Drew Angerer

Investment Thesis

Affirm (NASDAQ:NASDAQ:AFRM) needs to take its medicine. There’s already enough evidence in the market to reflect both the positive and negative elements facing Affirm.

My bull case for Affirm is that as soon as Affirm downward revises its fiscal 2023 guidance, and states that it won’t reach positive adjusted operating income in fiscal 2023, the market will welcome its renewed guidance.

Once bad news is out, Affirm will become attractive, particularly given that its market cap is only $5 billion.

Entering Unchartered Territory

In the past few days with seen guidance from a broad range of companies, including Carnival (CCL) (cruise company, skewed toward budget customers), Nike (premium sports goods), Micron (memory chips aimed at both enterprise and retail markets), and FedEx (FDX) (package-deliveries).

And what these companies have in common is that they have all notified the investment community that their outlook is weaker than previously expected.

Meanwhile, analysts were caught back footed and have nearly ubiquitously asserted blame on management teams for poor execution! Indeed, it’s better to blame management rather than see the landscape for what it is, an unprecedented slowing down of the economy.

We’ve just come away from a period of plenty, with stimulus monies being thrown out the window, and we have now entered ”the lean” period.

From Affirm’s perspective, this is where the situation gets complicated. I recognize that Affirm is going to need to negatively shock the investment community as it will have to come clean and downwards revise its near-term guidance.

The backdrop that Affirm faces today is markedly different from the backdrop back in August when Affirm guided for fiscal Q1 2023 (ended September). And that’s what we’ll discuss next.

Revenue Growth Rates Slow Down

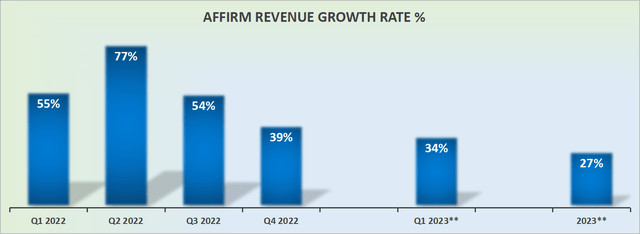

AFRM revenue growth rates

Anyone who’s anyone by now has to realize that Affirm is facing two problems. Two very different types of problems. One not of Affirm’s own making, while the other is of its own making. And I’ll address these in turn.

As alluded to already, Affirm’s environment last year could not possibly be more different than today.

In fiscal 2022, the economy was swinging. Affirm cleared 55% CAGR in fiscal 2022. And the value proposition of its business model clearly resonated with both merchants and consumers.

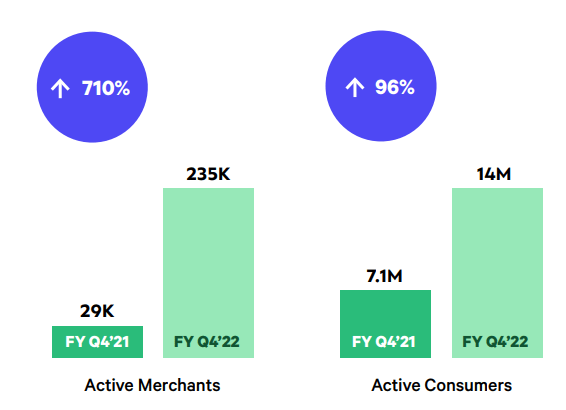

AFRM Q4 2022 presentation

As you can see above, there was obvious virality to its offering as it was being rapidly embraced by both merchants and consumers.

And this leads me to its second problem, a problem that’s not of Affirm’s own making. Affirm’s offering was too successful. That meant companies from all walks of life sought to deploy their own competitive Buy Now Pay Later offering.

From PayPal (PYPL) to Klarna (private), Apple (AAPL) to Afterpay (SQ), as well as a myriad of other platforms, the landscape today is fully littered with competing offerings.

And while Affirm can contend that so much competition is interested in this space is a vindication of its business model, this level of competition doesn’t bode well for Affirm’s ability to substantially take market share.

Ultimately, if there’s not even a small moat around Affirm, its ability to trade at a premium valuation will be significantly impaired.

Hence, this takes us to discuss its valuation.

AFRM Stock Valuation – Difficult To Appraise

Let’s be honest, Affirm’s ability to reach GAAP profitability is a long time away. Affirm. Nevertheless, Affirm continues to proclaim that by the end of fiscal 2023, as a run rate, it will see positive adjusted operating income.

However, realistically, I simply don’t believe that Affirm’s business model will have achieved enough scale to reach its intended target by the end of fiscal 2023.

That being said, for all the pizzazz that Affirm oozes, the fact remains that the market hasn’t wanted anything to do with Affirm for a while. Indeed, its stock is already down 85% from the highs set last year.

And while nobody should price anchor Affirm’s share price to those levels, the fact remains that Affirm already has seen investors’ sentiment turn negative.

In sum, Affirm is a story stock. And like a story stock in a bull market, it soared. And like a story stock in a bear market, it plummeted. However, I believe that the truth lies somewhere between those two extremes.

The Bottom Line

Affirm has already seen its share price fully collapse, and from this point, the risk-reward substantially improves. That being said, realistically, there are serious near-term problems that I believe will materially impact Affirm’s potential.

However, I believe that the market also will see through this. I believe that the market has already discounted Affirm prospects too aggressively. Hence, with a $5 billion market cap, I believe that this stock today is interesting and worth following closely.

Essentially, I believe that Affirm will be forced to come clean, take its medicine, and downward revise its fiscal 2023 guidance to push back its plans to reach positive adjusted operating income by the end of fiscal 2023. And that investors will welcome a more realistic and measured path to profitability.

Be the first to comment