hapabapa

Investment Thesis

Adobe Inc.’s (NASDAQ:ADBE) Q3 2022 results took investors by surprise. It was not so much a large acquisition that caused the company problems, but the fact that Adobe announced this acquisition at a time when it also missed its revenue estimates.

I don’t like to describe this corporate event as desperate, but I feel that on this occasion this is what it is, at least on the surface.

Investors didn’t like this news, and the stock sold off 16%. But I’m not convinced that this is how the story ends. I believe that this is only the start of a new, dark journey for Adobe.

On balance, I recommend a sell on this stock.

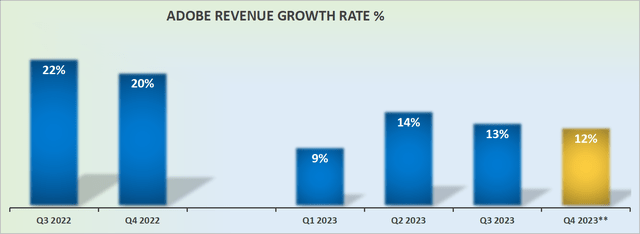

Adobe’s Revenue Growth Rates Slow Down

When Adobe missed its revenue guidance, that wasn’t the main story leading to the sell-off.

Rather, it was a combination of things.

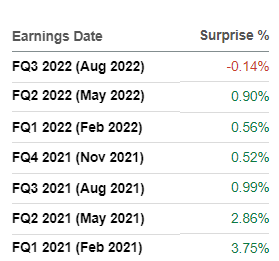

ADBE revenue surprises

As you can see illustrated above, Adobe rarely misses on the Street’s revenue estimates. But even that would not be such a big deal.

What I do believe is a big deal is that Adobe is betting too much on its Figma acquisition.

The Figma Acquisition

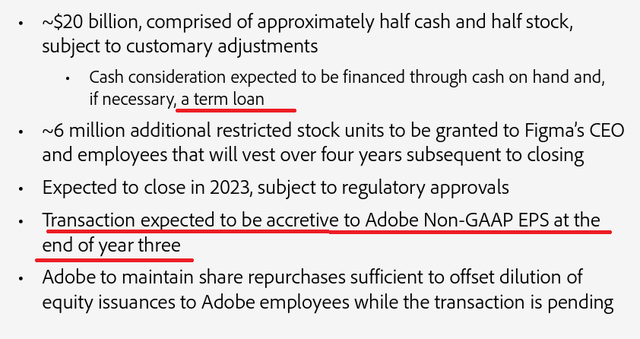

Two important insights are highlighted above. Adobe may have to raise debt. And Figma won’t be accretive to Adobe’s non-GAAP EPS figures until the end of 2026. Let’s discuss these two aspects in more detail.

Adobe finished Q3 2022 with $5.6 billion of cash. But keep in mind that it also holds approximately $4.1 billion of debt.

Hence, if we assume that Adobe, as a business, has ample recurring free cash flows, and can drain down the cash balance sheet, it still only has approximately $5 billion of available cash.

Even if Adobe makes around $2 billion of free cash flow over the next twelve months, there’s going to be a $3 billion shortfall in its cash position.

That will have to come in the form of debt. That leaves around $10 billion of equity dilution.

Given that Adobe has been so active in repurchasing its shares all the way from +$600 to around $300, it looks like a very poor use of capital to now dilute shareholders.

It could be said that Adobe’s management team was buying back its stock high and now is selling low. To be clear, there’s no hindsight on the analysis here.

It’s a fact that Adobe was repurchasing shares at higher prices and it’s now diluting shareholders at a lower price.

What’s more, Figma is being bought at a multiple much higher than Adobe presently trades for. Something we’ll discuss next.

Thinking About The Multiple for Adobe and Figma

In the past 12 months, Adobe deployed $6.2 billion to repurchase its shares. On the back of this capital deployment, the total number of shares have come down by 2.5%.

The multiple that Adobe trades at is approximately 7x next year’s revenues.

Meanwhile, Figma is being bought at approximately 25x next year’s revenues. To be clear, my 25x forward multiple is different from the 50x multiple that others on SA have noted.

The reason for the discrepancy is that I’m extrapolating 100% in revenue growth rates into 2023.

Needless to say, there are not many companies in the world growing at 100% to $800 million of ARR.

In plain English, I’ve assumed a very aggressive growth rate, to justify the 25x forward multiple. A more realistic multiple for Figma is around 30x next year’s sales.

Now, as I look around at other unprofitable businesses that are growing at higher than 50% CAGR, I don’t see any of them today at a +20x next year’s sales.

In short, I believe that Adobe paid an above-”market multiple” for Figma.

On the other hand, I can acquiesce that it’s possible that Adobe could make the argument that it could find potential for synergies as it cross-sells into Figma’s customer base.

ADBE Stock Valuation – 7x Sales

By this time next year, Adobe will probably be reporting $20 billion in revenues. This means that Figma’s total revenues will account for less than 5% of its total revenues.

Thus, here’s my question, is it worthwhile paying more than 10% of your market cap for a business that is only going to bring in less than 5% of your market cap?

We’d need to strongly believe that Figma can continue to report truly explosive growth for a good few years to justify this valuation.

Particularly when the multiples that investors are today paying for tech have come down across the board.

The Bottom Line

The single most important aspect of investing is to make sure that we are receptive to new points of view. The second most important aspect of investing is to avoid price anchoring.

The stock is down, 50% in a year, and for a lot of investors with the stock down so much, there’s sometimes disbelief that it may fall any further. After all, this time last year the stock was comfortably above $600 per share.

But after taking on board what I’ve written, I believe that you’ll agree, that it matters little where Adobe was last year.

All that matters now is what the future holds for the company. Where will the organic growth come from? And whether or not there’s enough margin of safety in the stock today.

And those are very difficult questions to find answers to. But when the stock is still priced at 7x next year’s revenues, I believe that it makes it a little easier to find the right course of action.

Be the first to comment