FotografiaBasica/iStock via Getty Images

By Silvia Kitchener

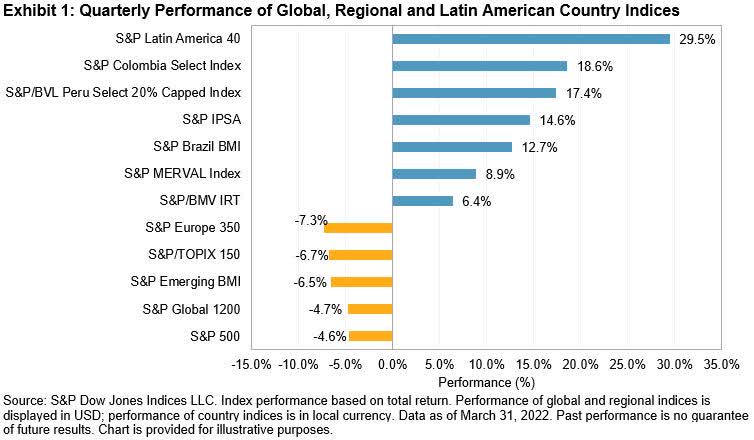

The Latin American pendulum has swung back from negative to positive returns in the past three months. The S&P Latin America 40 ended the quarter up 29.5%, its best Q1 performance since 1991. This is in stark contrast to other global equity markets, which ended in the red, with the S&P 500® losing 4.6%, the S&P Europe 350® down 7.3%, and the S&P Emerging BMI down 6.5%.

Two years into the COVID-19 pandemic, most of the world seems to be turning the corner, despite different variants continuing to appear. However, the uncertainty of the ups and downs of the virus is still leaving many countries in a scrambled state. Added to this, the Russia-Ukraine conflict has caused major geopolitical and macroeconomic shocks – most notably by triggering a sharp rise in commodity prices, which has broadly supported the Latin American region’s markets and economic activity. However, these benefits may ultimately be offset by some economic and political risks, such as rising inflation, ongoing supply chain disruptions, and newly elected governments coming into play.

Despite the existing political, economic and social environment, the markets greatly rebounded in Q1. So much so that on March 31, 2022, the flagship indices for Mexico and Peru both reached their all-time highs. The S&P/BMV IRT, which was launched on Oct. 30, 1978, with a base value of 0.7816, ended March 2022 at a record high of 83,810.9. The S&P/BVL Peru General Index, which was launched on Jan. 31, 1992, at a base level of 108.55, closed March at an all-time high level of 24,915.50. All the other Latin American markets’ main indices also ended with positive returns. Exhibit 1 shows the strong returns among Latin American country headline indices contrasted with the negative returns across other major global regions.

S&P Dow Jones Indices LLC

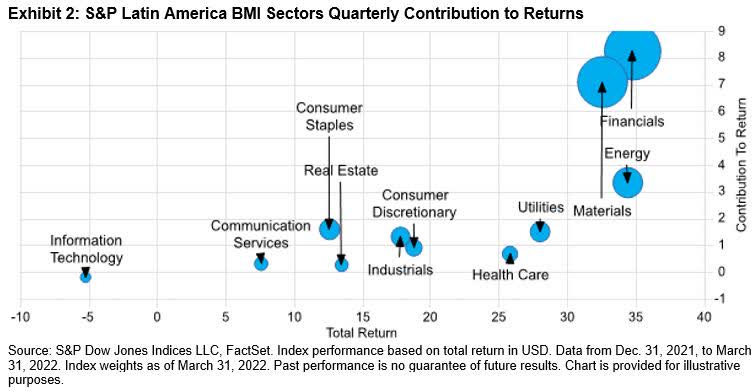

Which sectors were the biggest contributors to the regional performance? Based on the S&P Latin America BMI sectors, only Information Technology did poorly, losing 5.2% in Q1; all others had strong positive returns. Exhibit 2 shows the contribution of each sector to the total return of the S&P Latin America BMI. Financials (35.0%) and Materials (32.5%) were the largest sectors by weight, and in Q1, they made the largest contribution to the total return of the broad regional index.

S&P Dow Jones Indices LLC

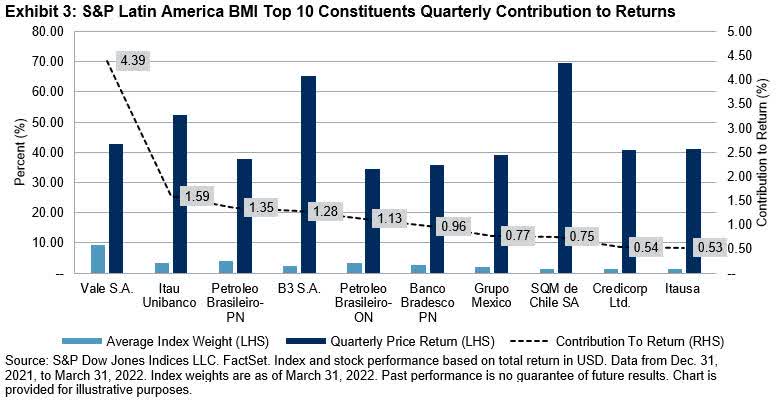

If we dig a little deeper, we can see that Latin American equity market gains were widespread. As shown in Exhibit 3, the S&P Latin America BMI gained 25.3% in Q1, with the index’s top 10 constituents representing approximately 13.3% of the total return. Brazil’s Vale S.A. (up 42.6% in Q1) was the largest contributor to returns, followed by Chile’s SQM (up 69.7% in Q1). Brazilian financial companies like B3 S.A. (OTCPK:BOLSY) (OTCPK:BOLSF) (up 65.2% in Q1), Itau Unibanco (ITUB) (up 52.3% in Q1), and Itausa (OTCPK:ITVMF) (up 41.0% in Q1) also had a big hand in the pendulum’s swing.

S&P Dow Jones Indices LLC

Despite geopolitical turmoil and market volatility throughout the world, Latin American equities had a great start to the year. The prospects of the region will be dependent on the development of the Russia-Ukraine conflict and on the economic and social policies, each government implements throughout the year.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment