RiverRockPhotos

Investing in gold is often associated with many misconceptions and emotional biases that prevent many retail investors from the benefits of owning gold during periods of high risk for the monetary system. Moreover, it is not a productive asset and as such investments in gold mining stocks are often avoided on basis of not having significant utility for the economy.

Although the last sentence is true and is the main reason why I don’t like keeping gold or gold miners as part of my portfolio, at present the reasons for having exposure to the precious metal are mounting.

In the following lines, I will quickly reiterate why I have been holding gold for a number of years now and why I recently decided to add exposure to gold mining stocks. In particular, I will expand on why I decided to buy Agnico Eagle Mines Limited (NYSE:AEM) against other more popular choices.

Why Having Exposure To Gold?

Indeed, gold is this shiny pet rock that does not have any real utility for our well-being. However, gold and precious metals as an asset class play an important role during periods of uncertainty and significant changes to the prevailing monetary system.

Most investors tend to think of gold as a safe haven asset that is supposed to protect you from inflation and is inversely related to real interest rates. These are some of the misconceptions about gold that I explained in my thought piece called ‘A Sober Look At Gold‘.

For most of the time, real interest rates have a significant impact on the price of gold, however, during periods of uncertainty and changes to the monetary system gold could significantly reduce overall risk exposure regardless of changes in real interest rates. I talk in detail about all that in my recent analysis called ‘GLD: Hold It For The Right Reasons‘.

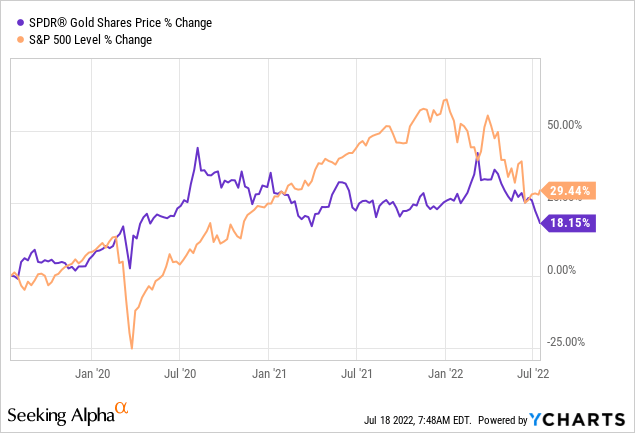

Since my first call for holding gold as an addition to an equity portfolio, the precious metal as measured by the SPDR Gold Trust ETF (GLD) has been an excellent addition to an equity portfolio, returning around 18% in 3 years but more importantly – significantly reducing overall volatility.

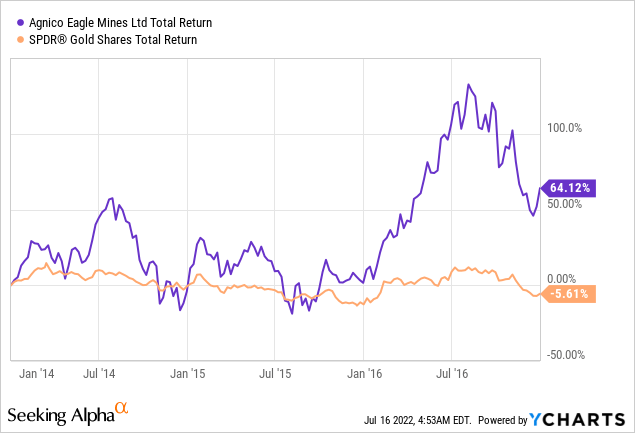

Having said all that, I should mention that throughout the years I have emphasized the advantages of either owning physical gold or investing through ETFs that track the price of the precious metal. In that regard, owning gold mining stocks resulted in lower diversification of the overall strategy due to the equity risk premium and other idiosyncratic risks associated with selecting individual mining companies.

At the same time, gold miners could significantly increase returns during relatively short periods of time. This, however, involves the aforementioned additional risks and as such I see such strategy as a more speculative one when compared to having direct exposure to gold.

