Robert vt Hoenderdaal/iStock Editorial via Getty Images

Introduction

Ahold Delhaize (OTCQX:ADRNY) (OTCQX:AHODF) (here after ‘Ahold’) is best known for its grocery chain in The Netherlands, Belgium and the US East Coast but investor easily overlook the company’s very important online exposure. The Ahold-owned website bol.com could easily be seen as “the Amazon of The Netherlands” and the company has been mulling over listing Bol.com as a separate entity and this would likely unlock a lot of hidden value on the balance sheet.

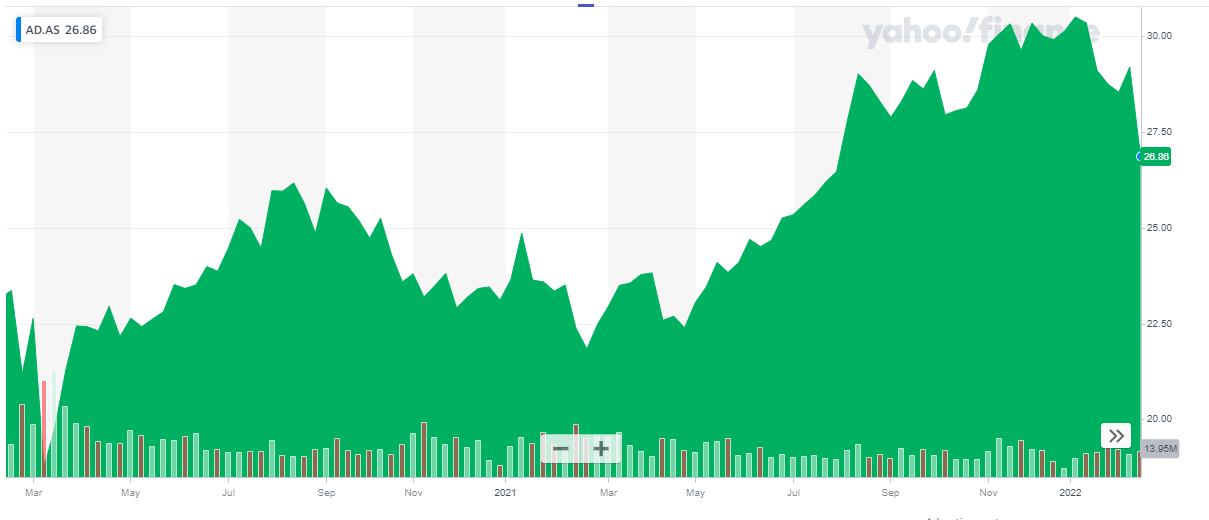

Yahoo Finance

I would strongly recommend to trade in Ahold’s shares on Euronext Amsterdam where the stock is trading with AD as its ticker symbol. With an average daily volume of approximately 3 million shares, the liquidity in Amsterdam is clearly superior to any of the secondary listings, while the Amsterdam listing also offers options which enables a put-writing strategy. The current market capitalization of Ahold is approximately 27B EUR. I will use the EUR as base currency throughout this article.

A strong result in 2021, but the reported free cash flow was hit by non-recurring events

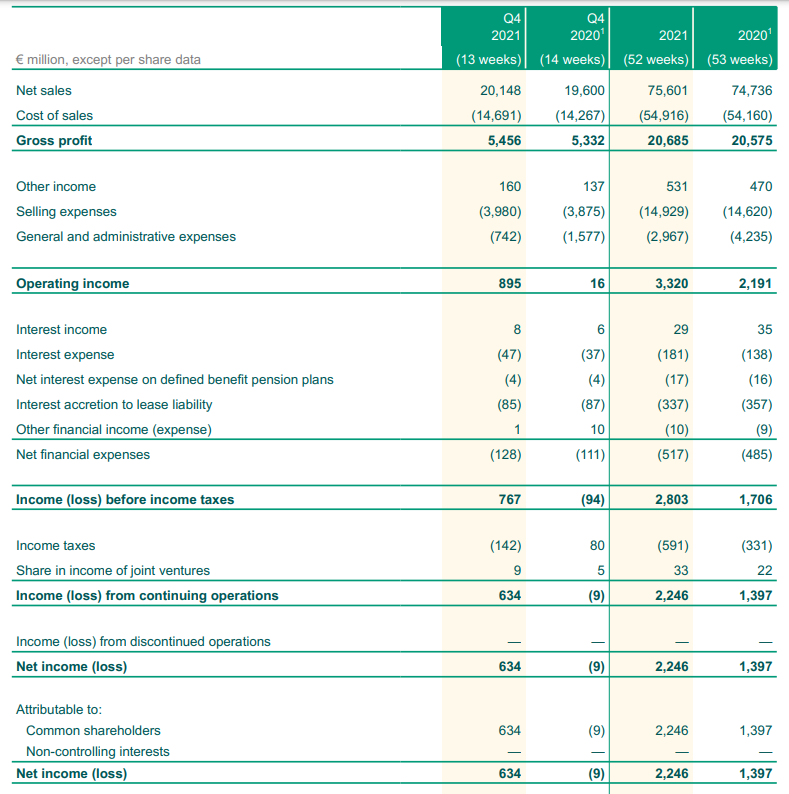

In 2021, Ahold reported a total revenue of 75.6B EUR which is an increase of approximately 1% compared to the financial year 2020 despite FY 2020 containing one additional week. The COGS also increased but Ahold still managed to show a 0.5% increase in its gross profit which isn’t too bad considering the volatility in the grocery chain sector as producers have been hiking prices and Ahold needs to deal with that as well.

The total operating income increased by about 50% but that’s mainly because FY 2020 was hit by non-recurring elements which weighed on the income statement. 2021 wasn’t fully immune to said elements as some of the issues that were recorded on the income statement in 2020 only hit the cash flow statement in 2021, and I will discuss that later in this article.

Ahold Investor Relations

The pre-tax income reported by Ahold Delhaize was 2.8B EUR resulting in a net income of 2.25B EUR for an EPS of 2.18 EUR. Keep in mind the EPS is based on the average share count of 1.03B shares while the current share count has dropped to just about 1B Shares which is about 3% lower. This means that if we would calculate the EPS based on the current amount of shares outstanding, the EPS would likely have been about 2.25 EUR per share.

A good result, but I’m mainly interested to see how much free cash flow the company was able to generate as that’s what will ultimately fund the dividend payment as well as the aggressive share repurchases.

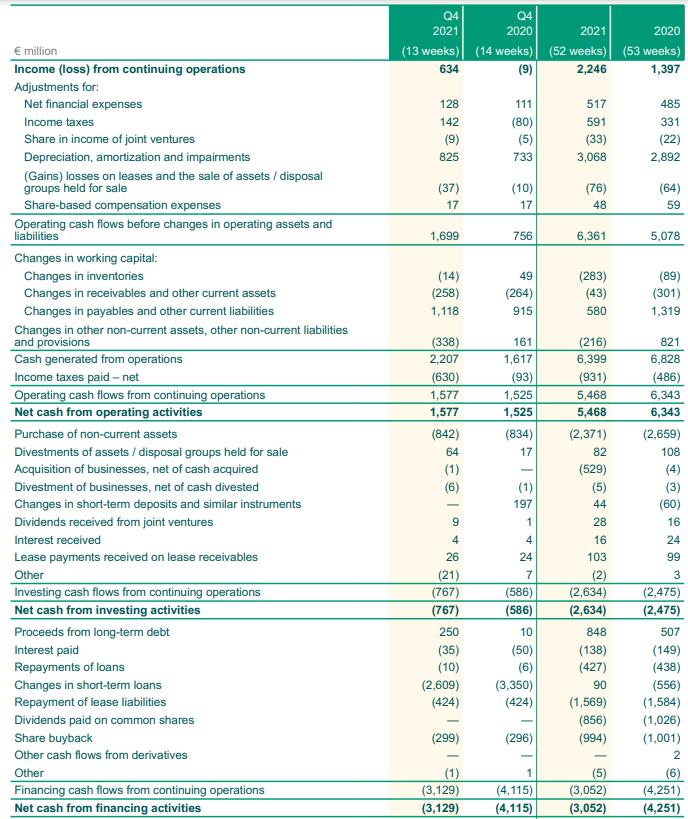

Ahold reported an operating cash flow of 6.36B EUR and roughly 5.8B EUR including the tax payments owed over FY 2021 (which were lower than the tax-related cash outflow). We should also deduct the 138M EUR in interest payments as well as the 1.57B EUR in lease payments. The adjusted operating cash flow was approximately 4.1B EUR.

Ahold Investor Relations

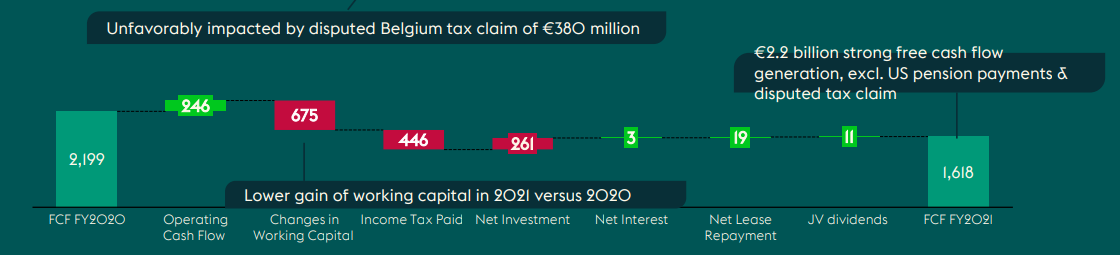

As you can see in the image above, the total capex was approximately 2.37B EUR but the investing cash flows also contain about 147M EUR in lease payments received as well as dividend and interest income. As such, the free cash flow generated in 2021 was approximately 1.9B EUR.

The underlying free cash flow was much stronger as the company’s cash flow statements include about 380M EUR paid in connection with a tax claim in Belgium while there was an additional 170M EUR cash payment spent toward pension liabilities in the US. On an underlying basis, the free cash flow result was approximately 2.2B EUR (and this includes the higher tax payment than what’s actually due over FY 2021).

Ahold Investor Relations

Ahold Delhaize is cautious for 2022

For 2021, Ahold is planning to pay a 0.95 EUR dividend and the company aims to keep the dividend unchanged for the current financial year. There will be additional attention for shareholder rewards as Ahold plans to complete another 1B EUR share buyback program and this should reduce the share count by an additional 3%. This will further enhance the EPS and FCFPS while the dividend payout ratio will decrease as there will be fewer hungry mouths to be fed.

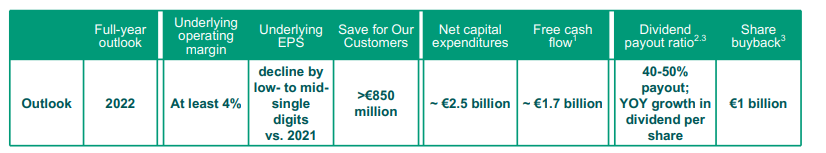

Ahold Delhaize will for sure feel the pain from inflation as well as supply chain issues and has released rather soft guidance for 2022.

Ahold Investor Relations

As you can see in the image above, the company is guiding for a free cash flow result of 1.7B EUR. While that’s slightly better than the reported result of just over 1.6B EUR in 2021, it’s about 20% lower than the underlying free cash flow result in 2021 after filtering out the non-recurring elements (the Belgian tax payment and the pension-related payments).

The ambitions for 2025 are quite positive. The company wants to increase its revenue by 10B EUR per year while it also expects a high single-digit EPS increase compared to 2022. While Ahold hasn’t provided a detailed EPS guidance for 2022, it did say it expects a low to mid single-digit decline compared to the 2.17 EUR EPS in 2021. Assuming the 2022 EPS will come in at 2.05 EUR, a continuous 8% increase (which is my interpretation of a “high single digit increase” would result in a 2025 EPS of 2.58 EUR per share. A portion of the EPS increase will be generated by the company’s activities but we should for sure not underestimate the impact of the large share buyback plans which allow Ahold to buy back about 3% of its share count on an annual basis. So almost half of the EPS increase in 2025 will likely be caused by the share buyback program.

Ahold Investor Relations

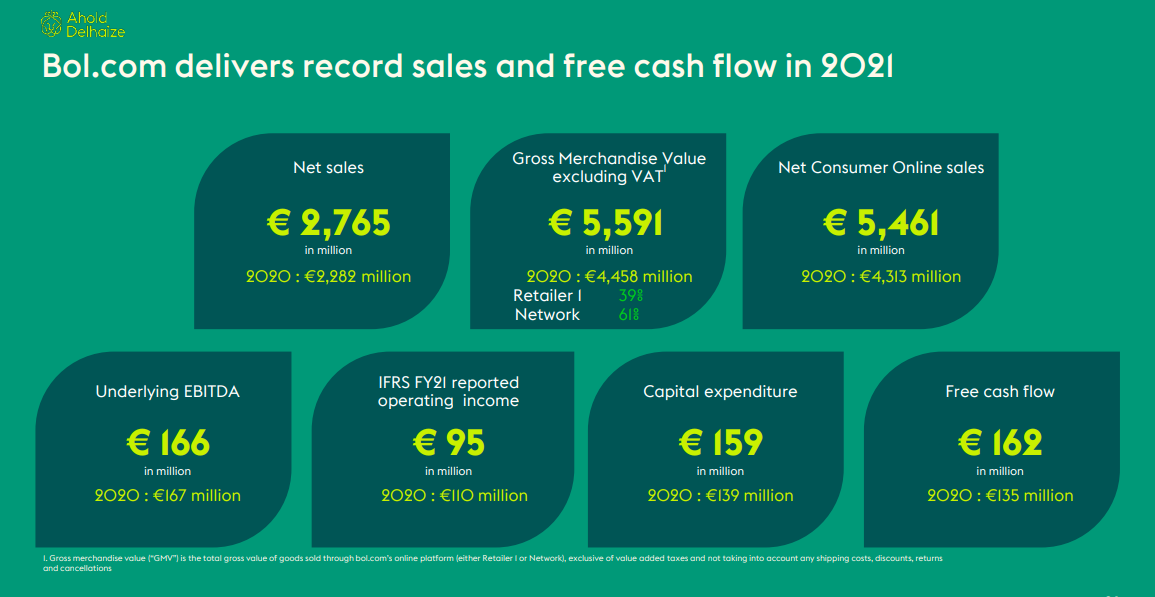

The Ahold balance sheet also contains a lottery ticket. Bol.com is the company’s online platform and it’s comparable to Amazon (which only very recently entered The Netherlands). Bol.com contributed about 162M EUR in free cash flow to Ahold in2021, and the platform continues to grow as several hundreds of new merchant partners were added to the pool and the revenue increased by almost 20%.

Ahold Investor Relations

Investment thesis

I currently don’t have a long position in Ahold as all my written put options expired out of the money in the past two years. While I did make a good return on those options, it means I still don’t own a single share of Ahold but I would like to change that. It’s clear 2022 will be a “difficult” year for the company and although the EPS and free cash flow performance will remain strong, the market may be underwhelmed when it sees a YoY decrease compared to 2021. I think this could create opportunities and I’m planning to write additional put options this year as the recent share price decrease will increase the volatility levels which will have a positive impact on the option premiums. Earlier today, I wrote a P25 for April which resulted in an option premium of 0.47 EUR per share, but I will likely write some more put options in the very near future. 2022 will be a tough year, but it could prove to be an excellent year to start building a position as the underlying free cash flow will remain strong.

Be the first to comment