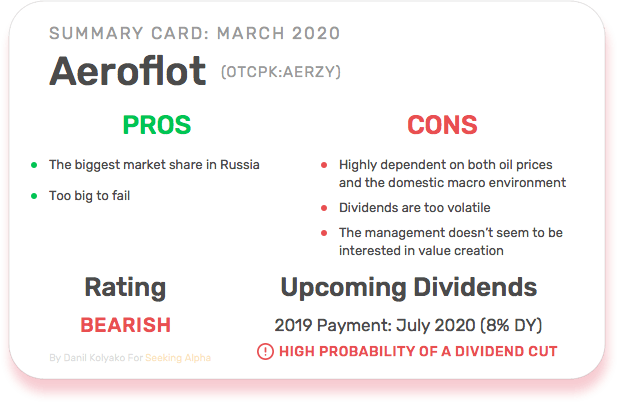

The coronavirus has given rise to new serious concerns about Aeroflot (OTCPK:AERZY). The company is about to face a full stoppage of its business as international flights are already fully suspended, and only some domestic routes are still operational. I expect a long recovery of airline business in Russia after the coronavirus pandemic, so if you’re looking for an once-in-a-lifetime investment opportunity in the airline sector, Aeroflot is definitely not a company worth considering.

Q4 Results Highlights

The revenue of Aeroflot for 2019 is up 10.8% YoY to 677.9 billion rubles. Revenues from regular passenger traffic increased by 12.2% compared to the previous year and amounted to 557.1 billion rubles, which is associated with an increase in passenger traffic. Revenue from charter flights decreased by 1.1% to 37.4 billion rubles.

Source: Company data, Author’s spreadsheet

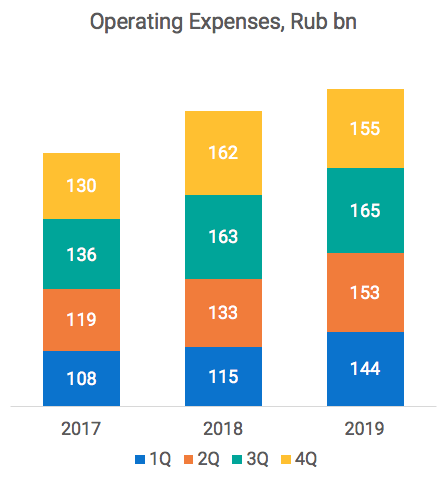

Operating expenses in 2019 increased by 12.1% compared to the previous year and amounted to 617.2 billion rubles, which is mainly due to the growth in the volume of operations, in particular the displayed capacities increased by 10.3%. Operating expenses in the fourth quarter amounted to 154.9 billion rubles, an increase of 2.3% YoY. In fact, all the growth the company managed to achieve in 2019 was completely offset by the growth in operating expenses.

Source: Company data, Author’s spreadsheet

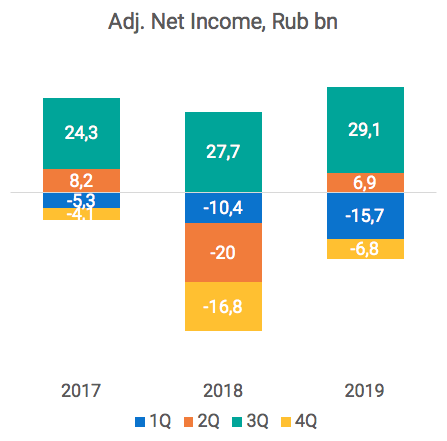

Aeroflot’s net profit for 2019 amounted to 13.5 billion rubles vs. a loss of 55.7 billion rubles a year earlier. The company’s net loss for the fourth quarter of 2019 amounted to -6.8 billion rubles, down by 82.3% compared to the fourth quarter of 2018.

Source: Company data, Author’s spreadsheet

Net debt at the end of 2019 amounted to 547.8 billion rubles, a decrease of 13.1% YoY. The decrease in the debt load is mainly due to the revaluation of lease obligations caused by the USD/RUB rate changes, as well as due to the repayment of obligations in accordance with the payment schedule.

The last two years were pretty tough for Aeroflot because of higher oil prices. Now oil prices are not a problem, but the coronavirus pandemic is going to turn the life of airline carriers into hell on earth.

The Outlook

From the highs of February, Aeroflot shares fell by more than 45% vs. a decline of MOEX by 25%. The company will suffer a catastrophic blow to its revenues; due to a rapid spread of the coronavirus, Aeroflot has so far closed 92 international routes out of 94, according to TASS.

Aeroflot could at least partially compensate losses by focusing on domestic routes, but they can be closed either. Aeroflot’s low-cost subsidiary, Pobeda, has already fully halted flights until June.

In the meantime, Aeroflot has once again proved that the main goal of the company is the personal enrichment of its management. The management has set itself an incredible 2.1 billion rubles bonus for 2019. This sum accounts for 15% of the company’s profits and is more than the dividends paid to the Russian government (1.5 billion rubles).

After such a move, Aeroflot may not count on generous support from the government. Russian authorities are likely to provide loans to Aeroflot just to let it maintain its social obligations in the domestic market, but nothing more. Also, investors shouldn’t count on dividends to be paid this summer as the company will almost certainly completely cut them.

Final Thoughts

Excluding the effect of the virus, Aeroflot is destined to suffer more than its international peers: the company can’t fully benefit from low oil prices because its primary market is Russia which is economically highly dependent on oil. Aeroflot can’t fully benefit from higher oil prices either as stronger consumer purchasing power is overshadowed by higher fuel expenses.

A strong driver for the stock rebound could be the news of a slowdown in COVID-19 spread and the elimination of restrictions on international air traffic, but there’s a high degree of uncertainty about the timing of such events.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment