MichalLudwiczak/iStock via Getty Images

This is my quarterly update of AcelRx Pharmaceuticals (NASDAQ:ACRX) – on the one hand. And in addition it is my contribution to seeking Alpha’s current article competition around Stocks with a Catalyst. Because frankly, I can’t think of any position in my portfolio for which taking such a perspective would be a better fit.

This article is structured as follows:

- Quick overview of ACRX’ business – readers familiar with the company or my previous extended coverage may simply skip it.

- Discussion of the most recent developments, this time from a catalyst perspective – changing the point of view for a company long covered is generally a useful technique

- Discussion of the “Elephant in the Room”, i.e. the one big catalyst, being the pending deal, or even deals, for the marketing rights of DSUVIA in the US (or even beyond)

There will be, and has to come, as discussed below, a major deal for the company. After my last article with a Neutral rating I added to my position, because meanwhile I concluded that there still is substantial upside from a stock price of about USD 0.31 if ACRX manages to seal a decent deal. This article summarizes why I believe such deal will come and what I believe the resulting favorable valuation impact to be.

Throughout the remaining discussion, EC refers to the 2q22 Earnings Call of ACRX.

ACRX Business Overview

ACRX is a pharmaceutical company operating in the space of supervised medical settings, i.e. hospitals, ASCs (Ambulatory Surgical Centers), and procedural suites, such as individual dental or plastic surgeons. It does not sell its products to pharmacies or drug stores.

Currently, ACRX’ active products are limited to sublingual sufentanil tablets (or SST). The main product is called DSUVIA and is sold in the US. It is an opioid based analgetic for use against acute moderate to severe pain. It is sold to the above mentioned supervised medical institutions (referred to as Commercial Sales by management), and also to the DoD (DoD Sales), which sponsored DSUVIA’s development and is anticipated to become the largest single customer in the short-term by supplying SKOs (sets, kits, and outfits) of the US Army with DSUVIA for battlefield pain management.

A detailed discussion of the features of DSUVIA, or more generally SST, can be found here.

DSUVIA is approved in Europe under the name DZUVEO, and ACRX partnered with private French company Aguettant to commercialise DZUVEAU in this territory. ACRX confirmed during the EC that DZUVEOs market launch is scheduled for the third quarter of 2022.

DZUVEO was sold in Europe under the name Zalviso for use through SDA (single dose applicators), but the private German commercialisation partner Grünenthal cancelled the sales agreement. Zalviso is not yet approved by the FDA for commercialisation in the US – and as discussed below, ACRX management announced during the EC that they dropped the plan to apply for approval any time soon.

Further, ACRX has licensed two syringes products with Aguettant for commercialisation by ACRX in the US. These products (the Syringes) are not yet FDA approved. The limited news to report on the progress of the approval process are discussed below.

The syringes provide ephedrine and phenylephrine, substances used to regulate severe side effects that come with analgesia, i.e. products like DSUVIA. Readers more interested in these substances and Aguettant find a detailed discussion here.

Finally, in January 2022 ACRX completed the acquisition of private Lowell Therapeutics, Inc. (hereafter: Lowell). Details of the transaction are discussed here. Lowell developed a product called Niyad, a Nafamostat-based regional anticoagulant for dialysis circuit during continuous renal replacement therapy for acute kidney injury patients in the hospital. Niyad is not approved by the FDA in the US.

Catalysts for Cynics

I am a Mathematician and my profession is notorious for taking the formal way. So, here we go by first recalling the definition of a catalyst, according to Wikipedia:

Catalysis is the process of increasing the rate of a chemical reaction by adding a substance known as a catalyst.

Now, combining this definition with the 10-chart for ACRX stock printed below may cause cynics to state that there is actually no need for acceleration of what is going on with the company:

The reasons for this historic development are easy to list:

- DSUVIA, or SST, to be more precise, were viewed by management, including Dr. Pamela Palmer, Chief Medical Officer as a game-change in the treatment of moderate to severe acute pain. However, since the final approval in late 2018 sales have lagged any management forecast by orders of magnitude.

- I have discussed candidates for reasons in depth in this article – they range from what was most likely a mis-focus initially on Emergency Room use all the way to COVID-19, which absorbed hospital capacity by requiring treatment of unprecedented numbers of people suffering from a lethal and highly contagious lung disease and left too little space for changing the standard of care in pain management.

- The result is obvious: High cash burn, ongoing dilution and fading investor trust. To be very clear: Per the end of 2q22, ACRX had USD 27 million of cash, USD 10 million of debt due until May 2023 and a quarterly cash burn of some USD 8 million.

None of the resulting obvious issues is needed at a higher dose or at an increased rate.

On the other hand, it seems that investors have priced in most of the essentially bad news that came in recently: First, ACRX received its second and final letter from NASDAQ, clarifying that ACRX stock will be delisted if, very informally, the stock price does not go back up to USD 1.00 at least.

As a result, ACRX started to prepare investors for an upcoming reverse stock-split by announcing a dedicated special shareholder meeting for September 23, 2022. In theory, the number of shares outstanding should not affect the equity’s market capitalization. However, since such reverse stock split is usually the result of poor returns, which are often the result of poor operational performance, it frequently accelerates the decline in stock price – thereby essentially becoming a catalyst.

I usually do not comment short-term market movements, or the lack thereof, but is seems plausible that anyone saw this reverse split coming, so market reaction wasn’t significant – at least in comparison to other movements that I will discuss below. In any case, most likely, we will witness a reverse stock split sometime in October / November.

For the sake of completeness, it is necessary to mention one piece of information that ACRX management shared during the EC. The company stopped all efforts for the Zalviso US-approval process with the FDA. A while back, this may have triggered strong investor reaction, but I guess this makes sense: As I have discussed before, the main reason is that most likely hospitals want to get sound experience with SST before handing it out to patients (in supervised medical settings, that is) through a dispensing device.

Bottom-line is that a lot went wrong during the last 3-4 years, so that certain unfavorable news just don’t do the catalyst job.

Accordingly, from here on I will focus on catalysts with upside potential.

Slow and Lame Catalysts

There are other things going on at ACRX that may appear huge, but did not trigger severe reactions.

Zalviso

Returning to Zalviso for example: It was fully approved in the EU, and ACRX sold a massive amount of expected Royalty payments it expected to receive to a third party (who, too, had an optimistic view on the market potential). The deal was non-recourse, i.e. without royalty payments there was no liability by ACRX to repay the financing.

The claim changed hands a couple of times, and the latest owner agreed with ACRX to bury the whole story, or in more formal terms per ACRX’ CFO’s words during the EC:

$84.1 million gain related to the extinguishment of the royalty monetization agreement that was held by SWK. This termination eliminates any further contractual obligation associated with the royalty monetization agreement and eliminates the corresponding liability previously recorded on our balance sheet.

A USD 80 million gain for a company with a market cap of some USD 40 million – this might kick-off fireworks for other companies, but was a nil event instead for ACRX, since this was obvious from the financial reporting in the past (sometimes markets do digest information efficiently).

And there is probably other near-term news to come that will not change an awful lot for investors in the short-term, but does represent milestones that I expect to contribute positively over the long term:

DZUVEO Launch

First, there is the formal DZUVEO launch in Europe by Aguettant, expected during the remainder of 3q22. At the EC, ACRX management reported first deliveries of DSUVIA to Europe, so things are developing. It goes without saying that we still need to wait for indications of the level of commercial adoption of DZUVEO in Europe. COVID is not gone by any means, and the slow adoption of DSUVIA in the US will not be of big help with marketing overseas.

On the other hand, there were no real-world studies published at the time of the DSUVIA US-launch demonstrating the use cases for SST. And by now, Aguettant know which surgical specialties have been adopting easily in the US, so they know where to start themselves.

Plus, things are different in Europe with regards to opioid use: We did not suffer from ruthless pharma companies pushing medication into the hands of laymen, who had no idea – and where actively mislead – about the addictiveness of these substances. On the downside from a pharma company’s view, drug margins are much lower in Europe.

Bottom-line is that we need to wait for another couple of quarters before we get a clear idea of the earnings potential from this market.

ACRX Pivot

Over the last 12 months, ACRX added two late stage assets for the US market: the Syringes and Niyad / Nafamostat. As I will discuss below, these are most likely not mere additions to the asset portfolio, but may in fact be the actual future of ACRX.

Per management commentary during the EC:

With two planned NDA filings in 2022, we expect our prefilled syringes will be our next FDA-approved products that a commercial launch could occur as soon as next year

And (emphasis added):

(…) we’ve prioritized our focus on Niyad, our first Nafamostat product, which is being developed for use in the U.S. as an anticoagulant for extracorporeal circuits, such as for use during dialysis.

The entire EC made clear that ACRX is moving away from DSUVIA:

- No more REMS certification or FA (Formulary Approval) numbers were given, despite this being a main KPI historically.

- DSUVIA sales increased a “meagre” 18% quarter-over-quarter, but this wasn’t anyone’s focus anymore (including analysts)

- The DSUVIA sales efforts at ACRX are left with a team of less than ten purely “virtual” sales people solely addressing procedural suites (as opposed to hospitals and ASCs, the initial focus)

I continue to assume that ACRX will retain the relationship with the DoD, given the long history of collaboration between the two parties. And comments made during the call seem to indicate that the procedural suites business and / or certain surgical specialties will stay with ACRX, too, see e.g. this comment during the EC (with “them” being maxillofacial and plastics clinics groups):

I think it’s important that we’ve been approached by them (…). (….) they would have a significant impact on our sales moving forward without quoting you a number. They would be our largest accounts.

It is good to see for many reasons that there is interest for DSUVIA, and that healthcare providers learn of this through word-of-mouth, especially in the plastics specialty. This will help with the DZUVEO launch and it should also help with negotiating the Big One, discussed below.

In any case, we can already observe how management attention is turned away from significant parts of the DSUVIA market.

For the Syringes and Niyad, the imminent tasks are all about FDA approvals. I have summarized the road ahead before for both Syringes and Niyad. If things go according to management plan, the first revenue may come in late 2023. Say that is 6 quarters from now, this makes for a cash need of some USD 50 million (being 6 * 8). Plus, there will be external cost for the Niyad approval process, as well as the USD 10 million of debt to repay. The grand total is a cash need of some USD 80 million, of which ACRX held some USD 27 million per the end of 2q22, which I will consider additional safety.

We will come back to this (ballpark) number soon.

Small Catalysts

That was many words about things that did not cause or most likely will not cause a huge effect on ACRX’ share price in the short-term.

Now it is time to look at those events that may in fact turn the fate at a faster pace. Before addressing the one big trigger that should be on any investors’ mind, let’s look first at some 2nd tier, but still relevant items.

DoD Order (Non-commercial Business)

ACRX shareholders have been waiting for years to hear about a huge order from the DoD. As a quick reminder, DSUVIA development was funded to a substantial degree by the DoD, supporting its search for appropriate battlefield pain management.

It took a while, but by now the US Army went through virtually all formal steps (including the often quoted Milestone C meeting) required for deploying the SKOs (Sets, Kits and Outfits) of their troops with DSUVIA. ACRX management’s estimate for the revenue from initial deployment of the SKOs to all branches of the military is USD 30 million, but we haven’t seen purchases anywhere near that level to-date.

Apparently, the DoD is a special customer, and there is little ACRX management can do to make them move faster. There were some smaller orders in almost any of the previous quarters – representing the non-commercial share of Revenue as reported by ACRX – most probably for studies conducted by the Army.

But if there were a clear indication that the DoD is starting to order for the SKOs, this would represent a favorable development – and in particular from a cash perspective, see a discussion of the potential low USD double digit million net cash contribution laid-out here.

But even a USD 16 million net cash contribution would just add 2 quarters of life span at the above mentioned cash burn rate, so we need to look further for a real game changer.

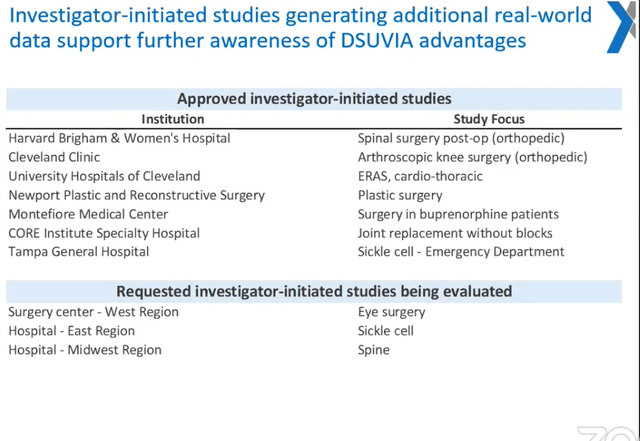

Favorable Results from IIS (Investigator-Initiated Studies)

The table below dates back to a year ago, but it does provide a good overview of the pipeline of IIS that may add further real-world evidence of the benefits of SST:

Of course, no study alone will change DSUVIA sales numbers significantly anywhere near term. But favorable findings from a renowned institution like Cleveland Clinic would help with sales efforts across the board, be it for DZUVEO in Europe or for the procedural suites business ACRX’ sales force is currently focusing on.

Or be it for the future commercial partner, or partners, for DSUVIA distribution in the US. Which finally brings us to the main catalyst for ACRX stock price:

The Big One

I will cut this short: There is no doubt that ACRX will soon announce a DSUVIA out-licensing agreement for the US, at a minimum. During the last two Earnings Calls and at various conferences management was open about the mere fact. But of course, they were silent about the details of such deal. Thus, all that we know is that negotiations are ongoing, probably as I type this article into my computer.

My guess is that we will hear more news within the next 4 weeks or so.

Thus the market is well aware of this catalyst, but I believe there is opportunity because the impact can be much bigger than reflected in today’s share price of USD 0.31.

Admittedly, it is difficult to guess the scope of any pending agreement:

- US only vs. US and some foreign markets

- Segments: Hospitals, ASCs, procedural suites

- Deal structure: agent vs. principal (or even a complete take-over of ACRX)

- Deal term

- Deal cash flows

The latter aspect is of highest relevance, since ACRX needs cash and it does need it soon. Thus any deal has to involve some immediate cash payment, probably accompanied by milestone payments and / or royalties for some sort of right to commercialise DSUVIA in a specific market or market segment.

I have done calculations like those below before in more detail, but here is the key things that make me believe that there is opportunity from the Big Deal to come:

Value of DSUVIA

What can ACRX make from selling a US license to some partner, like Zimmer Biomet Holdings, Inc. (ZBH) with whom they had a sales agreement before that fell victim to a restructuring at ZBH?

Assuming ACRX needs USD 80 million immediate cash from the deal (a rather prudent estimate, I believe). Let’s further assume that such deal would involve an immediate payment of 10% of the expected revenue the partner will generate (before royalties) – in this case, such partner would have to expect USD 800 million in DSUVIA sales. DSUVIA is patent-protected until 2031, so this turns into USD 100 million per year with patent-protection. At a unit price of USD 40, that would be 2.5 million doses per year.

I’ll leave everything else to the reader, but I continue to believe that DSUVIA is useful a medication enough to support such sales numbers for an established sales organization.

Value of ACRX

Assuming ACRX will receive some USD 80 million upfront – and assuming further it will burn that cash until all of DoD sales, procedural suite sales by its own sales force, DSUVIA royalties from the partner in the US and from DZUVEO, plus Syringes and Niyad sales pick up:

- Niyad is estimated by ACRX management to generate USD 200 million annually in the long-run; let’s haircut that to USD 100 million

- The Syringes are projected to generate annual sales of USD 100 million; that is USD 50 million after another 50% haircut

- Let’s say everything else generates a meagre annual sales volume of USD 30 million (DSUVIA shelf life is 4 years, so DoD orders alone would generate 30 / 4 = 7.5 million replacement orders)

This makes for USD 180 million annual revenue, conveniently in line with the current diluted share count of 180 million. Applying a P/S ratio of 3 (most big pharma trades at more than 4) yields a stock price on the back of this envelope of USD 3 in 2-3 years’ time.

That is good enough for some serious upside from the current stock price.

Conclusion

The countdown on ACRX’ cash is running, so without a clearly favorable catalyst the company’s path is quite clear, and it is not pretty for shareholders.

However, under the hood, there still is a lot of potential, I believe. The main scenario is that ACRX will give away the most part of its commercialization rights for DSUVIA in the US – and maybe even beyond. And that it will use the funds from essentially selling its roots to bring to the US market some other, recently acquired late-stage assets: The Syringes and Niyad (and maybe further applications of Nafamostat).

The market is still trying to make up its mind, as is visible from the significant recent stock price movements, supported by large volume:

As long as there are no details known about the deal, uncertainty will be high. And of course, even a good DSUVIA deal would need a good management job with bringing the Syringes and Niyad to the market.

So we are in the perfect situation for a large movement in stock price, triggered by one big catalyst.

I took my bet, that things will look much better a couple of weeks down the road. Returning to Wikipedia’s article covering catalysts provides for a decent closing line:

If the reaction is rapid and the catalyst recycles quickly, very small amounts of catalyst often suffice.

Be the first to comment