Andrey Kovalenko

Introduction

It’s time to discuss at least two very important things. First of all, we’ll discuss my view on agriculture markets as I expect crop prices to continue to increase and remain elevated on a longer-term basis. This provides a favorable foundation for (global) farmers to invest in equipment. The AGCO Corporation (NYSE:AGCO) is in a terrific position to capitalize on this thanks to its high-quality brands and faster adoption of its Fendt brand beyond Europe. Second of all, global initiatives to reduce (agriculture) pollution while simultaneously looking to combat hunger are causing a very tricky situation that favors next-generation technologies that only a few companies can meet. In addition to Deere & Company (DE), AGCO is increasingly focused on its ability to meet these high-tech demands.

Moreover, while the company struggled with supply chain and cybersecurity issues in its second quarter, it is sticking to its full-year targets and is in a fantastic position to deliver outperforming total returns for its investors.

So, without further ado, let’s get to it!

Let’s Discuss Agriculture

I like to start these articles with a macro background as it helps us to understand why companies are reporting certain results.

Agriculture isn’t just a very complex topic in general, but one of the most important things to keep an eye on in the current macro environment as well.

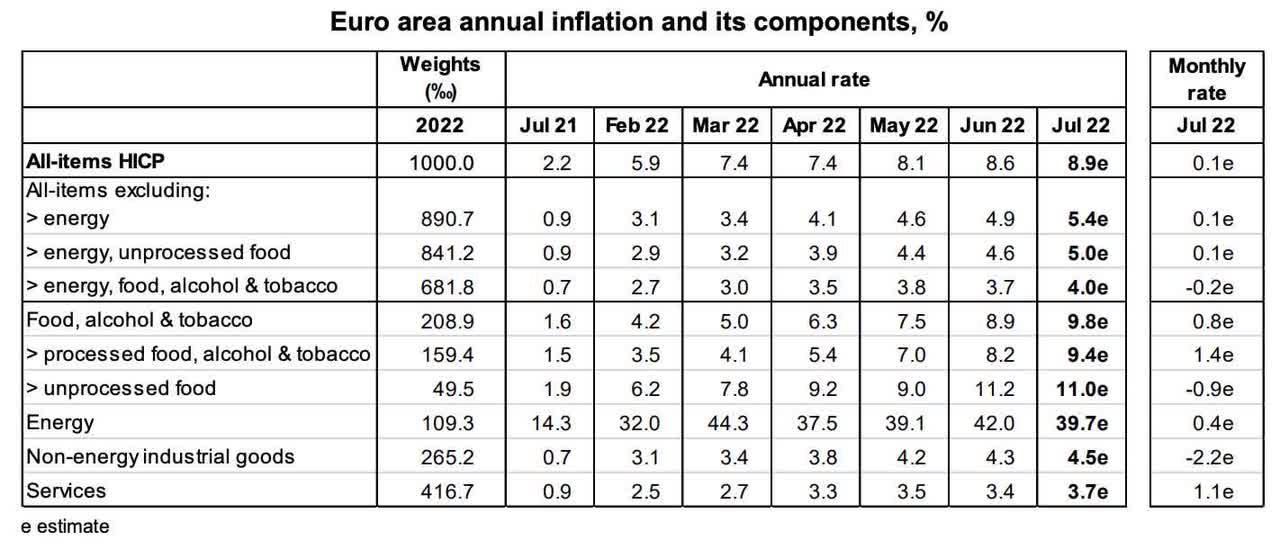

To give you one of many good examples, unprocessed food prices in the euro area have risen by 11.0% in July of 2022.

European Commission

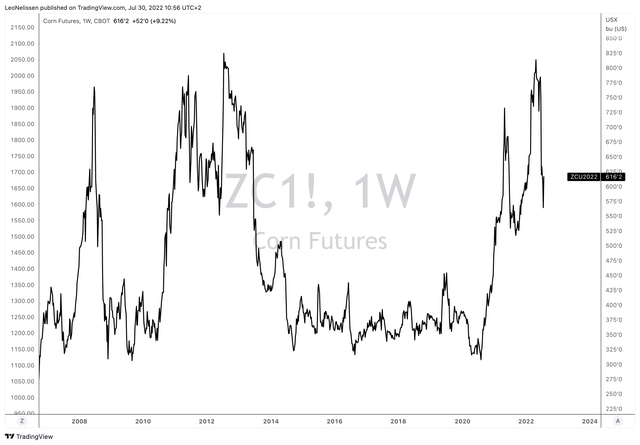

The agriculture bull case started in the first half of 2020 when the pandemic crushed pretty much every stock index and commodity, including agriculture commodities. Energy demand fell off a cliff, restaurants were closed, many meat processing plants were (partially) closed due to COVID, and other factors caused crop futures like corn to drop.

Initially, the bull case was simple: the reopening would cause demand to come back. That happened indeed as corn (I’m often using this crop as a proxy for the entire market) quickly rebounded. Then, later in the same year, it already reached above-average levels (using the six years prior to 2020).

The demand came back roaring. China accelerated imports to build large crop inventories while it was also rebuilding its hog herds after the African Swine Fever.

Moreover, bad weather and accelerating energy prices made production more expensive and pressured overall yields. Hence, using corn as an example, 2020 was the third year in a row with usage exceeding production. That’s not a great development, to put it mildly.

CME Group

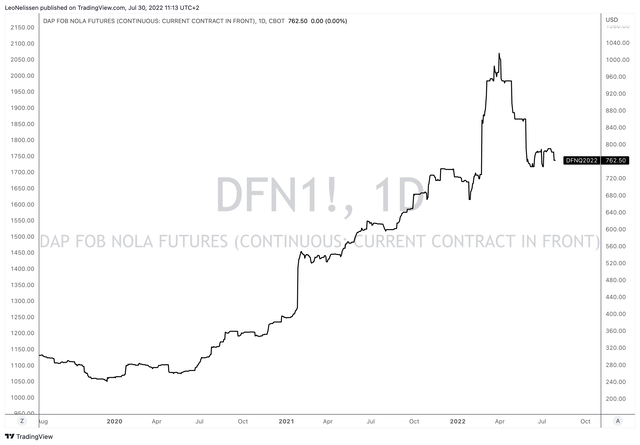

Then, in 2021, the agricultural bull market accelerated. Demand remained strong, while supply was further pressured by weather and soaring energy prices towards the end of the year. Not only are we seeing a structural supply deficit as I explained in articles like this one, but it was made worse due to lower gas flows from Russia to Europe. This happened prior to the actual invasion earlier this year and it caused fertilizer prices to explode.

TradingView (DAP Fertilizer Futures)

At this point, I believe that the risk/reward for the agriculture trade is favorable as I do not see a situation where the supply/demand dynamics shift in favor of the consumer – unless we get another strong recession that pressures energy prices, which drive production costs and demand for biofuels.

With that said, the OECD published its long-term 2022-2031 agriculture outlook on June 29.

There were a few things in this 363 pages report that are worth including in this article. For example, the OECD expects long-term food consumption (crop demand) to rise by 1.4% per year, driven mainly by population growth.

With regard to agricultural production, the OECD expects 1.1% growth per year. According to the OECD:

The Outlook assumes wider access to inputs as well as increased productivity-enhancing investments in technology, infrastructure, and training as critical drivers of agricultural development. However, a prolonged increase in energy and agricultural input prices (e.g. fertilisers) will raise production costs and may constrain productivity and output growth in the coming years.

It is no surprise that the focus is on productivity-enhancing methods as costs are rising while we’re also dealing with a long-term decline in arable land.

OurWorldInData

The outlook suggests that following SDG 2 (sustainable development goal 2) of zero world hunger cannot be achieved by 2030. Moreover, emissions from agriculture would increase. This is extremely obvious as agriculture production would need to increase by 28% over the next 10 years to reach the SDG2 goal. That’s more than triple the growth rate of the past 10 years. That’s not possible – let alone while reducing emissions.

So, we’re once again back at the argument for high tech. According to the OECD:

Comprehensive action to boost agricultural investment and innovation and to enable the transfer of knowledge, technology, and skills are urgently required in order to put the agricultural sector on the necessary trajectory for sustainable productivity growth and the transformation towards sustainable food systems.

Now, with that said, we’re not just in a situation where agriculture crop prices are set to remain high, but also a favorable environment for one of the world’s largest producers of high-quality equipment: AGCO.

AGCO Has More Upside

As someone who has observed AGCO’s brands for many years, I believe that AGCO is the biggest competitor of my Deere investment and a force to be reckoned with.

Located in Duluth, Georgia, the company owns some of the biggest agriculture brands in the industry.

With a market cap of $8.1 billion, the company owns tractor brands like Challenger, Fendt, Massey Ferguson, and Valtra.

Moreover, roughly 10% of its sales are generated through brands like GSI, which provide farmers with grain storage facilities, and everything related to raising poultry.

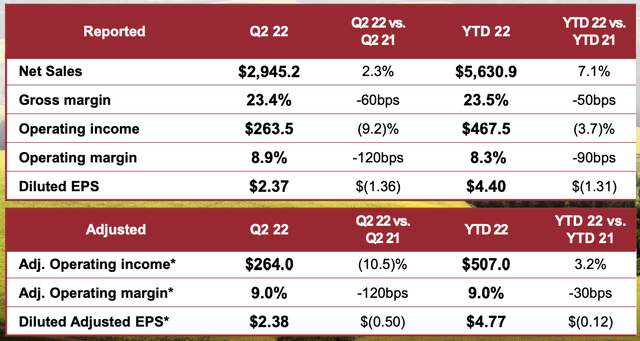

On July 28, the company reported a fantastic quarter, doing $2.95 billion in revenue, $30 million higher than expected and up 2.4% despite multiple severe supply-chain-related headwinds. Its adjusted EPS result was $2.38, $0.27 higher than expected.

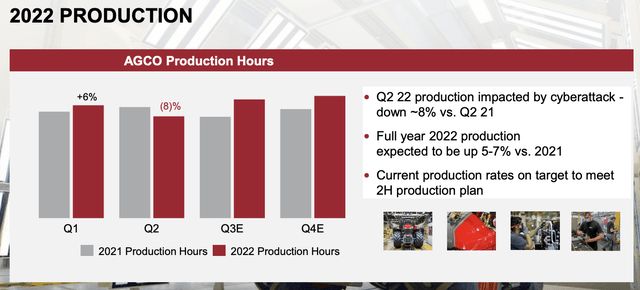

While the company was able to raise production hours by 6% in its first quarter to work on higher demand, 2Q22 production hours were down 7% due to the impact of a cyberattack that pressured operations. However, AGCO is positive that it can achieve higher growth in the second half, which should offset 2Q22 weakness and result in full-year production growth of 5-7%.

Year-to-date, the company was able to do $507 million in adjusted operating income. That’s up from $492 in the prior-year period, but with a 30 basis points lower operating margin of 9.0%.

In 2Q22, adjusted operating income fell by 10.5% to $264 million. However, this is mainly caused by the aforementioned supply chain and production problems.

This is what the company commented on using pricing to offset rising costs:

We expect to deliver these results, even with the continued supply chain and logistics challenges, as well as material and freight cost inflation, which are being muted by strong pricing. For our markets, although commodity prices have pulled back from the extremely high levels earlier this year, they remain at levels still – that still support healthy farm income.

While the company reports that the industry in North America produced 7% fewer tractors and 8% fewer combines (similar developments in other regions), it believes that this is due to companies’ inability to produce. It is not a reflection of orders.

Moreover, the company is limiting new orders are it has a large order book. Controlling incoming orders allows the company to better deal with inflation.

In 2Q22, average pricing was 9%. On a full-year basis, the company expects to hike prices by 10%.

On a full-year basis, AGCO expects retail tractor unit sales (excluding pricing) to rise by 5-10% in North America, at least 10% in South America, and flat growth in Western Europe.

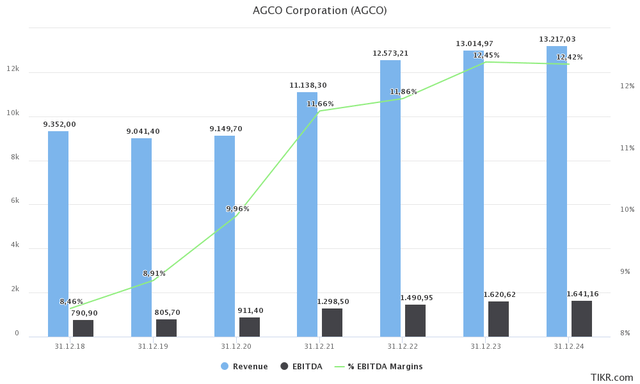

Based on these numbers as well as 15% to 20% higher engineering expenses, 10% pricing gains, a higher market share, and a negative currency impact of 7% (due to a strong dollar – AGCO has just 19% sales exposure in the US), the company sees between $12.4 and $12.6 billion in annual sales. Analysts agree with that according to the chart below. Free cash flow is expected to be $600 million, or 7.4% of the company’s market cap. EBITDA is expected to rise to $1.5 billion, implying an 11.9% EBITDA margin – up from 11.7% in 2021.

Additionally, and with regard to higher market share expectations, the company is taking its Fendt brand global. Historically, Fendt has mainly serviced Europe. This German brand is a star in the European agricultural industry. While Fendt is available in North America, the company will push harder for these products – including Fendt-branded equipment.

In the first half of this year, Fendt-branded sales have increased 20%. In the second half, AGCO expects these sales to further improve. In 202, Fendt and Challenger sales are expected to double versus 2020.

Adding to that – and with regard to the first half of this article – the company is accelerating Precision Agriculture sales:

At AGCO we address the Precision Ag market in two ways. First is through our precision planting business, which has become one of the fastest growing ag-tech companies in the world. Precision planting has been successful in providing automation and intelligence to planters, and now they’re growing well beyond planters into other parts of the crop cycle like spraying, harvesting, and even others.

Moreover:

The other way we address the Precision Ag opportunity is our business called Fuse, which provides OEM solutions for our AGCO equipment, options like telemetry guidance, field mapping, and other Precision Ag capabilities make our AGCO machines smarter and more productive for the farmer.

While these opportunities are long-term opportunities they address a few points I highlighted in the first half of this article. Precision agriculture reduces labor, fuel, seed, and fertilizer costs while improving yields.

It won’t be enough to achieve SDG2, but it sure is the way to go. Moreover, I believe that this is where both Deere and AGCO shine as established producers with the ability to innovate faster than companies without a large customer base and existing equipment portfolios (startups).

So, what about the valuation?

Valuation

AGCO has an $8.1 billion market cap, $200 million in pension-related liabilities, neglectable minority interest of $0.1 million, and $150 million in net expected cash in 2023 (more cash than gross debt).

This gives the company an enterprise value of $8.2 billion.

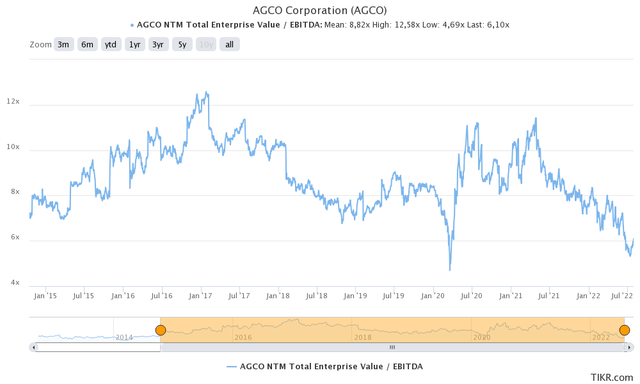

That’s 5.1x next year’s expected EBITDA of $1.6 billion, which I believe is way too cheap. Using the company’s EV/EBITDA (next twelve months) valuation range, we’re dealing with what I believe to be deep value.

Hence, I believe AGCO is at least 40-50% undervalued.

The problem is getting there. Right now, the market is throwing buyers a bone as AGCO has added more than 11% in a week, with support from the broader market. Unfortunately, we’re still dealing with slowing economic growth, which may prevent AGCO from trading at its “fair” value for at least another 12-24 months.

So, please keep in mind that while the bull case for AGCO is strong, it’s not a price target I expect AGCO to hit anytime soon.

Takeaway

The agriculture bull market is strong. Production costs are expected to remain high (mainly due to energy), and demand growth is expected to remain high, which means all eyes are on production growth given how tight supply is.

AGCO confirms my expectations as it sees strong international demand for its products and healthy far financials to support large investments like tractors and equipment.

While its 2Q22 was challenging, the company is sticking to its targets as it will ramp up production in Q3 and Q4 while pricing is expected to offset rising inflation to a large extent.

The company is generating high free cash flow and boosting its most successful brands, which should provide the company with longer-term market share gains.

Moreover, AGCO is able to deliver high-quality next-gen equipment needed to enhance crop yields when it matters most.

The valuation is way too cheap and I believe that AGCO is in a good spot to deliver long-term outperforming total returns for its investors.

(Dis)agree? Let me know in the comments!

Be the first to comment