Rich Polk

Article Thesis

Activision Blizzard (NASDAQ:ATVI) will report its third-quarter earnings on Monday night. We will look at what investors can expect from those results, while the pending acquisition by Microsoft (MSFT) naturally is also important for ATVI’s upcoming share price performance. With ATVI currently trading significantly below the price Microsoft is offering, the market is pricing in a serious chance of the acquisition falling through. If that happens, ATVI could have further downside, due to a pricey valuation and the fact that the near-term outlook for consumer discretionary spending, such as gaming, isn’t great.

Activision Blizzard’s Q3 Earnings: What To Expect

On Monday night, Activision Blizzard will report its results for its fiscal third quarter. Wall Street analysts are currently expecting that the company will report revenues of $1.71 billion, which would be down 9% year over year, and earnings per share of $0.50, which would be down by a hefty 31% year over year.

The revenue decline can be explained by several factors. First, the macro environment plays a role. During the pandemic, when lockdowns were in place and when many people stayed at home, gaming was an area that saw significant growth, as consumers were flush with cash and searching for hobbies doable from their homes. With 2020 and 2021 being strong years for gaming companies, 2022 is a year where the comparison is pretty tough. At the same time, consumers have been shifting their spending towards other things as the pandemic winds down, such as going out, traveling, and so on. Consumers with spending power are thus less interested in spending money on gaming, relative to the pandemic years. On top of that, there’s another headwind in place for companies such as Activision Blizzard. With inflation still running at a multi-decade high and with an economic slowdown being increasingly likely, some consumers are reducing their consumer spending, either to preserve cash before a recession or due to the fact that high energy, food, etc. prices are eating up their savings. In that case, they won’t spend as much as they did in the past on consumer discretionary items, including games offered by Activision Blizzard.

The combination of a tough macro environment and a harsh comparison thus explains why Activision Blizzard’s revenues have likely declined during the period.

Earnings being forecasted to fall more than revenues is explainable as well. Lower revenue means that operating leverage is working against the company, as fixed expenses, e.g. for the development of new games, are distributed over a smaller revenue number, thereby hurting margins. On top of that, ATVI most likely has been impacted by an issue that has also hurt Meta Platforms (META), Alphabet (GOOG)(GOOGL), etc., during the quarter — tech professionals are demanding major pay increases, which leads to significant operating expense increases versus the previous year. Between these two factors, it wouldn’t be surprising if ATVI sees its profits come down versus the same quarter one year ago.

Of course, Activision Blizzard’s game lineup also plays a role when it comes to its sales performance during an individual quarter. On that side, Q4 will likely be a stronger period for the company again, relative to the third quarter, as Q4 will see the impact of several major titles. The newest “Call of Duty” release came out on October 28, and the newest “World of Warcraft” title will be released in November. Analysts are thus predicting that the forecasted revenue decline from the third quarter, and the revenue declines from Q2 and Q1, will reverse during the current quarter (Q4).

The Pending Acquisition By Microsoft

A little less than a year ago, Microsoft announced that it wants to acquire Activision Blizzard for $69 billion in cash, which pencils out to $95 per share. That represented a hefty premium at the time of the announcement, and it still represents a major premium versus where ATVI is trading today. At $72 per share, Activision Blizzard has an upside potential of around 32% to the takeover price.

Clearly, the market is pricing in a significant possibility of the deal falling through. Whether that happens or not is not known so far, but in-depth reviews of this deal by regulators in the UK and the EU mean that there are still some major hurdles for this deal. If the acquisition goes through, investors that own shares or buy them at current prices would see a steep return, most likely in a couple of quarters.

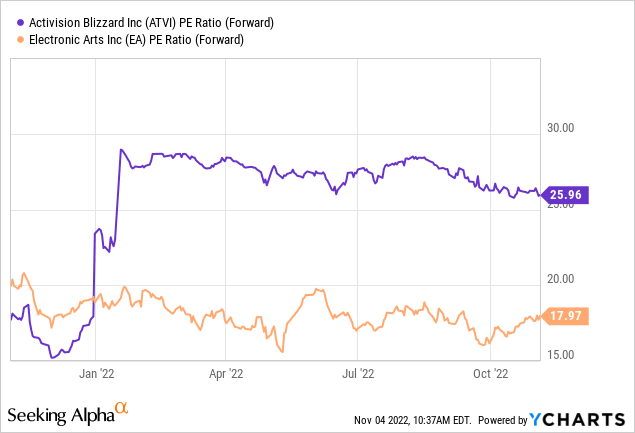

But on the other hand, there is the risk of the deal falling through, in which case Activision Blizzard would likely see its shares decline. After all, the company is currently valued at a pretty pricy 26x net profits, based on expectations for the current year. A comparison to game company Electronic Arts (EA) shows how expensive ATVI is at current prices:

Prior to the deal being announced, Activision Blizzard actually traded at a discount compared to Electronic Arts, being valued at 15x to 18x net profits over those couple of months. Since then, EA’s valuation has been mostly flat, which is why we can assume that Activision Blizzard could see its valuation trend back to the levels seen before the acquisition announcement as well. In that case, ATVI’s share price could decline to the $42 to $50 range, as that would be consistent with a 15x to 18x net earnings multiple based on forecasted earnings per share of $2.80 this year. In other words, if the acquisition falls through, Activision Blizzard could see its shares drop by 35% to 40%. For shareholders, a lot depends on whether Microsoft will be able to close the takeover of Activision Blizzard. If that happens, there’s considerable upside potential, but if Microsoft fails to get the required support from regulators, Activision Blizzard could have considerable double-digit downside potential, relative to where shares trade today. In other words, the pending takeover by Microsoft makes ATVI a higher-risk, higher-reward stock. For those that think that the likelihood of this takeover getting approved is high, ATVI could be interesting, but others may want to avoid the stock for now, as the downside risk is substantial.

If the acquisition fails, Activision Blizzard would likely see its shares fall considerably in the short term. In the long run, however, ATVI might turn out to be a solid investment. After all, the company has several advantages. First, gaming is a growth industry. Due to the pandemic impact in 2020 and 2021 and due to inflation headwinds, 2022 will not be a growth year, but in 2023 and after, global gaming revenues could start to climb again. More and more people around the world are spending time on this hobby, thus the long-term market potential is solid. Activision Blizzard owns a couple of strong brands, such as the aforementioned Call of Duty and Warcraft, but also Diablo, Overwatch, and so on. When the company executes well, these assets should be easily monetized, meaning ATVI could deliver growth in line with the market, or potentially above that, over time.

Activision Blizzard also has a strong balance sheet, as its net cash position totaled more than $7 billion at the end of the most recent quarter. If the acquisition by Microsoft were to fall through, ATVI could utilize this cash by either looking for an acquisition target itself, or by using its cash hoard for buybacks. As the company’s market capitalization would likely fall to the $40 billion range (down ~30% from here), $7 billion worth of buybacks could reduce ATVI’s share count by 15% to 20% over time. Thus, we can say that the near-term reaction to the takeover falling through would be negative for sure, but over a couple of years, ATVI might still generate solid returns, between business growth in 2023 and beyond and its ability to create value with the company’s huge net cash position.

Takeaway

The upcoming quarterly results from ATVI will likely not be strong. Q4 results should be better again, however, thanks to new game releases. Quarterly results won’t matter too much when it comes to ATVI’s share price performance, however, as the pending takeover by Microsoft will mean that news about this takeover will be more important than ATVI’s underlying business performance.

If the deal closes, ATVI has significant upside potential, but shares would likely fall considerably if Microsoft fails to close the deal. I thus believe that ATVI is a higher-risk, higher-reward pick that is not suitable for everyone.

Be the first to comment