Roman Valiev/iStock via Getty Images

Published on the Value Lab 17/6/22

Adecoagro (NYSE:AGRO) might be one of the more appropriate picks and agnostically positioned ones that we’ve seen since the recent crash. The company sells key crops as well as ethanol produced from sugarcane waste. Gross sales are increasing across the crops on account of expanded fields and in most cases higher prices, and decent volumes provide feedstock for ethanol production. The ethanol market is sound, and the Ukraine invasion as well as a higher rate environment lend themselves to investment in key crops and food products. With high FCF yields despite incoming inflation benefits, the company appears rather attractive, although its leverage can work both ways.

Quick Overview

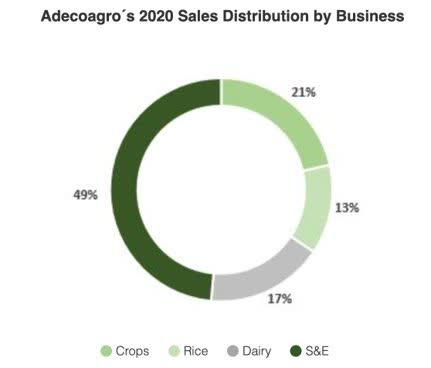

The company acknowledges results in 4 segments.

Segments (Adecoagro Website)

Crops include peanuts, sunflowers and grains. Dairy is simply the milk and cheese segment. Rice is accounted for separately. S&E is the production of ethanol from the agricultural waste.

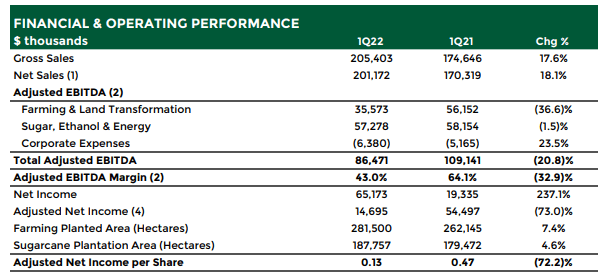

Q1 Data

In Q1, prices of all crops were broadly up, with declines in rice and lost out profits from the land transformation segment causing declines. Land transformation only produces profits on the sale of revalued land, and due to the lack of farm sales, the revenue did not appear this quarter.

Q1 Financials (Q1 2022 Report)

The only commodity to decrease in price was rice, by 9%, which caused the rice segment to almost hit negative territories. This isn’t because rice production is so unprofitable, it is because mark-to-market accounting completely perverts figures. The revaluations in biological assets are in magnitude of 1.3x the operating profits in Q1 2022. Overall, rice gross volumes grew a lot on the basis that more farmed lands are owned by Adecoagro, explaining also the high incremental fixed capital rates for the company, where investment outflows meaningfully exceed depreciation. All segments including dairy are seeing meaningful growth in assets, which is great because it means more volumes and more feedstock for ethanol production. This is despite falls in yields and price. There is some inflation on labor and logistics which is affecting results, but for the most part, things look fine for the segment.

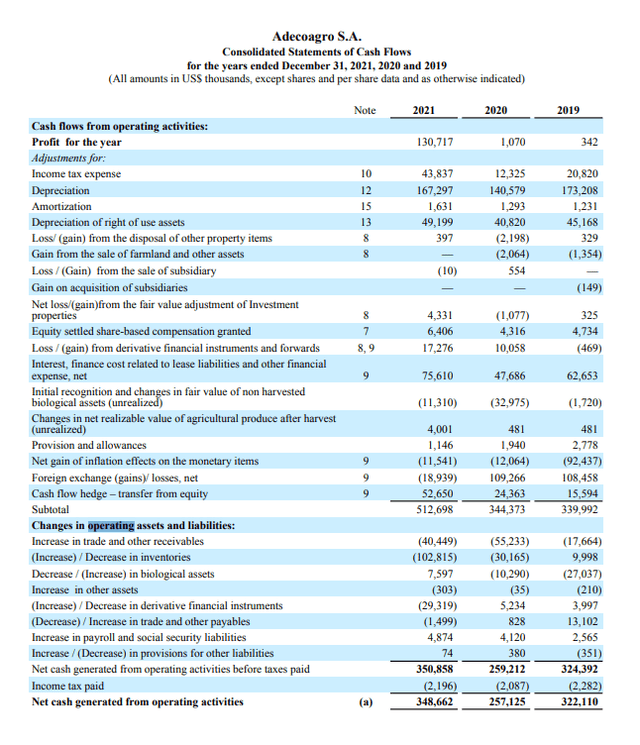

FY Picture

With mark-to-market and seasonality making quarterly figures a little difficult to understand, especially as assets and leverage to biological values grow rapidly, it helps to look at the cash flows (not the P/L) for the full year to see how effects average out net of revaluations as over a year a greater proportion of biological asset value changes are realised. Consistency is more apparent now, as is the effect of higher prices on both inventory and sales.

CF Statement (Annual Report 2021)

The company is a clear beneficiary of the situation with Ukraine, where grain prices are rising, as well as being hedged for increased costs for rearing cattle, where costs can be passed onto the milk from the feed. As far as interest rates go, all these products are safe from substantial demand erosion as disposable income falls, with all of them being staples. Ethanol is even a Brazil reopening play, since the substantial Brazilian presence means that with minimum 15% mandated blends of ethanol into fuel to support farming lobbies and increase fuel octane, more mobility will mean more ethanol production. Ethanol prices, like all energy prices, are hiking 31%, and while weather effects have meant serious drops in sugarcane feedstock, inventories from previous periods have come in clutch to assure contribution in Q1 2022, with ethanol contribution remaining flat thanks to higher prices. With crushing of sugarcane resuming, enough to compensate for lost time, ethanol feedstock should be maintained at higher prices and sugar production will also continue.

Conclusion

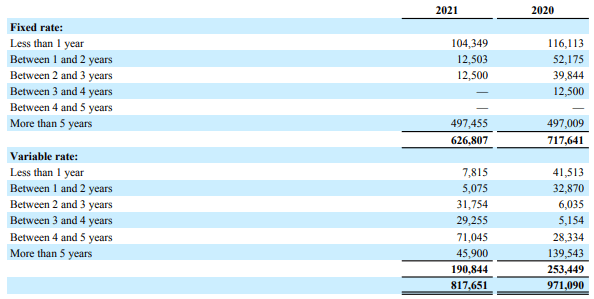

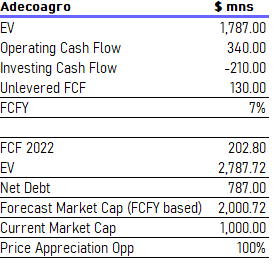

The company produces staples and energy, trading at $1.78 billion so that its FCF yield (unlevered) lies at 7%. Climate change is a longer-term risk, where the whole complex of activities constituting this business could struggle were climate change to progress into 2050, even forced to cease entirely. Debt is also quite high with FCF, which is a figure that is residual after interest, covering it only 1x. At least the fixed to variable rate debt is at a ratio of 6:2.

Rate Structure (Annual Report 2021)

But by selling food staples they are hedged to household income risks as interest hikes and inflation take their toll. They are also a reopening play. Ticking lots of boxes, they could be a great buy for the current environment. The opportunity for levered returns is high with property size increases coming plus the inflation.

Valuation (VTS)

But just be aware that the leverage can work both ways, and this is a commodity exposure where fluctuations can be substantial across the cycle.

Be the first to comment