winhorse

Investment Thesis: I take a bullish view on Adidas AG given an attractive P/E ratio, strong performance across Western markets, as well as anticipated sales from the company’s partnership with Foot Locker.

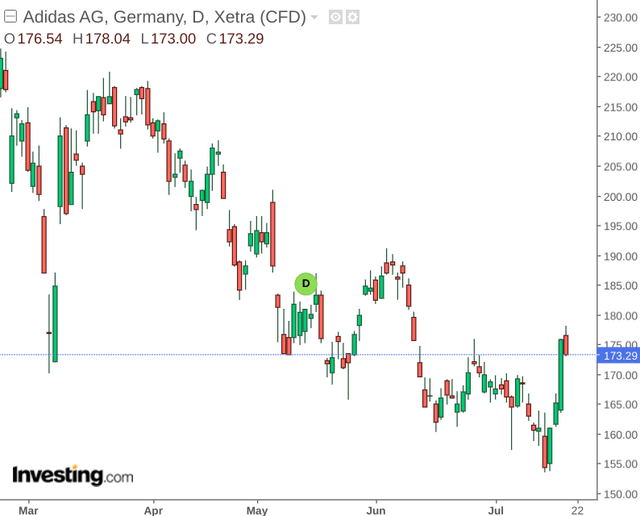

In a previous article back in March, I made the argument that Adidas AG (OTCQX:ADDYY) could see potential downside in the short to medium-term as a result of supply chain issues and increasing competition in China.

Since then, the stock has seen significant downside:

While the stock came under significant pressure from COVID-19 lockdowns in China due to both a drop in sales as well as supply chain constraints – I wish to assess whether the stock could have room for significant upside from here.

Recent Performance

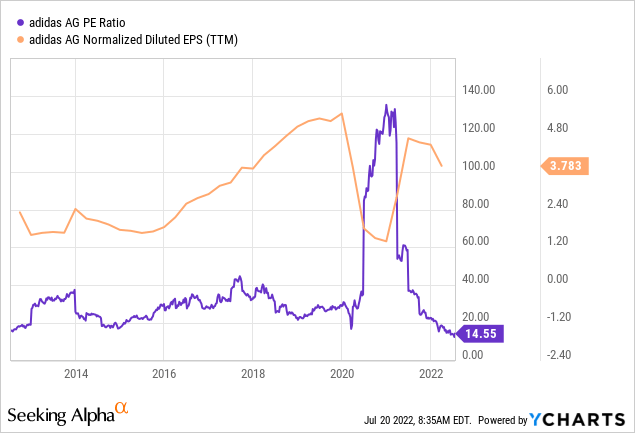

When looking at the performance of Adidas AG from an earnings standpoint – we can see that earnings per share has been rebounding to near levels seen pre-2020, while the P/E ratio itself is at a 10-year low.

ycharts.com

Notwithstanding the recent pressures on the stock as a result of macroeconomic headwinds, I take the view that Adidas AG could be in a good position to see strong upside provided market conditions become less volatile and strong growth in sales and earnings continues.

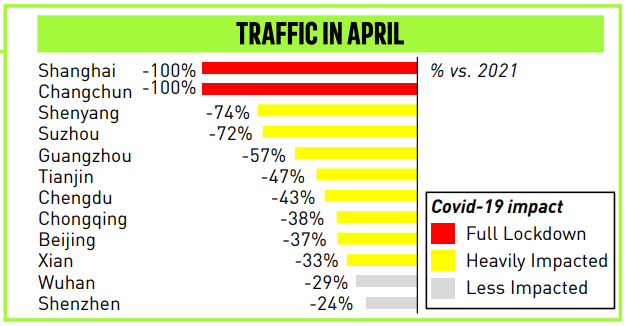

While diluted earnings per share (from continuing and discontinued operations) was down by just over 10% from the same quarter last year – much of this was driven by a drop in sales growth from China. According to the company – traffic also fell significantly in cities that were not strictly under full lockdowns:

adidas AG: Q1 2022 Results

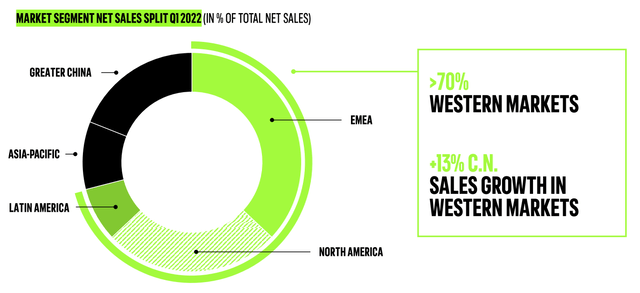

Additionally, in spite of supply chain issues reportedly having the most impact on the EMEA region, we can see that over 70% of sales were in Western markets – and overall sales growth was 13%.

Therefore, while earnings as a whole may have fallen as a result of weak performance in China – the fact that EMEA and North America have continued to see growth is highly encouraging.

Looking Forward

From a performance standpoint, I take the view that if Adidas AG is able to continue demonstrating strong growth across Western markets and sales across Greater China rebound significantly as COVID-19 lockdowns are eased – Adidas AG is in a good position to see a strong rebound given that the stock’s P/E ratio is trading at a 10-year low relative to earnings.

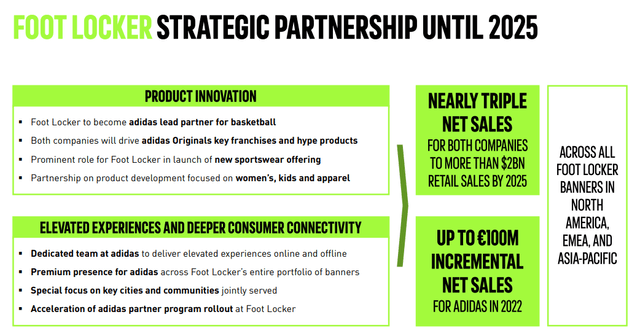

Going forward, while Adidas has a significant opportunity to bolster sales across Greater China once again – the company also could see strong growth arising from the strategic partnerships with Foot Locker (FL) which is forecasted to produce €100 million in incremental net sales for Adidas this year, as well as triple net sales for both companies to over $2 billion by 2025.

The motivation for such a partnership was for Foot Locker to make up for lost sales as Nike (NKE) decided to sell more of its shoes via its own channels.

Should sales come in as expected – then this would also be of benefit to Adidas, as the company can bolster traffic and in turn increase cross-sell across its own product lineup. As a result, there is a possibility that we could see total sales exceed existing forecasts.

Additionally, this partnership gives Adidas a stronger foothold into the North American market. While Nike has been the one to beat across the footwear market – the expanded visibility from teaming up with Foot Locker could give a significant boost to sales across the North American segment as a whole.

Conclusion

To conclude, Adidas AG has seen some downward pressure as a result of supply chain pressures and lower sales in Greater China.

However, the company’s resilience across Western markets has been quite encouraging and the partnership with Foot Locker could substantially increase traffic and brand visibility for Adidas as well as bolstering sales.

Moreover, with the company’s P/E ratio at a 10-year low – the stock seems to be trading at attractive value. For these reasons, I take a bullish view on Adidas AG.

Additional disclosure: Long Adidas AG (ADS: Xetra) stock as listed on the German XETRA exchange. This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment