JamesBrey

Note: All amounts discussed are in CAD.

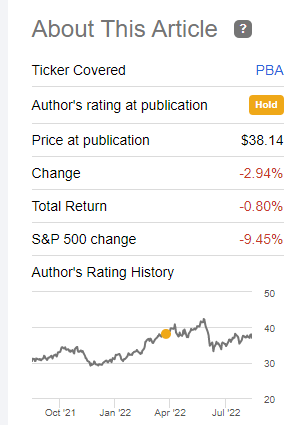

When we last covered Pembina Pipeline Corporation (NYSE:PBA), (TSX:PPL:CA) we gave it a “hold” rating as the impressive rally had left the shares at a less than stellar valuation. This was despite expectations of very little growth from the midstream company. Specifically, we said,

That still does not lead us to a sell rating. There is still room for some valuation expansion here as the world figures out the value of Canadian oil and gas and PBA starts getting due credit for managing a full self-funded growth plan. So while the shares are no longer compelling, we are only moving this to a hold/neutral rating. We still think, two years out, PBA outperforms the broader indices.

Source: Pembina’s Preferred Shares Offer A Good Risk-Reward

So far that theory has been working. PBA has stayed flat but beaten the broader markets.

Returns Since Last Article (Seeking Alpha )

In the same piece we highlighted the good value in the preferred shares. We look at the recent news from the company and explain why the preferred shares might be a compelling value.

Q2-2022

Pembina reported Q2-2022 adjusted funds from operations (AFFO) of a $1.23 that came in about 20% over consensus estimates. The key segment that outperformed was the marketing one with extremely strong margins helping EBITDA. Interestingly, the pipeline division disappointed on a relative basis with declines in Ruby Pipeline. Contract expirations at the Nipisi and Mitsue pipelines also slowed things down. Overall, this area was slightly higher ($523 million) versus 2021 ($5222 million), but underperformed the other two areas. The firm’s assets remained in strong demand as it added NEBC commitments from Tourmaline Oil Corp. (OTCPK:TRMLF) (TOU:CA), for transportation and fractionation services on a take or pay basis. The company raised its adjusted EBITDA guidance to $3.63 billion (midpoint). Investors worried about inflationary impacts were also assuaged by this boosted guidance alongside management commentary.

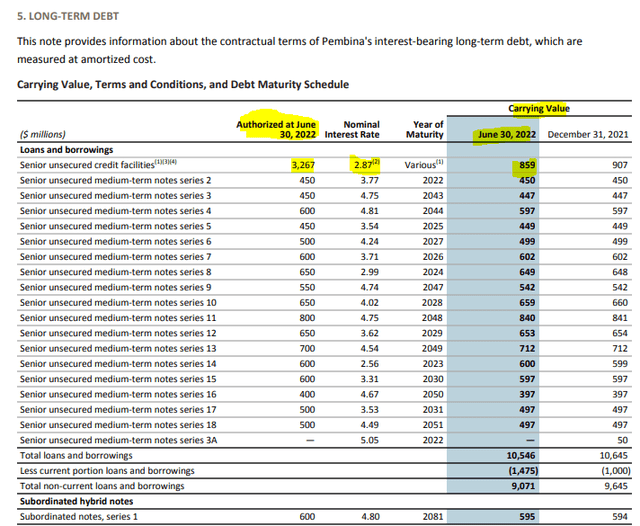

Despite broader inflationary pressures across the global economy, Pembina continues to benefit from a variety of protections inherent in the business. First, many long-term agreements include inflation adjustment mechanisms in the toll structure and for short-term interruptible arrangements, there is an ability to periodically adjust tolls to market conditions. Second, the largest components of Pembina’s operating costs are labour, power, and integrity and maintenance. The majority of Pembina’s long-term contracts have provisions which allow Pembina to recover power costs, and in some cases, non-routine maintenance or integrity items. Third, as it relates to capital projects, line pipe for the Peace Pipeline Phase VIII Expansion (“Phase VIII”) has been procured, and construction contracts have been structured to provide labor inflation protection. However, inflationary pressures may impact future growth projects, which may affect the viability and sanctioning of future projects. Finally, with respect to the balance sheet, as at June 30, approximately 95 percent of Pembina’s outstanding debt carried fixed rates, and the weighted average term of the fixed-rate debt was approximately 13 years.

Source: Seeking Alpha

The company trades at about 10X adjusted funds from operations. Looking at its breadth of competition, Enbridge Inc. (ENB), TC Energy (TRP) and Keyera Corp. (OTCPK:KEYUF), we can see that this is about the same multiple across the board. What PBA offers here in this strong and cheap group is the lowest relative debt. Here TRP is at the upper bound with near 6.0X debt to EBITDA, but Pembina is grazing at just 3.5X for 2022 end. This setup, along with a fully cash flow funded growth, is what makes it one of the more conservative choices for income. The company finally hiked the dividend and rewarded investors for their patience.

Pembina’s Board of Directors previously approved a $0.0075 per common share increase to its monthly common share dividend rate, to $0.2175 per common share per month (representing an increase of 3.6 percent), subject to closing of the joint venture transaction with KKR. The first dividend under which the increase will take effect is expected to be declared in early September 2022, and payable on or about October 14, 2022.

Source: Pembina

The Preferred Shares

From an income perspective, the preferred shares take the conservative nature of a Pembina investment to another level. There are a few different ways to look at this. The first is the coverage of the preferred dividends from AFFO. For 2022, AFFO should be close to $2.7 billion and preferred dividends about $135 million. So by that measure, preferred share dividends are covered 20 fold. A more conservative measure is to see preferred share dividends as part of the fixed costs the company has to cover and lump it with the interest expense. So here, we add the interest expense back to AFFO and divide that number by the sim of interest expense and preferred share dividends. For 2022, we get a 5.33X coverage ($3.2 billion divided by $600 million). Both are some of the best measures we have come across and the safety of these shares remain exceptional.

Which One?

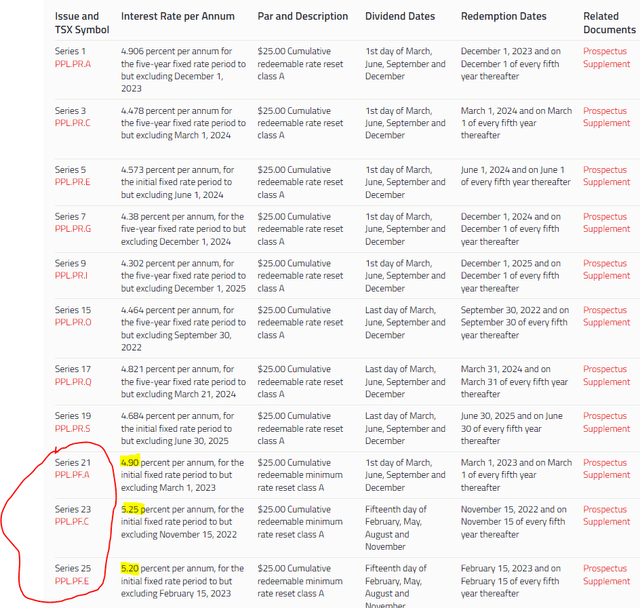

Well, all of the preferred shares of Pembina have their pros and cons. We will highlight the same three we liked last time as they continue to be set for any interest rate environment.

Pembina

The 3 highlighted above have a floor rate. So 4.9%, 5.25% and 5.2% are the minimum amounts they can pay out. PPL.PF.C is up first and the reset is due on November 15. The actual rate for the subsequent period will be set a little before.

“Fixed Rate Calculation Date” means, for any Subsequent Fixed Rate Period, the 30th day prior to the first day of such Subsequent Fixed Rate Period.”

Source: Pembina

The new rate will be calculated as the following for PPL.PF.C.

The Annual Fixed Dividend Rate for the ensuing Subsequent Fixed Rate Period will be determined by the Company on the Fixed Rate Calculation Date (as defined herein) and will be equal to the sum of the Government of Canada Yield (as defined herein) on the Fixed Rate Calculation Date plus 3.65%, provided that, in any event, such rate shall not be less than 5.25%.

Source: Pembina

The current 5 Year Government of Canada bond yield is 3.19%. This is a good deal higher than what it was (2.54%), when we wrote about these shares in April.

MarketWatch

So the current expected reset coupon is 6.84%. Since these shares are trading at a stripped price of $24.70, your expected yield is 6.92%, assuming rates don’t change.

PPL.PF.A and PPL.PF.E have lower spreads (3.26% and 3.51%, respectively) and lower fixed yields. They also have later reset dates. This might work for you or against you, depending on where interest rates move in the interim. All 3 are also convertible into floating rate (90 day T-Bill rate +3.65% for PPL.PF.C) preferred shares (assuming holders of at least 1 million shares choose this option) but we don’t think that is a good option to exercise.

Verdict

Pembina preferred shares are an even better deal versus what they were 5 months back. The company has delivered exceptional results and decided to dedicate its excess cash flow to debt reduction. We cannot think of any midstream firm at 3.5X debt to EBITDA with such attractive preferred shares. Those same shares are set up for a big inflationary environment and also if interest rates collapse down the line. That is where the fixed 5.25% comes in. If you get a deflationary apocalypse, the 5.25% fixed yield adds a floor on the price.

One small risk to the thesis is that Pembina might call these. At close to 7%, this is the highest coupon the company is paying. If it sees this as “debt” then it may go after this issue and redeem. If it sees this as equity (which it is), then the 7% is cheaper relative to its 10% AFFO yield. The company has massive room on its unsecured credit facility, so this can be done.

Pembina Q2-2022 Report

Of course investors don’t really lose anything if they are called as these are still trading below par. The worst case is that this becomes a cash parking area for a 10% plus annualized yield.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment