Oliver Rossi/DigitalVision via Getty Images

Acadia Realty Trust (NYSE:AKR) is a real estate investment trust (“REIT”) with interests in 188 high-quality retail properties located primarily in high barrier to entry metropolitan areas in the U.S. Their operations are conducted through two primary vehicles: their core portfolio, which represents approximately 60% of total revenues and consists of properties either 100% owned, or partially owned through joint venture interests; and their fund portfolio, which are investment vehicles through which AKR and outside institutional investors invest in opportunistic and value-add retail real estate.

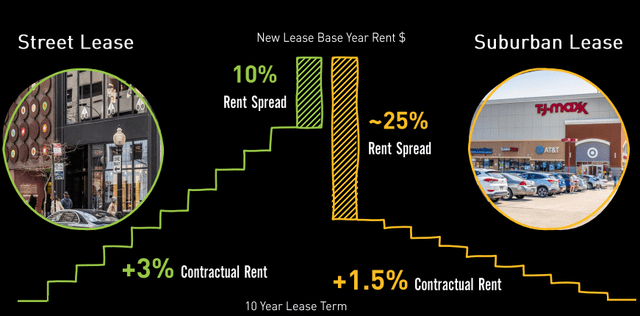

Within the core portfolio, the composition is weighted more towards street/urban properties as opposed to more suburban ones. While there has been some concerns regarding the future of urban environments, given the growing allure of the suburbs, street leases have provided better economics for AKR. On a 10-year lease, for example, AKR would need to achieve a 25% rent spread on a suburban lease to achieve the equivalent returns on a street lease with a 10% spread due to the variation in the contractual rent growth on a street lease versus a suburban lease.

Spring 2022 Investor Presentation – Comparative Economics of Street Vs Suburban Leases

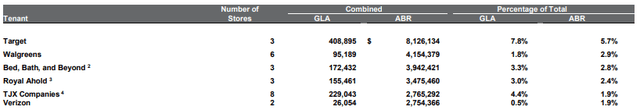

Some top tenants of AKR include well capitalized publicly traded companies such as Target Corporation (TGT), Walgreens (WBA), and the TJX Companies (TJX), to name a few. At 5.7% of annualized base rent (“ABR”), TGT is their largest tenant. Overall, their top five tenants represented a collective total of approximately 18% of ABR.

Q1FY22 Investor Presentation – Summary of Top Tenants

Over the past one year, shares in AKR are down about 20%, with a nearly 25% decline YTD. While shares have rebounded from their early 2020 lows, they have yet to reach pre-pandemic trading levels, even at the height of market highs in 2021. At 13.3x forward funds from operations (“FFO”), shares are discounted to the sector median, which is currently 15.2x forward FFO.

With a modest dividend yield of 4.3%, shares also offer income-focused investors a steady source of continuing income. Steadily improving operational performance coupled with strong leasing activity should enable AKR to return to pre-pandemic trading levels of approximately $20/share, which would represent a forward multiple of about 15.7x, in-line with the broader sector median.

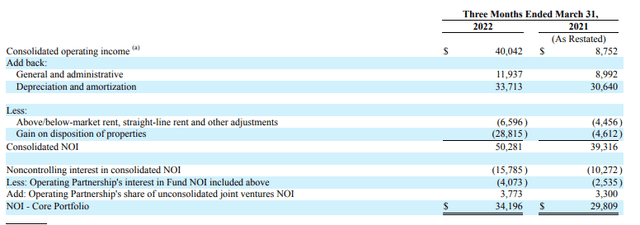

Nearly 10% Same-Property NOI Growth

In the most recent filing period ended March 31, 2022, AKR reported total revenues of +$81.5M. This was up 19.5% from the same period last year and in-line with expectations. Within the individual segments, core revenues were up 14%, driven by lower credit loss reserves and the accretive effect of acquisitions during the comparative period. The contributions from acquisitions, however, were more pronounced within the funds segment, whose revenues were up nearly 30% due to a +$4M contribution from 2021 acquisitions.

Though expenses were higher during the period, particularly general and administrative (“G&A”), which was up 32%, consolidated NOI in the core portfolio still came in higher, up about 15% from 2021. Within same-property, NOI was up 9.7%, driven by improvements in credit losses and abatements, occupancy increases, and positive leasing spreads.

Q1FY22 Form 10-Q – Summary of NOI

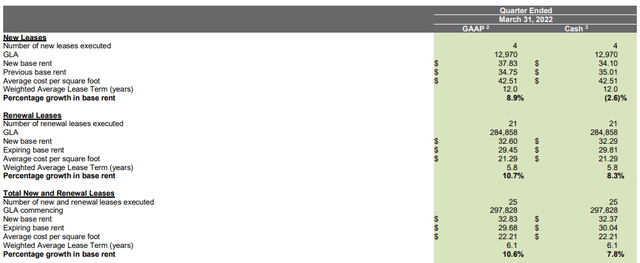

Favorable Leasing Spreads

Occupancy continued to improve from prior year levels, ending the current period at 94% leased within the same-property portfolio. This is 350 basis points (“bps”) better than last year. Additionally, in their street and urban portfolio, AKR experienced a 70bps sequential improvement in occupancy levels, suggesting the current leasing environment remains favorable for growth.

Physical occupancy stood at 90.4%, representing a spread of 360bps between their leased space and signed but not yet commenced leases (“S&O”). This compares favorably to a spread of 230bps last year. According to management, this represents approximately +$7.5M of pro-rata ABR or more than 5% of annualized first quarter base rents. With over 90% of the S&O pipeline set to commence in the second half of the year, NOI is set to benefit, as the embedded rental growth in these leases is in excess of 15%.

Overall leasing spreads during the quarter were robust, with GAAP and cash spreads of approximately 11% and 8%, respectively. With a new GAAP base rent of $32.83, however, there is still room for further improvement, as there are a number of leases expiring in the next several years with average ABR greater than current going rates. Ideally, base rents should rise to the $35-38 range to offset the effects of the expirations in later years. Commencements in the S&O pipeline will likely be one catalyst in arriving at those levels.

Q1FY22 Investor Supplement – Summary of Leasing Activity

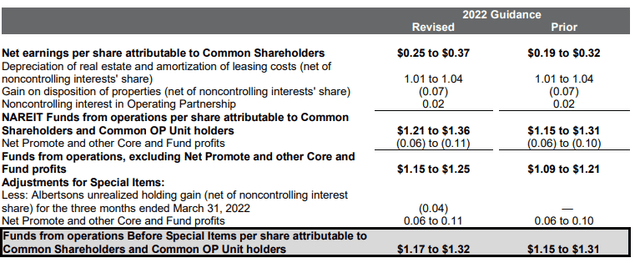

Upward Revisions in Full-Year Guidance

Looking ahead to the remainder of the year, AKR increased their full-year guidance across the board on expected strength in occupancy and leasing. FFO/share is now expected to be in the range of $1.17 to $1.32, up from $1.15 to $1.31 previously. At the midpoint, this represents YOY growth of more than 13%.

Q1FY22 Investor Supplement – Full-Year Guidance

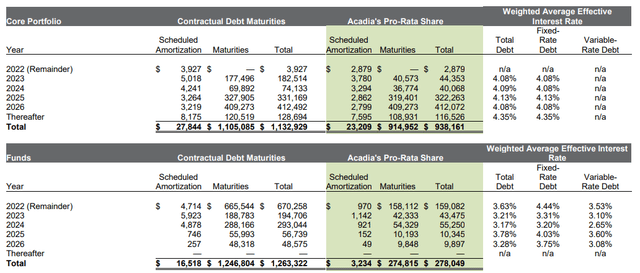

Reasonable Debt Structure and Adequate Repayment Capacity

At the end of March 31, 2022, AKR had total assets of +$4.5B and total liabilities of +$2.1B, comprised principally of +$1.8B in unsecured debt and mortgage and other notes payable. The split between the two was approximately 50/50 with an approximate 70% weighting towards fixed-rate debt. This is preferable as it reduces the company’s exposure to rising interest rates.

As a multiple of EBITDA, overall net debt stood at 7x on an unadjusted basis and 6.6x adjusted. When excluding the debt burden from their fund portfolio, net debt on an unadjusted and adjusted basis was 6.3x and 6x, respectively. Though generally in-line with sector averages when considering just the core portfolio, the 7x multiple on the overall portfolio is on the high-end. It is worth noting, however, that the multiple improved significantly from the end of 2021, where it was most recently at 7.9x and 7.4x on an adjusted basis.

