D. Lentz/iStock Unreleased via Getty Images

While it’s true that not everyone loves sports, many people have at least one sport that they favor. In my case, that sport is none other than golf. There’s nothing quite like the serenity of driving a ball a couple of hundred yards straight down the fairway on a beautiful day. As an investor then, you can imagine my enthusiasm when I find a quality golf-oriented company that is trading at levels that should be considered appealing to many. A great example of this can be seen by looking at Acushnet Holdings Corp. (NYSE:GOLF), the owner of the wildly famous Titleist brand name, as well as the owner of the FootJoy performance wearables business. For the most part, financial performance for the company has been showing signs of strengthening. Add on top of that how cheap shares are right now, and I do believe that, even though shares have risen meaningfully in the past several months, further upside could still be on the table.

Talk about performance

The last time I wrote an article about Acushnet Holdings was back in May of this year. In that article, I talked about the attractive growth that the golf industry had experienced over the prior few years. I also analyzed the company and concluded that shares were trading at attractive levels. These two factors were instrumental in my decision to rate the company a ‘buy’, reflecting my belief that it should generate upside for investors that was greater than what the broader market could. Fast forward to today, and that call is looking pretty solid. While the S&P 500 is up by only 1.5%, shares of Acushnet Holdings have generated a return for investors of 20%.

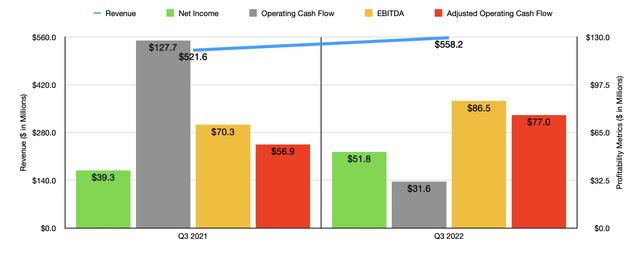

It would be helpful to understand exactly why this upside has come about. To truly understand it, we should touch on the most recent performance the company has provided. You see, when I last wrote about the company, we only had data covering through the first quarter of its 2022 fiscal year. Today, that data now covers through the third quarter. For the third quarter itself, financial performance was really robust. Revenue, for instance, came in at $558.2 million. That’s 7% higher than the $521.6 million generated the same time last year. Interestingly, the FootJoy brand name actually saw revenue drop by about 4.5% year over year. But the company’s hallmark Titleist brand performed incredibly well. Golf ball sales jumped by 8.4%, while Golf Club sales grew by 13.5%. The real winner though was the miscellaneous golf gear under the same brand name. Revenue growth there was 27% year over year. On a constant currency basis, the picture would have been even better, with these year-over-year increases being 13.3%, 19.8%, and 35%, respectively. Management chalked a lot of this up to higher sales volume, particularly when it came to the high-end offerings in its portfolio. But they also said that an increase in pricing in some categories, including for golf gear, was helpful as well.

With this rise in revenue came improved profitability. Net income of $51.8 million dwarfed the $39.3 million reported the same quarter last year. Higher sales volumes and higher average selling prices more than offset increased inbound freight costs and other related expenses. Of course, we should also pay attention to other profitability metrics. Yes, operating cash flow did worsen year over year, dropping from $127.7 million to $31.6 million. But if we adjust for changes in working capital, it would have risen from $56.9 million to $77 million. And over that same window of time, we saw EBITDA increase from $70.3 million to $86.5 million.

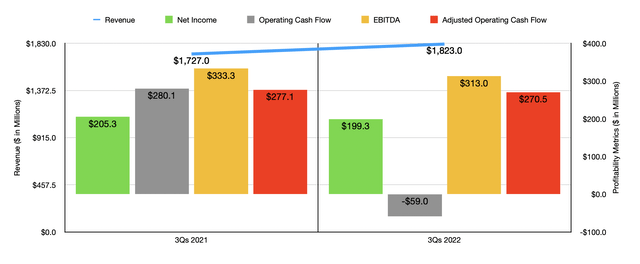

Although the latest quarter was particularly strong, results for the first nine months of the 2022 fiscal year as a whole have been somewhat mixed. Revenue of $1.82 billion beat out the $1.73 billion reported the same time last year. However, net income has fallen from $205.3 million to $199.3 million. Operating cash flow has gone from $280.1 million to negative $59 million, while the adjusted figure for this has gone from $277.1 million to $270.5 million. Even EBITDA has shown some signs of weakness, dropping from $333.3 million to $313 million.

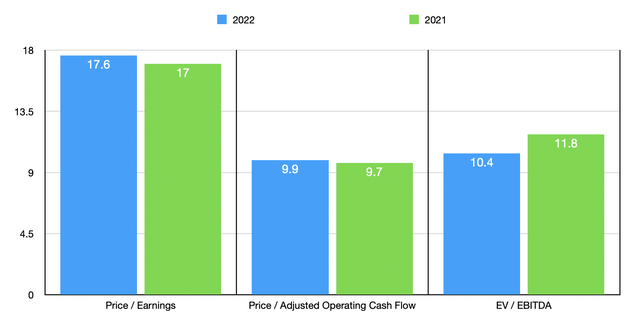

Despite this performance for the first nine months as a whole, management has recently increased guidance for the 2022 fiscal year. The company now anticipates revenue of between $2.225 billion and $2.25 billion. This compares to the $2.15 billion reported last year. Meanwhile, EBITDA should come in at between $325 million and $335 million. By comparison, the same metric last year was $289.4 million. If we assume that other profitability metrics will perform at the same rate as what we saw in the first three quarters, then we should anticipate net income of around $173.7 million and adjusted operating cash flow of $306.6 million. This should give us a forward price-to-earnings multiple on the company of 17.6, a forward price to adjusted operating cash flow multiple of 9.9, and a forward EV to EBITDA multiple for the firm of 10.4. By comparison, using the data from 2021, these multiples would be 17, 9.7, and 11.8, respectively. Also, as part of my analysis, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 3.6 to a high of 20.8. Using the price to operating cash flow approach, the range was between 3.9 and 106. In both cases, two of the companies were cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range was between 3.9 and 15.5. In this scenario, two of the companies were cheaper than our target while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Acushnet Holdings Corp | 17.6 | 9.9 | 10.4 |

| Vista Outdoor (VSTO) | 3.6 | 3.9 | 3.9 |

| Topgolf Callaway Brands Corp. (MODG) | 20.8 | 64.8 | 10.4 |

| YETI Holdings (YETI) | 19.5 | 77.3 | 11.8 |

| Latham Group (SWIM) | N/A | 106.0 | 15.5 |

| Sturm, Ruger & Company (RGR) | 9.1 | 9.3 | 4.8 |

Takeaway

Based on all the data available, I must say that I remain impressed by Acushnet Holdings and its performance so far this year. Although the year-to-date results have shown some signs of weakness, the most recent quarter was particularly robust. Management seems optimistic about the near term for the company and shares are trading at a cheap enough level to warrant a reiteration of my ‘buy’ rating.

Be the first to comment