seeking Alpha)

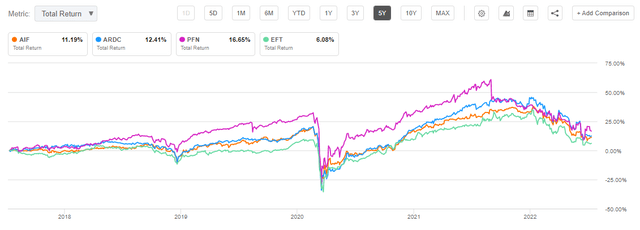

On a 5-year basis the picture is fairly similar with AIF displaying a robust performance:

5-Year Performance (Seeking Alpha)

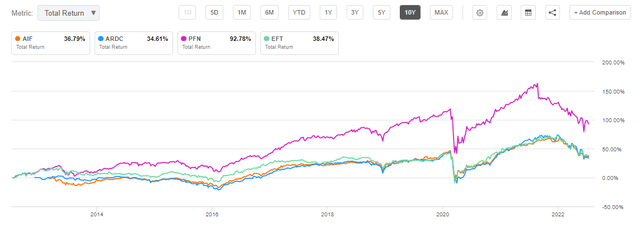

A decade long graph paints a two-cohort picture, with AIF being in line with two other floating rate funds, but underperforming a well known PIMCO fund, Pimco Income Strategy Fund II (PFN) (to be fair, PFN only has a 30% allocation to leveraged loans, hence other risk factors come into play):

10-Y Performance (seeking alpha)

Premium/Discount to NAV

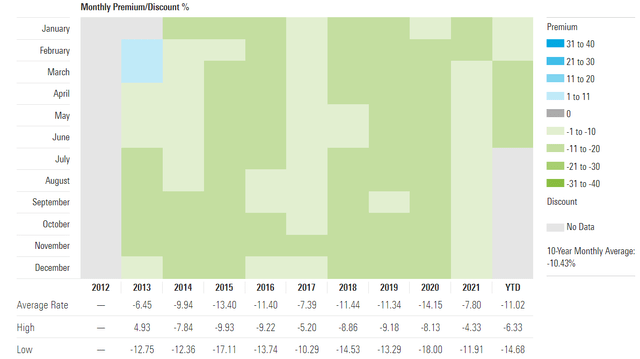

The fund is currently trading at a -12.5% discount to NAV, which is on the wide side from a historic standpoint:

Premium/Discount to NAV (Morningstar)

We can see from the above table sourced from Morningstar that the widest discount to NAV for the fund was recorded in 2020, when the market moved the price to an -18% discount to net asset value.

Conclusion

AIF is a leveraged loan/high yield bond CEF from Apollo. The fund has a high concentration of low rated credits (“B” and “CCC”) and a high leverage ratio of 37%. AIF has performed fairly robustly this year being down only -16% and its discount is close to historic highs at a -12.5% level. We expect the fund to constitute a good play for a recovery in credit, but have it at Hold for now, waiting for the interest rate picture to normalize which should also mark a top in credit spreads, the main risk factor for the fund.

Be the first to comment