akinbostanci/iStock via Getty Images

5 Stock Picks To Ride The Commodities Bull Market

Commodity stocks are back in business.

Tesla (TSLA) CEO Elon Musk recently stated that investors should look to own physical assets over cash during periods of high inflation.

Meanwhile, Goldman Sachs’ head of commodities research recently stated that the firm is “extremely bullish” on commodities, “amid a super cycle that has the potential to last for a decade.”

Weakened currencies, supportive central banks, and soaring government deficits are fueling inflationary expectations, and have increased the attractiveness of commodities as a hedge against inflation, according to a report by Refinitiv.

I couldn’t agree more. We are witnessing the beginning of a big move in commodity prices, including oil, gold, copper, nickel, platinum, palladium, and other metals.

Commodity prices have risen substantially this year but still have a long way to go to catch up to the performance of general equities and other assets.

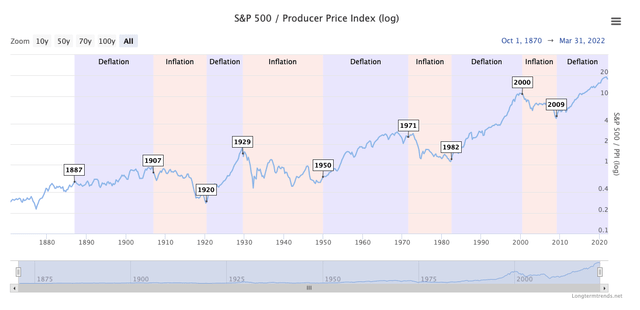

Check out this chart below from Longtermtrends which shows a stocks-to-commodities ratio. It measures the S&P 500 relative to the commodity market index PPI (Producer Price Index).

When the ratio declines, it means we’re in a commodities bull market. Stocks are still performing very well compared to commodities based on this ratio.

Stocks to Commodities ratio (Longtermtrends)

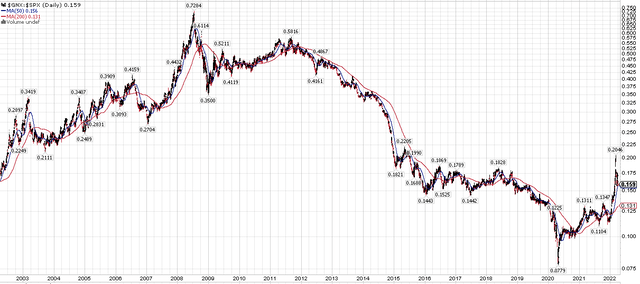

Here’s a chart I created showing the S&P GSCI Commodity Index divided by one share of the S&P 500. The ratio is currently .159, well below its 20-year highs of .72 set back in 2008 before the Great Recession.

Commodities to S&P 500 (StockCharts)

I’m focused on adding quality commodity stocks to my portfolio as I believe the commodity super cycle is just getting started.

As my name indicates, I’m biased toward precious metals (gold and silver) as I think the metals will attract growing investor and central bank demand in the coming year – but I also view the copper and nickel as very attractive investments as the world scrambles to secure the critical EV battery metals.

Here are five commodity stocks to consider buying.

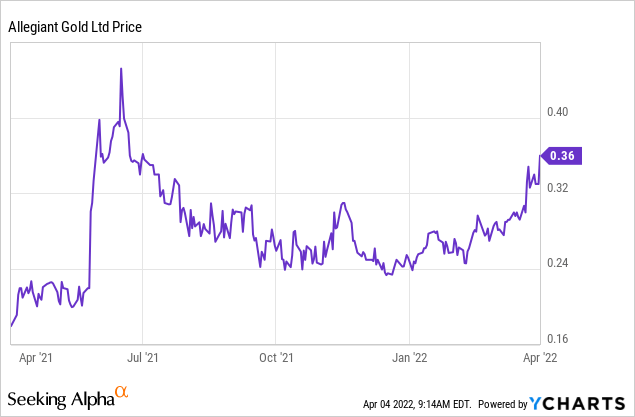

In prior coverage, I mentioned that Allegiant Gold was either going to be drill results or a new financing round. Sure enough, Allegiant Gold has announced a C$4 million financing round with strategic investor Kinross Gold (KGC).

Kinross invested C$4 million at a price of C$.40 and has become a 9.9% shareholder in Allegiant. They also receive warrants to purchase an additional 10 million shares at C$.70, which would give Allegiant another $7 million in financing.

