Svitlana Hulko/iStock via Getty Images

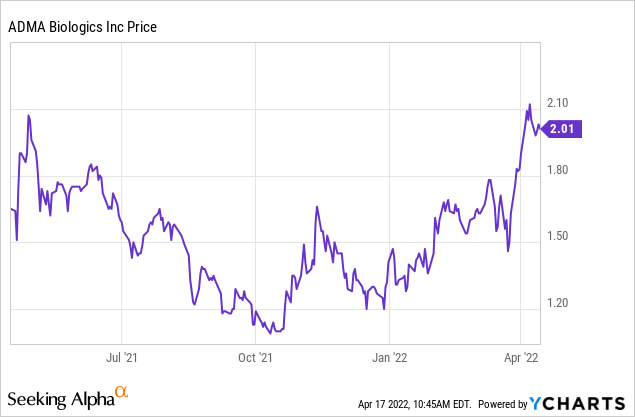

ADMA Biologics (NASDAQ:ADMA) had a tough 2021 but 2022 has been off to a great start. Since bottoming out at around $1 per share in October 2021, ADMA has doubled since. Nonetheless, ADMA is still only trading with a market capitalization of roughly $400 million and there are many positive catalysts on the horizon. In this article, I’ll provide an update on ADMA since my last article on January 18th and outline my take on ADMA’s future.

Updates Since January

Activist Investors Circling

In February, an activist investor, Caligan Partners, disclosed a 5.6% stake in ADMA in a 13D filing. Caligan said it was supportive of management’s strategic review using Morgan Stanley, i.e., ADMA pitching itself to potential acquirers/potential financing partners.

Caligan also said ADMA could be worth more than $4.50 per share and touted that ADMA’s assets “are extremely difficult to replicate and the public markets and not appropriately valuing those assets today.” Caligan noted it did not plan to nominate board members and wage a proxy fight, but the fact that they filed a 13D and not a 13G means they are intending for this position to be more active and they could wage a proxy filing at a later time.

In the weeks following Caligan’s announcement, many other funds filed 13D / 13G filings for ADMA:

1. NWQ Investment Management Company, LLC on February 11, 2022 reported a 5.42% stake on a 13G filing.

2. Stonepine Capital Management, LLC on February 11, 2022 reported a 5.1% stake on a 13G filing.

3. Consonance Capital Management LP on February 14, 2022 reported a 4.94% stake on a 13G filing.

4. Perceptive Advisors on February 14, 2022 reported a 6.1% stake on a 13G filing.

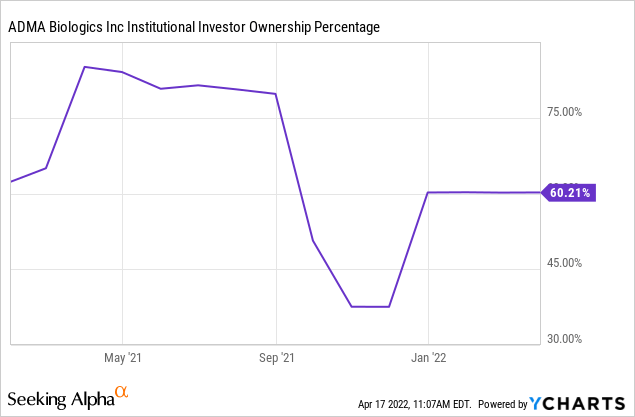

Since bottoming out at the end of 2021/beginning of 2022, institutional ownership has been raised pretty significantly and currently stands at 60.21%. Several may agree with Caligan and believe that ADMA is trading lower than its true value. A key date to note is that ADMA’s poison pill expires on June 15, 2022. A poison pill prevents a corporate raider from acquiring a sizeable holding in a company and pushing a company to sell itself.

Q4 Report

On March 24th, ADMA reported Q4 earnings and beat expectations on both the top and bottom lines. ADMA reported revenue of $26.38M (+80% y/y), beating expectations by $4.61M and Q4 GAAP EPS of -$0.09 per share, beating expectations by $0.01 per share.

In the press release, ADMA also announced that they refinanced their debt with Perceptive Advisors with new debt from Hayfin Capital Management. ADMA’s CEO summed up the import of the refinancing:

We believe the Company’s improved funding position resulting from today’s announced debt refinancing with Hayfin will enable ADMA to execute on its operating strategy, while continuing to explore strategic business opportunities with Morgan Stanley. Financially, the new debt meaningfully reduces ADMA’s cost of capital, extends the interest-only period to March 2027 and provides significant non-dilutive capital to fund the Company’s continued growth. This new loan from Hayfin completely repays all outstanding indebtedness to Perceptive and we thank Perceptive for their multi-year partnership and support.

With this new financing, ADMA ended the year with a strong cash position, reporting $178.4 million of working capital compared to $133.8 million in the same period the year prior. ADMA can also potentially draw down another $25M under the Hayfin credit agreement (provided certain milestones are met). This positions ADMA to finance the company without dilutive issuances as noted by ADMA’s CEO on the conference call:

We’ve now got all the cash we need, we believe, to get to the promised land of profitability and we really feel that, that’s the right way to approach a strategic alternatives process. And that process continues and is progressing. And I think it just really strengthens ADMA’s position of looking across the table to maximize value for shareholders here, showing that we’ve now got a fully financed organization.

ADMA also disclosed that they have 5 FDA-approved plasma collection centers and it is on track to have 10 FDA-approved centers before the end of next year, which would allow the company to potentially reach plasma supply self-sufficiency by the end of 2023. ADMA is currently supplementing its supply with third-party suppliers, but having a completely vertically integrated network will improve profitability. Management guided towards achieving profitability no later than the first quarter of 2024.

In the 3 months ended December 31, 2021, ADMA had net losses of $16.6 million, which is down from $19.4 million in the same period the year prior, which was primarily driven by an increase in gross profit contribution.

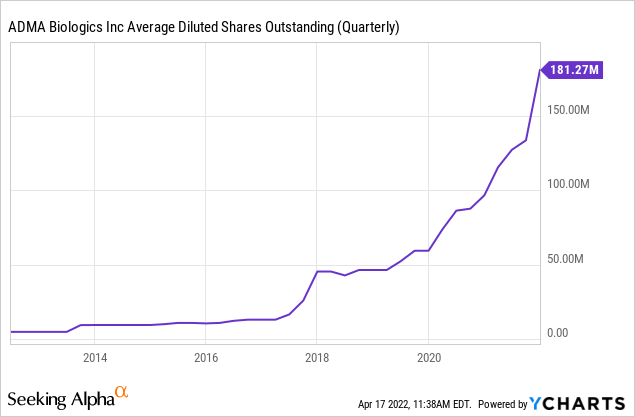

Dilution Risk

Despite all of these positive developments, the biggest risk for ADMA is that it isn’t able to achieve profitability as quickly as possible. If that doesn’t occur, ADMA will likely have to issue more equity and dilute its existing shareholders further. ADMA’s shareholders have felt the pain of dilution over the past several years and the prospect of further dilution could lead to the shares falling below the current $2 level.

Conclusion

ADMA has slowly been building its asset base and investing in growing a large network of collection centers and vertically integrated businesses that could produce robust profits. ADMA is operating in a market with high moats to entry and I believe there could be a potential bid for the company prior to the June 15th expiration of the poison pill.

Be the first to comment