fotojog/iStock via Getty Images

Introduction.

The most important of the problems with the behavior of meme stocks is that meme stocks are valued far above their replacement cost, priming investors for a fall. Yet the SEC’s laundry list of possible shortcomings of the National Market System (NMS) released following the meme stock crisis of January 2021 makes no mention of a solution to this problem.

This is no criticism of the SEC. This is a criticism of Wall Street’s private sector. The agency is tasked with solutions to market inefficiencies. The disparity between the market value and replacement cost of an asset is manifestly the function Wall Street’s private sector serves in the competitive hurly-burly of the financial marketplace.

The valuation of stocks is the quintessential function of financial markets. But there is little doubt that meme stock prices get wildly out of line. However, this pricing problem cannot be solved through regulation. Below is a market-based solution.

The SEC’s approach to meme stocks.

The SEC has begun to address the regulatory issues the meme stock fiasco bared. The SEC study “Staff Report on Equity and Options Market Structure Conditions in Early 2021” lists the SEC’s concerns.

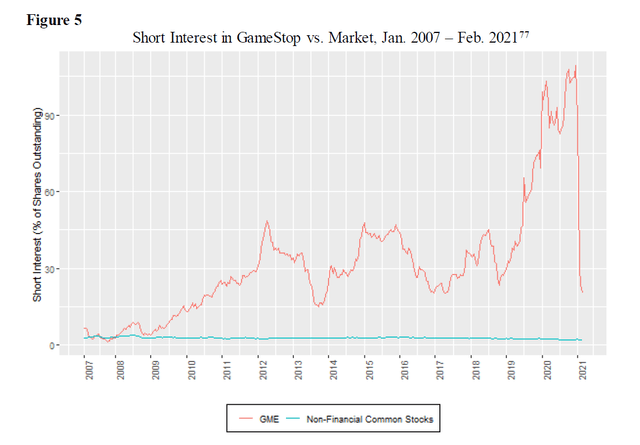

- Short interest – GameStop (GME) short interest (as a percent of float) in January 2021 reached 122.97%, far exceeding other meme stocks like Dillard’s, Inc. As the SEC study indicates,

“High levels of short interest can trigger a short squeeze. A short squeeze might occur when an event triggers short-sellers en masse to purchase shares to cover their short positions. For example, if there is a sudden increase in the price of the stock being shorted, short sellers could face margin calls requiring them either to post additional collateral or to exit their position. Short sellers that cover their positions by buying the underlying stock would cause additional upward price pressure on the stock, which could force other short sellers to exit their positions, adding further upward price pressure.”

The graph below shows how GameStop’s short interest behaved.

SEC

- Clearing Agency Margin and Capital Issues. On January 27, 2021, in response to market activity during the trading session, National Securities Clearing Corporation (NSCC) made intraday margin calls from 36 clearing members totaling $6.9 billion. Some broker-dealers restricted activities in a limited number of individual stocks in reaction to margin calls and capital charges imposed by NSCC. This, the staff paper notes, is a decision made by the broker-dealers and not directed by NSCC.

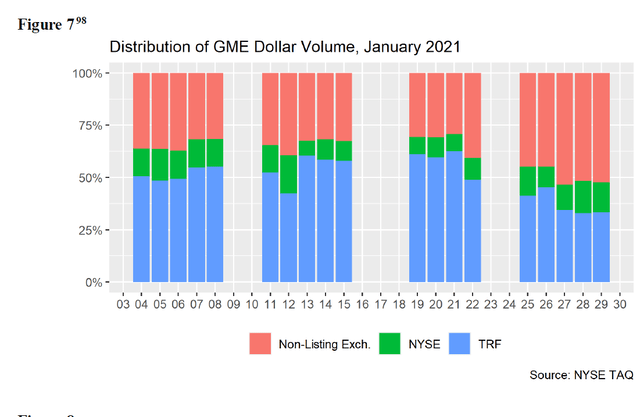

- Role of Off-Exchange Market Makers. During the January explosion in trading activity, the ratio of on-exchange to off-exchange trading volume fell dramatically (see graph below).

SEC

SEC staff-suggested remedies for identified failures:

- Broker trade restrictions. Add to the amount of capital held by clearers and shorten the settlement cycle.

- Payment for order flow. PFOF may create a conflict of interest between retail brokers and retail investors. The SEC study questions the propriety of payments for order flow.

- Trading in dark pools and through wholesalers. These transactions are opaque. The quality of prices may be an issue.

- Short selling. Improved reporting of short sales would allow regulators to better track short-seller dynamics.

A private-sector approach to meme stock valuation. Virtual meme stocks.

The SEC-proposed remedies are a half step in the right direction. A full step is a private-sector solution that features a portfolio manager managing an exchange-issued virtual version of the meme stock.

Broker-dealers and investment managers like BlackRock (BLK) and Vanguard might offer an ETF-like instrument that emulates the meme stock when this is in the investors’ interest but is actively managed by the investment manager when the meme stock begins to falter.

The virtual meme stocks thus created would be different in value from the meme stock itself since the investment manager would have discretion in protecting investors from shortcomings in the decision-making process of meme stock management.

Since, as with other ETF managers, ownership of the meme stocks backing the virtual meme stock portfolio resides with the virtual meme portfolio manager, the manager could influence corporate decision-making on one hand, and in the shorter term diversify out of the meme stock.

Positive aspects of this method include:

- Instantaneous clearing – a clearing solution that moves cash from buyer to seller with the same electronics as the transaction.

- A futures-style clearinghouse – the exchange-managed clearinghouse becomes the counterparty of buyer and seller – this reduces credit risk and performance risk to a bare minimum. It also eliminates payment for order flow from wholesalers to retail brokers.

- An exchange-originated ETF-like security – the exchange-traded instrument would be issued by a captive fund manager that takes ownership of the meme stocks it holds in support of the value of the exchange-listed security. The security’s specifications would differ from those of an ETF because its closing value would not be the same as that of the security it mirrors.

- Transparency of transactions. All transaction prices and volume would be public domain information provided by the exchange.

- Short selling is automatically limited to the amount of the virtual security issued by the exchange.

- Broker-dealers have no ability to halt trading in the virtual meme stock.

See my earlier article for a fuller description of virtual securities trading.

Conclusion

The meme stock crisis drew national attention to the shortcomings of our National Market System. The SEC is seeking to improve financial market efficiency. This article considers a proactive private-sector solution to the problems bared by the meme stock crisis.

This solution addresses each of the issues raised by the SEC staff study. More importantly, it provides investors with a safer, professionally managed, virtual version of the meme stocks themselves. It allows investors access to the professional management of the circumstances that created the meme stock in the first place.

Be the first to comment