kodda

Africa Oil Corp. (OTCPK:AOIFF) has actually outperformed many other oil companies during some of the recent weakness. The company’s market capitalization remains over $1 billion, highlighting its financial strength. As we’ll see throughout this article, on top of that, the company continues to have substantial room to outperform with its portfolio.

Africa Oil Corp. Share Buyback

Africa Oil Corp. has announced a new share buyback program highlighting the strength of its cash flow.

From the September 27-30 period, the company repurchased roughly 2 million shares of stock publicly, for ~$3 million USD total, or 0.3% of its outstanding shares. That’s a share repurchase rate of almost 40% annualized but it’s also one that the company can comfortably afford to keep going given its massive cash flow.

The company has the ability to repurchase roughly 8% of its outstanding shares over the upcoming 12 months. That’s something that the company can comfortably afford and something that we expect it to take advantage of during market downturns. That continued ability to drive shareholder returns makes the company a valuable investment.

Africa Oil Corp. Overview

Overall, Africa Oil Corp. is one of the company’s best positioned to outperform in an expensive oil environment.

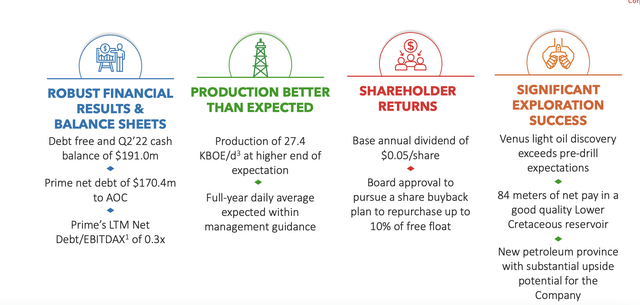

Africa Oil Corp. Investor Presentation

Africa Oil Corp. has a number of valuable assets; however, the entirety of its production is from its Prime Oil and Gas division. The company has net debt of $170 million attributable to the company from Prime Oil and Gas, an incredibly manageable financial position. The company has managed to substantial reduce its debt over the past few years.

That means in upcoming years, without the need to pay down debt, cash flow should grow substantially. The company has announced an annual dividend of roughly 2.5% annualized and we expect it to be able to repurchase the 10% of free float over the next year. The company also has a size-able exploration portfolio that we expect to increase earnings.

Africa Oil Corp. Financial Performance

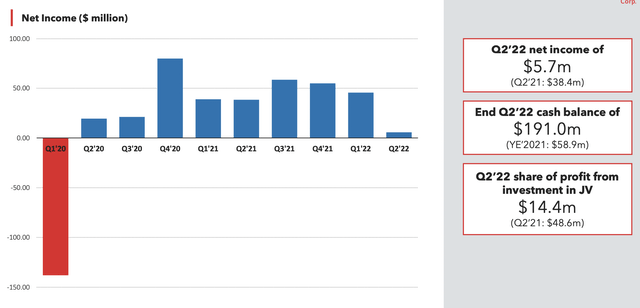

Africa Oil Corp.’s financials have remained incredibly strong.

Africa Oil Corp. Investor Presentation

The company has maintained strong earnings. The company’s cash balance is now almost $200 million and the overall company has a net cash position. That’s despite having a net debt position of almost $1 billion just a few years ago when it acquired Prime Oil and Gas. That financial position means there’s minimal risk to the company in a downturn.

It also means that the cash flow that was originally being put towards interest or debt repurchases can now be redirected towards shareholder rewards. Going forward we expect the company’s net income to be to the tune of $100s of millions annually. The company will be able to redirect that to a variety of double-digit shareholder returns.

Africa Oil Corp. Growth Potential

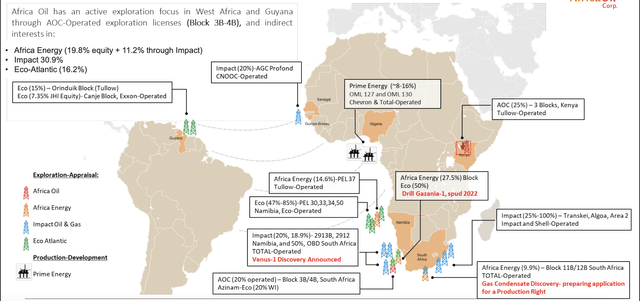

Africa Oil Corp. has continued growth potential from its diversified portfolio of assets.

Africa Oil Corp. Investor Presentation

The company has substantial equity stakes in 3 companies that are exploring the global oil fields of primarily Africa and South America. The company has seen several discoveries here including a gas condensate discovery by Africa Energy and the massive Venus-1 discovery which could lead to the development of a new large field.

The company has several opportunities here that could start producing before the end of the decade. At the same time, should these assets not pan out, there’s no risk to the company.

Africa Oil Corp. Shareholder Rewards

Africa Oil Corp. has a number of levers it can use to drive strong shareholder returns.

Starting from the basics, the company now has a dividend yield of more than 2% which it can afford easily. That forms the basis of the company’s shareholder returns and makes it competitive with other ETFs and stocks while providing a base level of cash to shareholder’s pockets. We expect this dividend to continue for decades.

Second is the company’s share buybacks. This provides a unique lever for the company to magnify future shareholder returns. Just over the next year the company has the ability to repurchase almost 10% of its shares outstanding, providing double-digit shareholder rewards. Regardless of how the company spends this cash, it’s a valuable investment.

Thesis Risk

The largest risk to the company is oil prices, however, the company is well protected in that department. OPEC+ has announced a 2 million barrel / day production cut (likely to be closer to 1 million barrels / day in reality) due to recession fairs. That indicates that they’re looking to keep prices at $90+ / barrel long-term, a level where Africa Oil Corp is very profitable.

Still volume can drop rapidly at any moment hurting the company substantially. It remains in a commoditized environment.

Conclusion

Africa Oil Corp. is a company that we’ve been a big fan of for a while, and the company is finally proving why through its share repurchase program. The company has a dividend that’s now more than 2% and the company’s share price has performed quite well recently, despite some weakness in the overall market.

The company also has the ability to repurchase almost 10% of its shares over the next year and it has started taking advantage of that. We’d like to see that continue, especially during any weakness, as the company’s decreasing debt load means it now has substantial cash.

Be the first to comment