Igor Kutyaev/iStock via Getty Images

By Melody Duan

Multi-asset strategies have been getting more attention in the last few years from market participants seeking pre-packaged solutions to diversification. As more strategies evolve to be increasingly complex, including black-box allocation algorithms, multiple signals, and 10 or more components, we felt it was time to highlight a simpler, transparent index-based approach.

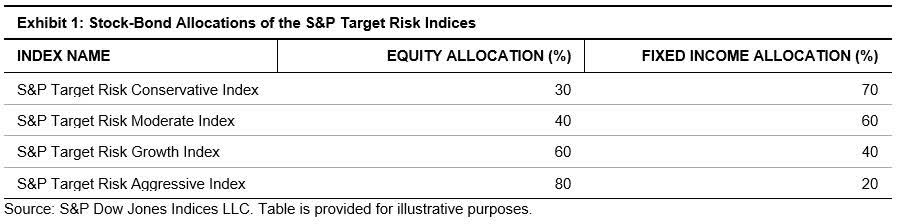

The S&P Target Risk Indices follow a target allocation strategy with preset allocations to equities and fixed income. The suite consists of four multi-asset indices, each corresponding to a particular risk level, designed to represent a risk spectrum from conservative to aggressive. Each index has varying levels of allocation to equities and fixed income aligned with their respective risk bucket – the more conservative indices have higher exposure to fixed income, while the more aggressive indices have higher exposure to equities (see Exhibit 1).

S&P Dow Jones LLC

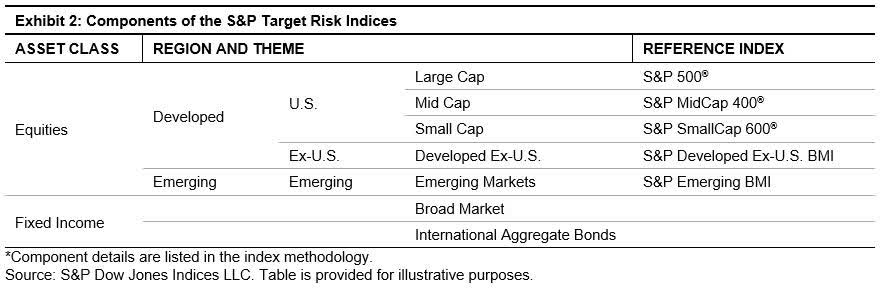

Designed to offer diversification by asset class and by region, the indices comprise seven liquid components across the U.S., developed and emerging markets representing equities and fixed income (see Exhibit 2).

While the stock-bond allocations are set, the methodology follows a set of rules to determine weights among the components within each asset class. Within fixed income, weights are distributed with 85% to the USD broad market and 15% to international aggregate.

Within equities, weights are based on the relative proportions of the float-adjusted market capitalization (FMC) of the reference indices for each component. For example, weights are first distributed between developed and emerging markets using the FMC of the S&P Developed BMI and the S&P Emerging BMI. We further distribute the developed market weight between the U.S. and ex-U.S. following the same procedure, and so on.

S&P Dow Jones LLC

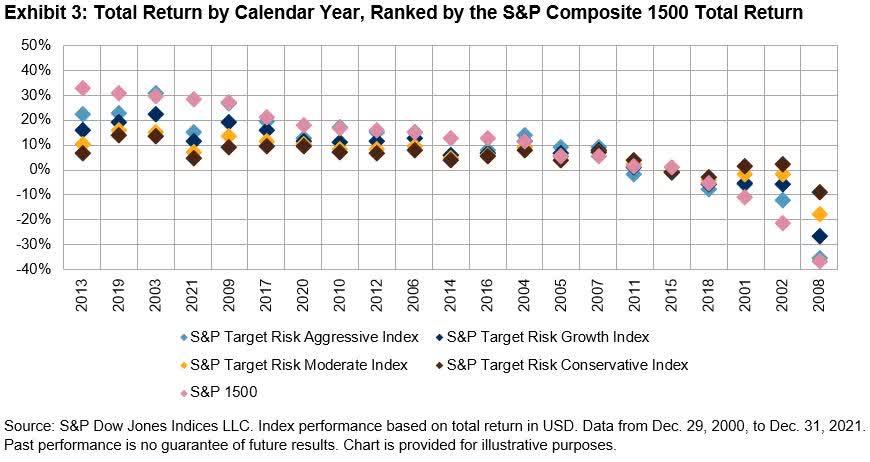

The addition of fixed income into an index can limit the downside and may provide stability during bear markets. During the bear markets in 2002 and 2008, we see this come into play as the more conservative indices (conservative and moderate) produced better returns than the more aggressive ones (growth and aggressive), while the S&P Composite 1500® was the worst performer (see Exhibit 3). Stability in returns balances the relatively lower total returns during periods of strong equity performance.

S&P Dow Jones LLC

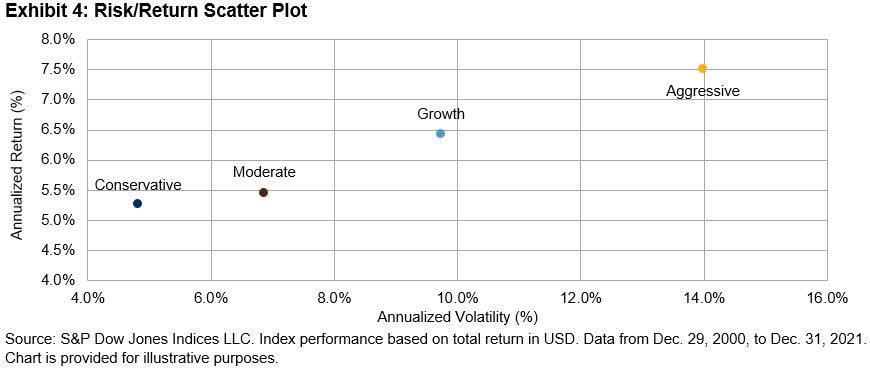

The risk-reduction benefits of larger allocations to less volatile fixed income assets are more prominent when measured over the long term (see Exhibit 4). The risk-adjusted returns of the portfolios, defined as annualized return over annualized volatility, was highest in the conservative index (1.09) and decreased as the portfolios became more aggressive. While the aggressive index was not as risk efficient (0.54), it had the highest annualized return in absolute terms; market participants with higher risk tolerances typically have longer investment horizons and tend to place a higher focus on long-term capital growth.

S&P Dow Jones LLC

In this post, we highlighted the key features of the S&P Target Risk Indices, including the convenience of a simple and transparent pre-packaged multi-asset solution, the flexibility in choosing different risk profiles, and the potential risk reduction provided by the addition of fixed income.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment