maxsattana

Investment Thesis

It is evident that Teladoc (NYSE:TDOC) investors were burned again after its recent FQ2’22 earnings call, with a $3.03B impairment expense and potentially more on the horizon, given Livongo’s eye-watering price tag of $18.5B then. In addition, the management issued softer FY2022 guidance, further derailing its stock performance then. As a result, the stock plunged even more, losing 14.6% of its value to $36.92, as of the time of writing. Otherwise, a gargantuan decline of 87.2% from its previous all-time highs of $290.16 in February 2021.

Tragic really, since we believe in telemedicine and still use the convenient service from time to time.

Why Should CVS Buy Teladoc?

CVS Health Corporation (CVS) is a healthcare provider that operates approximately 9.76K retail stores. Additionally, CVS recently launched Aetna Virtual Primary Care with TDOC, which will complement CVS’ MinuteClinic at 1.1K locations with select HealthHUB services. CVS added:

Aetna Virtual Primary Care gives our members the power of choice and convenience, making it easier for people to get and stay healthy, even when balancing the demands of work and life. This, coupled with access to in-person visits with providers in our network, including MinuteClinic and HealthHUB locations, provides the flexibility needed for better health outcomes. – CVS

For FQ2’22, CVS reported more than 24.4M medical memberships, with 17M attributed to commercial consumers and 7.4M to government bodies. In addition, the company also serves over 45M unique digital customers in FQ2’22, representing an excellent increase of 1.5M QoQ. The hybrid models of health care obviously took off during the pandemic, with CVS encouraging delivery options, curbside pickup for online purchases, and virtual medical appointments. CVS added:

We see this as consistent with our expected LT (long-term) strategy for CVS, moving to grow managed care and care delivery while shrinking legacy bricks-and-mortar retail business.” – Reuters

In addition to the highly advantageous relationship, CVS could combine and activate the synergies between both health care providers. It would help to improve their operating efficiencies while also expanding profit margins moving forward. TDOC will also be able to tap into CVS’ MinuteClinic, HealthHUB, and retail pharmacy capabilities. Patients that choose its telemedicine service would have the choice of either a self-collection prescription at any CVS outlets or a same-day delivery option. Beyond the retail segment, CVS would also be able to tap into TDOC’s existing corporate and insurance clients, since the former is already well integrated with Aetna, a health care insurance company.

Financing-wise, CVS also had more than sufficient cash and equivalents of $12.11B on its balance sheet in FQ2’22, while generating $15.95B in Free Cash Flow (FCF) in the last twelve months (LTM). Therefore, more than sufficient capital, given TDOC’s existing market cap of $5.97B and long-term debts of $1.54B at the moment.

In a note written by Gordon Haskett’s Don Bilson, there is a strong possibility of a takeover by CVS or Walgreens (WBA), leading to TDOC gaining 1.4% on 29 July 2022. This speculation was similar to that experienced by One Medical (ONEM) on 6 July 2022, before Amazon (AMZN) announced the buyout deal on 21 July 2022. Nonetheless, CVS investors probably would not welcome the deal, since Amazon only paid $3.9B for One Medical with a market cap of $1.98B prior to the announcement. This number has obviously burgeoned to $3.31B as of the time of writing. (Reminder, TDOC paid a monumental sum of $18.5B for Livongo. )

To qualify for a similar bailout deal, TDOC may have to fall even more, possibly to $12.23 per share with a total market cap of $3.3B, tragically killing all shareholders’ value by then. We shall see, though I suspect TDOC may possibly fall to $20s or even $10s by the end of FY2022. This is assuming another $6.9B in Livongo impairment, bringing the latter to a speculatively fairer value of $2B in market cap then. A catastrophe indeed.

TDOC’s Growth Is Slowing Down, With Minimal Improvement In Profitability

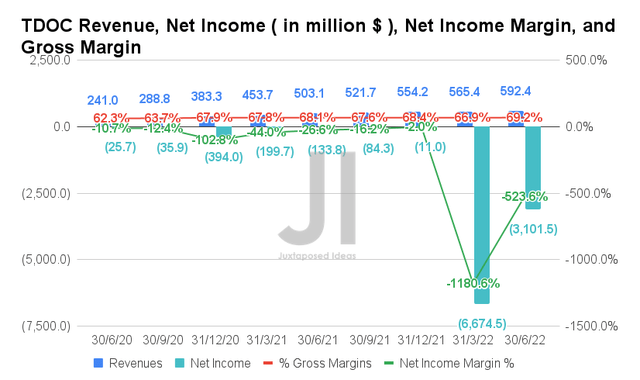

In FQ2’22, TDOC reported revenues of $592.4M and gross margins of 69.2%, representing YoY growth of 17.7% and 1.1 percentage points, respectively. In the meantime, the company reported adj. net losses of -$71M and adj. net income margin of -11.9%, representing an improvement of 46.9% and 14.7 percentage points YoY, respectively. Therefore, if we were to ignore the noise from the impairment charges of $6.6B in FQ1’22 and $3.03B in FQ2’22, we can definitely see the slight progress in its profitability thus far.