Within their core portfolio, AKR has no significant maturities until 2025. But they do have +$365M of fund debt that is expiring in 2022. 30% of this is expected to be refinanced or extended in the normal course of business. Refinancing of the remaining balance is underway and is expected to be completed in the second half of the year.

Q1FY22 Investor Supplement – Summary of Debt Maturities

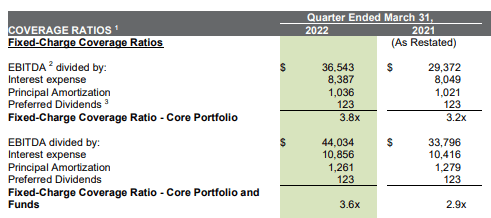

AKR also is generating solid coverage on their fixed charges. Including their fund portfolio, their fixed coverage ratio was 3.6x in the current period versus 2.9x last year. This comfortably exceeds the 1.5x that is required within the various debt covenants.

Greater exposure to variable-rate debt within their fund portfolio does subject the company to greater interest rate-related risks, but they do appear to have sufficient cushion to weather any resulting increases.

In addition, the company utilizes the interest rate swap market to hedge their long-term variable-rate exposure. As such, their exposure is generally limited to the short-term borrowings the company uses to fund their structured finance book, whose profits are more than enough to exceed the interest burden.

Q1FY22 Investor Supplement – Summary of Coverage Ratios

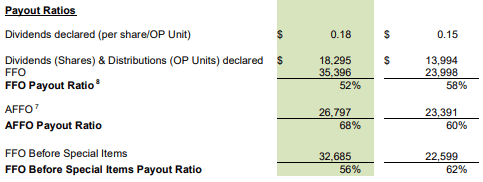

Further Dividend Hikes Supported by Improving Cash Flows

Stable occupancy levels and continued rental rate growth generates a steady stream of cash flows for the company. In the current period, for example, they generated +$26.5M in operating cash. Though this was lower than the same period last year, which came in at +$31M, the declines were primarily due to changes in working capital, such as the pay down of short-term payables, as opposed to declining rents/earnings.

A net +$150M was used on investing activities during the quarter, most of which was financed through the issuance of common shares via their ATM program at a gross issuance price of approximately $22.50. Given current leverage levels, this funding arrangement was the most feasible, though it did come with the drawback of shareholder dilution.

Overall, current cash flow levels are adequate to support continuing quarterly dividend payouts of $0.18/share. This is up 20% from Q4FY21, but still down from the $0.29/share that was paid out prior to the COVID-19 pandemic. A return to that level would translate to a yield of nearly 7% at current pricing. With current payout ratios hovering around 70% on an adjusted basis, capacity certainly is there for further hikes in subsequent periods.

Q1FY22 Investor Supplement – Summary of Dividend Payout Ratios

A Return to Pre-Pandemic Trading Levels is Likely

AKR is a mid-sized REIT with interests in high-quality retail properties in top metropolitan areas across the U.S. While there are concerns regarding the future of urban environments, given the growing allure of the suburbs, AKR has benefited from their current business model.

Their street leases, for example, have stronger contractual growth and more fair market value rent resets than their suburban assets. In addition, costs are generally lower on these leases and rents are currently at cyclical lows, despite retailer sales that have already surpassed pre-COVID volumes. This gap between rent and sales should begin to narrow in future periods.

A downturn in the broader macroeconomic environment is one risk to consider. But AKR is well-positioned to weather any setbacks, especially after successfully navigating through the worst effects of the COVID-19 pandemic. A well-capitalized tenant base and stable occupancy levels are two defensive features embedded into the company’s operations.

Down nearly 25% YTD and trading at 13.3x forward FFO, shares appear ripe for a rebound. Their significant S&O pipeline that is expected to commence later this year supports the assertion of continued NOI growth and operational recovery back to pre-pandemic levels.

At $20/share, AKR would be valued at a forward multiple of 15.7x, which is reasonable, considering one peer, Saul Centers, Inc (BFS), is currently fetching 16.1x. For investors seeking double-digit upside potential, in addition to a stable dividend payout, AKR is one to keep an eye on ahead of its earnings release next week.

Be the first to comment