simonkr/E+ via Getty Images

Why Is Admiral Share Price Dropping?

We review Admiral Group plc (OTCPK:AMIGY) after shares fell below 2,000p on Tuesday (September 27), for the first time since H1 2022 results on August 10, including a loss of 8% since last Thursday:

|

Admiral Share Price (Last 1 Year)  Source: Google Finance (27-Sep-22). |

Two developments drove the decline in Admiral shares in our view:

- The British pound falling and U.K. interest rates rising significantly, especially after a government “mini-budget”

- Poor results reported by Saga plc (OTC:SGPLF), a niche competitor to Admiral in motor and home insurance

We believe the decline in Admiral’s share price to be unfair. The weaker currency and higher government bond yields will have little real impact on Admiral’s business, though the former will be a negative for international investors. Poor results at Saga are in fact a positive, as they demonstrate how recent regulatory changes represent an advantage for Admiral. In addition, claim cost inflation is similar to what others had reported for H1, and pricing is improving.

Relative to pre-COVID 2019, when Admiral was insuring 19% fewer U.K. vehicles, shares have a 13.1x P/E. Our forecasts show a total return of 124% (31.4% annualized) by 2025 year-end and an 8% Dividend Yield. Buy.

Admiral Buy Case Recap

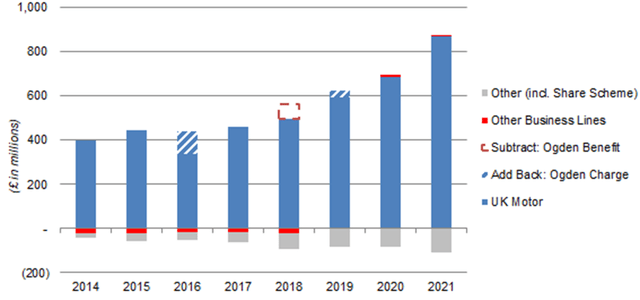

Admiral is a U.K. insurer with a market capitalization of £5.9bn ($6.3bn). It generates most of its Profit Before Tax (“PBT”) in U.K. motor insurance, where it is the market leader. It also offers household insurance, travel insurance and personal loans, and has small presences in Italy, France, Spain, and the U.S.:

|

Admiral PBT By Business (2014-21)  Source: Admiral company filings. |

We upgraded our rating to Buy in October 2020. Our investment case centres around the U.K. Motor business, where:

- The sector has continued to grow structurally, with the number of vehicles historically increasing at 1-2% annually, and premiums rising over time due to growing claim costs for both vehicles and medical treatment

- Admiral has continued to gain market share and generate solid profits because its lower Expense Ratio (from scale and efficiency) enables it to offer insurance at lower prices than competitors but achieve higher profits

- Admiral’s growth differs during different parts of the insurance cycle, but we believe it can achieve a high-single-digit EPS CAGR. During 2015-19, which we believe represents an entire cycle, U.K. Motor had CAGRs of 6.8% in vehicles and 8.2% in both total premiums and profits

- 2022 regulatory reforms requiring insurers to offer the same prices to new and existing customers will lead to higher pricing on new business, improve sector profitability and entrench leaders like Admiral

Admiral’s other businesses are small and generated just £5.2m in PBT in aggregate in 2021; some are loss-making. They can potentially create significant value in the long term, but this is not in our investment case.

2022 is expected to see a one-off step-down in Admiral’s profitability, as a result of claims frequency normalizing upwards after COVID-19, elevated claim cost inflation and sector pricing still adjusting to new regulatory reforms. Thus far Admiral has performed much better than peers, with H1 2022 U.K. Motor PBT being 25.9% higher than in 2019, and we expect full-year 2022 group PBT to be 10% higher than in 2019.

Our views are unchanged after recent developments.

U.K. Currency and Interest Rate Shifts

Since Admiral’s H1 2022 results on August 10, the U.K. Pound has fallen 12% against the U.S. Dollar, including a 5% decline since last Thursday (September 22), a significant deterioration in market sentiment towards the country:

|

GBP/USD Exchange Rate (Last 1 Year)  Source: Google Finance (27-Sep-22). |

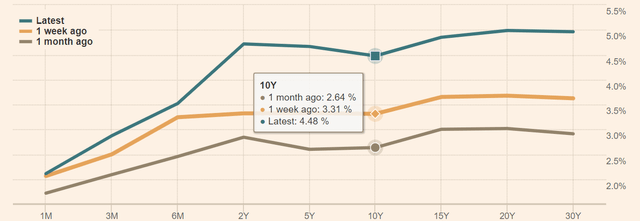

U.K. government bond yields have risen correspondingly (a negative, as it means higher borrowing costs for the government), with the 10-year yield at 4.48% now, compared to 3.31% a week ago and 2.64% a month ago:

|

U.K. Government Bond Yields (Latest vs. Prior Periods)  Source: Financial Times (27-Sep-22). |

The U.K. faces a number of macro headwinds, in particular higher energy costs after the Russian invasion of Ukraine in February and higher trade barriers with the European Union after the transition period ended at 2020 year-end. Market sentiment took another downward turn after the new Liz Truss administration released their first “mini-budget” with new Finance Minister Kwasi Kwarteng on Friday (September 23).

The “mini-budget” centered on tax cuts and was regarded as fiscally unsustainable by many commentators. As one of Kwarteng’s predecessors from his own party, Ken Clarke, commented:

I’m afraid that’s the kind of thing that’s usually tried in Latin American countries without success … We’re heading in the Italian direction. That is going to be a problem, a very great problem, in the short term if it leads to a collapse in the pound and the loss of confidence in our economy. We’re going to drive investment away, not attract it.”

The Chief Economist at UBS (UBS) Wealth Management, Paul Donovan, went so far as calling the new Truss government a “doomsday cult”.

Many investors have completely lost confidence in the current U.K. government, causing the Pound to fall and U.K government bond yields to rise.

Little Impact on Admiral’s Business

Changes in the value of the Pound and U.K. government bond yields will not affect Admiral’s business meaningfully.

Admiral’s annual reports quantify the direct impact of such changes as small. As of 2021, for currency risk, each 10% depreciation of the Pound against the Dollar is expected to only reduce group PBT by £1.9m (out of £769m); and each 25% movement in both the Dollar and the Euro is expected to only reduce Group Solvency Ratio by 3 ppt (out of 195%). Similarly, each 50 bps decline in the yield curve is expected to reduce Group Solvency Ratio by 3 ppt (implying that an increase in the yield curve will actually be positive). Ultimately, Admiral has predominantly U.K. earnings and has a well-matched balance sheet in assets and liabilities.

There will be some indirect impact, though both pressures on consumer incomes and claim cost inflation – a cheaper Pound will make everything, including replacement cars and repair parts, more expensive for U.K. consumers. However, many consumers consider having a car as essential, and motor insurance premiums have proved resilient in past downturns (as described in prior articles). For the same reasons, we expect insurers to be able to pass on higher claim cost inflation through higher pricing over time.

Admiral does utilize reinsurance and quote insurance provided by international insurers, notably Munich Re, which underwrites 40% of its U.K. motor business. However, these are long-term relationships that have remained stable through past macro shocks such as Brexit; the Munich Re relationship, in particular, dates back nearly 20 years.

We also note the continuing interest from foreign firms in acquiring U.K. insurers since the 2016 Brexit referendum, with Canadian Intact Financial (IFC:CA) acquiring RSA’s U.K. business (and other assets) and Nordic Sampo (OTCPK:SAXPY) acquiring Hastings. We do not expect any difficulties with Admiral’s reinsurance.

For non-U.K. investors, the devaluation of the Pound is a real negative, reducing the value of Admiral shares in their home currency.

Positive Read-Across from Saga Results

Saga PLC is a niche competitor for Admiral in motor and home insurance, targeting primarily customers who are over 50 years old; it also has businesses in Cruise and Travel.

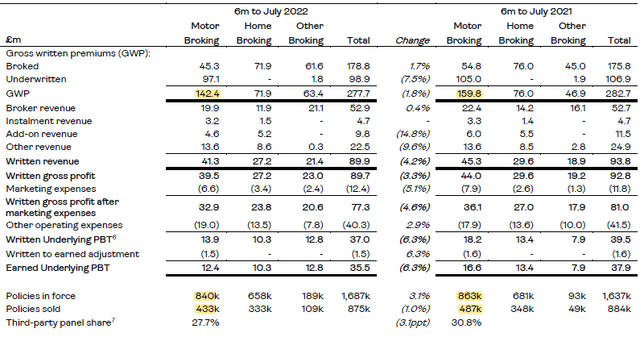

Saga released its H1 FY22 (ending 31 July) results on Tuesday (September 27), sending its shares down 24% for the day. Admiral shares were down 6.3% at one point, before closing 3.9% for the day; other U.K. motor insurers were also affected, with Direct Line (OTCPK:DIISY) shares losing 3% while Sabre Insurance (OTCPK:SBIGY) shares losing 2%. However, we believe Saga’s results actually provided positive read-across for Admiral.

First, Saga results demonstrated how recent regulatory changes represent an advantage for Admiral. In Saga’s Retail Broking business, which sells motor and other insurance as a broker, Motor policies sold were down 11% (54k) year-on-year, and Motor Gross Written Premiums were similarly down 11% (£17.4m) year-on-year:

|

Saga Retail Broking Financials (H1 FY22 vs. Prior Year)  Source: Saga results release (H1 FY22). |

(Saga’s Motor policies in force were only down 3% year-on-year, as the company has been selling multi-year policies which come up for renewal less often.)

Recall that Admiral actually gained 210k vehicles (or 4%) in its Motor business year-on-year in H1 2022. Saga is likely to be among the competitors who have lost market share to Admiral, because regulations now prevent them from using discounts to attract new customers and funding these discounts by higher prices for renewing customers.

There were other signs that regulatory reforms have benefited Admiral at the expense of Saga. During H1 FY22 Saga generated 50% of its new business in Motor and Home through direct channels, down 8 ppt year-on-year, while the other 50% has mostly come through price comparison websites, a channel where Admiral traditionally leads. Saga has also just introduced a new one-year Motor insurance product, having tried to use multi-year products to increase customer retention since 2019.

Other comments made by Saga management indicate the motor insurance industry is stabilizing. Saga has observed claim cost inflation of “around 13%” (for all insurance) currently, not far from the 11% figure (for Motor only) observed by Admiral back in August. They have also seen an improvement in market pricing, with “some movement in the last 3 months” and “a more rational response”, again consistent with what other companies were saying last month.

Valuation: 7%+ Dividend Yield

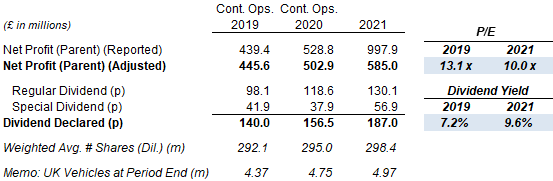

With shares at 1,950.9p, Admiral is trading at a 13.1x P/E with respect to 2019 and a 10.0x P/E with respect to 2021:

|

Admiral Earnings & Valuation (2019-21)  Source: Admiral company filings. |

2019 financials are more representative, as 2020 and 2021 benefited from lower claims frequency due to COVID-19; 2021 also included cash proceeds from the Price Comparison Website (“PCW”) disposal. However, Admiral now insures 18% more U.K. vehicles than at 2019 year-end and H1 2022 PBT was already 19% higher.

Admiral’s Dividend Yield is somewhat subjective because of the one-off component in recent dividends. The dividend was 140p in 2019 and 279p in 2021, but the latter included 92p funded by the PCW disposal; H1 2022 interim dividend was 105p, or 60p excluding the final 45.0p funded by the PCW disposal, compared to 63p declared in H1 2019. Our forecasts, based on a 90% Payout Ratio, indicate a dividend of 156.6p in 2023.

Relative to our 2023 forecast, which we see as the most representative, the Dividend Yield is 8.0%.

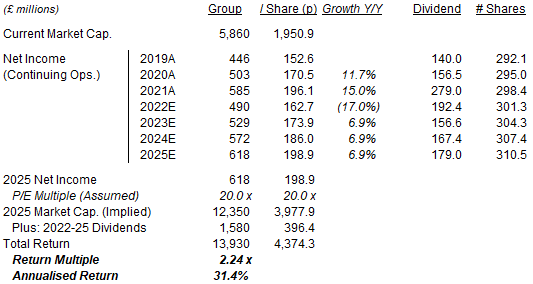

Illustrative Return Forecasts

We keep our forecasts unchanged, and key assumptions include:

- 2022 Net Profit of £490m, 10% higher than in 2019

- From 2023, Net Profit to grow at 8% annually

- Share count to grow at 1% annually

- Dividends to generally be 90% of EPS

- 2025 P/E of 20.0x, implying a 4.5% Dividend Yield

|

Illustrative Admiral Return Forecasts  Source: Librarian Capital estimates. |

With shares at 1,950.9p, we expect an exit price of 3,978p and a total return of 124% (31.4% annualised) by 2025 year-end.

Conclusion: Is Admiral Stock A Buy?

We reiterate our rating on Admiral Group PLC stock.

Be the first to comment