Jonathan Leibson

Overview

adidas (OTCQX:ADDYY) has been a sour surprise for investors – The stock is down 65% year-over-year as the company has been facing decreasing demand as a result of a challenging macro-environment and its latest dilemma surrounding Kanye West. The German-based company designs, develops and markets a range of athletic and sports lifestyle fashion products. With over 2500 own retail stores, adidas is the second-largest sportswear company in the world.

When adidas introduced its growth strategy ‘Creating the New’ in 2015 for the following 5 years, shareholders saw their investment grow by over 300% as the company reported record sales and profits. Fast forward, adidas gave up almost its entire gains and faces significant challenges as a result of weaker economic prospects in its most important markets. However, adidas’ low current valuation and long-term prospects could reward patient investors.

Deep Value

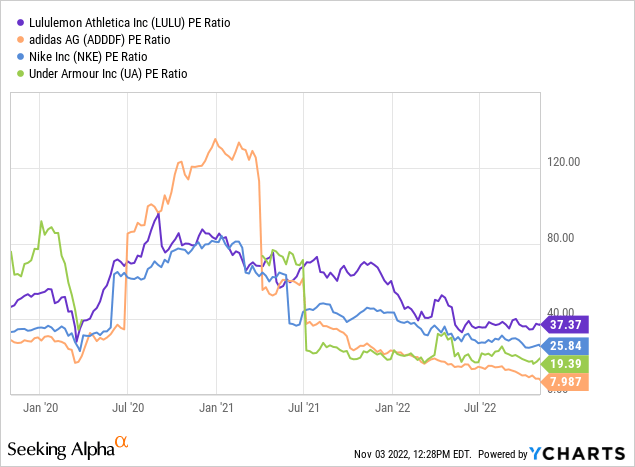

After falling 70% from all-time highs, adidas has now become a deep-value stock, trading at 8 times annualized earnings. While adidas has never been trading cheap, the company is now trading at a 7-year valuation low, similar to 2015. While there are many stocks trading at an 8 times P/E ratio or even much less, leading sportswear companies are usually trading at 20 times earnings and above. For instance, Nike (NKE) and Lululemon Athletica (LULU) trade at a P/E of 25x and 37x, respectively. This is even after the two companies sold off over 40% last year. Notably, Nike has never traded below 15 times earnings over the last 10 years, reflecting its competitive advantages relating to its brand value. Certainly, adidas deserves a valuation premium as well, considering its size and reach in the sportswear industry.

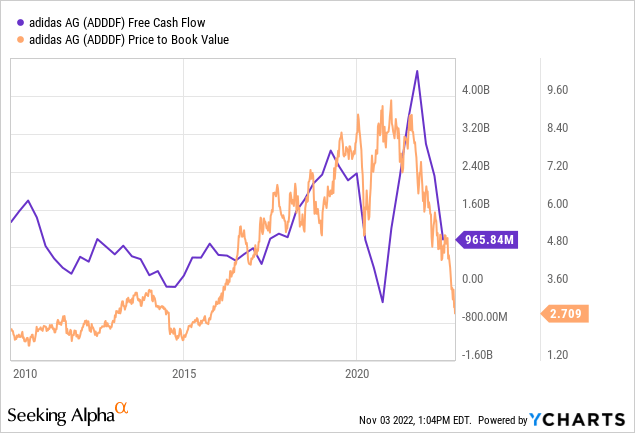

The company also has a healthy balance sheet with $6.8 billion in Equity compared to just $2.6 billion in long-term debt. As a result, its debt-to-equity ratio is now trading at levels similar to 2010-2015. With its solid balance sheet, adidas should be able to ride out even a severe long-lasting recession.

In adidas’ preliminary Q3 earnings, the company reported 6.4 billion Euros, up 11% from last year and up 4% in constant-currency terms. Excluding greater China, currency-neutral revenue grew in double digits as a result of Covid-19 related restrictions. Overall, the company reported net income of 179 million Euros, compared to €479 million in Q3 2021. The drop in net income reflects one-off costs of almost €300 million relating to its Russia business and elevated inventory levels in Greater China, impacting net income by up to €500 million for the year. The company also expects to increase its marketing spend in the fourth quarter to counteract softening demand in Western Europe. These measures will likely impact profitability as well. Nevertheless, adidas sees headwinds from the FIFA World Cup 2022 in the fourth quarter, which will likely boost sales throughout 2023.

The Long-Term Opportunity

In early 2021, adidas introduced its growth strategy ‘Own the Game’ until 2025. The company’s strategy will focus on strengthening the brand, increasing the consumer experience, and sustainability. According to the report, around 95% of its sales growth should come from its five strategic categories including Football, Running, Training, Outdoor, and Lifestyle. It also aims to grow its e-commerce business to $9 billion by 2025, focusing on greater China as well as Africa to drive further e-commerce growth. By 2025, adidas expects to invest over $1 billion to drive its digital transformation forward.

adidas is also driving increasing its sustainability efforts. The company aims to produce nine out of ten products from sustainable materials by 2025. It will expand its production using fully recyclable materials and reduce its overall CO2 footprint by 15% by 2025. adidas is also focusing on innovating its products by integrating data and technology into its products. For example, the adidas running app introduced various new features allowing users to train more effectively. It can also be expected that adidas continues to broaden its accessory portfolio in order to expand its addressable market.

Despite losing a major sponsorship, adidas’ overall marketing strategy should not suffer too much. The company is positioned as a world-leading sports brand by interacting with its customers and building an emotional connection to the brand. While adidas may have lost Kanye West, adidas still hosts notable sponsorships with celebrities such as Beyonce, David Beckham, James Harden, and Lionel Messi. By partnering with major athletes, adidas’ has built a leading market share in major sports. For instance, in football, 38% of the top European footballers are wearing adidas footwear, while 52% wear Nike. That means Nike and adidas control nearly all of the supply of football footwear, with Puma making up just 8%. In North America, things look different, with Nike controlling its home market through its popular Jordan brand. Nevertheless, adidas will continue its efforts in gaining market share in the region and expand its brand beyond football.

Conclusion

The termination of the partnership with Kanye West undoubtedly hurt adidas. After all, the company’s iconic Yeezy’s were a bestseller and a steady growth engine for its upcoming generation of consumers. Nevertheless, adidas’ business consists of more than just sneakers and will also survive this setback. adidas’ leading market share in sportswear is backed by a strong brand with powerful sponsorships. While adidas faces significant short-term uncertainties as a result of economic challenges weighing on demand and profit margins, adidas could come back stronger than ever in the future.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment