Editor’s note: Seeking Alpha is proud to welcome Ace River Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

TERADAT SANTIVIVUT

Dear Partners & Friends,

For the first quarter 2023, Ace River Capital Partners, L.P. (the “Fund”) returned (-14.63%). Over the same period, the S&P 500 (SPX) and Russel 2000 (RTY) Indexes returned 7.45% and 2.34%, respectively.

Strategy

I do not subscribe to wide diversification and acknowledge the natural limits of focus. I can only research and follow a limited number of companies deeply. I will not spend much time on them if I am unwilling to take a substantial position and have the conviction to add to that position on weakness. My goal is to maintain a concentrated portfolio of small and micro-cap companies with unique advantages and growth potential within their respective industries, with the aim of holding them for the long term. Finding such companies requires significant time and effort. Due to the scarcity of suitable opportunities, constraints on time and resources, and opportunity costs, I will take substantial positions in the companies that meet my criteria and pass my risk/reward assessment. This approach requires a lot of research and patience. There will be long periods of waiting with very little trades and I will rarely hold more than 5 companies at a time. I will normally aim to have one short position. The short position will usually target a much larger company than the small and micro-cap companies held as long positions. This strategy accepts short-term volatility in pursuit of higher, long-term, tax-efficient returns.

Top Position

The fund’s top position is RCI Hospitality (RICK). RICK is the only publicly traded owner of adult nightclubs in the US. Currently they own 54 clubs across 13 states and an additional 13 sports-bar restaurants with the “Bombshells” concept that has recently began franchising. With few municipalities issuing new adult entertainment licenses these businesses function as local monopolies with excellent unit economics.

RICK has become the acquirer of choice for owners of these clubs across the country. As many current owners approach retirement, RICK has been producing cash at record levels and is in the unique position of being experienced in managing these assets efficiently, while having the cash or access to capital to roll up the top performing clubs with little to no competition. The US market has roughly 2200 of these clubs and 500 of those meet RICK’s acquisition criteria.

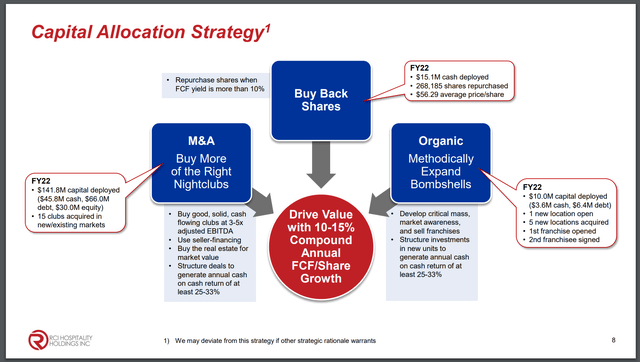

Management has proven to be excellent allocators of capital since a change in strategy in 2015. Utilizing the three main capital outlets of club acquisitions, share buybacks, and expanding the Bombshells concept, they have options to increase shareholder return in most economic environments. See the Capital Allocation Strategy slide from a recent investor presentation below.

RCI Hospitality Capital Allocation (RICK Investor Presentation)

The company has a unique competitive advantage in a niche industry with a long runway for growth with adult nightclubs and an even longer runway with the franchising and expansion of the Bombshells concept. Some new ventures such as Ricks Cabaret, Steakhouse & Casino coming soon in Colorado and potential OnlyFans competitor website “AdmireMe” are low risk high reward ventures that could have the ability to strengthen the capital allocation strategy with more or even better / higher ROI outlets in the future.

I have followed this company since 2016, started a small position in 2018 and took advantage of the market drop of 2020 to make this by far my largest holding. Management has set the stage for what looks to be a strong decade of growth.

New Position

MarineMax (HZO) is a vertically integrated boat and yacht retailer and services company. It sells new and used boats in addition to providing financing, insurance, maintenance, and storage solutions.

The company has more exposure to the higher end of the market with its yacht business and higher priced boats on average than its competitors. I expect the top end of the industry will be more resilient in a downturn than the mid-priced and lower priced segments.

The company has recently been focused on growing the higher margin businesses and reducing the reliance on new boat sales. The recent acquisition of Midcoast Construction Enterprises, a marine construction company should provide the infrastructure needed to purchase and develop waterfront real estate to expand the marina business and in turn grow all associated businesses. I will be added long exposure and looking for entry points on weakness. Currently trading at a small multiple to earnings and cash on hand I believe this presents a favorable risk/reward entry for a long-term position. I believe the company is well positioned in a fragmented industry. I would like to see MarineMax collect waterfront real estate during a recession and build marinas to set the stage for strong performance into any recovery or economic upturn.

Thank you for reading. Please reach out for any reason.

Nicholas D’Agnillo

Be the first to comment