David Tran/iStock Editorial via Getty Images

Investment Thesis

Adobe Inc. (NASDAQ:ADBE) reported a better than expected FQ2 card but disappointed the market with its guidance for FQ3 and FY22. The company attributed headwinds related to its pullout from Russia and Belarus, foreign exchange, and seasonality.

However, with the stock down 48% from its November 2021 highs, we believe the market has likely priced in much of its weakness. Notwithstanding, the company’s weaker-than-expected guidance sent the stock down a further 4% post-earnings as investors parsed the impact on its valuations.

Despite that, we think Adobe’s weaker than estimated guidance reflects headwinds that are likely to be transitory in impact. Therefore, it should not significantly impact its recovery trajectory from FY23.

Still, investors should not expect the company to post the gangbusters revenue growth rates it delivered over the past five years, moving ahead. However, we believe its solid free cash flow (FCF) profitability highlights its robust moat, deserving of its premium valuation.

In addition, our reverse cash flow valuation analysis also suggests that it should be able to achieve our revenue targets by CQ2’26. However, our price action analysis indicates that its most updated price action has yet to demonstrate a validated bear trap signal after the recent sell-off.

Notwithstanding, we believe it’s likely to be at a near-term bottom, and we urge investors to watch its price action closely for a robust signal.

We reiterate our Buy rating on its more attractive valuation.

Adobe’s Growth Has Continued To Slow

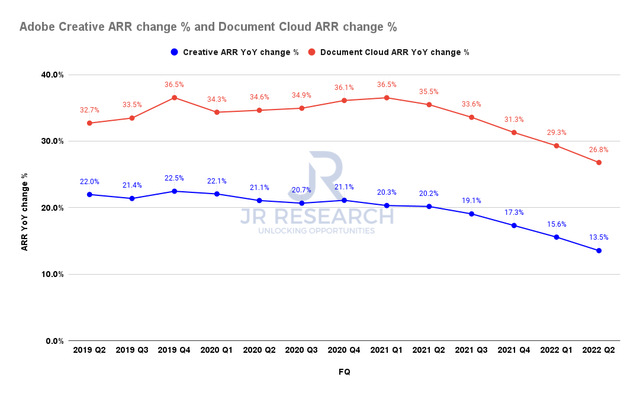

Adobe ARR change % (Company filings)

Readers can glean from Adobe’s slowing annualized recurring revenue (ARR) growth since reaching its peak in FQ1’21. Therefore, the market’s prescience in setting up its double top bull trap (which we missed previously) to digest its rapid gains from 2020-21 was justified.

Adobe reported a 12.5% YoY increase in its most important Creative ARR, down from FQ1’s 15.6% growth. However, its smaller Document Cloud ARR continues to outperform, registering a 26.8% increase and down from FQ1’s 29.3% growth.

Therefore, we think there’s no doubt that Adobe’s growth has slowed down significantly, as it couldn’t keep up with the challenging comps it delivered in FY21.

But, Look Forward To A Brighter FY23

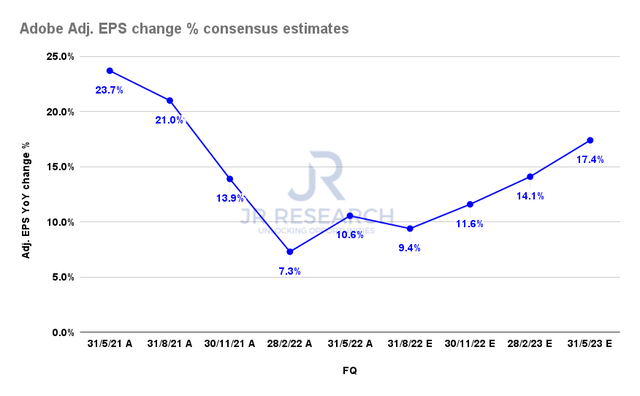

Adobe adjusted EPS change % consensus estimates (S&P Cap IQ)

Notably, Adobe delivered a better than estimated adjusted and GAAP EPS growth in FQ2. As seen above, Adobe’s adjusted EPS increased by 10.6% in FQ2 (Vs. consensus estimates of a 9.3% increase).

However, it proffered markedly weaker revenue and earnings guidance for FQ3 and FY22. Adobe’s revenue guidance of $4.43B in FQ3 (up 12.58% YoY) is well below the consensus estimates of $4.52B (up 14.8% YoY). As a result, its adjusted EPS guidance is also lower at $3.33 (up 7.07%), compared to the consensus estimates of 9.4% growth.

We also expect the rest of the consensus estimates for FQ3-FQ4 to be revised downwards as Adobe navigates the challenging comps from FY21. However, we remain confident that its FY23 recovery remains on track, as its growth normalized this FY.

Valuation Is Also More Attractive – But Not Undervalued

| Stock | ADBE |

| Current market cap | $172.5B |

| Hurdle rate (CAGR) | 15% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 4% |

| Assumed TTM FCF margin in CQ2’26 | 42% |

| Implied TTM revenue by CQ2’26 | $28.73B |

ADBE stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

We must highlight that investors should not expect the significant market-beating returns Adobe posted over the past five years. Notably, ADBE stock delivered a 5Y CAGR of 21.37%, with a TTM 5Y revenue CAGR of 21.9%.

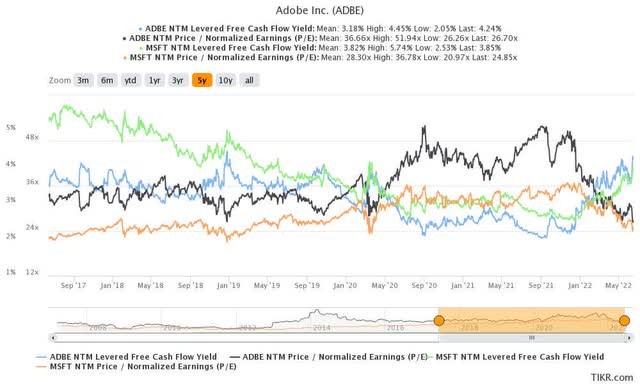

ADBE valuation metrics (TIKR)

Given its much slower growth, we have adjusted our hurdle rate to 15%, which is slightly ahead of our expectations of the market’s average. Consequently, we revised our required FCF yield to 4%, in line with its current metrics but well above its 5Y mean of 3.18%. Given its markedly slowing topline growth, we think it’s justified that the market is asking for a higher FCF yield.

Consequently, our parameters suggest that Adobe needs to deliver a TTM revenue of $28.73B by CQ2’26. It implies a revenue CAGR of 14.54%, which we think seems achievable.

Is ADBE Stock A Buy, Sell, Or Hold?

Our price action analysis suggests that ADBE is at a near-term bottom, but there’s no bear trap price action yet. Therefore, more conservative investors may consider waiting for a validated signal before pulling the trigger.

Otherwise, we think its valuation is attractive enough to reiterate our Buy rating, even though it’s not undervalued.

Be the first to comment