tracielouise

The Q2 Earnings Season kicked off with a whimper, with Newmont (NEM) raising its cost guidance and increasing upfront capex estimates at two major projects. Fortunately, for the sector, Agnico Eagle (NYSE:AEM) has swooped in with a large beat, reporting record production, industry-leading margins and strong cost controls, and strong mid-year reserve growth from its Detour Lake Mine. This has placed the company well on track to meet guidance, and the continued exploration success combined with a strong pipeline point to a very bright future. So, with the stock trading at one of its cheapest valuations in years, I see the stock as a Strong Buy below $42.00 per share.

Detour Lake Mine (Company Presentation)

Just over two months ago, I wrote on Agnico Eagle, noting that the stock was very attractively priced and that the pullback in the stock near its 52-week lows at $50.00 was a gift. In hindsight, this view that the stock was a Buy was brutally early and a terrible call. And in my opinion, whether “right” on the fundamentals or not, being brutally early is just as bad as being wrong. That said, my conviction regarding my thesis that this is the best producer to own in the current environment is even higher today than it was in June, reinforced by the company’s exceptional results despite a challenging first half for much of its peer group. Let’s take a closer look below:

Agnico Eagle Operations (Company Video)

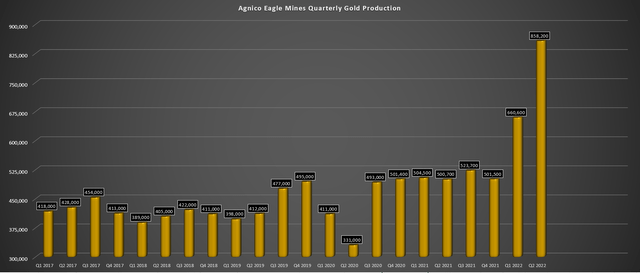

Q2 Production

Beginning with production, Agnico had a record quarter on a consolidated basis, helped by adding three world-class operations to its portfolio from its recently closed merger. These three assets combined for more than 340,000 ounces in Q2, pushing Agnico’s consolidated production to ~858,200 ounces (~1.52 million ounces year-to-date). However, even on an organic basis (ex-Kirkland contribution), Agnico’s legacy mines performed just as impressively given the continued headwinds (labor tightness, supply chain headwinds). This was evidenced by a record quarter from Amaruq for production (Meadowbank: ~96,700 ounces), a quarterly record for mill throughput at Kittila, and strong production (~87,200 ounces) & exciting exploration results from Malartic.

Agnico Eagle – Quarterly Gold Production (Company Filings, Author’s Chart)

After subtracting out the ~342,000 ounces contributed from Kirkland Lake’s operations (now under Agnico Eagle following the merger), Agnico’s production was up approximately 3% to ~516,000 ounces. This was helped by higher production at Goldex (improved productivity and grades), Meadowbank (higher throughput and grades), Meliadine (higher throughput), and Kittila (record throughput of 556,000 tonnes). When combined with higher grades, the Finnish asset enjoyed a record quarter with production of ~64,800 ounces, beating its prior record of ~63,200 ounces achieved in Q3 2021. Finally, La India was up against easy year-over-year comps due to low local water availability in Q2 2021, providing a further boost to quarterly production.

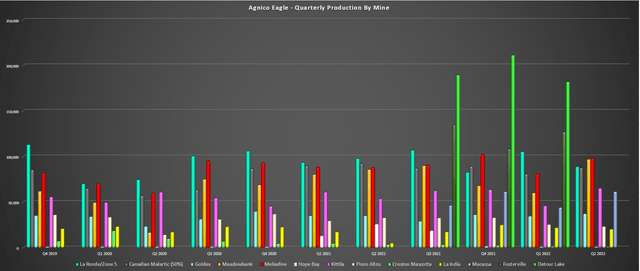

Agnico Eagle – Quarterly Production by Mine (Company Filings, Author’s Chart)

Moving over to the new mines in the portfolio, Macassa rebounded strongly in Q2 to produce ~61,200 ounces at cash costs of $582/oz, helped by strong grades of 22.02 grams per tonne of gold. This asset continues to have a very bright future, with the mine now benefiting from improved ventilation (connection of #4 Shaft) with the commissioning of Shaft #4 expected by year-end. The completion of this project will increase hoisting capacity to 4,000 tonnes per day and contribute to much lower unit costs.

However, this asset’s future is even more exciting given the addition of Amalgamated Kirkland (AK – a previously orphaned deposit), which could contribute 40,000 ounces per annum beginning in 2024 to the production profile with the underground ramp from Macassa extended by 615 meters. Assuming this is the case, this should be able to support a 375,000+ ounce production profile at sub $500/oz cash costs post-2024, nearly 80% above the FY 021 production rate (~210,200 ounces). To date, drill highlights at AK have been encouraging, evidenced by the following intercepts from shallow drilling that can’t be reached from the under round ramp:

- 6.7 meters of 6.9 grams per tonne gold (138-meter depth)

- 6.0 meters at 5.9 grams per tonne gold (147-meter depth)

- 9.2 meters at 9.0 grams per tonne gold (171-meter depth)

- 7.7 meters at 6.0 grams per tonne gold (125-meter depth)

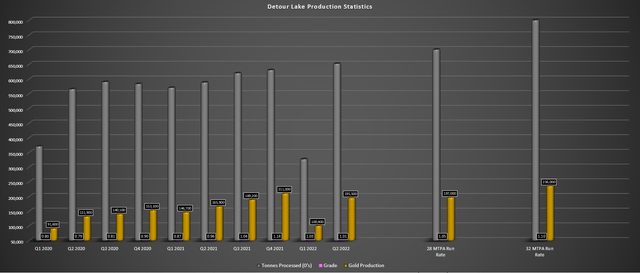

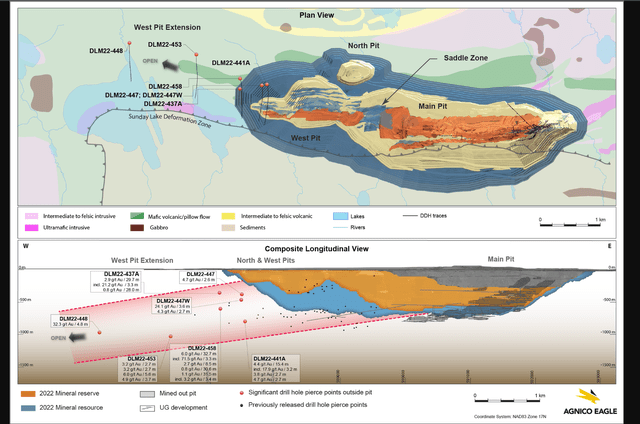

Moving over to Detour Lake, Agnico had a solid quarter, reporting quarterly production of ~195,500 ounces, with ~6.52 million tonnes processed at an average grade of 1.01 grams per tonne gold. However, in addition to the strong operating results, there were several other pieces of exciting news. These were as follows:

- mentions of 1.0 million-ounce per annum production potential long-term

- a 38% increase in mineral reserves to 20.4 million ounces

- continued exploration success outside of current reserves and resources

Detour Lake – Operating Metrics (Company Filings, Author’s Chart)

