mikkelwilliam/iStock via Getty Images

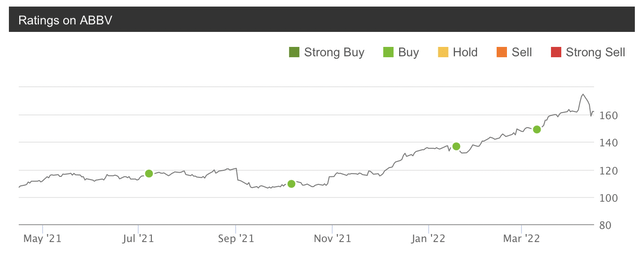

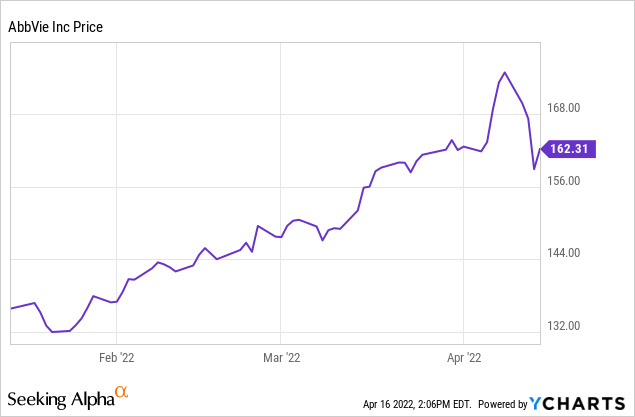

AbbVie (NYSE:ABBV) shareholders have enjoyed 2022 so far, but this rocket ship looks like it may have recently topped out in the mid $170s. Now, as the stock attempts to regain composure, shareholders must prepare for the release of quarterly earnings, which the company recently noted it would announce on Friday, April 29, 2022, before the market opens. The market’s response to the earnings could determine the longevity of this recent trend.

I am a believer in AbbVie’s portfolio that consistently argued the company was undervalued. The company is finally getting some respect.

Zvi Bar on AbbVie recently (Seeking Alpha)

Given the company’s recent performance, it is clearly less undervalued, and possibly now fairly valued. Many large pharmaceutical companies have performed well in 2022, due to their being deemed value stocks. Here, that means they have present earnings that support above average dividends.

AbbVie’s strong current earnings and cash flow should continue to be key drivers for its probable outperformance. Of course they should have been driving the stock a year ago, and they weren’t then, so what really matters is keeping the market happy. In that regard, here and now, what matters most is what comes up next in the form of an earnings report. The company’s performance and guidance are likely to be material to the continuation of this recent trend.

I think a key concern here is that the company may sandbag guidance. Management tends to be conservative, and the world is chaotic at the moment, so it is reasonable to presume that management might want to provide conservative guidance.

Another recent issue is that just last week, AbbVie’s Vice Chairman and President Michael Severino’s resignation was announced, and it appeared to contribute to a 6% decline in share price. There was some possibility that Severino could have become the future CEO of AbbVie, but that is now improbable, and the market dislikes uncertainty, even if over an issue it does not fear as material.

That total decline was certainly not wholly due to Severino’s resignation, as the company went ex-dividend for $1.41 on that same date, and it was also a weak day for several other large pharmaceutical companies with high yields. Interest rate sensitivity is a reality for high yielding stocks, so there were several forces at working in harmony. The compound effect appeared to be a countering of a seemingly meaningful breakout that started at the beginning of April.

I believe that any continued weakness here will become a strong long term opportunity to acquire a premium asset that has the appearance of being overvalued due to its recent outperformance. I also believe that there is a reasonably high probability that the recent spike upwards was due to a sizable position being acquired by an entity that may end up continuing to accumulate shares here.

There is some reason to expect good news out of the its aesthetic and cosmetic treatments, including Botox, Juvederm, and CoolSculpting, which were brought into the portfolio by the 2019 acquisition of Allergan. That acquisition was never truly appreciated by the market, but it was rather profitable, and also added diversification.

Here, there is reason to believe that a return to normalcy will include an increase in cosmetic treatments such as Botox, Juvederm, and CoolSculpting, which could provide some benefit to near term guidance. There is also some good reason to believe that the cash cow of the company, Humira, will continue to exceed expectations.

Humira almost always exceeds expectations in terms of continued sales and the ability to fend off competition, but there is always a cloud of uncertainty, and a bunch of contenders. AbbVie recently entered into an agreement with Alvotech Holdings to settle a patent and trade secret dispute related to Humira. According to the settlement terms, Alvotech obtained the non-exclusive right to market its high-concentration biosimilar candidate for Humira, AVT02, in the United States, with a license entry date of July 01, 2023.

Competition will inevitably weaken Humira, but it is still a powerhouse drug that is likely to bring in billions each quarter for the next several quarters. Even the settlement with Alvotech means that its biosimilar will not compete until the second half of next year. It is not yet clear whether that competition will actually be available then, or at what price, and how quickly it may take share, or reduce margins. What is probable, though, is that Humira is likely to record over $10 billion in Humira related revenue between now and when Alvotech’s non-exclusive license right commences.

Going into earnings, and following this dip, I believe AbbVie is likely to continue its trend higher. I also wholly acknowledge that this appears to be a good time to realize some of those unrealized gains. As a result, I have reduced some of my ABBV equity exposure, and replaced it with short term options that are at and near the money.

I started with $160, $165, and $170 strikes, and I intend to continue to replace my position in such a manner as we approach earnings. I will roll up the strikes on the options if the shares quickly recoup and return to their recent highs in advance of earnings. I already had some LEAPS, but I may add to them as part of this share replacement strategy, and pressing any resumption of strength. It really depends on how AbbVie reacts over the next two weeks, as we approach that April 29 earnings and options expiration date.

ABBV bar chart (Finviz)

If AbbVie continues the recent drop, those near term options may become worthless, but I will likely be better off than if I had held the shares, depending upon the severity of that drop. If that were to happen, I can opt to get back in sometime next month. Similarly, if shares quickly bounce back, the leverage of those options is likely to benefit me in the near term. This should especially be the case as we approach earnings, because implied volatility is likely to spike just before earnings, so options should contain significant implied volatility value on April 28.

This should provide an opportunity to sell those options for some value, and a possibly significant profit, in advance of earnings, as well as hold exposure through earnings while maintaining less capital at risk. The worst case scenario for my strategy is that AbbVie goes nowhere now and through earnings, but then quickly resumes the prior ascent shortly afterwards.

Conclusion

AbbVie may be considerably more expensive than it was last year, but it still appears to be a relatively strong value in a market saturated with overvalued equities. AbbVie underperformed for several years, but broke out in late 2021 and continues to outperform in 2022. I believe this trend is likely to continue up through 2023, and that the recent weakness is likely to be a buying opportunity. The decline was a clear overreaction, and the company’s sizable ex-dividend almost certainly exacerbated the situation.

I expect that the most probable way for this recent uptrend to stop is a poorly received earnings report, or a bad clinical trial result. The upcoming earnings report on April 29 is therefore a major risk factor, but it is also a potential catalyst to the resumption of a meaningful uptrend. Just getting through it should remove a headwind, and there could also be a positive addition at that time, such as a share repurchase plan.

I reduced my total value at risk, but added leverage to the position by selling some shares and buying options here in between AbbVie’s ex-dividend date, last week, and earnings report date, on Friday, April 29. If AbbVie resumes its uptrend in advance of reporting, I will continue this strategy and roll forward the strikes.

Be the first to comment