webphotographeer/iStock via Getty Images

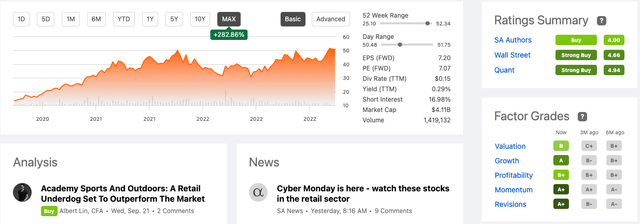

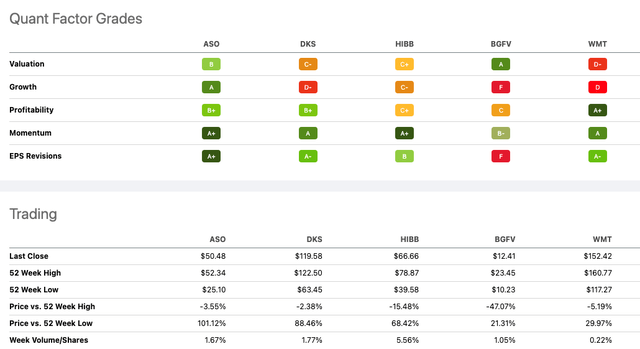

Academy Sports and Outdoors, Inc. (NASDAQ:ASO) has rewarded its early investors with 282.86% returns since going public in 2020. This year the stock price has also been trending upward along with consecutively positive top and bottom-line quarterly performance. If we look at SeekingAlpha’s Quant Factor Grades over the last six months, we can see the company’s strong growth and momentum progress.

Stock and Factor Grade Trend (SeekingAlpha.com)

This well-established company, which has been private for most of its history, has had a successful performance in the market since its IPO in 2020 at $13.00 per share, growing to a medium-cap stock of $4.11 billion. The stock price is still well under the one-year analyst expectation of $60.91. The company has recently opened nine new stores, with an ambitious goal of adding 80 to 100 new stores in the next five years to their current total of 268 stores in 18 states. Furthermore, it will shortly release its Q3 financial results and is entering the high shopping season. Therefore there is a lot more upside for this growing entity, and investors may want to take a bullish stance on this company.

Overview

ASO was founded in 1938 as a sporting goods store chain with head offices in Texas. Initially a family business, it remained private until it was acquired by investment company KKR & Co. Inc. (KKR) in 2011. It IPOd on Nasdaq in October 2020. Since 2011 it has been a multi-channel retailer with an increasingly important e-commerce store. The company has 278 stores and is expanding into new states, now in eighteen states.

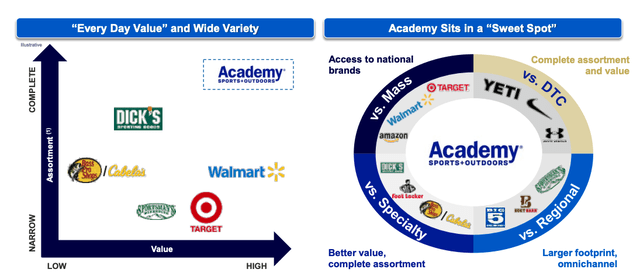

The company aims to meet the demand of a broad range of customers with national and private label brands in the following categories; they focus on outdoor activities such as fishing and BBQing, and clothing and footwear to meet casual and sports requirements.

Brand and Value Offering (Investor Presentation 2021)

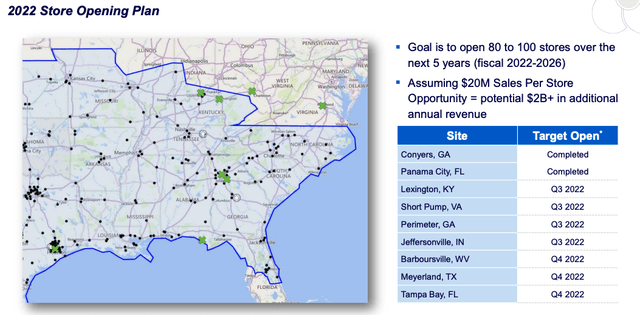

Hunting and fishing licenses can also be acquired within the stores. Although large retail stores are the primary income source, online stores continually contribute to a more significant percentage of the total revenue. Last year it accounted for 10% of total revenue. There is a massive potential in this market in which more customers are shifting their spending to sports, leisure and wellness, especially with an at-home focus. The total addressable market is said to be worth $110 billion. In 2022 the company opened nine stores, two very recently and in new states. If we look at the sales potential from the company’s goal to open 80 to 100 stores in the next five years, there is a lot of upside potential.

Store Growth Potential (Investor Presentation)

Financials and Valuation

Although the company has not been on the stock market for many years, it is a well-established company that has succeeded privately for over seventy years. If we look across some key retail analytics, we can see severe growth and upward-performing trends promising future growth and value.

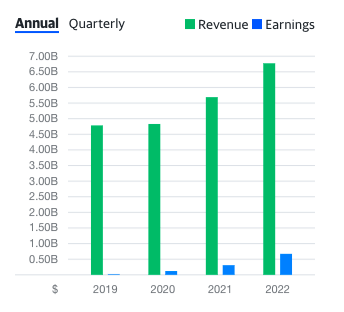

Yearly Earnings and Revenue (YahooFinance.com)

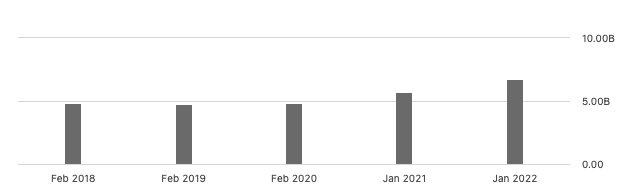

If we have a look at the annual revenue, gross margin and earning trends, we can see growth year on year since 2018.

Total Revenue per Year (SeekingAlpha.com)

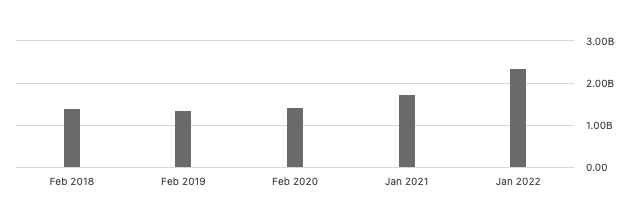

We can see the impact of the pandemic on sales numbers in 2020. However, we still see a five-year growth in sales from $4.835 billion to $6.5555 billion. Below we can see that the gross profit margin has improved over five years from 28.93% to 34.71%. In the previous quarter, the gross profit margin was 35.33%, which looks promising for the year-end results.

Gross Profit (SeekingAlpha.com)

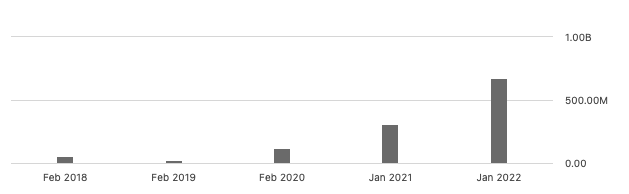

If we look at net income over five years, we also see a significant upward trend.

Net Income per Year (SeekingAlpha.com)

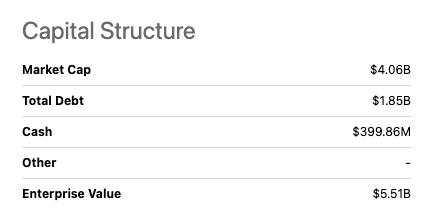

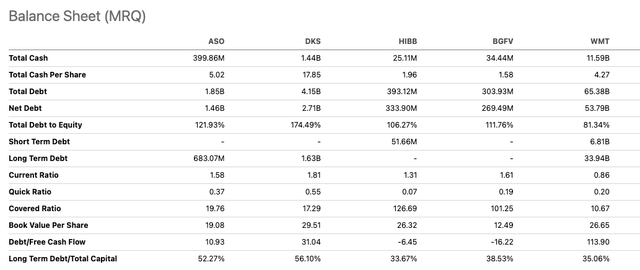

Below we can see the breakdown of the capital structure. I have looked at the following peers, DICK’S Sporting Goods (DKS), Hibbett, Inc. (HIBB), Big 5 Sporting Goods Corporation (BGFV), as well as a comparison to the largest retailer in the world, Walmart Inc. (WMT), to indicate the overall balance sheet performance.

Capital Structure (SeekingAlpha.com)

ASO’s current ratio is lower than its peers but much healthier than WMT’s. At 1.58, the company should have enough cash to meet its liabilities, keeping in mind an effective use of capital.

Balance Sheet Comparison (SeekingAlpha.com)

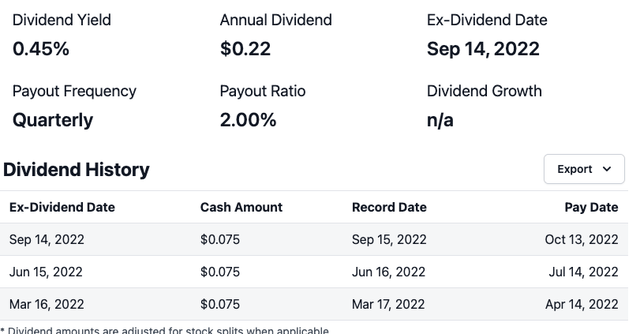

It is also ASO’s first year of paying out quarterly dividends. They made the last payment in September 2022, $0.075 per share. The dividend yield is 0.45%, and it paid a total of $0.22 per share last year.

Dividend Information (Stockanalysis.com)

Suppose we continue to the peer valuation of Dick’s Sporting Goods, Hibbett, Inc., and Big Five Sporting Goods Corporation. We see impressive factor grades across the board, and the stock is cheaper than DKS, HIBB and WMT.

Peer Comparison (SeekingAlpha.com)

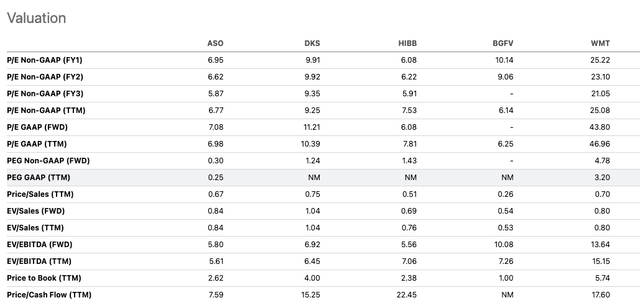

ASO has a price-to-earnings ratio of 6.98, lower than all its peers. If we omit HIBB and forward-looking, the company looks to be undervalued. It has a price-to-sales ratio under one of 0.67, indicating investors are paying less than a dollar for every dollar the company earns in revenue. ASO also has a lower EV-to-EBITDA ratio than its peers, suggesting it may be undervalued.

Peer Valuation (SeekingAlpha.com)

Risks

Retail is a competitive and quickly changing landscape due to technological advancements and the ease of shopping online and door-to-door delivery possibilities. On top of that, the COVID-19 pandemic has sped up the pace at which customers switched or added online shopping to purchase goods. Although retail sales are expected to grow at high rates, online shopping is becoming increasingly important. One question is whether there will be a future for large retail stores. It is increasingly essential for companies to create omnichannel shopping experiences and keep up to date with the evolving nature of what customers are searching for.

Furthermore, as inflation increasingly soars in the United States, it directly impacts consumer shopping behavior. A study shows that 40% of consumers will make more comparisons before purchasing and expect to buy less overall. ASO has a wide range of products and is considered a good value for money. However, this could immediately impact the sales and gross margin to remain competitive.

Final Thoughts

ASO is healthy and growing with lots of upside potential packaged in the ambitious plan to open eighty to one hundred new stores across current and untapped US states for the company. The company is growing and performing above average if we look at its peers. Although the stock price has increased significantly since its IPO, and there are questions as to whether there is a lot more upside potential, various ratios indicate that the company is undervalued and has room to keep going. Investors may want to take a bullish stance on this company.

Be the first to comment