Allegiant has agreed to allocate no less than 80% of the investment by Kinross for the advancement of the newly discovered high-grade zone (“HGZ”) at Eastside. This is smart as it’s where Allegiant produced the following stellar drill holes reported in 2021.

- Hole 243 included 2.55 g/t Au over 147.8 meters (3.17 g/t Au over 117.3m)

- Hole 239 included 111.3m of 1.45 g/t Au including 3.1 meters of 39 g/t at the bottom of the hole

- Hole 244 included 76 meters of mineralization with best intercept being 6.1m of 1.48 g/t Au

- Hole 245 included 15.2 meters of 3.4 g/t Au from relatively shallow depths (177m)

Another positive: Insiders own 10% of the company, which is great as I love to see insiders have skin in the game, and insiders were recently buying shares in the public market.

I am absolutely bullish on Allegiant Gold here ahead of its Eastside drill results and I view the Kinross investment as a major third-party endorsement of Allegiant’s assets.

What are the risks? Investors should understand that Allegiant is a thinly traded gold exploration stock which carries more risk than producing gold miners. As an explorer, it produces little to no cash flow from operations, and needs to produce strong assays from drilling to see its stock price move.

Despite the risks, I think the risk vs. reward here is favorable given the potential for excellent drill results at Eastside and the strong support from Kinross.

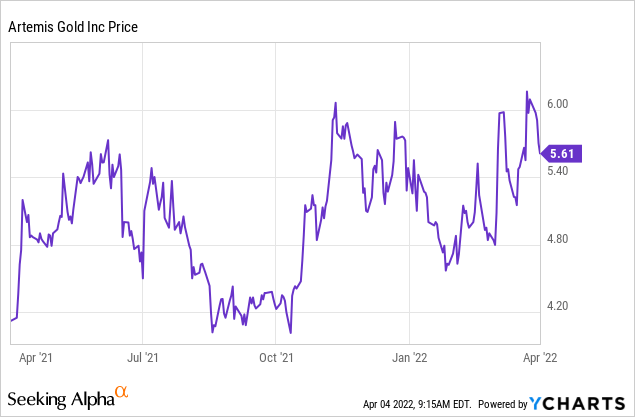

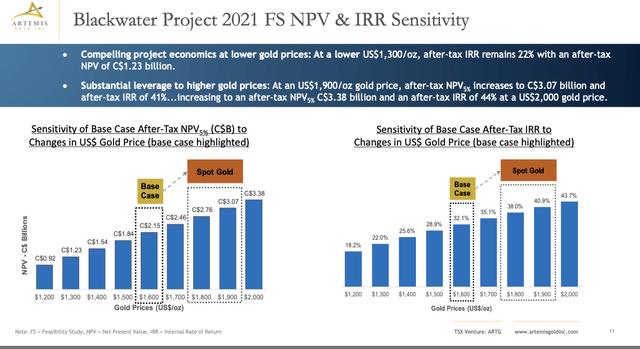

Artemis Gold is a gold developer focused on advancing its Blackwater project to production by 2024.

I believe its shares are a bargain here. According to a feasibility study, the Blackwater project carries a post-tax NPV north of C$3 billion at spot gold prices, yet the company’s market cap is only ~$850 million.

Blackwater works at much lower gold prices, but it is highly leveraged to gold prices and it is certainly economical.

Better yet, Blackwater is fully financed following its stream agreement with Wheaton Precious Metals (WPM) and secured a $385 million debt financing package.

Blackwater FS results (Artemis Gold)

In addition, it carries a short construction to production period of about 2 years, with initial production estimated by 2024. Insiders appear to be very bullish on the company as they own a whopping 41% of shares.

Blackwater is likely going to be a low-cost, high-margin gold mine in the tier-1 jurisdiction of Canada, making this one of the most obvious M&A targets in the mining sector.

The biggest risk here is that Artemis runs into issues bringing Blackwater into production by 2024, such as cost overruns which would force the company to issue more equity or debt. Since this is its only asset, the company won’t produce any cash flow until Blackwater is producing gold.

Despite that risk, I think Artemis is too cheap to ignore and I believe it will get bought out at a premium by a larger gold miner at some point in the next 1-2 years.

Canada Nickel owns 100% of its flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp.

The stock hasn’t done much of late but remains a deeply undervalued nickel developer. Its project carries an NPV well over $2 billion at spot nickel prices, based on its PEA study.

Canada Nickel will be well financed once it closes its previously announced private placement financing:

-

8,325,806 common shares of the Company (each, a “Common Share”) at a price of C$3.10 per Common Share; and

-

3,424,658 flow-through shares of the Company (each, a “FT Share”) to be sold to traditional flow-through purchasers (each, a “Traditional FT Share”) at a price of C$3.65 per Traditional FT Share;

-

1,500,000 FT Shares to be sold to charitable purchasers (each, a “Charity FT Share”) at a price of C$4.46 per Charity FT Share.

The average financing price, converted to US dollar, is equal to a stock price of US$2.67, lower than its current stock price of US$2.35, which means you can buy shares today at a 13% premium to the financing price.

Nickel is in a bull market and that’s not likely to change anytime soon given the massive nickel demand from EVs, and the upcoming nickel deficits.

Big nickel projects in tier-1 jurisdictions are extremely rare, and this makes Canada Nickel an obvious takeover target for a base metals producer, or perhaps even an EV-maker such as Tesla.

The biggest risk: Canada Nickel is an early-stage developer, and like the other stocks mentioned so far on this list, it doesn’t produce any cash flow from operations.

However, the latest financing gives the company more than enough capital to complete its exploration work for at least another year, at which point the stock price should be trading much higher. I view this as a top nickel junior.

4. Vale (VALE)

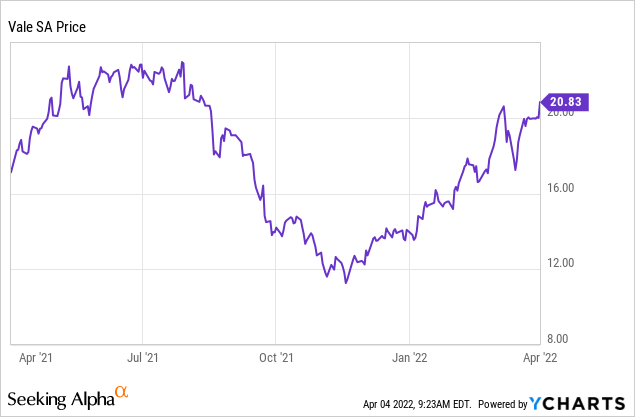

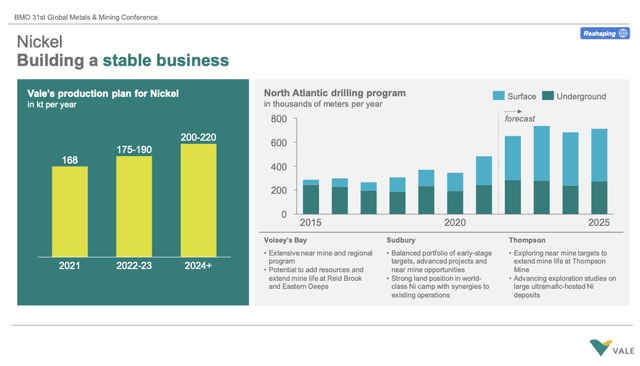

Investors looking for a quality nickel and base metals producer should seriously consider buying Vale stock.

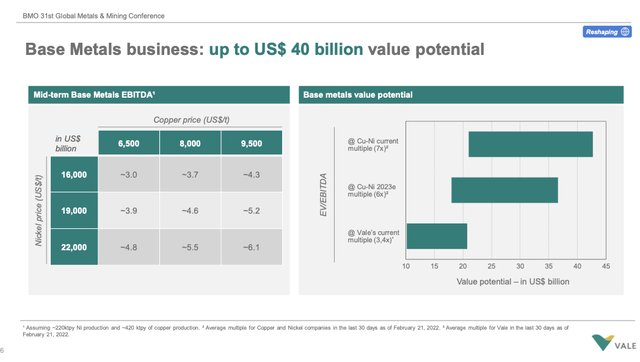

Vale is known primarily as an iron ore producer, but investors shouldn’t overlook its nickel and base metals business, which the company estimates produces more than $6 billion in annual EBITDA at spot prices.

This part of Vale’s business has soared in value over the past few months and will likely rise more value as commodity prices skyrocket.

In fact, Vale has estimated that its nickel/base metals business is worth up to $40 billion in a potential spin-out (or 43% of its current market cap) applying a 7x EV/EBITDA multiple and a $9,500/t copper price and $22,000/t nickel price, according to its corporate presentation.

