turk_stock_photographer

REITs have taken a severe beating in recent weeks, and while some mortgage REITs offer high yields that look tempting, this is not the time to be cute and take on outsized risk. To use a baseball analogy, wealth is generated by hitting singles and doubles rather than trying to hit it out of the park every time.

This brings me to Agree Realty (NYSE:NYSE:ADC), which I was cool on the last time that I visited it, when the share price was much higher. Somewhat predictably, ADC, like other net lease REITs, has fallen precipitously in conjunction with rising rates. This article highlights why now is a great time to land this great dividend payer for sound long-term returns, so let’s get started.

Why ADC?

Agree Realty is a net lease REIT that’s been around for over 50 years. Today, along with well recognized retail focused peers Realty Income Corp. (O) and National Retail Properties (NNN), ADC has become one of the premier net lease REITs, with a portfolio of 1,607 properties, located in 48 states covering 33.8 million in gross leasable area.

What sets ADC apart from peers is its very high exposure to investment grade rated tenants, which represent 68% of its portfolio annual base rent. Also, perhaps unbeknownst to some investors, 13% of ADC’s ABR comes from ground leases, which are safer than traditional building leases.

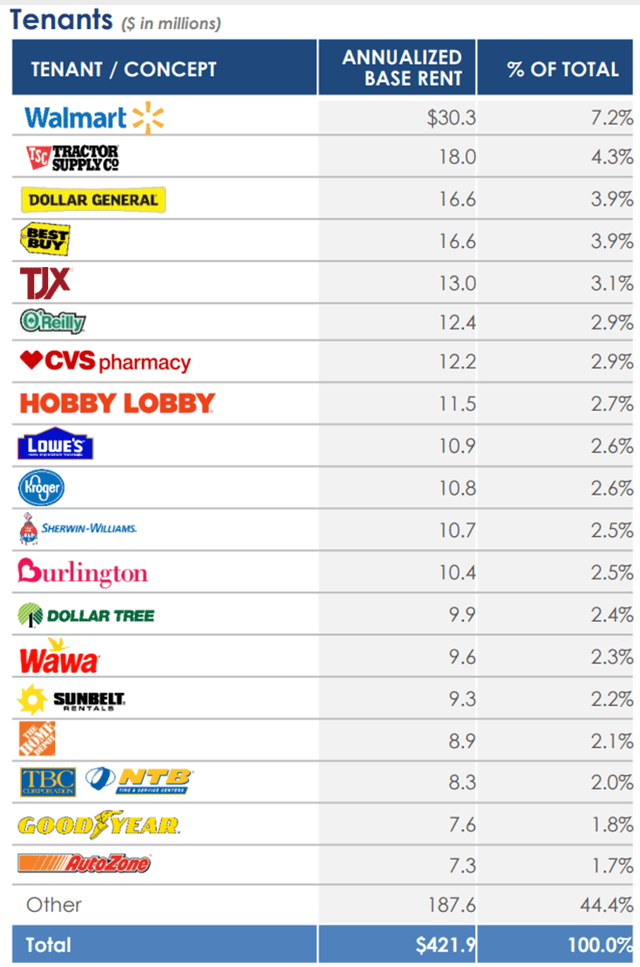

Moreover, while ADC is heavily retail focused, its tenants are rather e-commerce resistant, with focus on tire and auto service, grocery stores, home improvement, convenience stores, off-price retail, and discount stores. These segments combine to make up nearly half (48%) of ADC’s total ABR. As shown below, ADC boasts many familiar names among its top tenant roster.

ADC Top Tenants (Investor Presentation)

ADC is also showing no signs of slowing downs as management recently raised acquisition for 2022 by 7% from $1.5 billion to $1.7 billion. Funding for current year acquisitions appears to be largely settled, as ADC raised a total $991 million from equity sales during the second quarter at much more favorable valuation, and issued an additional $300 million of senior unsecured notes due in 2032 at a very attractive interest rate of 3.76%.

Headwinds to ADC include higher interest rates, which raises ADC’s cost of debt. However, I view ADC as being better positioned than most peers in both the public and private space. This is reflected by ADC’s very strong balance sheet with a proforma net debt to recurring EBITDA of just 3.8x (including the settlement of recent equity proceeds). This puts ADC in a good position to outbid higher leveraged private market buyers. As such, higher rates can actually work in favor of ADC, as management suggested in its recent conference call:

Given our improved cost of equity capital, we are able to invest in even greater spreads and provide additional cash flow accretion. Our superior cost of capital, combined with our fortress balance sheet positions us to pursue many exciting opportunities while levered competitors have exited the market. We are seeing distress amongst owners and developers and are intent on leveraging our strong positioning. While once again raising our acquisition guidance, we are cognizant of the dynamic macro environment and will remain disciplined to our strategy.

Moving on to our Development and Partner Capital Solutions platforms, our team continues to uncover compelling opportunities with a growing pipeline. Cap rate expansion, inflationary pressures and rising construction interest rates have uniquely situated us to deliver projects timely and on budget.

Meanwhile, the recent share price downturn has pushed ADC’s dividend yield up to a more attractive 4.1%. The dividend was recently raised by a robust 7.8%, one of the highest in the net lease sector, and comes with a very safe payout ratio of 72%.

I also find ADC to be attractively priced at $67.58 with a forward P/FFO of 17.3. While this sits just below its normal P/FFO of 17.6 over the past decade, I believe a buy rating is justified considering the accelerating growth that ADC is showing and its very strong balance sheet, putting it in strong position to capitalize on the currently weak real estate market. Sell side analysts have a consensus Buy rating on ADC with an average price target of $81.30, equating to a potential one-year 24% total return including dividends.

Investor Takeaway

In summary, I believe ADC is a very well-positioned net lease REIT that is attractively priced following the recent market sell-off. It has strong investment grade tenancy, e-commerce resistant tenants, and a very solid balance sheet that puts it in good position to take advantage of distressed selling in the currently weak real estate market. As such, I find ADC to be a buy at present for income and growth investors.

Be the first to comment