Sliveoak/iStock via Getty Images

A global pandemic, war, record inflation and higher interest rates makes for an interesting backdrop for a bullish article, but here it goes.

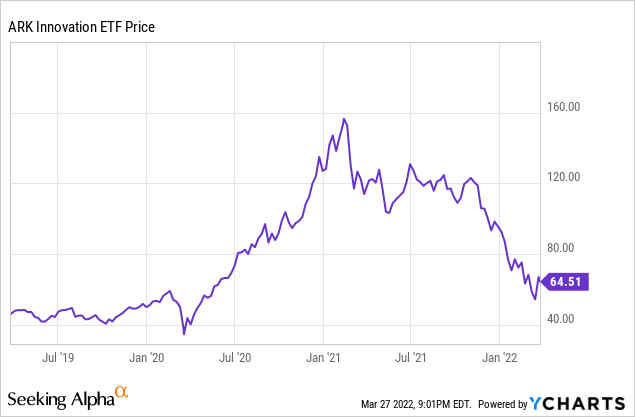

It is certainly no secret that high multiple, small to mid-cap growth stocks have been thoroughly obliterated lately. Considering all of the macro and political upheavals in the world today, a selloff in momentum and growth names make perfect sense.

The severity of this sell-off has been sharp and broad based among growth, however, pockets of the market, specifically so called momentum and COVID names, have fared much worse. This is not to say that the majority of the sell-off was undeserved. It certainly was.

It is quite healthy and rational for the market to reset valuations to more realistic and sustainable levels after a period of very extreme optimism such as in late 2020 & into 2021.

However, whenever the market resets valuations to such an extreme, it is very prudent to sift through those name which have been slaughtered to hunt for a few diamonds in the rough.

So let’s dumpster dive! Below, I have compiled a list of interesting candidates for further research that have been basically left for dead by Wall Street.

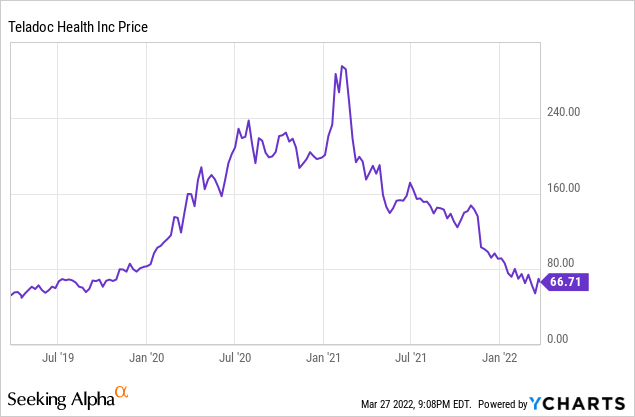

Teledoc Health (TDOC)

Let’s begin with the poster boy of the COVID pandemic, Teledoc. This company’s chart is akin to a person winning the lottery, then going bankrupt the following year. Frankly, it makes no sense given the underlying business.

Teledoc’s business of virtual healthcare was admittedly a massive winner of the pandemic, however, this business does not simply go away afterwards. The company has made massive strides in locking in patients and solidifying its value proposition with insurance carriers. In short, the last two years do in fact matter to the long-term thesis.

In addition, the Livongo acquisition’s benefits are truly only just beginning in chronic care management which is ideally suited for telehealth participation. Margins have certainly been an issue, however the company has made significant strides of late towards the goal of profitability and with contracts locked in at insurance carriers, a more predictable and therefore, profitable revenue stream is beginning to materialize.

Telehealth, like it or not, is here to stay long term and scale does matter in a market such as this. Teledoc appears to be a rather extreme victim of the COVID stock sell-off and currently sells for a 5.4 S/EV ratio, the cheapest it has been, even before the pandemic. I have this one on my list to pick up in the near future.

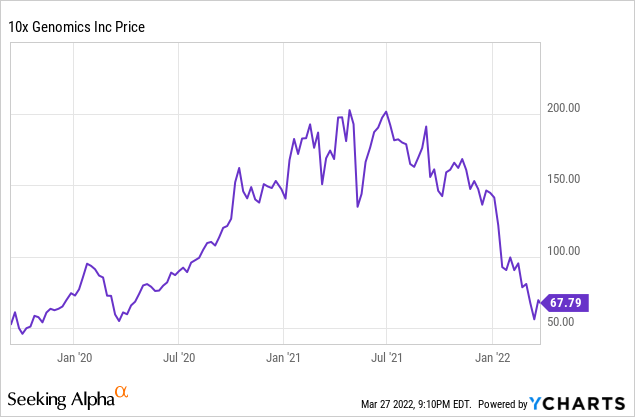

10X Genomics (TXG)

Shifting from a COVID stock to a momentum name, 10X Genomics took the escalator all the way up to roof level, only to slide down the railing back to 2019 IPO levels in the matter of only a few months.

Some of this sell-off is certainly justified, the stock shot up from $60 to over $200 in a period of less than two years, however, looking under the hood, the company looks very well positioned in the single cell biology market which is set to explode higher in the coming years.

Verified Market Research

The company’s offering includes instruments, consumables and software. The company’s products are considered vital and groundbreaking for leading academic institutions and drug designers researching cancer, autoimmune disease and neurodegenerative disorders.

Contrary to Teledoc, 10X was hampered by the COVID pandemic given its reliance on academic researchers and as such, the company recently announced a guidance cut for 2022 mainly driven by COVID disruptions in consumable products leading to the latest leg of the current downtrend.

This is a type of company that I want firmly on my radar as the platform appears to be cutting edge, the gross margin profile is high at over 80% and it is looking at what is likely to be a temporary disruption to the overall growth cycle.

I am continuing to research the company further, however it would not surprise me to announce the addition of 10X to my growth portfolio in the near future.

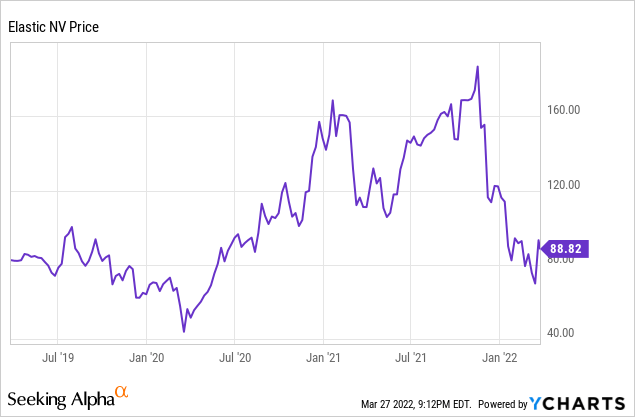

Elastic N.V. (ESTC)

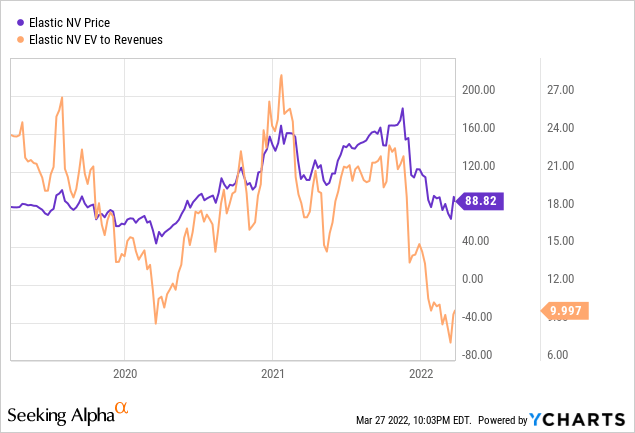

I recently wrote an article on Elastic, so it should come as no surprise that I believe shares are attractive. Anytime a stock craters over 50%, in a period of only a few months, usually I assume something terrible has happened.

In Elastic’s case, nothing has really changed whatsoever! The only headline worth mentioning is the transition of the founder and prior CEO, Shay Banon to the CTO position and the elevation of the former CPO Ashutosh “Ash” Kulkarni to CEO. In my opinion, this is a huge positive as Shay Banon clearly felt that he could offer more to the company in the trenches and Ash has been groomed for over a year for this role at Elastic.

The company recently announced Q3 earnings that were a clean beat and raise with 2022 revenues looking to grow at over 40%. In addition to operating at a high level, the company is frankly the cheapest it has ever been, recently dropping below valuation metrics last seen in the March 2020 crash.

The company currently holds nearly $300 million in net cash and is making rapid progress towards sustained profitability, the only true negative that I can find in my research.

Elastic holds a very attractive niche in the data observability and security markets given its open source roots and I see the company continuing to grow rapidly into the future. I view levels below $100 to be highly attractive long term.

Twilio Inc. (TWLO)

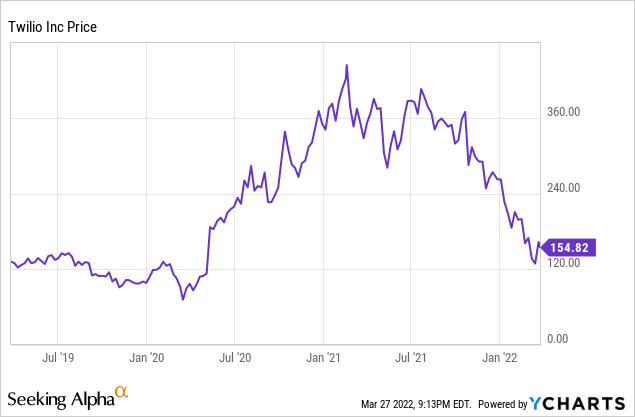

Heading back to what was a COVID darling stock, Twilio, in my opinion has an even stronger case than Teledoc as far as the current sell-off being unjustified. The stock is down from $409 to under $160 currently, over 63%!

For a nearly $80 billion market cap company to sell off 63% on no obvious negative news or development, the market is clearly stating that the business was dramatically overvalued. I happen to agree with that sentiment, at a $409 price tag, however, I believe that the pendulum has swung way too far in the other direction at today’s price.

Twilio is by far the leader in the fast growing CPaaS industry and has many many more years to come of rapid growth ahead. CEO Jeff Lawson recently stated that he expects the company to become profitable from 2023 onwards as the company has hit a scale inflection point where it can both invest for growth and continued leadership along with achieving cash flow and for the time being non-GAAP profitability.

I recently wrote an article explaining that I believe the company is worth at a minimum $203 currently and that I believe the current price point is very attractive for long term investors.

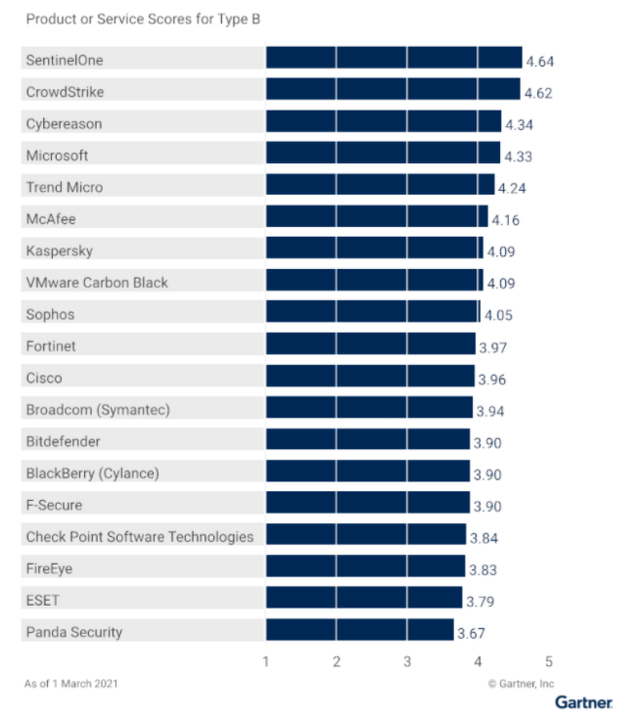

SentinelOne, Inc. (S)

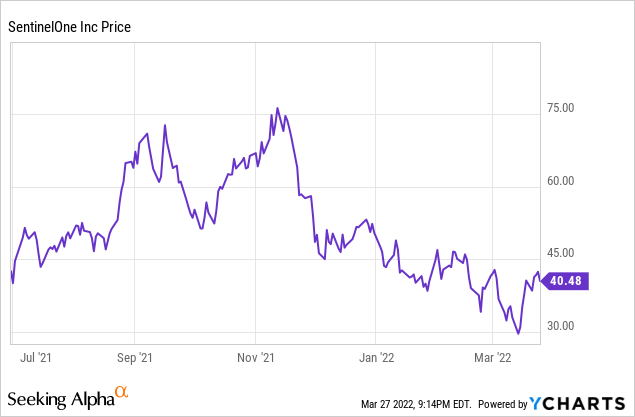

Cybersecurity is a sector that I did not expect to catch a beatdown in the current sell-off, however SentinelOne, given its rapid rise after its 2021 IPO would seem to qualify much more as a momentum name than other industry stalwarts.

Again, like others on this list, nothing truly negative has happened to justify the nearly 50% fall from the $76 high the stock reached late in 2021, in fact, the company just issued yet another beat and raise quarter on March 15th.

I, along with many others that are much more knowledgeable than myself view the company’s endpoint protection platform as potentially best in class.

As we all know, having a great product does not necessarily translate to a great stock, but in SentinelOne’s case, I believe that it just may. Functional and specifically automated cybersecurity is an absolutely critical requirement for all enterprises today and the company appears to be having no trouble at all selling its products to enterprises around the globe.

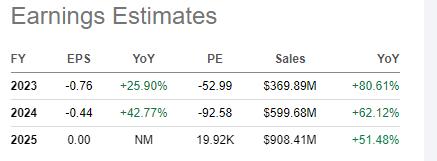

Revenue growth in 2022 exceeded 100% by a wide margin and 2023’s estimates show over 80% growth projected.

Seeking Alpha

The company is beginning to grow revenues into some rather serious numbers. The type of explosive growth required to go from under $100 million in revenue during fiscal 2021 to potentially approach $1 billion in 4 years is indeed a rare accomplishment if achieved.

I will never claim that a company such as SentinelOne is cheap, that would be disingenuous, it is not, but I do view the current valuation given of 24 times 2023 S/EV to be a fair price among its peers given the extremely rapid growth predicted at the company, the momentum in the cybersecurity sector as a whole, the execution that the company has already shown in increasing gross margins along with laying out a realistic path to profitability in the midterm.

The company is flush with cash, holding $1.7 billion on the balance sheet with no debt and looks to be completely funded to reach sustained profitability. I recently opened a small position in SentinelOne and will be adding to this position soon.

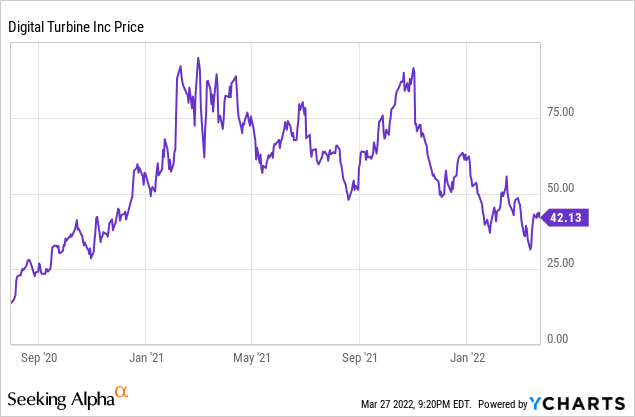

Digital Turbine, Inc. (APPS)

The ad-tech market over the last 5 months has, in my opinion, been rather unfairly punished over unfounded fears that privacy moves by leading tech giants will completely close the cookie jar for the industry. Digital Turbine has been no exception to this punishment, recently dropping over 50% from a recent high of $91.

Digital Turbine is near and dear to my heart, I rode this bad boy up from the low single digits all the way to near $65 just a year ago. During my absence as a shareholder, the company appears to have executed brilliantly and further strengthened its position.

In fact, the recently announced privacy moves from Alphabet (GOOGL) appear to play directly into the company’s strengths as they have an abundance of first party data, thanks to an 800 million-plus installed base to leverage and do not rely on others data that may be more affected.

The main knock on Digital Turbine has long been its rather anemic margins and frankly, this is not likely to change much in the near term and is a byproduct of the OEM partnership market in which they operate, but in my opinion, investors are missing the forest for the trees as the company is forecast to grow earnings at over a 40% CAGR clip through 2024 and revenues by nearly 33% per annum.

The company is profitable on a GAAP basis, a rarity for the high growth tech sector and currently selling for a PE of 25.73 and a S/EV multiple of 4.37 making it almost a value play in the current market.

This company is solidly on my list to pick up on continued weakness.

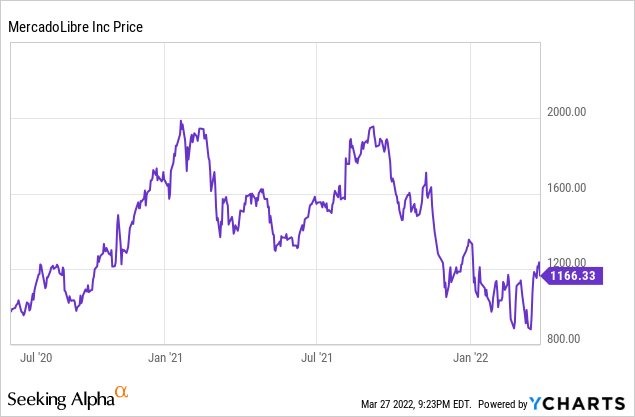

MercadoLibre, Inc. (MELI)

The roller coaster that is MercadoLibre appears to have hit yet another valley in what has been a rather crazy ride over the last two years.

Shares once again are nearly 40% off the recent $1,946 high achieved in September 2021. In a common theme for this list, the company has operated brilliantly during the pandemic, dramatically expanding the extensive logistics network it owns in Latin America and continuing to exploit the nascent fintech market present on the continent.

In my opinion, MercadoLibre is truly a best in class eCommerce operator in Latin America and has decades of rapid growth still firmly in front of it. In addition, the company has shown the ability to turn GAAP profitable basically at will during times of reduced investment giving executives the ability to fine tune an investment plan to further break away from the pack all while rewarding investors with profits.

Like with SentinelOne, I will not claim the company is cheap. It is not. But the current price looks more than fair to me given the dramatic growth ahead for the name, particularly for long term investors.

I expect shares to remain highly volatile as the Latin American market in which they operate is both very attractive and extremely unstable, leading to rapidly changing conditions that give the native MercadoLibre a decided advantage over foreign competition but tends to produce lumpy results and sentiment.

I recently added to my position near the $940 level, however, I feel the current price is still a very attractive entry point for long term investors.

Bottom Line

The current sell off appears to be a natural and healthy process for the market to reset valuations, however, surprise, surprise, the extreme pain dished out over the last few months may not have been distributed fairly. I believe the companies on the list above warrant a sincere look for long term growth oriented investors.

We may still have further to go in this sell off so I have been scaling slowly into positions I find attractive, usually over a period of months. I have a long time horizon and as such, volatility in the short term does not bother me too much and I try to use it to my advantage. It is a scary world we are living in today and extreme volatility appears to be more the norm then the trend so please make sure your risk tolerance is appropriate if you choose to follow in my footsteps.

let me know your thoughts in the comments below. Thank you for reading and good luck to all!

Be the first to comment