Denis_Vermenko

Measuring the size of one’s wealth by portfolio value is one way to do it, but I view measurement by cash flow as being equal and if not more important. For example, one may feel wealthy with a basket of non-dividend-paying stocks when times are good, but it can feel downright depressing during a bear market, even if one feels that their portfolio should be worth far more than what the market is pricing in.

That’s why I advocate for having good exposure to dividend-paying companies, especially those in sectors that are incentivized to make payouts to shareholders. For example, REITs don’t have to pay federal taxes at the corporate level, so long as they distribute at least 90% of their taxable income to shareholders.

This brings me to the well-known and respected REIT, W. P. Carey (NYSE:WPC), which is now trading well below its recent highs in the $85 to $90 range. This article highlights why now is a great time to be layering into this quality name, so let’s get started.

Why WPC?

W. P. Carey has a long history of delivering shareholder returns through dividends and capital appreciation. It was founded 49 years ago, and currently owns 1,390 net lease properties that are diversified across 386 different tenants. WPC is also one of the few net lease REITs to have exposure outside the U.S., where it has the scale and borrowing capacity (often at more attractive rates) to buy properties at attractive cap rates. At present, 65% of WPC’s annual base rent stems from the U.S. and much of the remainder (33%) from Europe.

Notably, WP Carey has acted in the interest of shareholders by rolling up numerous private investment vehicles into the overall enterprise. This increases transparency and removes potential for conflict of interest. This is reflected by WPC’s latest rollup of CPA:18 into the greater enterprise. The CPA:18 merger adds 65 high-quality self-storage operating assets. The fact that WPC will be operating these assets gives them more potential upside than merely collecting a rent check, and this merger increases WPC’s operating self-storage property count from 19 to 84.

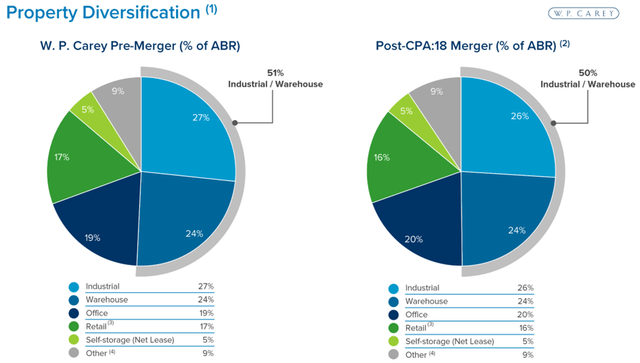

Moreover, since most net lease REITs are retail-focused, WPC could be a great diversifier for a net lease investor, as it’s more focused on industrial and warehouse, which is a fast-growing segment and comprise half of its portfolio ABR, as shown below.

WPC Portfolio Mix (Investor Presentation)

Meanwhile, WC maintains very strong occupancy of 99.1% and, like its net lease peers, has a long-weighted average remaining lease term of 10.8 years. It’s also growing both its top and bottom line, with revenue growing by 7.7% YoY and AFFO per share growing by 3.1% during the second quarter. Importantly, WPC maintains a strong BBB rated balance sheet and has a healthy net debt to EBITDA ratio of 5.6x, cash interest coverage ratio of 6.6x, and debt to gross assets of 39.8%. This lends support to the dividend, which is well-covered by an 80.5% payout ratio based on management’s full-year guidance for AFFO per share of $5.26 at the midpoint.

Factors that could drive WPC’s stock price down include inflationary concerns and a potential slowdown in the U.S. and Europe, which may affect tenant profitability. However, WPC is far more insulated as a landlord compared to its tenants, and its prudent tenant selection and underwriting have enabled it to weather many economic downturns over the past half-century. Moreover, WPC’s aforementioned strong balance sheet along with a very strong cash interest coverage ratio and rental increases should help it to offset potentially higher interest refinance rates.

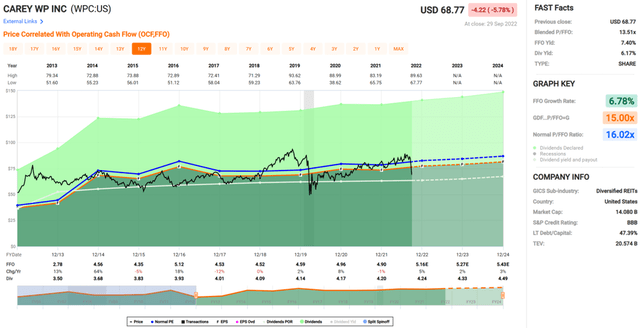

Lastly, I view the recent material drop in price as presenting a good buying opportunity. At the current price of $69, WPC trades at a forward P/FFO of 13.5, sitting well below its normal P/FFO of 16.0 over the past decade. Sell-side analysts have a consensus Buy rating on WPC with an average price target of $92.40, translating to a potential one-year 40% total return including dividends.

Investor Takeaway

W. P. Carey is a very high-quality net lease REIT with a long track record of delivering investor value over its half-century of operation. It has a strong balance sheet, is diversified by tenant and property type, and exhibits strong portfolio fundamentals. With the material drop in price, I believe now is a great time to be adding to or initiating a position in this well-regarded name.

Be the first to comment