DNY59

AGNC Investment Corp. (NASDAQ:AGNC) is a bond fund with a REIT tax structure. It specializes in owning mortgage bonds, or mortgage-backed securities (MBS). This hasn’t just been a tough year for bond investors like AGNC – it’s been historically awful.

2022, the historically awful bond market

Two charts highlight how tough this year has been for bond investors. The first chart is from a Market Watch article from September 24, 2022, whose title starts “A historic global bond-market crash…”:

Market Watch

We’ve just had the third worst bond market in U.S. history!

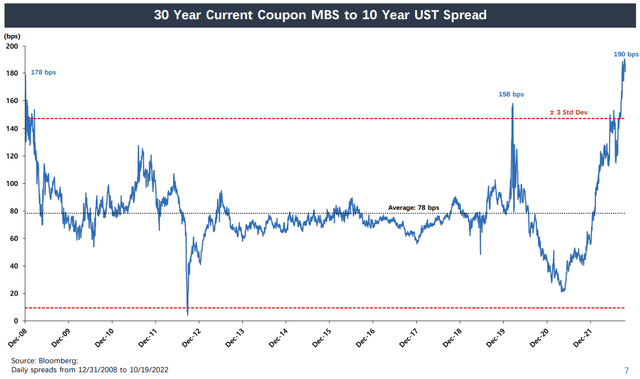

The second chart focuses on MBS investments. The chart, presented by AGNC in its Q3 earnings presentation, shows a history of the spread between the MBS yield and the Treasury yield. The wider the yield, the lower AGNC’s book value. Here’s the chart:

AGNC financial report

At present, a wider spread than during The Financial Crisis and COVID!

Yet, AGNC is still upright. Bloodied and bruised, yes, but alive. But more than just alive – It generated operating EPS of $3.19 per share annualized so far this year and it has maintained its $1.44 annual dividend.

AGNC is still alive for two basic reasons – (1) it limited its interest rate risk and (2) it maintained moderate financial leverage. Let’s drill down a bit into those two factors.

AGNC’s survival tactic #1: Limit its interest rate risk

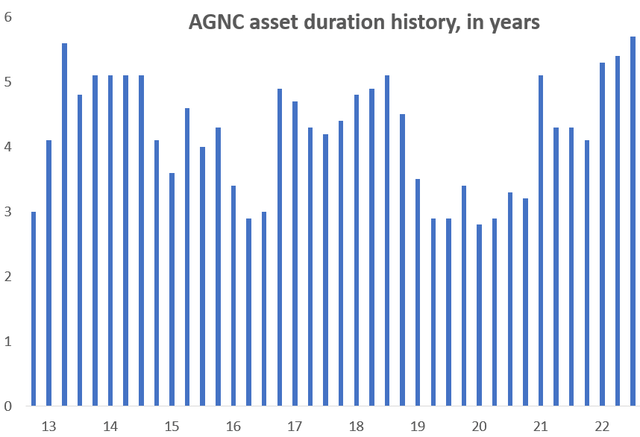

Investing in MBS creates a number of tricky interest rate risks. The major one is that the expected life – or “duration” – of a mortgage is uncertain. We may buy a house and stay there for the 30-year life of the mortgage. More likely, we will move at some point and pay off the mortgage. And frequently we have the opportunity to refinance our mortgage to capture a lower interest rate, paying off the first one in the process. As a result, AGNC’s expected MBS durations have swung wildly based on refinancing and home sale activity, as this chart shows:

AGNC financial reports

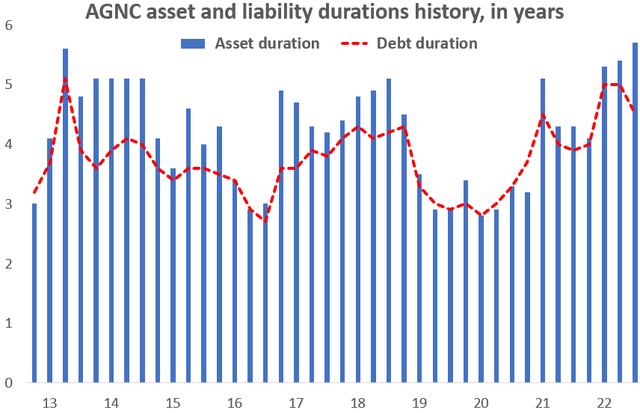

The chart shows that at present AGNC’s asset duration is its highest ever at 5.7 years because the surge in the mortgage rate has shut down refinancing and slowed home sales. Interest rate risk is created if AGNC’s debt has a materially different duration than its assets. Let’s compare the history of the two:

AGNC financial reports

Pretty close. Debt durations are not on auto-pilot; AGNC management has to change them. The above chart shows that management has done a pretty good job of keeping the duration match close. Which in turn has helped AGNC survive.

AGNC’s survival tactic #2: Maintain moderate financial leverage

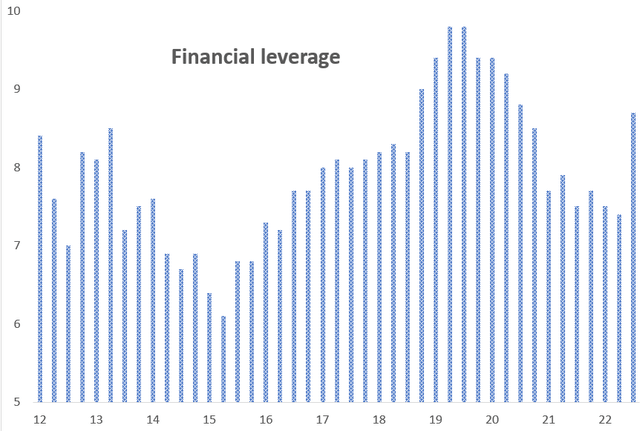

AGNC, like other lenders including banks, uses financial leverage to boost its return on investors’ equity. For example, regional bank PNC’s Q3 ’22 assets were 12.0 times its equity. Here is a history of AGNC’s leverage:

AGNC financial reports

The chart shows that despite a nearly $3 billion write-down of equity due to this year’s bond bear market, AGNC’s current financial leverage is still well within its historical range. AGNC took two steps this year to limit its leverage increase. For one, it shrank its assets by $10 billion, or 14%. Second, it raised over $400 million of new common and preferred stock. Both actions hurt earnings per share, but AGNC is still here.

The bond bear market should be nearing its end

I believe that the bond bear market is very close to ending, for three reasons:

- Signs are growing that the inflation rate is peaking. Home and used car prices are now declining. COVID checks are largely spent. More supply chain chokepoints are easing. Oil has been in a multi-month trading range. Etc.

- While the Fed has said it is willing to accept a recession as a cost of curbing inflation, I’m sure it doesn’t want to get blamed for a more serious downturn.

- $70 trillion. That is the amount of total private and government debt the U.S. will be nearing by year-end. A one percentage point increase in servicing that debt subtracts $700 billion of spending power. Three percentage points subtract off $2 trillion of spending power. Per year. Why do you think that Japan, the most indebted country in the world as a percent of GDP, resists raising interest rates? The Fed has to be worrying about the same thing.

The ending of the bond bear market should in turn narrow the MBS yield spread to Treasury yields. That in turn will increase AGNC’s book value. AGNC will then be able to grow its assets at today’s attractive spreads. As Peter Federico, AGNC’s CEO said on the company’s Q3 conference call:

“You would expect us to generate our best returns following huge widening events. And this obviously is one of the most historic widening events that the market has ever experienced.”

The higher returns available on current investments will in turn make AGNC’s dividend safer.

AGNC is extremely cheap to a more normal bond market

As I write this, AGNC is selling at:

- 92% of the company’s estimated late October book value of about $8.50.

- An 18% dividend yield. Yes, that’s right – 18%.

- A P/E ratio of 3½ of Wall Street analysts’ expected EPS for ’23 and ’24 of about $2.15 (Seeking Alpha)

Now consider that the end of the bond bear market should increase AGNC’s book value. If it recovers half of what it lost over the past year, that’s a $12 book. Assume that the stock reaches its median historic price-to-book of 95%. That’s an $11.50 stock, or up 45% from its current price. Plus the 18% dividend. Note that even at $11.50, the stock would still yield a hefty 12.5%, so a higher price is not unreasonable.

What could go wrong

Obviously, the big risk is that the Fed keeps raising interest rates well longer than the market currently assumes. That seems unlikely, but so was the Phillies making the World Series.

Be the first to comment