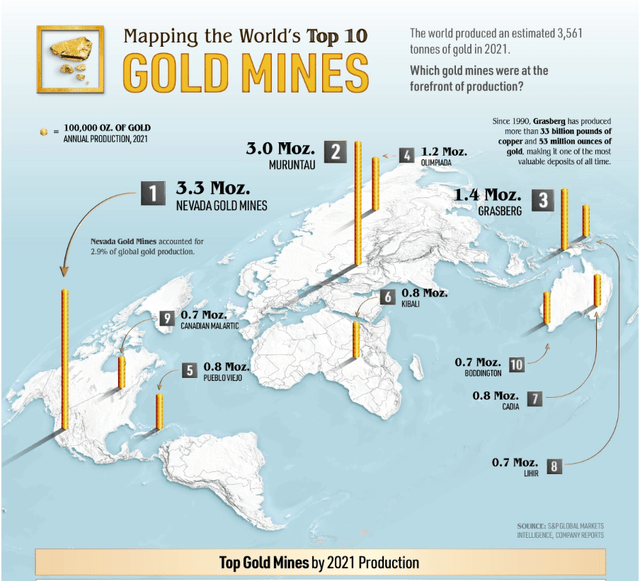

In terms of the 1.0 million-ounce per annum production potential, Detour is currently operating at ~27 million tonnes per annum but is permitted to operate at 32.8 million tonnes. At this higher throughput rate, which is being explored, and with the addition of higher-grade underground material, this could be a 1.0 million-ounce per annum producer at a feed grade of 1.05 grams per tonne of gold and a ~92% recovery rate. This is a later-in-the-decade opportunity, but this would translate to more than 30% production growth from current levels and make Detour a top-10 producer globally and a top-3 in Tier-1 jurisdictions (ahead of Cadia, Boddington, and Canadian Malartic, and just behind the Carlin Complex).

Top Mines by Production (Visual Capitalist)

From a reserve standpoint, reserves now stand at 20.4 million ounces of gold, and the mine life has been extended to 2052, with 1.8 million ounces added between 2032-2042 and 3.0 million ounces added between 2043-2052. However, there are 16 million ounces of gold outside of reserves. This suggests the opportunity to increase the mine life even further and also fill in gaps within the mine life to boost the production profile from the current average of ~730,000 ounces (2023 through 2031). There’s also the potential to boost the 2032-2042 production profile.

The assumed mill throughput across the mine life is based on only processing 28 million tonnes per annum (15% below permitted capacity), suggesting meaningful upside to this production profile. In addition, this mine plan does not include looking at the underground potential where there are much higher grades to augment feed grades, nor does it look at exploration upside on the property, which continues to beat expectations. In fact, regional exploration drilling in the West Pit Extension hit 32.3 grams per tonne over 4.8 meters at 955 meters depth, 2.7 meters at 3.2 grams per tonne gold at 592 meters depth, and 5.6 meters at 6.0 grams per tonne gold at 940 meters depth.

Detour Lake Exploration Map (Company Presentation)

While not nearly as thick as traditional intercepts from the Main Pit, Saddle Zone, and West Pit, these are a big deal. This is because they suggest a further regional potential west of what’s already one of the world’s largest gold mines. It’s still early days, and a few solid high-grade holes do not confirm a new major deposit, but this is certainly very encouraging. Meanwhile, closer to current resources in the West Pit zone to the west of the resource pit, Agnico intercepted 15.4 meters of 4.4 grams per tonne gold, 2.7 meters of 3.8 grams per tonne gold, and 3.6 meters of 24.1 grams per tonne gold. Overall, this looks to be a deposit that will keep on giving for decades to come, and the fact that Agnico is thinking big with “1.0 million-ounce per annum potential” is certainly encouraging, given that this will further improve already attractive unit costs (sub $900/oz all-in sustaining costs).

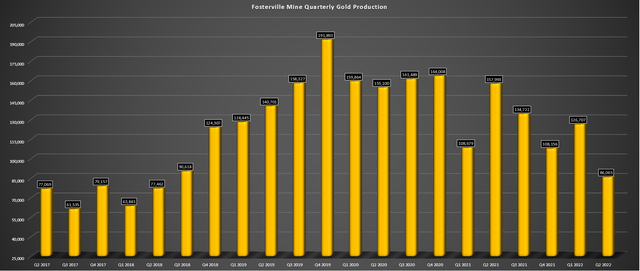

Fosterville Quarterly Production (Company Filings, Author’s Chart)

Finally, Fosterville had a decent quarter, producing ~86,100 ounces, though lower than previous quarters due to a decline in throughput (~122,000 tonnes vs. ~170,000 tonnes). This appears to be related to low-frequency noise constraints that may have impacted mining rates, leading to lower throughput in the period (Agnico cited primary ventilation operating restrictions). This is not a new issue (noise complaints), and Agnico is evaluating the potential installation of the primary fans underground longer-term. The good news is that grades were solid (~22 grams per tonne of gold), and it should be an exciting year of exploration ahead as the Robbins Hill and Lower Phoenix exploration declines were completed.

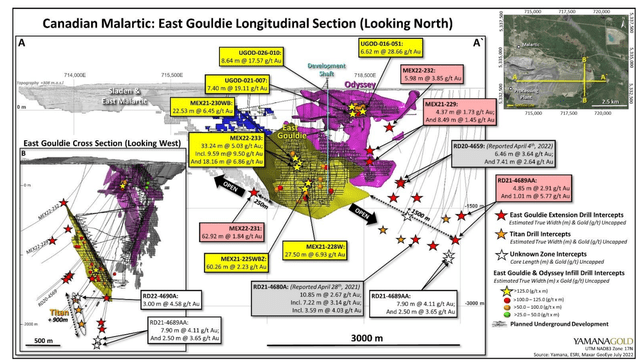

Before moving on, it’s worth discussing the continued exploration success at Agnico’s 50% owned Canadian Malartic [CM] Mine. During the quarter, the CM partnership reported incredible infill holes from East Gouldie, which included the following:

- 22.53 meters at 6.45 grams per tonne gold

- 33.24 meters at 5.03 grams per tonne gold

- 60.26 meters at 2.23 grams per tonne gold

- 27.50 meters at 6.93 grams per tonne gold

It also reported impressive results on the East Gouldie Extension, which could prompt the sinking of a second shaft later this decade, given the significant growth in resources and excess capacity at the CM mill. These were as follows:

- 5.98 meters at 3.85 grams per tonne gold

- 62.92 meters at 1.84 grams per tonne gold

- 7.9 meters at 4.11 grams per tonne gold

Finally, Odyssey South, which is a lower-grade deposit relative to East Gouldie, turned up phenomenal conversion drilling intercepts that included 7.4 meters at 19.11 grams per tonne gold, 6.62 meters at 28.66 grams per tonne gold, and 8.64 meters at 17.64 grams per tonne gold. Overall, the drilling success at CM continues to be very encouraging, suggesting a 20+ million-ounce resource potential at this mine on a 100% basis, which should support exploring a larger production scenario to pull ounces forward and leverage the existing infrastructure. While a second shaft isn’t cheap, this project is shared on a 50/50 basis, with any potential capex focused on increasing underground mining rates shouldered by both parties.

Canadian Malartic Exploration (Yamana Presentation)

Margins & Financial Results

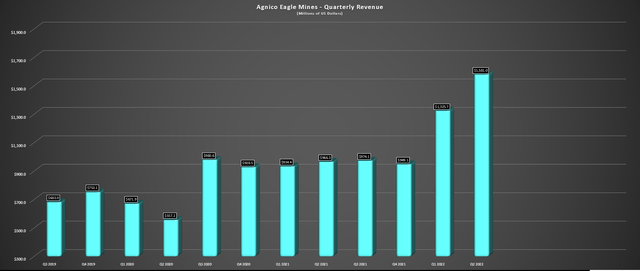

Moving to the financial results, Agnico reported revenue of ~$1,581 million, translating to a 61% increase from the year-ago period. This was related to higher sales volumes (increased production) at higher gold prices, with an average realized price of $1,866/oz (Q2 2021: $1,814/oz). The sharp increase in revenue combined with similar operating costs year-over-year translated to a quarterly operating cash flow of ~$633.3 million, up from $419.4 million in the year-ago period. After subtracting ~$401.6 million in capex (capex + capitalized exploration expenditures), this translated to quarterly free cash flow of ~$231 million or ~$0.50 per share.

Agnico Eagle – Quarterly Revenue (Company Filings, Author’s Chart)

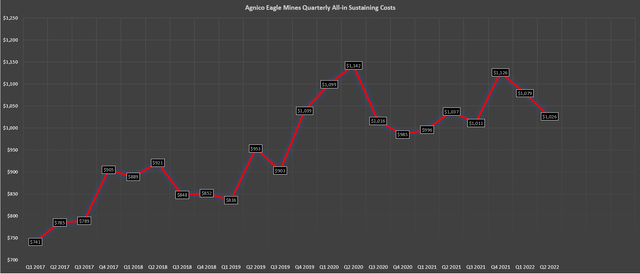

Looking at operating costs, Agnico had a strong quarter, reporting all-in sustaining costs of $1,026/oz, more than 15% below my updated industry average estimate of $1,230/oz for FY2022. This figure was down from $1,037/oz last year, with an additional benefit of up to $40/oz from planned synergies in coming years. This suggests that Agnico has a path towards getting costs back below $1,000/oz despite inflationary pressures, which is very impressive given the margin compression and rising costs we’re seeing sector-wide. Given the higher gold price, Agnico’s AISC margins increased to $840/oz from $777/oz, an 8% improvement from the year-ago period.

Agnico Eagle AISC (Company Filings, Author’s Chart)

In addition to benefiting from the foresight to hedge a considerable amount of diesel exposure (43% hedged for the remainder of the year), Agnico benefits from being in a prolific region in Australia from a gold endowment standpoint (Victoria) but away from the labor tightness in Western Australia. This hurt Newmont in its Q2 results, with Western Australia having over 100 mines/projects, multiple commodities being exploited (iron ore, nickel, copper, gold), and 150,000 employees. This leads to companies fighting to secure workers and contracted services. In Agnico’s case, it’s the employer of choice in Victoria, with its only real competing mine being Costerfield from a labor standpoint.

Meanwhile, it certainly helps that Agnico operates several high-grade underground mines, which means higher production per tonne of material moved. Meanwhile, its high-volume mines benefit from economies of scale. Lastly, the company benefits from the availability of hydroelectricity (low emission public grid) in Ontario and Quebec at its mines, with these costs not spiking suddenly related to higher oil/gas prices, which has impacted more remote miners working off of diesel generators.

Long-term, the company should benefit from the Kivalliq Hydro-Fiber Link Project, endorsed in Canada’s 2021 Federal budget. It could also benefit from the possibility of trolley assist for its haul trucks at Detour Lake long-term, and this could see some help from the government in funding this project. For those unfamiliar, trolley assist is a system for diesel-electric haul trucks at mines, pulling them along a trolley line with electric power, which translates to lower costs and emissions (bypassing the diesel engine entirely). This technology is already used at Cobre Panama, which is operated by First Quantum, a massive copper-gold mine.

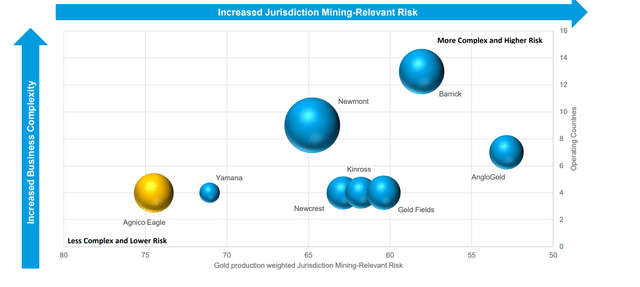

An Industry Leader Across All Metrics

This differentiator of operating higher than average grade operations that benefit from economies of scale certainly helps when it comes to maintaining industry-leading margins. Meanwhile, Agnico’s ~95% Tier-1 jurisdictional profile allows investors to sleep well at night without the negative surprises that some companies face in less attractive jurisdictions. However, safe jurisdictions or not, I’d be remiss not to note that the company’s strict adherence to social responsibility and environmental standards is industry-leading, further elevating the investment thesis from an ESG standpoint.

Agnico Eagle – Jurisdictional Profile (Company Presentation)

For example, the company hires over 90% of its workforce locally (and 100% Mexican for its Mexico Operations) in addition to community programs and considerable local procurement spending (2021: $1.6 billion), enriching the communities where it operates. This attention to the communities where it operates is not only in the form of higher wages than would be otherwise available (assuming sourcing of ex-pats instead) and direct investments but by taking a superior approach in cases like its Pinos Altos Mine in Mexico. In fact, Agnico should be praised for listening to what the community needs and helping them achieve those goals in a non-paternalistic manner.

One example is the case of a school in Pinos Altos that needed to be expanded. Instead of building it for them, Agnico went a step further, providing materials, supervision, and training so that they could build it together with the people in the town building the new school rooms. This is an important distinction not only from a pride standpoint but also from a long-term standpoint, given that the town’s people are now equipped with the expertise to continue to build their local economy and take on new projects. Carol Plummer pointed this out in the company’s recent Sustainability Presentation, Agnico’s EVP of Operational Excellence.

Nunavut Operations (Company Presentation)

Meanwhile, in Nunavut, Agnico took care of its Nunavummiut workforce during the past two years by keeping them home with pay when necessary. From a safety standpoint, this was the right thing to do, recognizing the more fragile situation in Nunavut from a healthcare standpoint relative to more developed Canadian provinces. In my view, these steps to build lasting relationships with its communities increase the likelihood of Agnico operating in these communities for decades to come.

While taking care of the environment and social responsibility would appear to be the highest priority initiatives, this isn’t always the case. This is a major advantage vs. operators less focused on these initiatives. One example is Goldcorp, with a profit-only focus at its Marlin Mine (Guatemala), which led to its shutdown and left behind extensive infrastructure while also giving the industry a bad rap. Of course, the major indirect benefit to being in jurisdictions for decades is less labor price volatility, with a higher ratio of employees to contractors. The result is much lower labor costs than the double-digit year-over-year price increases we’re seeing in some cases for contracted services and specialized labor in prolific mining jurisdictions (Ontario, Western Australia).

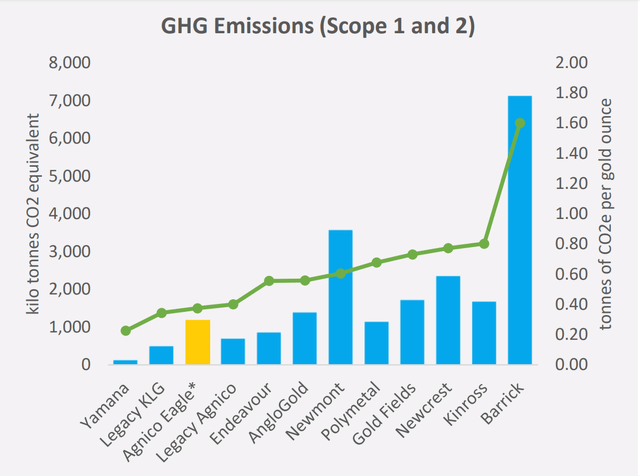

GHG Emissions (Scope 1 & 2) vs. Peers (Company Presentation)

From an environmental standpoint, Agnico continues to be a leader from a greenhouse gas intensity standpoint, and its investments in this category will allow it to maintain a leading position. Examples to help reduce emissions include automatic ore handling systems (RailVeyor at Goldex) and battery electric vehicles at Macassa. Notably, battery electric vehicles are being tested at LaRonde, Kittila, and Fosterville, potentially reducing emissions even further. In a period of rising energy costs, this renewable energy focus and ability to tap into hydroelectricity at some of its mines is a key advantage from a cost standpoint as well, with Agnico further insulated by its diesel hedging program.

Now that we’ve covered the necessary bases (the company’s strong culture, phenomenal operating/financial results, and bright future based on a robust pipeline), let’s look at the valuation.

Valuation

Based on ~455 million shares outstanding and a share price of $39.50, Agnico trades at a market cap of ~$18.0 billion, a ridiculous valuation for a company with ~50 million ounces of mineral reserves (now valued at less than $370/oz). When we add in an additional ~40 million ounces of M&I resources, Agnico’s resource/reserve combo (excluding inferred ounces) is being valued at just ~$200/oz. This metric might make sense if the company’s all-in sustaining costs were above $1,400/oz. However, with all-in sustaining costs likely to come in below $1,000/oz in FY2023, this is the cheapest I recall seeing Agnico from a valuation per ounce standpoint in years.

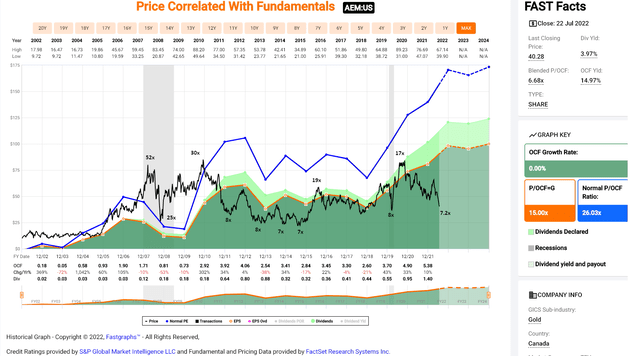

Agnico Eagle Mines – Historical Cash Flow Multiple (FASTGraphs.com)

Meanwhile, from a cash flow standpoint, Agnico now trades at just ~7.3x FY2022 cash flow per share estimates based on a more conservative estimate of $5.40. This is a massive discount to its historical cash flow multiple of ~26.0 and its 20-year average cash flow multiple of 19.0. Even if we used a 50% discount to its historical multiple and a 30% discount to its 20-year average (13x cash flow vs. 19x cash flow), Agnico’s fair value would come in at $70.20 – nearly 80% upside from current levels. Importantly, this assumes no upside in the gold price and represents conservative estimates. Given the ~$480 million available for buybacks which could eliminate over 2% of the float, I would argue that FY2023 estimates of $5.30 in cash flow per share could be conservative.

Summary

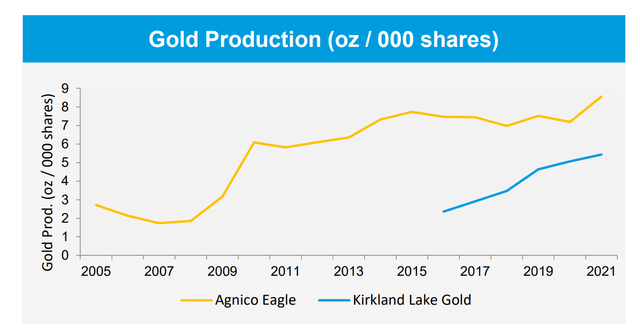

Companies rarely check all the boxes for investment, with there often being at least one glaring weak spot. However, Agnico Eagle is an exception to the rule, and its discipline and attention to detail allowed it to shine in the current environment. These key attributes are an ultra-low cost profile, safe jurisdictions, strong sustainability metrics, and a near unrivaled organic growth profile among its peer group. Most importantly, though, is its ability to consistently over-deliver on its promises, being laser-focused on per share growth, not solely absolute metrics. This is a crucial metric for investors in the sector to watch because if a company is not growing or maintaining production per share, it’s often better just to hold the metal itself.

Gold Production Per Share (Company Presentation)

The issue with Agnico from an investment standpoint was that outside of March 2020 and September 2018, the stock commanded a massive (though deserved) premium for its near flawless track record relative to its peers. That attribute made it difficult to invest in the stock with a significant margin of safety and be comfortable building a large position. However, this violent correction has left it trading at a valuation reserved for an industry laggard, which makes zero sense. This is because, across nearly every metric, the company is an industry leader. So, with AEM being a rare case of growth and value, I see it as a must-own name for those looking to add precious metals exposure, so I’ve continued to accumulate an overweight position in the stock.

Be the first to comment