PLDT is digital payments and online banking leader Poike/iStock via Getty Images

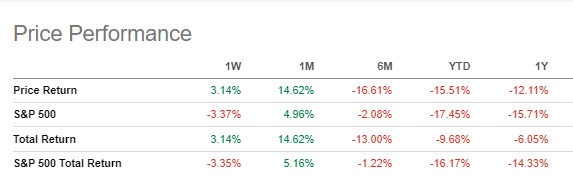

The stock of PLDT Inc. (NYSE:PHI) is –8.43% since my September 21, 2021 buy recommendation. I again endorse this stock as a buy. PHI’s one-month price return is +14.62%. You can take your profits now from this substantial gain. If you are in for the long-term, I am highly confident PHI has enough momentum to rise near its 52-week high of $39.

Based on the chart below, PHI is on a bounce-higher trend. This stock currently trades 22.75% below its 52-week high of $38.40.

Seeking Alpha Premium

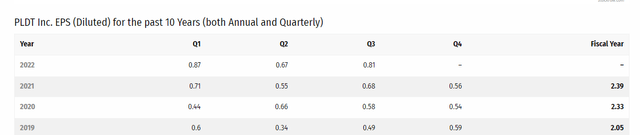

The +14.62% one month rally is a big seal of enthusiasm over PLDT’s Q3 net income of P10.64 billion ($191.413 million). This is 79% greater year-over-year. This was a nice follow-up to Q2’s net income of P8.8 billion, or $158.31 (+14% Y/Y). This consistent and improving profitability is why you should accumulate more PHI shares.

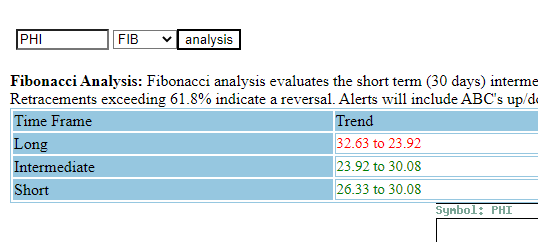

The TTM EPS of PLDT is now $2.81. PHI is on track toward beating the $2.23 estimate for the fiscal year 2022. Based on the chart below, basic linear progression analysis, we can guesstimate that Q4 will likely deliver an EPS of $0.56 or higher.

Why Not Take Profit?

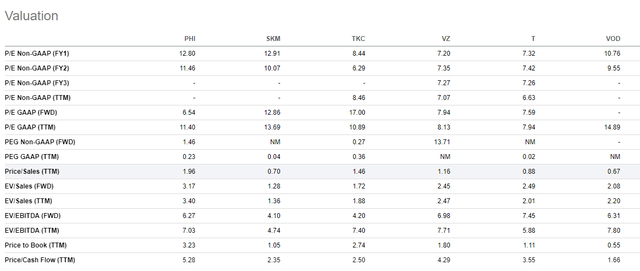

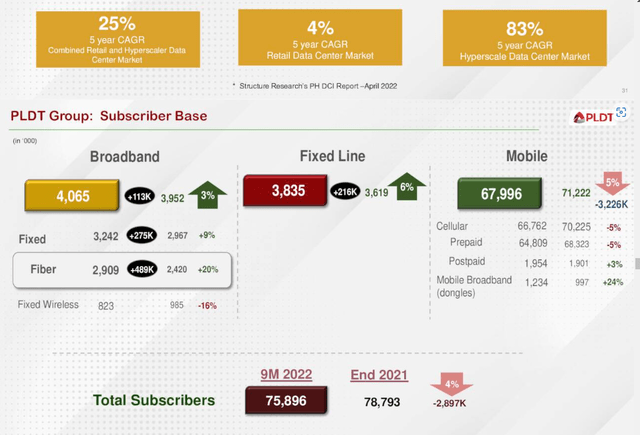

My contention is that the bull run for PLDT is not yet over. The $+14.62 percent over the past 30 days has not erased PLDT’s relative undervaluation. The GAAP forward P/E of PHI is only 6.54x. This is much lower than SK Telecom’s (SKM) 12.86x, and Turkcell Iletisim’s (TKC) 17x.

The much lower forward P/E valuation of PHI against SKM and SKM is a market aberration. PLDT is the one with the best profitability. Kindly refer to the chart below, PHI’s net income margin is 17.25%. This is higher than Turkcell Iletisim’s 13.41%, and SK Telecom’s 5.81%. PLDT touts higher gross and net income margins than AT&T (T) and Verizon (VZ).

The better net margin and consistent profitability of PLDT should be rewarded with a higher forward P/E ratio. Let us give PHI a forward P/E of 13x and guesstimate that the FY 2022 EPS would be $2.50. My near-term price target for PHI would be $32.50. Let’s project that FY 2023 EPS could be $2.90. Multiply this by 13x, and my long-term price target is $37.70.

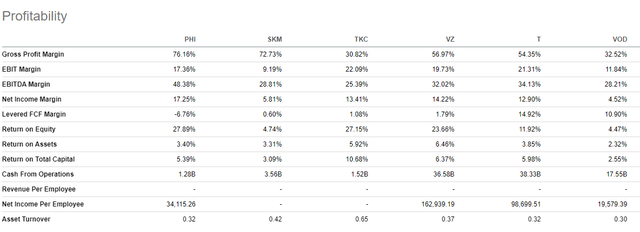

My optimistic EPS guesstimates are possible. As far as I know, PLDT is the only telecom company in the world today that was granted a digital banking license. PLDT’s Maya digital bank was launched last May of this year. Evaluate PHI’s investment quality by taking note that its subsidiary Voyager (parent company of Maya), is now a unicorn firm with a $1.4 billion valuation.

Maya is a universal digital bank that can do what traditional brick-and-mortar banks can do. PLDT is not spending on overheads like buying or renting bank offices across the Philippines. Maya is a low-overhead growth driver for PHI.

Most Investors Are Optimistic

Most investors have a cycle of emotions. It is always prudent to refer to technical indicators to gauge investor emotion. Based on its Relative Strength Index score of 66.08, PHI is still receiving bullish vibe from investors. This persistent market optimism for PLDT is again reflected by its fast stochastic number of 80.41. PHI has received a short-term bullish signal called Stochastic Overbought Buried. It means PHI’s fast stochastic is above 80 and has been so for the past five trading days.

PLDT’S Fibonacci retracement chart below also shows it only retraced below 38.2%. Fibonacci is therefore saying that the upward momentum of PHI will likely continue.

StockTa.com

PLDT is a Digital Banking and Payments Leader

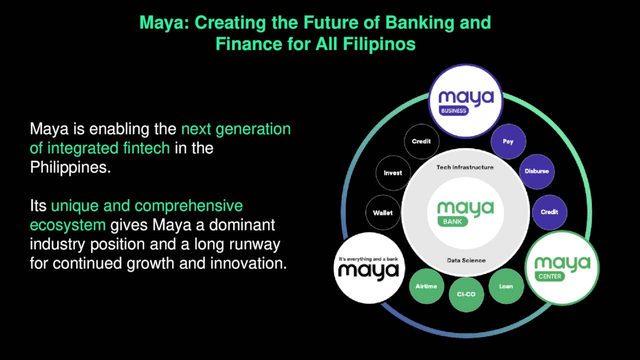

Based on its 9M 2022 investor presentation, PLDT wrapped up the first nine months of this year with almost 76 million subscribers. Almost 68 million of those are mobile prepaid and postpaid subscribers. Going forward, it is easy to assume that 5 to 10% of those 76 million might open savings and checking accounts.

The old PayMaya digital wallet (now renamed to Maya) already has 47 million users as of early 2022. PLDT’s rival Globe Telecom (OTCPK:GTMEY) owns the GCash wallet and that one has 60 million users. Globe has introduced the GSave feature on GCash, which now has more than 5 million depositors. PLDT’s Maya digital bank could eventually attract 5 million depositors.

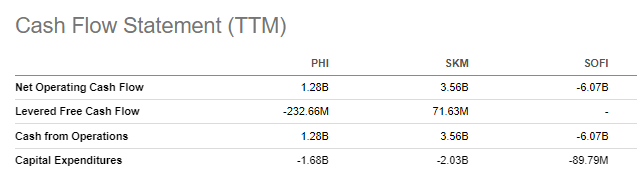

Maya could become as successful as SoFi Technologies (SOFI). Going forward, PLDT could in due course, spin out Voyager via an IPO. SoFi was valued at $8.65 billion when it had its IPO last year. Nurturing Maya to have it become an IPO-worthy venture is going to be easy because there are almost 76 million PLDT subscribers. The international minority investors in Voyager include Tencent (TCHEY) and KKR & Co. Inc. (KKR) I opine that foreign investors expect Voyager to eventually do an IPO.

Make a forward valuation of PLDT considering that it might spin out Maya Bank’s parent company, Voyager.

A potential future IPO could be good for PLDT It is the downside handicap of PLDT that it has a huge $5 billion debt. A Voyager IPO could pare down that debt load. Going forward, fees from remittances, digital payments, and lending through Maya could help improve PLDT’s cash flow.

Aside from the 2% cash-in over-the-counter fee and the 2% to 5% ATM machine withdrawal fee, Maya’s list of fees on different transactions is long and not permanent. Maya Bank fees can be raised at any time by PLDT management.

Downside Risks?

PLDT has a $5 billion debt burden. It is also unattractive that PHI has negative levered free cash flow. Its MRQ total cash position is only $368.54. This is understandable. PLDT’s MRQ capital expenditure is $1.68 billion.

Seeking Alpha Premium

The large capital expenditures forced PLDT to take on so much debt that its Altman Z-score is now only 0.71. On the other hand, cash is not going to be a problem for PLDT. It recently sold its 4G and 5G towers for P77 billion ($1.386 billion).

There’s also no serious threat from Dito Telecommunity. Its parent company, Dito CME, is beset by increasing losses and a huge P64.6 billion ($1.163 billion) bank debt. Dito CME owner Dennis Uy’s Udenna Group is currently shopping around its prized assets to pare down a $3.2 billion debt. My fearless assessment is that Mr. Uy is not going to waste money to finance the infrastructure expenditures of Dito Telecommunity. He is already having a hard time paying back Dito’s P450 million ($8.1 million) obligation to PLDT.

Why PLDT Needs Its Own Bank

Almost 50% of Filipino households that make 30,000 pesos ($538) per month or more have savings accounts. Going forward, five million Filipino residents, immigrants, and overseas workers can contribute an average of $500 in annual Maya savings. That’s $2.5 billion in depositor money that PLDT can lend to its broadband and wireless regular and business customers at 12% annual interest. Like GCash, Maya can lend money to anyone it considers creditworthy. Maya Credit is now live.

The possibility of opening a savings account and a cryptocurrency account is already a big deal for Maya.

PLDT makes good money by selling prepaid plans that expire. It can also compel millions of people to open accounts at its Maya Bank. PLDT’s offer of accelerated fiber internet for subscribers just to use a Maya account is genius. I am a PLDT Fiber subscriber and a GCash user. I might open a Maya account before December is over. I want a Maya-boosted 200 mbps fiber speed. The other inducing feature is that Maya Bank is offering 6% per annum interest in savings accounts.

The only requirement is that people should have at least P100,000 ($1,791.20), and they should use Maya to pay bills and make online purchases. The base interest Maya pays is only 4.5%. This covers accounts with at least one peso up to P5 million ($89,500). The highest interest rate that savings accounts with at least P100k balance can get from other Philippine banks is 2.6%. Maya’s rival GCash’s GSave only offers 2.3% interest. PLDT is likely to attract depositors away from traditional banks and GCash. Maya offers the highest interest rate on a savings account.

PLDT’s strategy of compelling its fixed and wireless internet subscribers to sign up for Maya Bank is effective. These subscribers and depositors can help improve PLDT’s weak average 5-year revenue CAGR of 4.16%. Low growth potential is probably why PHI has a forward P/E of less than 7x.

PLDT can also use Maya’s depositor money as a source for its expansion plans. Maya can lend its parent company, PLDT, local Filipino money to finance its P85 billion ($1.52 billion) in capital expenditures. This is better than sourcing out dollar-denominated foreign loans. There’s no forex volatility when taking out a loan from your own local Philippine digital bank.

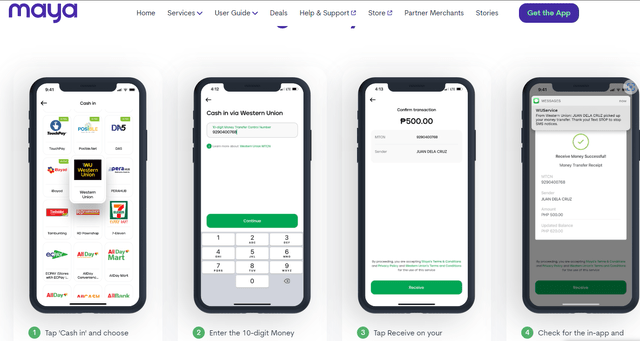

Going forward, Maya Bank could generate additional annual revenue of $200 million to $250 million. This guesstimate is feasible. The old PayMaya digital wallet was already expected to process P1.4 trillion ($25.07 billion) in transactions last year. There were only 38 million PayMaya users last year. Maya is now a universal digital bank that could also benefit from international remittances. Filipino immigrants and overseas workers could send money directly to Maya account holders via Western Union (WU).

Aside from Western Union, Maya users can also receive remittances processed through MoneyGram (MGI). PayPal (PYPL) also allows direct transfers to Maya. PLDT’s digital bank/wallet has a long-term tailwind from the $2.5 to $3 billion/month remittances that the Philippines gets from its overseas workers and Filipino immigrants.

My guesstimate that Maya Bank could add up to $250 million in new annual revenue is important. It could improve PLDT’s forward revenue CAGR of 1.36%.

Maya Bank could help PLDT achieve its estimated forward dividend yield of 8.72%. PHI is a buy because its consistent profitability has made it a generous dividend payer. Invest in companies that share their profits with their shareholders.

Conclusion

My buy rating for PLDT Inc. is not congruent with the hold recommendation that Seeking Alpha Quant has for it. Exercise your own due diligence. I reside in the Philippines, and I have been a customer of PLDT since 2002. My optimism for PHI might just be biased because I make money through PLDT’s fiber internet and 5G cellular data.

The +14.62% one month performance has not dispelled the relative undervaluation of PHI. Compared to its telco peers, PLDT’s very low 6.54x forward P/E, better profitability, and ownership of a digital bank makes it more attractive.

My long-term price target for PHI is $37.70.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment