Cindy Shebley/iStock Editorial via Getty Images

As one of the leading companies in the EV charging space, Blink Charging (NASDAQ:BLNK) is set to capitalize on the continued adoption of EVs, which is expected to grow at a 21.7% CAGR from the year 2022 to 2030. An updated policy from the US government which supports 500,000 electric vehicle chargers along America’s highways will help BLNK’s top line grow exponentially.

Revisiting this stock after I first covered it, which formerly traded at $42.17 and was close to my first fair price of $49.4, BLNK failed to materialize my expected short squeeze and fell more than 60% in response to its strong resistance at $50. As of today, it trades at a logical support and unlocks pullback opportunity. I believe BLNK’s positive demand outlook and improved margin provides a better reward opportunity as of this writing.

Enjoys A Positive Demand Outlook

BLNK ended its Q1 2022 with a strong 339.07% YoY growth in its top line and currently has tailwinds from the Biden administration’s building a national network of 500,000 EV charging stations by 2030. As of today’s rising inflation, the price of fuel has been going up steadily around the world, making electric vehicles more attractive as an alternative to gas-powered cars.

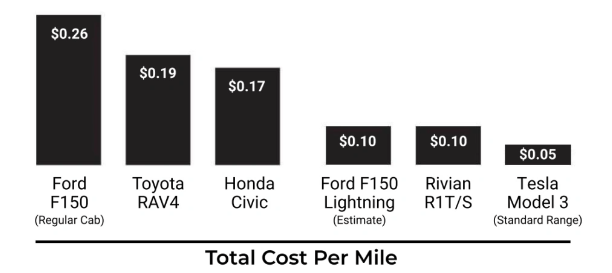

EV Is Cheaper To Operate (Source: Image from electrek.co)

In addition to being environmentally friendly, electric vehicles are also cheaper to operate than traditional gas-powered cars. To put it into context, the total cost per mile for an electric car in California is about half that of the gas-powered car, as shown in the image above. Another factor to monitor is that battery prices have been dropping as battery technology is improving. In my opinion, although there is a rising risk from inflation, we might still see a continued shift towards electric vehicles.

Another value adding catalyst for the company is its outstanding growth in operating EV chargers with its recent agreement to purchase SemaConnect, adding nearly 13,000 EV chargers and an additional 3,800 site host locations for BLNK. This figure is also better compared to its bigger peer, EVgo Inc. (NASDAQ:EVGO), in terms of market capitalization, which only has an operating charging stall number of 3,300 (including under construction), up from 1,500 recorded in Q1 2021.

Additional EV models are also scheduled for delivery within the next three years, making BLNK’s charging infrastructure more important and making the company attractive at its further drop.

Getting Better

BLNK’s recent announcement of acquiring SemaConnect will not only give the company an advantage over EVGO, but will also challenge its bear thesis of the inability to compete with its limited footprint capabilities and limited growth with its immaterial research and development investments for the past calendar years.

On top of this sentiment, according to management, they will now have an in-house research and development department, enhancing BLNK’s competitive edge. Additionally, according to management, this acquisition brings leadership to the company and promotes operating efficiency, as quoted below.

With this acquisition, Blink Charging will be the only EV charging company to offer complete vertical integration from research & development and manufacturing to EV charger ownership and operations. This vertical integration creates unparalleled opportunities for Blink to control its supply chain and accelerate its go-to-market speed while reducing operating costs. Source: GlobeNewsWire

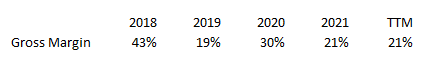

Improving Gross Margin

BLNK: Gross Margin 5 year Trend (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

Although BLNK’s gross margin remains under pressure compared to its 5 year trend as shown in the image above, it produced a better figure of 21% compared to EVGO’s trailing GAAP gross margin of 2.1% (including depreciation, amortization and share based compensation).

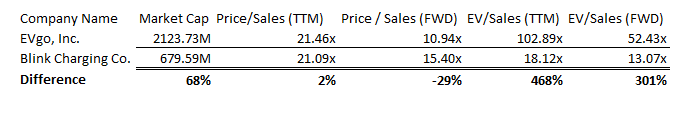

Cheaper Than EVGO

Cheaper BLNK (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

Prior to its recent M&A announcement, BLNK posted an already enticing multiple, as shown in the image above. Looking at its trailing P/S, it seems on par compared to EVGO, but shows some concerning figures in its forward P/S. However, I believe that with its better operating footprint and strong R&D catalyst in place, we can see an upward revision from analysts in the future. Moving forward to its EV/Sales multiple, BLNK shows a more impressive figure, especially comparing its forward EV/Sales to its 66.96x 5 year average. In my opinion, BLNK is more attractive than EVGO as of this writing. To sum it up, I believe a 30.63x average price target of Wall Street’s analysts for BLNK seems reasonable and achievable in today’s operating environment.

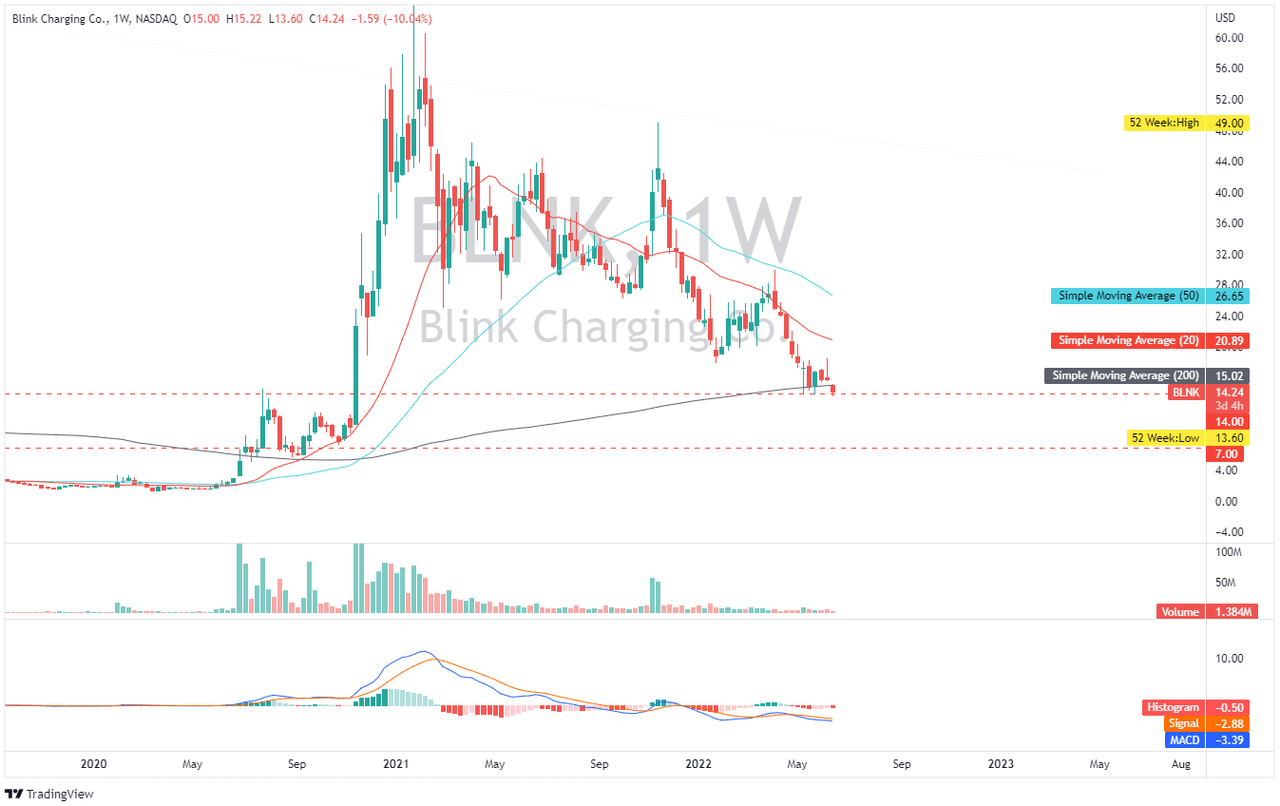

Trading At A Strong Support Zone

BLNK: Weekly Chart (Source: TradingView.com)

Looking at its weekly chart as it broke down its 200 day moving average, BLNK entered a strong support zone. Investors and traders should be aware of BLNK’s strong bearish sentiment where its current price trades below all of the 3 SMA’s, as shown in the chart above. However, looking at its MACD indicator, a potential bullish crossover from its MACD and signal line could provide some bullish moves in the next trading weeks.

Final Notes

I believe BLNK is liquid enough to fund its recent announcement of acquiring SemaConnect for $200 million, which is still subject for adjustments through cash and common stock transactions. Looking at its cash balances, BLNK has $162 million in cash and cash equivalent and an improving current ratio of 9.65x, up from its 4.48x 5 year average, as well as an improving debt to equity of 0.01x, better compared to its 3 year average 0.04x.

In the ongoing value reset, BLNK has fallen far enough toward a strong support zone, which creates a safer buying opportunity, making it a buy on the current weakness.

Thank you for reading and like always, good luck!

Be the first to comment