Michael Vi

AbbVie (NYSE:ABBV) has become a more popular name among the dividend community over the years with good reason. Flat out, the company has performed on many different levels.

- Share Price Appreciation

- High-Yield Dividend

- Strong Dividend Growth

All of these are what makes ABBV what I like to call an Investor’s Trifecta.

There are some high-yield dividend stocks out there that really only give you that nice yield. The dividend does not grow all that much and the share price stays pretty flat. There are other dividend stocks that are more volatile and could provide some nice share price appreciation in some years, but the dividend yield is low.

AbbVie on the other hand can contribute in all three phases and I will touch on each of those in today’s article.

Share Price Appreciation

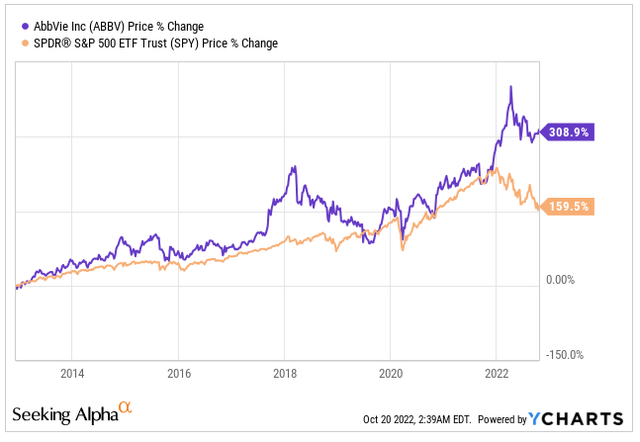

Over the past 10 years, ABBV’s share price has increased over 300%, almost doubling up the return of the S&P 500. The best part of this is the fact that the return does not even include dividends.

Over the years, ABBV has had the best-selling drug in the world in Humira as its revenue driver. A few years back, the company lost patent protection overseas and in 2023, ABBV will lose patent protection here in the US.

ABBV originally spun off from Abbott Labs (ABT) back in January 2013, so the company is going to be celebrating 10 years in a few months of being on their own. Going back a handful of years, Humira accounted for roughly 70% of total company sales.

Fast forward to today, and those sales are now less than 40%. A few things have taken place over the past few years.

- Patent protection overseas was lost

- Portfolio growth occurred both organically and through acquisitions

We already touched on the patent lost overseas, so let’s move to the growth of the portfolio. ABBV not only has a long drug pipeline, but they have a strong pipeline of current a future drugs.

Skyrizi accounts for the second largest share of revenue for the company. As of Q2 ’22, Skyrizi sales came in at $1.3 million, which accounts for 8.6% of company sales. Imbruvica, which is a drug that was co-produced with Johnson & Johnson (JNJ), accounts for 7.9% of company sales at $1.1 million. Lastly, Rinvoq is another up and coming drug that currently only accounts for 4% of company sales at $0.6 million.

Skyrizi and Rinvoq are two drugs that have blockbuster potential for ABBV. During the most recent quarter, both drugs grew 86% and 56%, respectively.

Both drugs were created in house and have helped ABBV diversify their portfolio.

Next, let’s take a look at how ABBV has strengthened their portfolio through acquisitions.

In May 2020, ABBV closed on their $63 billion acquisition of Allergan, who brings a whole new set of products to the table, further diversifying and strengthening the portfolio. Think of botox and implants, among other things within the Allergan portfolio.

ABBV is taking a much different approach than they had in the past. Early on, they were more of a one trick pony. Humira had the strengthening to keep the company moving forward on its own. Today, they are strength in numbers. They may not have a Humira like blockbuster product, but they have a whole slew of high-quality products.

High-Yield Dividend

This leads us nicely into a discussion regarding the dividend. When it comes to dividend stocks, one of the first things you want to look for in a company is whether they have strong Free Cash Flow. Net income is not where a dividend is paid from, instead Free Cash Flow is where it’s paid from.

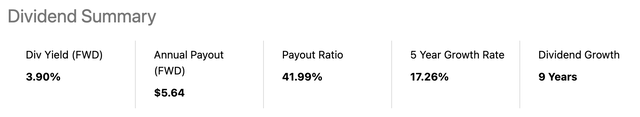

Over the past four quarters, ABBV has grown their FCF by 13.5%. Currently, ABBV pays an annual dividend of $5.64 per share, which equates to a 4% dividend yield.

On a per share basis, ABBV has generated FCF of $12.49, which means they have a FCF payout ratio of 45%. This tells me that the company has plenty of room to not only pay their dividend, but continue to grow their dividend.

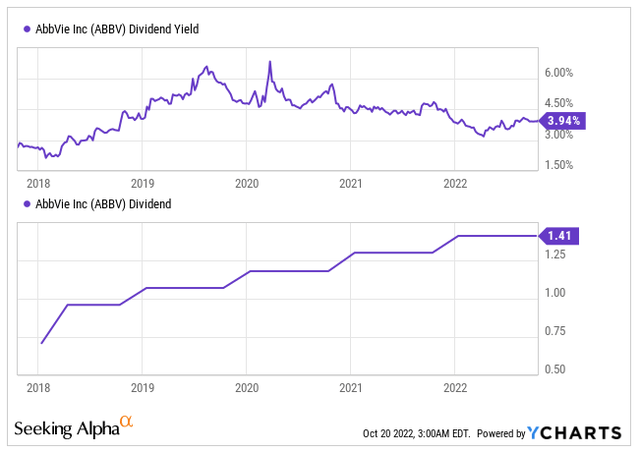

Over the past five years, ABBV has averaged a dividend yield of 4.2%. Over those five years, you can see how the yield has hovered above 4% while also growing on a per share basis.

Strong Dividend Growth

Speaking of dividend growth, this is one of my favorite things about ABBV. Dividend growth stocks are my favorite type of stock to invest in as it really allows for the power of compounding to be put in overdrive.

ABBV does just that as they have increased their dividend at an average annual rate of 17.3% over the past five years.

The dividend has increased for all nine years of the company’s existence and I do not expect that to slow down any time soon.

Risks Ahead

There are plenty of risks when it comes to investing in a pharmaceutical company in general and then there are also some ABBV specific risks.

To state the obvious, pharmaceutical companies spend millions upon millions on research and development costs searching for that next Humira like drug. AbbVie is not immune to going through numerous trials only to scrap a drug they poured millions of dollars into.

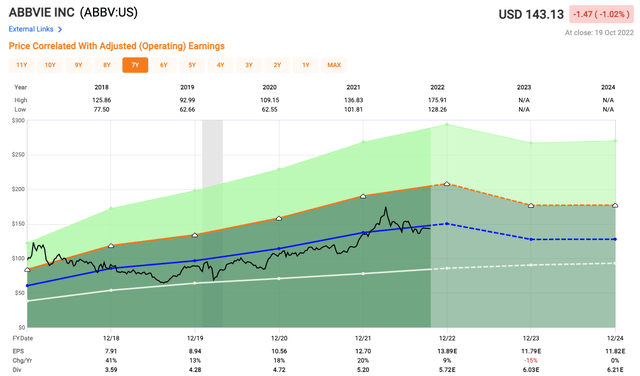

Another risk, which is more ABBV specific, is centered around a slowdown in the business. As I mentioned, Humira sales are set to fall in 2023 as they lose patent protection. Management has done a fine job preparing investors for this, as growth is expected to be minimal in 2023 before they expect things to pick back up in 2024.

Investor Takeaway

AbbVie is a stock that checks a lot of boxes for investors. They have strong free cash flow, which more than supports a high-yield and growing dividend. They have had the number one selling drug in the world for a number of years and are in the middle of a transition, which I believe they are more than ready for.

ABBV shares currently trade at a P/E of 10.5x. Over the past five years, ABBV has averaged an earnings multiple of 10.8x. As such, shares appear to be fairly valued at the moment, especially considering the drop off that is expected to come next year.

I do love the company, as it is one of my largest positions, but at the current valuations, I am not looking to add at current levels. If we see another market-wide pullback that drags shares lower, I could see adding more around the $125 level, which puts us back at a single digit multiple.

Therefore, I rate shares of ABBV as a HOLD currently.

Be the first to comment