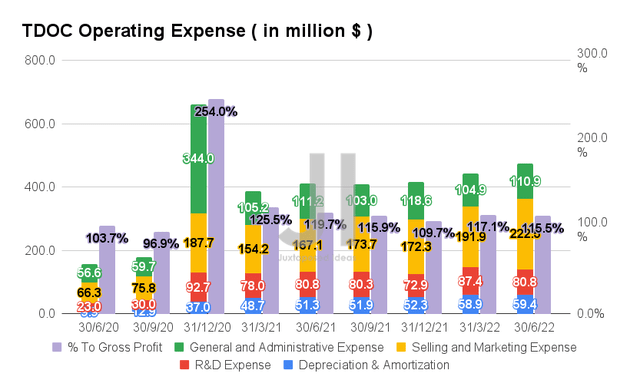

Much of TDOC’s lack of profitability is attributed to its elevated operating expenses at $473.6M in FQ2’22, representing an increase of 6.8% QoQ and 15.3% YoY. Though the ratio to its growing gross profit has moderated to 115.5% in FQ2’22, it is apparent that the company is still spending more than it earns.

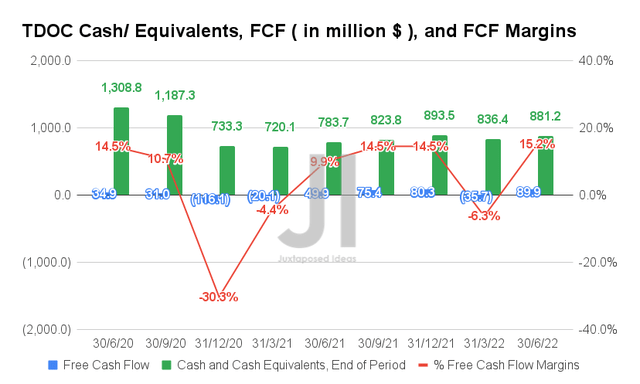

Therefore, it is not surprising that TDOC still struggles to report sustained FCF profitability thus far, with an FCF of $89.9M and an FCF margin of 15.2% in FQ2’22. It may appear that the company has plenty of cash and equivalents on its balance sheet at $881.2M, but the company obviously still relies on debt to a large extent.

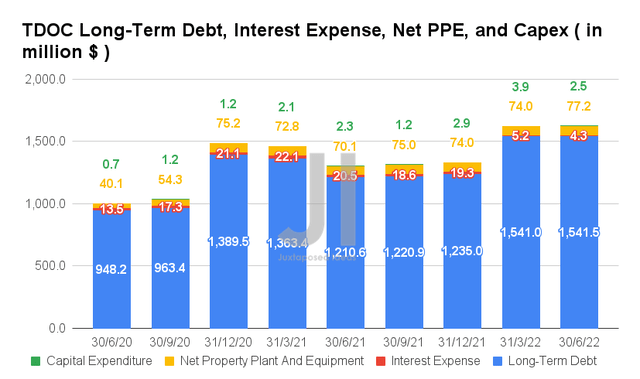

By FQ2’22, TDOC reported long-term debts of $1.54B, representing a notable increase of 27.2% YoY, though we are somewhat encouraged by the reduction in its interest expenses to $4.3M at the same time. Though the company has been operating with an asset-light strategy at net PPE assets of $77.2M and capital expenditure of $2.5M in FQ2’22, its total assets have been decimated by 54.3%, from $17.7B in FQ4’21 to $8.1B in FQ2’22. This is obviously attributed to TDOC’s massive write-down for Livongo then.

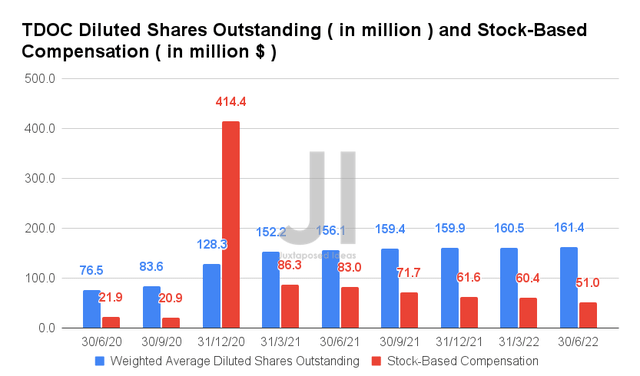

Therefore, given its minimal profitability, TDOC has and will continue to rely on stock-based compensation (SBC) moving forward, with $240.4M in FQ4’20 attributed to Livongo. By FQ2’22, the company reported SBC expenses of $51M, which continues to erode the stock’s value for long-term investors.

YTD, TDOC recorded diluted shares outstanding of 161.4M, representing a massive dilution of 447% since its IPO, with a total share count of 36.1M in 2015. In addition, the company reported a total of $311.4M in non-vested SBC expenses to be recognized approximately over the next 1.9 years in its FY2021 10-K. This would translate to an additional dilution of up to 8.32M shares by 5.1%, based on current stock prices and share count, respectively. Investors, take note.

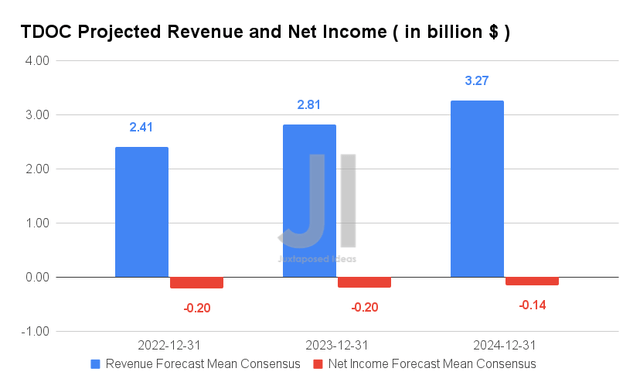

Over the next three years, TDOC is expected to report revenue growth at a CAGR of 17.22% while remaining unprofitable by FY2024. For FY2022, consensus estimates that the company will report revenues of $2.41B and adj. net incomes of -$0.2B, representing YoY growth of 18.7% and 200%, respectively. These numbers represent a notable decline of 6.4% though an improvement of 14% from previous estimates in February 2022, respectively.

In the meantime, we encourage you to read our previous article on TDOC, which would help you better understand its position and market opportunities.

- Teladoc: Let’s Apply Aloe Vera On The Burns

So, Is TDOC Stock A Buy, Sell, or Hold?

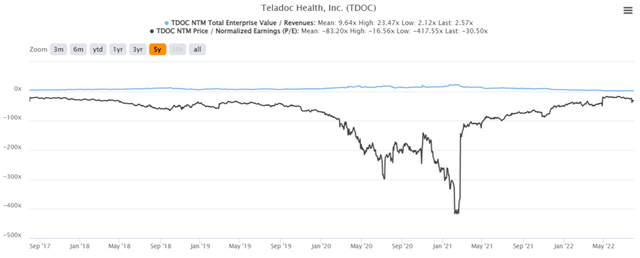

TDOC 5Y EV/Revenue and P/E Valuations

TDOC is currently trading at an EV/NTM Revenue of 2.57x and NTM P/E of -30.50x, lower than its 5Y mean of 9.64x and -83.2x, respectively. The stock is also trading at $36.92, down 76.4% from its 52-week high of $156.82, nearing its 52-week low of $27.38. It is evident that TDOC’s management and option holders are not optimistic about its stock recovery as well, given the massive insider sales worth $335.9M in the past two years. In contrast, there have been zero insider purchases.

TDOC 5Y Stock Price

Given the recent events, it is also no wonder that consensus estimates have put a hold rating on TDOC with a price target of $39.25 with only a 6.31% upside. We are highly conflicted about this stock, since we love the convenience of telemedicine services and often use the service for our family. On the other hand, it is also evident that the company has made a very costly mistake with the Livongo acquisition, triggering considerable pessimism from the stock market and a massive loss of value for its existing shareholders.

Anyone who had bought in at the ultra-low prices of $10s could potentially see some returns ahead, assuming a takeover deal from CVS or any other healthcare operators. In contrast, those who had bought in at highs have my absolute condolences, since it is unlikely that we can see such levels anymore. The bulls could possibly see a slow and steady growth ahead, if Cathie Wood was right about its potential. We shall see.

In the meantime, we rate TDOC stock as a Hold.

Be the first to comment