Khanchit Khirisutchalual/iStock via Getty Images

The Fed recently did what it should have done at least two years ago: it raised interest rates for the first time since 2018. Despite the fact that the central bank is far behind the curve when it comes to raising interest rates, an aggressive rate hike cycle appears to be upon us and the mortgage trust sector. Lower net interest margins may result in a larger book value discount for a stock like AGNC Investment Corporation (NASDAQ:AGNC). At around $10, I will consider purchasing AGNC’s yield.

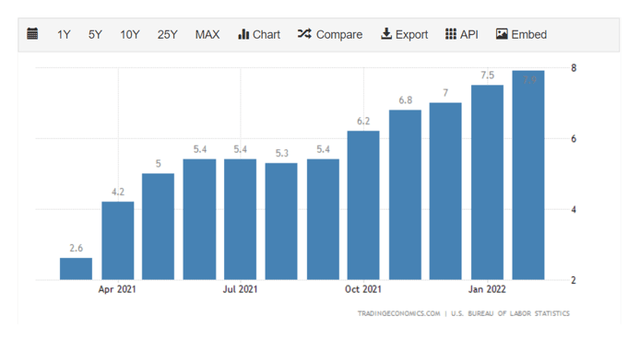

Soaring Inflation Is Forcing The Hands Of The Fed

Inflation has risen at the fastest rate since the early 1980s, thanks to artificially low interest rates and aggressive bond purchases during the Covid-19 pandemic, as well as fiscal stimulus bills of unprecedented size.

Inflation rose 7.9% in February, and it is likely that consumer price growth will accelerate in March as a result of sky-high energy prices related to Russia’s invasion of Ukraine.

Inflation Rates (Trading Economics)

High inflation rates pose a threat not only to investors and consumers, but also to the mortgage real estate investment trust sector, which relies on low borrowing costs more than any other industry to make its leverage-based business model work.

As inflation rises, the Federal Reserve is under more pressure than at any point in recent years to raise interest rates at least a few more times in 2022. Inflation of 7.9%, and interest rates of 0.25% show how out of touch the central bank is when it comes to raising interest rates. In normal times, interest rates are roughly equal to inflation rates, providing savers, investors, and consumers with a cushion against income depreciation.

As the Federal Reserve catches up to the rate of inflation, the cheap debt on which mortgage trusts like AGNC rely to make money will become much more expensive. Because the trust profited from 0% borrowing costs during the pandemic, this creates a significant profitability issue for AGNC.

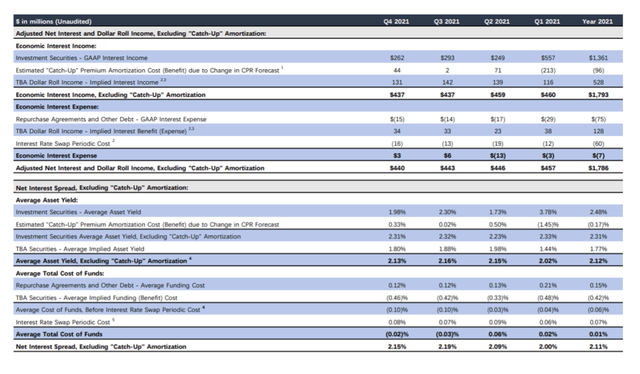

Low borrowing costs increased the mortgage trust’s net interest margins during Covid-19, and the net interest spread remains inflated. The net interest margin is the difference between the yield on an investment and the cost of borrowing, and it is a key indicator of investment performance for mortgage real estate investment trusts.

In 2021, AGNC’s net interest spread increased to 2% amid record low interest rates reminiscent of the period following the 2008 financial crash. The chart below shows that AGNC’s average funding costs are negative (before consideration of interest rate swaps). As this anomaly reverses, AGNC will face higher average total costs of funds and lower trust profitability.

Average Funding Costs (AGNC Investment Corp)

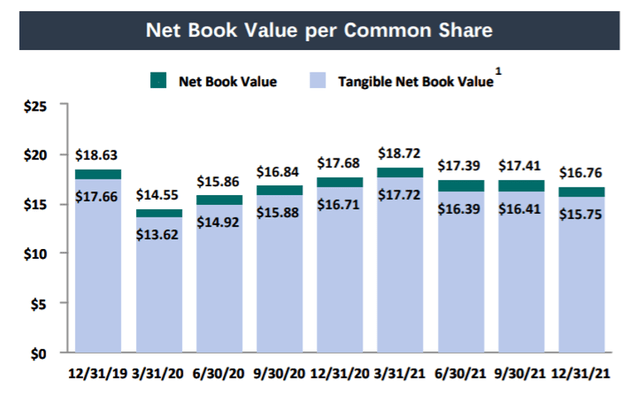

AGNC’s Book Value Has Continued Dropping In 2022

According to AGNC’s most recent estimate of tangible net book value, the TNBV at the end of February was only $13.48, indicating that the trust’s TNBV has dropped another $2.27-per-share, or 14%, since the end of the previous quarter. AGNC has a poor track record of increasing book value, and the trust’s TNBV has fallen in two of the last three quarters. The $0.02-per-share increase in TNBV in 3Q-21 had little impact given that the book value fell 4% again in 4Q-21.

Net Book Value Per Common Share (AGNC Investment Corp)

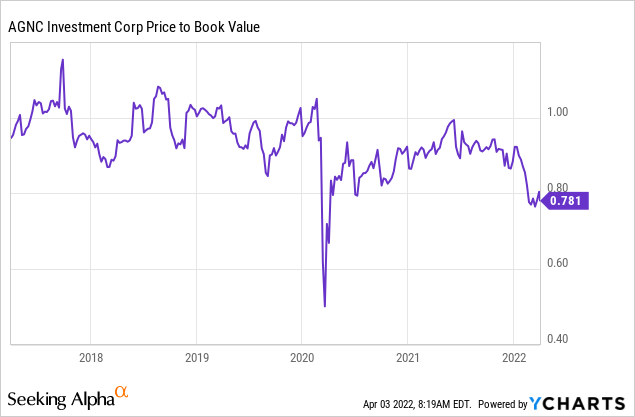

Due to expectations of higher interest rates and lower net interest spreads moving forward, the stock of AGNC has started to trade at a larger discount to book value again in recent months. The AGNC trust’s book value is currently 22%, but more downside may be lurking around the corner as the market prices in the possibility of more aggressive rate hikes.

To compensate for the risk that an investment in AGNC entails, especially in terms of inflation and interest rates, I would expect AGNC to trade even lower (at a higher book value discount) in the short term. If inflation worsens, which seems likely, AGNC’s net interest spread could narrow significantly.

My Conclusion

A stock like AGNC does not deserve to trade at a premium to book value because of the temporarily inflated net interest spread and the trust’s rather poor record in terms of growing the most important metric for mortgage REITs: book value.

Furthermore, AGNC has been a serial dividend cutter, so in order for any investor to take the risk with AGNC, a large discount to book value is required. AGNC did trade at large premiums to book value historically, but this is not where we are presently.

If AGNC’s stock falls in price due to rising interest rates and increasing net interest spread risks, I would consider purchasing AGNC at around $10 for the sake of the trust’s yield. With the stock currently trading at $13, it is still not a buy.

Be the first to comment