Poulssen

After a 100% upside booked in Aegon (NYSE:AEG), we are still optimistic about the Dutch insurer. In our follow-up note, our re-new buy case recap was based on the following:

- A higher FCF generation that, according to our estimates, was over €2.0bn until 2023;

- A debt reduction thanks to the sale of its Hungarian businesses;

- Wilton Re’s reinsurance transaction, which was helping the company to achieve a better margin of safety on US mortality;

- No exposure to Russia/Belarus/Ukraine.

Q2 Results

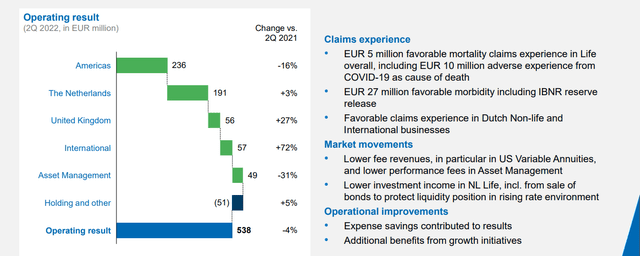

The quarterly performances were a good indication of Aegon’s positive trajectory, and the company stock price is currently up by >8%. However, looking at the results, the company delivered a mixed quarter. Starting from the bottom line, we note a loss of €348 million compared to a profit of €849 million achieved in the same period last year. This negative result was driven by two one-off charges: a loss related to bond sales to protect the company’s liquidity given the inflation expectation and another capital loss booked for hedging the rising interest rates in the United States. Going up in the P&L, the Aegon’s operating result stood at €538 million versus the €562 million recorded in Q2 2021. Numbers in hand, there was pros and cons development to report. On one hand, Aegon achieved better cost savings and lower claims. On the other hand, the results were totally offset by a lower fee generation in the US segment, a decrease in performance fee in the Asset Management division (due to the negative equity market), and decremental income generation in the home country Life segment. Cross-checking Wall Street analysts’ estimates, we noticed that operating profit was a beat by 11% while net income was a miss by more than €200 million.

Aegon Operating Results (Aegon Q2 Results)

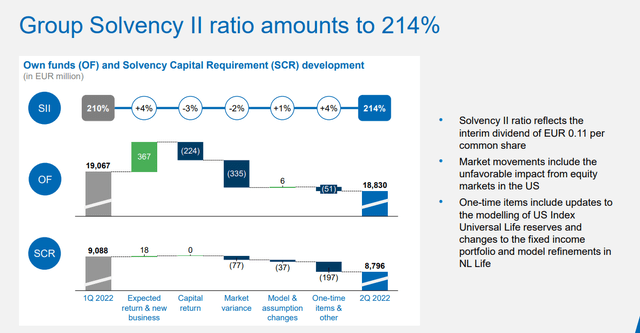

Regarding Aegon’s solvency ratio, the company was well ahead of the average consensus (214% versus 200%). All the regions were impacted by market volatility and negative equity performances. However, the Netherlands Life solvency ratio was 400 basis points higher on a quarterly basis thanks to management actions that lowered the capital requirements. The same story happened for the US RBC ratio, which reached 416% and was also ahead by 22 points versus expectations. Aegon’s solvency ratio was also impacted by the interim dividend payment, which was 3 cents higher than the previous year’s payment.

Aegon Solvency Ratio (Aegon Q2 Results)

Conclusion and Valuation

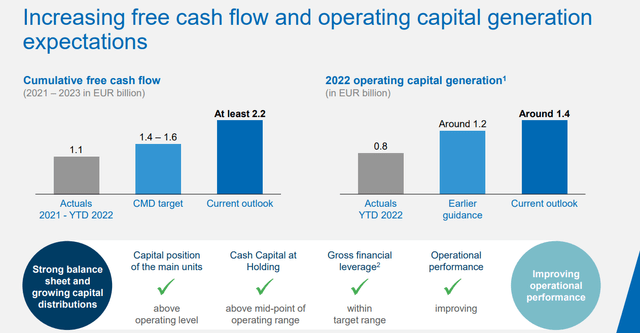

The company has a sufficient capital buffer for regulatory requirements and, more importantly, has upgraded its FCF guidance to >€2.2bn over the period between 2021 and 2023. As we can see below, during the company’s CMD, they were targeting €500 – €1.500 billion, and looking at Mare Evidence Lab’s previous publication we estimated “over €2.0 billion until 2023“. Last time, we also explained how: “the strong cash generation will allow for additional returns and be upfront on the deleveraging target“. This is exactly what is going on. The company’s interim dividend was €0.11 per share versus expectations of €0.10 and in addition, Aegon is now targeting a DPS of €0.25 for 2023. Since our last update, the stock price is trading at the same price value. Thus, Aegon is currently trading with an FCF yield higher than 10% and a normalized P/E 2023 lower than 6x, we reaffirm our target price at €5.7 per share and continue to maintain an outperforming rating.

Be the first to comment