Maksim Labkouski

Technical Analysis

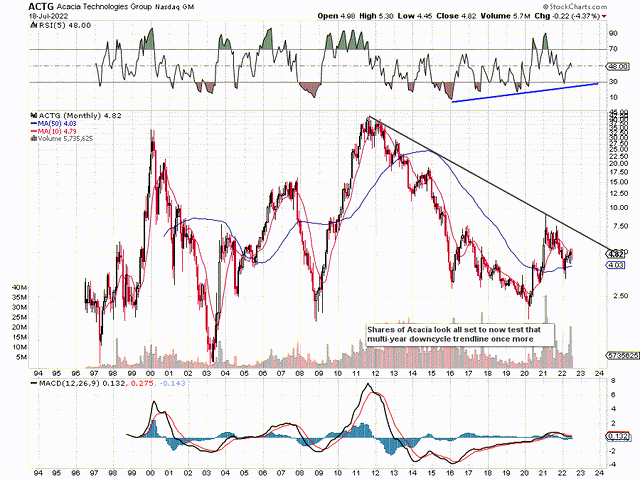

If we look at a long-term chart of Acacia Research Corporation (NASDAQ:ACTG), we can see that the 50-month moving average has now turned up meaningfully and the MACD indicator is fighting to drive on into positive territory. Furthermore, the bullish divergence in the RSI momentum indicator is a bullish indicator that indeed trend followers may start to get long this stock once a change in trend has been confirmed here in earnest. For this to happen, we need to see price break out above the multi-year downcycle trendline on strong volume. That resistance point at present comes in just above the $7 level. We believe shares will at least test this level over the near term in Acacia Research due to what we are seeing on the near-term chart.

Technical Chart Of Acacia Research (StockCharts)

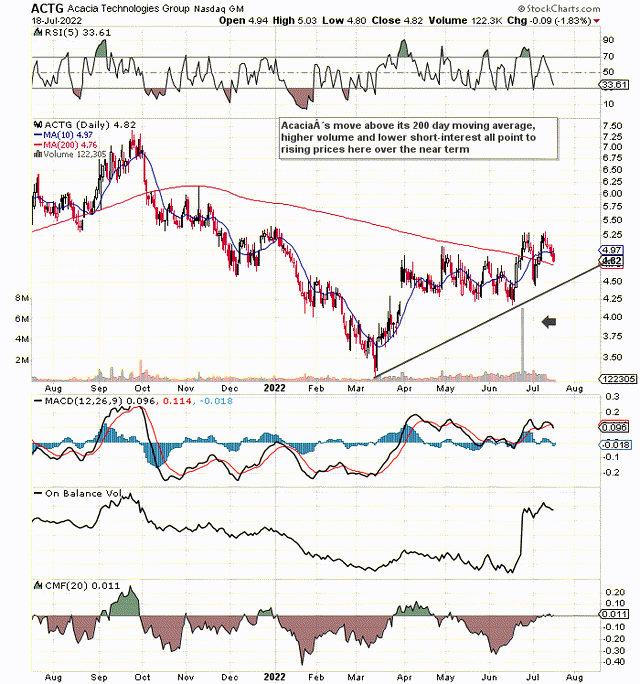

As we can see from the near-term chart below, shares now have significant downside support, having bottomed at the $4.24 mark in late June which then led to the taking out of the stock´s 200-day moving average of $4.76 (At Present). Suffice it to say, the longer shares can remain above their 200-day moving average, the higher the probability that at least a new short-term bullish trend has begun. Furthermore, as we can see from the chart below, there was a significant increase in buying volume in late June which corresponded with a significant drop in short-interest (Current short-interest now comes in under 3%). Suffice it to say, all of these trends are bullish from a timing standpoint, which leads us to believe that shares should continue to rally from their present level ($4.82 approx.). The stock´s fundamentals and very keen valuation explain why Acacia may avail of renewed investor interest here.

Acacia In Bullish Mode (StockCharts)

Proven Track Record

In fact, with the VIX trading up around the 25 level, management remains poised to deploy elevated amounts of capital in order to take advantage of present lower stock prices in general. Therefore, when we combine the fact that stocks are currently on sale with Acacia´s $1 billion war chest, it becomes clearly evident that Acacia is in a good place given the firm´s ever-growing number of participating investors and executives that have the ability to close complex deals. The track record is there also as we see with the ongoing capital gains continuing to come off the life sciences portfolio. We also saw recently how Mycovia´s recent drug approval will lead to strong cash flow for Acacia over time. Investors will be hoping similar type gains can come off the capital which is coming off these deals.

Growth In Sales, Capex, & Working Capital

Acacia Research is expected to report -$1.76 in earnings per share this fiscal year on sales of $54 million. The following year, analysts who follow this stock expect Acacia to do -$0.08 in earnings per share which would be practically a return to positive profitability if indeed the projection was met for fiscal 2023. Since revenues can jump around significantly in Acacia, investors will be clued into how profitability including cash-flow generation can be enhanced from the opportunities it takes on. Despite the fact that Printronix drove sales forward in the company´s first-quarter results this year, other less followed metrics such as working capital and Capex spend also reported strong 12-month growth rates. Capex spend was up by 33% and Capex spend grew by almost 17% over the same period of 12 months prior.

Bullish Balance Sheet Trends

These trends are being facilitated by what is happening on the balance sheet. Cash & Short-term investments of $572 million at the end of March 2022 were up close to $100 million over the same period of 12 months prior. Short-term borrowings in senior secured notes issued to Starboard Value at the end of Q1 came in at $168.7 million, which was down over $12 million sequentially. Management also repaid an additional $50 million in the beginning stages of the second quarter, so we should see a meaningful drop in debt in the upcoming second-quarter numbers.

Shares Trading Under Book Value

Suffice it to say, when we couple the stock´s technicals above with its encouraging financials and very keen valuation, it becomes evident that downside risk is limited in Acacia. At present, the stock´s book multiple comes in at approximately 0.66, meaning the investor attains $1.52 of the company´s assets for every $1 invested in the company. However, this is what one receives with respect to how Acacia´s assets stack up today. The book multiple looks even more attractive given the depth of the acquisition pipeline the company currently has at its disposal.

Conclusion

Therefore, to sum up, as we stated above, the longer Acacia can remain above its 200-day moving average, the higher the probability that shares will experience a sustained bullish trend. We look forward to continued coverage.

Be the first to comment