24K-Production

Thesis

Leading mREIT AGNC Investment Corp. (NASDAQ:AGNC), which has a sizeable portfolio of Agency mortgage-backed securities (MBS) has seen its stock continue its downtrend bias since its highs in June 2021. Moreover, AGNC took a steeper dive from its July 2022 highs, falling nearly 43% to its October lows.

As a result, AGNC is closing in on its March 2020 COVID lows as investors fled AGNC, given the unprecedented rate hikes by the Fed in battling record inflation rates.

We believe the battering is justified, given the tremendous interest rate volatility, leading to the rapid widening of the MBS spreads. The market had correctly anticipated in June 2021 that the bear market rally in AGNC’s long-term downtrend had overstayed its welcome, as it anticipated AGNC’s malaise. Given the market’s positioning, we believe the weak performance in AGNC’s distributable earnings and its book value per share (BVPS) justified the battering.

However, at this critical juncture, we urge investors to consider whether another bear market rally against AGNC’s secular downtrend is overdue, given the pummeling.

We also gleaned that the consensus estimates have been cut markedly to reflect the current uncertainties. Furthermore, we observed that AGNC’s valuations had been hammered to levels that could at least spur a mean-reversion opportunity.

AGNC’s price action suggests that the selling downside has likely subsided, with a bullish reversal likely forming. Therefore, we assess that a speculative mean-reversion opportunity looks likely at the current levels.

Investors with the ability to stomach some downside volatility could capitalize on its attractive 17.4% NTM dividend yields, with the potential for capital appreciation.

Hence, we rate AGNC as a Speculative Buy with a medium-term price target of $10 (implying a potential upside of 24%).

Unprecedented Pace Of Rate Hikes Created Tremendous Fear

The Fed’s hawkish posture caused tremendous volatility in the market as spreads widened, which hurt AGNC’s BVPS, impacting investors’ confidence markedly.

US30Y Vs. US2Y yield curve % (koyfin)

Furthermore, investors were also concerned about the impact on its distributable earnings (or net spread and dollar roll income), as AGNC typically “borrows short and lends long.”

As seen above, the yield curve inversion on the 30Y and 2Y treasury yields reached levels that weren’t seen over the past 20 years. Moreover, the pace leading to the inversion likely stunned Agency MBS investors, given the Fed’s unrelenting rate hikes.

Notwithstanding, AGNC CEO Peter Federico highlighted that it could hedge its short exposure. He articulated:

Our funding is short-term. Our repo rolls over about every 90 days. But we don’t have that exposure if you have that short-term debt hedged out synthetically with longer-term interest rate derivatives. The inverted yield curve can have significant earnings impact, typically negative. But what’s important in today’s environment is that even though the yield curve is inverted, what really matters is where is our underlying asset relative to that 10-year part of the curve where that is most inverted. Typically, that spread is not as wide as it is today. If you lever that 7x or 8x, you can generate a very significant return on that investment even though it is inverted. (Barclays Global Financial Services Conference)

Still, Federico cautioned that the volatility from the rate hikes has made its hedging activities more challenging, with the need to rebalance its portfolio more frequently. However, AGNC’s prelim Q3 release suggests outperforming the consensus estimates on its Distributable earnings per share, corroborating management’s confidence.

While its tangible net BVPS guidance of $9.08 is down nearly 21% from June’s metrics, we believe the damage had already been reflected in its valuation, given the battering.

Hence, the market had correctly anticipated the impact of the Fed’s aggressiveness in its rate hikes on AGNC’s BVPS.

But AGNC Investors Need To Look Ahead

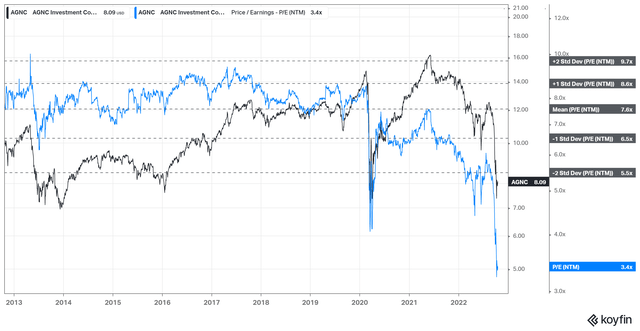

AGNC NTM Distributable EPS multiples valuation trend (koyfin)

As seen above, AGNC’s NTM Distributable earnings multiples have fallen to lows well below the two standard deviation zone under its 10Y mean. However, we concur with some bears that this metric is not so useful to gauge AGNC’s valuations, given its long-term downtrend bias.

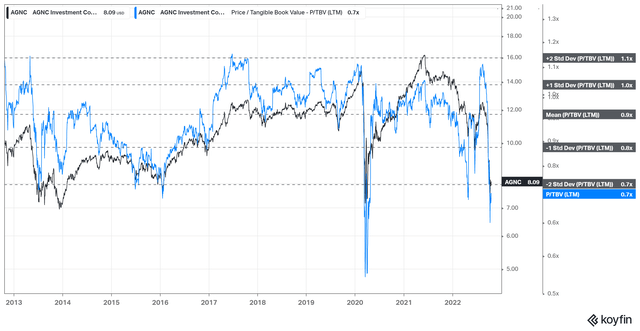

AGNC TTM Tangible BVPS valuation trend (koyfin)

However, we gleaned that AGNC’s TTM tangible BVPS multiples have also fallen well below the two standard deviation zone under its 10Y mean. AGNC’s BVPS multiple could be more representative of assessing the mean reversion opportunity for AGNC.

As seen above, AGNC has been able to stanch further selling downside over the past ten years when the selling forced it into such extreme valuation zones.

Is AGNC Stock A Buy, Sell, Or Hold?

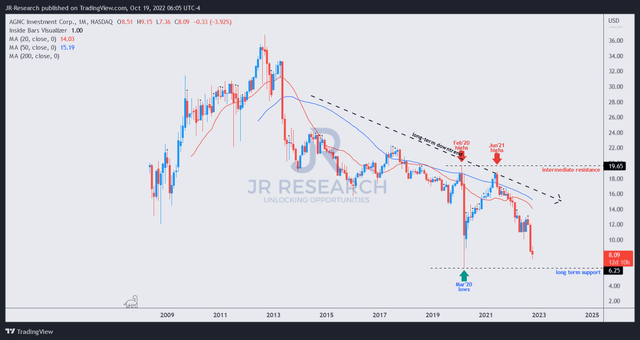

AGNC price chart (monthly) (TradingView)

However, we must caution investors that AGNC remains mired in a long-term downtrend, with its 50-month moving average as its dynamic resistance level. Hence, selling opportunities near its 50-month moving average should be considered to cut exposure and follow its bearish bias. As such, we don’t encourage investors to hold AGNC over the long run until it can break free from its downward bias.

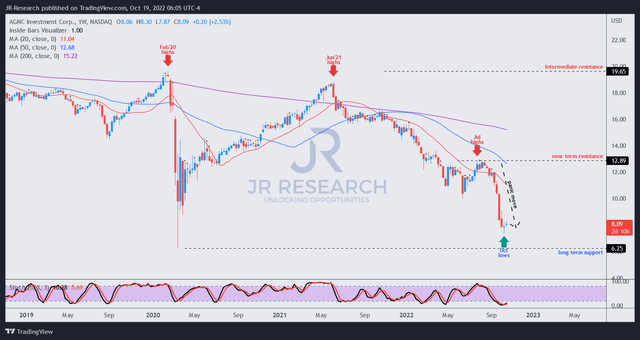

AGNC price chart (weekly) (TradingView)

However, that doesn’t mean investors cannot participate in appropriate mean-reversion opportunities.

We believe the recent panic-selling to force capitulation in AGNC holders has created such an opportunity for investors who were biding their time.

We noted that the selling pressure has likely subsided after its rapid downward move, with a bullish reversal (still pending) in the works.

Hence, we postulate that a speculative opportunity is ready for investors with experience utilizing strict risk management strategies (profit-taking/stop loss). However, given AGNC’s long-term downtrend, we don’t advise new investors to partake in its recovery.

Accordingly, we rate AGNC as a Speculative Buy, with a medium-term PT of $10.

Be the first to comment