ptasha/iStock via Getty Images

Adobe’s Q1 2022 results were perceived as a disappointment for a few reasons:

- Omicron had helped margins in 1Q due to lower travel expenses etc but could see costs flare up as people get back to the office and things return to the pre-pandemic normal

- The Ukraine – Russia war has led the company to stop all sales in the region, which has led to Adobe reducing its total ARR by $87 million and a revenue impact of $75 million for 2022. Q1 also saw some weakness in Europe due to the conflict.

- After nearly half a decade of not changing pricing, Adobe is planning to revamp its pricing which is expected to slowly percolate through the user base over 2Q and possibly start showing an impact in 2H.

All things considered, prima-facie, the market isn’t wrong in expecting Adobe to have fallen out of favour and possibly the management losing its mind – what are they thinking raising prices when the Fed has publicly become hawkish?

The answer to this question is both fascinating and ambitious!

Rewind five years back

In June of 2018, Adobe started mentioning something called the Unified Customer Profile or the UCP.

Recent advancements include a new Unified Customer Profile that combines data across an enterprise, intelligent services, and General Data Protection Regulation, or GDPR readiness, all aimed at solving key challenges facing marketers, data scientists and developers.

Source: Q2 2018 Earning Call from Seeking Alpha

It did not take much time for the company to disclose the UCP was a detailed online view of an individual, aimed at allowing understanding them better.

First, with respect what we are doing on the Experience Cloud, an area of innovation that we’re particularly excited about is enabling for all enterprises to have a Unified Customer Profile, where we are getting all of the behavioral, demographic data for customers across all of our different solutions. It’s something that customers are already testing out in beta. And if you think about that, what it really means for us is this Unified Customer Profile can become the central nervous system in an enterprise, not just therefore targeting the CMOs but increasingly having the CIOs look at that as the basis for how they want to integrate a unified customer experience across all of the different enterprise solutions that might exist.

Source: Q3 2018 Earning Call from Seeking Alpha

This then led to chatter around a data-driven operating model or DDOM, which was geared towards upselling more to customer based on their usage patterns derived from the earlier work on the UCP.

Calling the DDOM as the single source of truth, the company laid out the following:

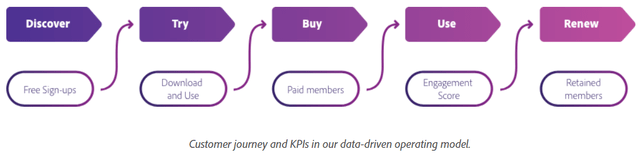

The model outlines the different phases of the customer journey — discover, try, buy, use and renew — which helps us structure the way we monitor the health of the business. Each phase has a specific KPI, programmes and owner and we take all the data we collect through the business around these to establish a single source of truth.

DDOM (Adobe)

Adobe was collecting user behaviour data of paying customers to understand their needs and building an analytical engine on top to help serve more, all with the knowledge of employers and while complying with every data and privacy law there exists.

The volume of user data and the analytics built on top of this interaction level data can was always a gold mine.

Fast forward to the present

In addition to perfecting what it serves to whom in its walled garden, Adobe is now going to up the prices of its servings!

While Facebook (or Meta) was held guilty on many occasions of misusing customer data for a spectrum of malicious activities, Adobe has access to the data of a large part of over 0.5 billion with no such compulsions. Adobe’s ARPUs are and will be much higher than what Meta could ever achieve, simply on the back of the data transactions Adobe has had. To get an idea of the scale of what Adobe deals with, one needs to get a sense of the volume of transactions the company processes. While discontinued from 2018 onwards, Adobe used to disclose how many data transactions were processed on its platform until 2017.

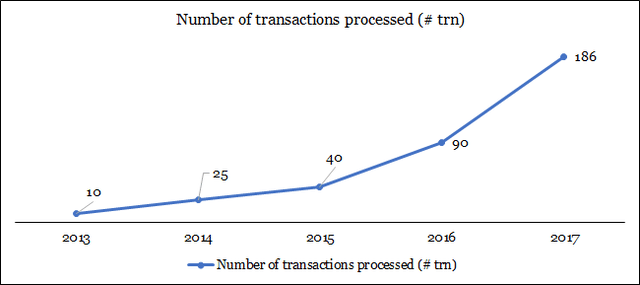

Number of data transactions processed (Adobe 10K filings)

As evident, the transactions were growing 100% y/y before the UCP was rolled out – we leave it to the user’s imagination how volumes would have grown after DDOM became mainstream.

To add a little more context, Adobe’s revenue grew from $4 billion in 2013 to a little over $7.3 billion in 2017, implying revenue per transaction kept falling from some 4 cents to one-tenth that value. Assuming an exponential growth in volumes, prices would be sub 1 cent – which should explain what the management can achieve by upping prices!

Let the numbers talk more

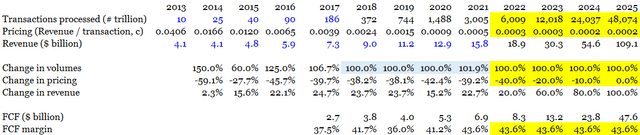

Adobe’s revenue analysis based on transactions (Adobe 10Ks, Author’s analysis)

We do not have management numbers as to how the transactions processed grew from 2018 onwards so we assume that until 2021 they were growing at a 100% y/y. The basis for our assumption is the introduction of the UCP and subsequent shift towards DDOM, both of which were focussed on understanding user behaviour better by increasing collaboration (and thus transactions). (2021 volume numbers had been adjusted for a 53-week fiscal.)

Pricing (or revenue per transaction)

Based on Adobe’s reported revenue, the obvious consequence of such a steep increase in transactions would have been a fall in pricing, something that was also seen historically. The pricing for us also fell at around 38-39% compounded over 2017-21.

2022 and beyond

Taking into account the lost business due to the war and balancing it with the increased collaboration, we conservatively peg the transaction growth at 100% for the next few years. To put things in context, Web3 is all about monetisation and gamification and Adobe knows a few more tricks in that arena than most!

Next, we consider the management’s expectation of increasing prices – frankly, that might be ambitious. We don’t think pricing will move much this year due to the following reasons:

- First-year out of the pandemic and if you raise prices, people are going to frown and then you end up giving discounts. Net-net some wins but overall should remain thereabouts.

- Also, let us not forget Europe could see some weakness with the issues around Russian gas etc.

Overall, we assume 2022 pricing to fall in line with 2021. 2023 should be a different ball game, where the customers would have gotten used to the management push for an increase in pricing. While the overall pricing should still be weak, there should be much better traction with almost 6-7 quarters of Adobe having invested in pricing. We see the subsequent years to continue seeing an uptick in pricing.

Bringing it all together

Adobe has guided to $17.9 billion in revenues – unless the transaction volumes fall off the cliff, we don’t see 17.9 to even be a conservative number. Our assumptions on volume and pricing are very conservative and those lead to $18.9 billion. Even a shade higher on pricing or volumes will case revenues to increase much ahead of where we are.

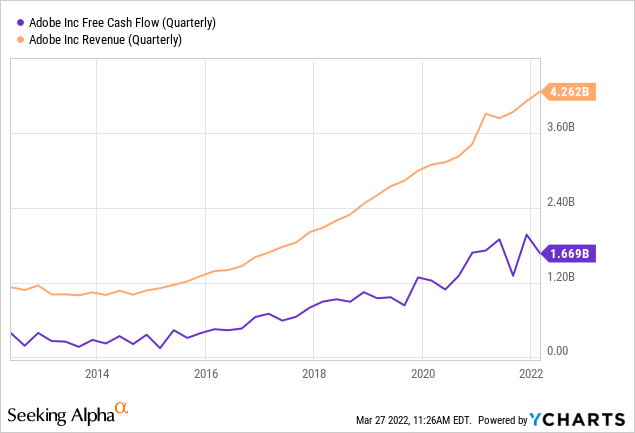

This also brings into question the free cash flow or FCF. We have seen a 40% FCF margin, assuming it around those levels, Adobe could end up generating more than $8 billion in 2022 alone! At $200 billion in market cap, the company trades at 25x to 2022 FCF, which is a yield of 4% and arguably not expensive.

Taking a 2023 view of $13 billion in FCF, a 6.5% yield is inexpensive. We think a 50-60% return (6.5% yield normalizing to 4%) is a very plausible base case, with the upside cases turning Adobe into a multi-bagger.

Risks

- Another episode of the pandemic could lead to a short-term disruption, which could be another buying opportunity given the pandemic has been pulling forward digital journeys.

- Should the Ukraine-Russia war impact larger areas of Europe or call for USA’s more direct involvement, our thesis could take a hit.

- Execution issues around implementing pricing have already been accounted for assuming a 40% drop in pricing and should provide adequate comfort.

Conclusion

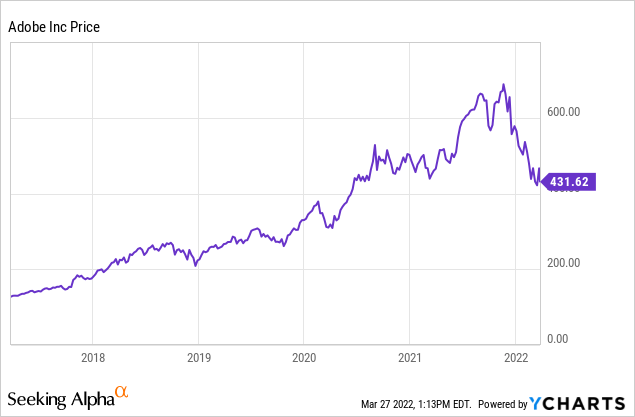

Adobe’s stock price has nearly quadrupled between 2018 and mid-2021, on the back of traction and growth in cash flows.

The growth in stock price until mid-2021 was driven by better user analytics (or understanding the demand psychology).

Armed with the understanding of a massive user base, serving up the right recipes are unlikely to let the customers pass. We think Adobe is at an actual inflexion point and could be a strong bet for the next couple of years and more.

Be the first to comment