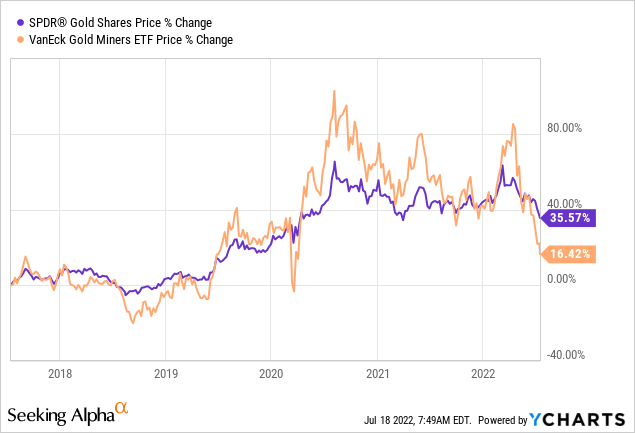

All that is clearly illustrated in the graph below, where GLD has outperformed the VanEck Vectors Gold Miners ETF (GDX) over the past 5-year period. However, the latter has achieved much higher returns during short periods of time when price of the precious metal was experiencing tailwinds.

It’s All About Free Cash Flow

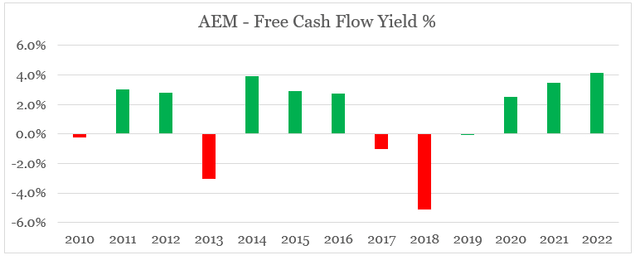

Since 2010, AEM has rarely traded on a free cash flow yield of above 4%. On a year-end basis, the company now trades at its highest yield in more than a decade.

prepared by the author, using data from SEC Filings

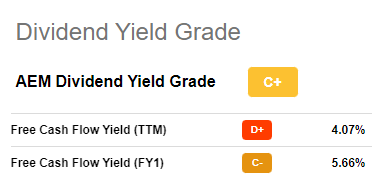

The calculation above, however, does not fully account for the recent merger with Kirkland Lake Gold, which will provide a significant tailwind for AEM free cash flow in 2022. Therefore, on a forward basis, the company trades on a free cash flow yield as high as 5.7%.

Seeking Alpha

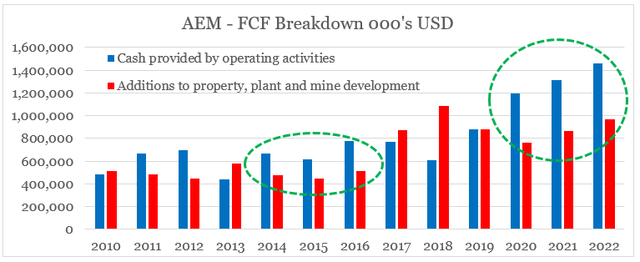

If we breakdown the free cash flow, we will notice that it has been primarily driven by higher cash flow from operations (see below). The last time that this occurred was during the 2014-16 period.

prepared by the author, using data from SEC Filings

Although it was a relatively long period, from 2014 to 2016 AEM significantly outperformed the GLD.

What About Costs?

As we saw above the 2014-16 period was a good time to hold high quality gold mining stocks, such as AEM. The strong performance in 2016, however, was not driven by their high free cash flow yield that we saw above, but rather due the increase in the price of gold accompanied by falling energy prices. The high free cash flow yield that was observed for most the period served as a margin of safety for AEM shareholders.

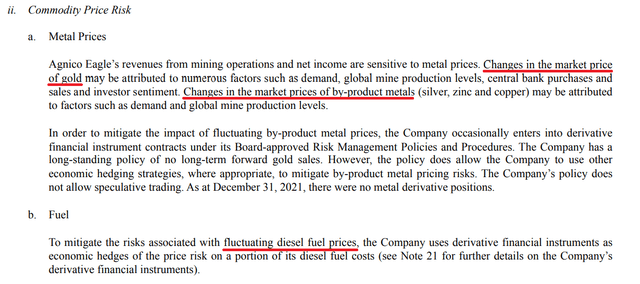

Although there are many costs involved in gold mining, the cost of energy (dies fuel in particular) is by far the largest component of cost of goods sold.

Agnico Eagle Mines Annual Report

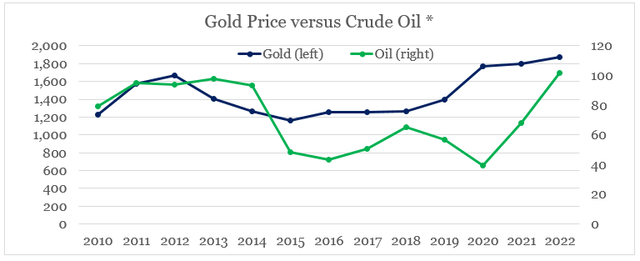

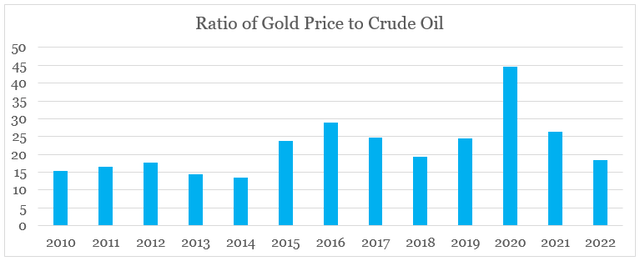

Therefore, the ratio of gold price to crude oil would be a reasonable assumption for the outside commodity risk for gold miners.

prepared by the author, using data from macrotrends.net

* average closing price for the year

As we see above, during 2015-16 period the ratio increased significantly and thus provided a major tailwind for Agnico (see below).

prepared by the author, using data from macrotrends.net

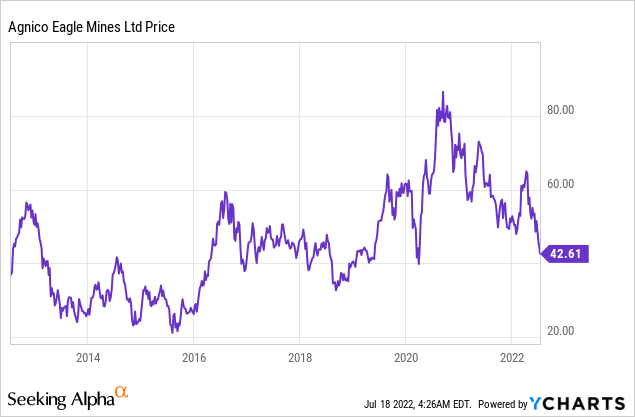

In a similar fashion, during 2020 the sharp fall in crude oil was accompanied by raising gold prices, which resulted in AEM reaching new all-time highs.

In hindsight, these highs in AEM share price were unsustainable as oil was witnessing temporary demand shock, which resulted in extreme pricing reaction. That is why, even as the price of gold remains elevated at present, the skyrocketing energy costs are bringing all gold miners to multi-year lows.

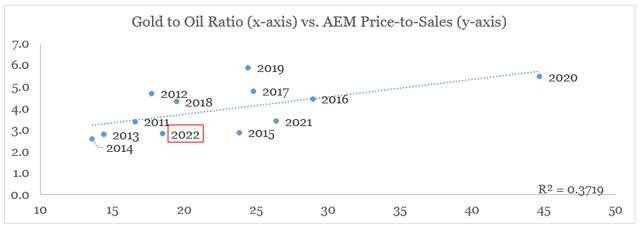

This could be clearly illustrated by plotting the gold to oil ratio on the x-axis and AEM Price-to-Sales multiple on the y-axis (see the graph below).

prepared by the author, using data from SEC Filings, Seeking Alpha and macrotrends.net

Based on that relationship, both 2019 and 2020 valuation multiples of AEM seemed to be pricing in a prolonged period of elevated gold to oil ratio, which although possible remains highly unlikely scenario. Therefore, investors were buying the company (and other gold miners) on too optimistic assumptions about the future being priced in.

Having said that, the sales multiple of AEM now reflects the opposite scenario of gold to oil ratio continuing to fall from its already decade lows. Once again, this is certainly a possibility, but not the most probable outcome.

Why Agnico Eagle Mines?

The main objective when selecting AEM as the go-to investment to take advantage of the trends described above was reducing overall risk-exposure. Although certain high-risk junior miners will deliver by far the highest returns in an event of gold to oil ratio increasing, the risk of potential losses is very high.

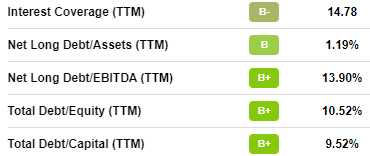

On the other hand AEM offers significant margin of safety due to a number of factors. Firstly, the company’s financial health profile is in very good condition.

Seeking Alpha

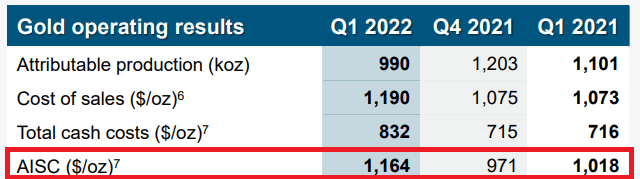

Secondly, Agnico’s all-in sustaining costs (AISC) remain low, even after taking into account the elevated commodity prices.

AISC per ounce in the first quarter of 2022 were $1,079, compared to $1,007 in the prior year period. AISC per ounce in the first quarter of 2022 increased when compared to the prior-year period primarily due to higher total cash costs per ounce, partially offset by lower sustaining capital expenditures.

Source: AEM Q1 2022 Earnings Release

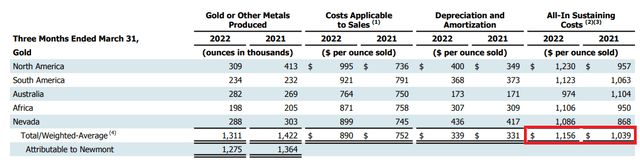

For the first quarter of 2022, AEM’s AISC are significantly lower when compared to other large gold miners, such as Barrick Gold (GOLD) and Newmont (NEM).

Barrick Gold Investor Presentation Newmont 10-Q SEC Filing

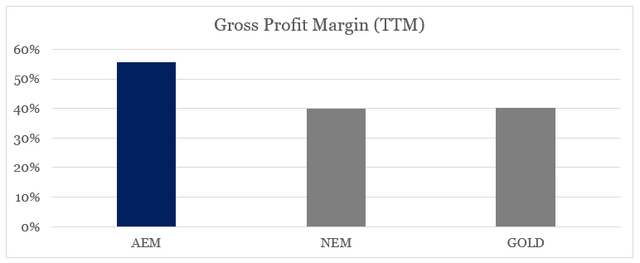

Not surprisingly, AEM also has by far the highest gross profit margin from the three large gold miners mentioned so far.

prepared by the author, using data from Seeking Alpha

In addition, the recent merger with Kirkland Lake Gold will result in significant synergies which will provide a tailwind for AEM’s operating margins, allowing it to reduce the share of fixed costs.

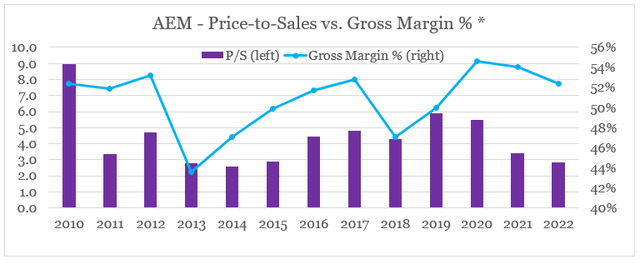

On a historical basis, AEM also trades significantly lower to what its current gross margins would suggest, resulting in a wide gap between the P/S multiple and margins.

prepared by the author, using data from SEC Filings

* 2022 gross margin based on last twelve months

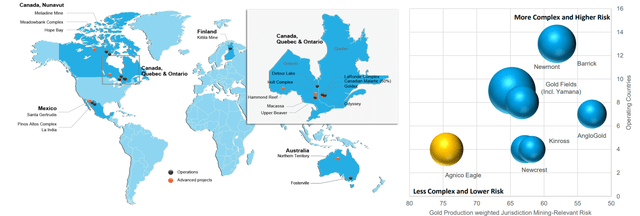

Last but not least, AEM offers high quality mine portfolio in low risk destinations, such as Canada, Australia, Mexico and Finland.

Agnico Eagle Mines Investor Presentation

During periods of reduced market liquidity, strong U.S. dollar and high risk of global recession, jurisdiction risk matters a great deal. All that will likely lead to more sovereign defaults in the near future which puts mining assets in those jurisdictions at risk.

Conclusion

Adding exposure to gold mining stocks significantly increases the risk-reward ratio and puts more pressure on getting the timing right. Although I remain a proponent of a more direct exposure to the precious metal, recent developments have made certain gold miners attractive investments in the short to medium term. Agnico Eagle Mines offers high quality mine portfolio in low risk jurisdictions alongside being a low cost producer with significant margin of safety based on its current valuation multiples and margins.

Be the first to comment