Vale Base Metals Business Value (Vale) Vale is a large nickel producer (Vale)

However, copper is trading at over $10,000/t and nickel at over $22,000/t, so that high-end valuation of $40 billion looks pretty conservative.

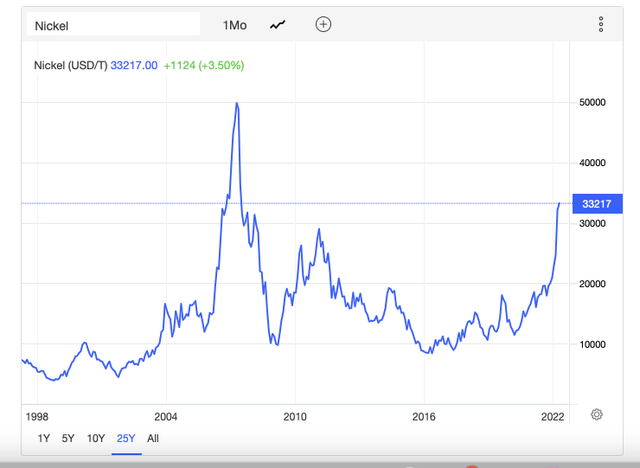

Copper is trading at $10,246/t and nickel is currently $33,217/t after witnessing a massive short squeeze on the LME (and which could witness more short squeezes, according to S&P Global).

Nickel Prices (Trading Economics)

Vale also looks dirt cheap here, trading at a P/E of 4, and the stock yields close to 10.7% as it has been paying most of its free cash flow out to investors.

The biggest risk to Vale stock is a sudden drop in commodity prices or another environmental disaster like the dam disaster in January 2019, in which it has agreed to pay $7 billion to victims.

5. Osisko Gold Royalties (OR)

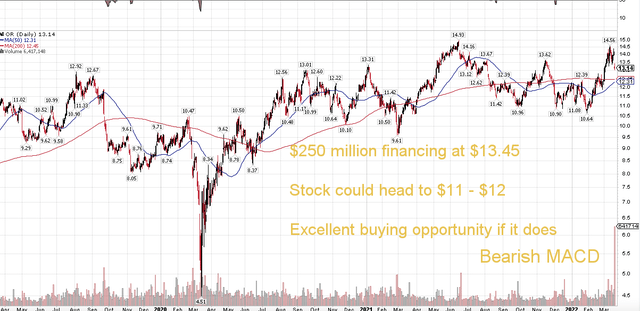

Osisko Gold Royalties is a gold streaming and royalty company. Its shares recently sold off after the royalty and streaming company announced a new $250 million equity financing at $13.45, which, at the time of the announcement, represented a discount to its stock price.

I understand that investors do not particularly care for dilution, but Osisko has been very active lately and recently announced a $90 million silver stream with Metals Acquisition Corp (MTAL), with MTAL holding an option to draw up to an additional US$100 million in upfront proceeds through the sale of a copper stream, on the producing CSA mine in Australia.

I would be upset at this dilution if this was not such a good acquisition. They are buying the right to purchase 100% of the silver produced at CSA at an ongoing cost per ounce of just 4%.

Average annual silver production at this mine is approximately 431,000oz or 5,600 gold equivalent ounces, with a targeted mine life of 15+ years.

Based on those figures and using $30/oz silver, the stream will produce ~$12 million annual cash flow to Osisko, good for a 13.3% return on its $90 million investment.

Its leverage to silver prices is outstanding: at $50/oz silver, the stream produces ~$20 million; at $75/oz silver, it’s ~$31 million. At $100/oz, it’s ~$41 million. This is based on 431,000/oz annual production and a 4% ongoing cost per oz).

Osisko could realistically earn $300+ million on the stream over a 15-year mine life using an avg. silver price of $50/oz if all goes according to plan.

I also believe Osisko isn’t done yet and will likely announce more acquisitions shortly. Remember, Osisko owns a 2%-3% NSR royalty on the Windfall project, and I believe Osisko might increase this royalty or perhaps purchase a gold stream on this high-quality asset.

I also think there are opportunities to buy streams on porphyry copper-gold deposits that were once deemed uneconomical, but now are profitable with copper in a bull market.

One such project it may look to invest further in is Casino, owned by Western Copper and Gold (WRN), in which Osisko already owns a 2.75% NSR (Rio Tinto (RIO) also holds 8% of WRN).

To recap: The dilution will hurt shares in the short-term and I think Osisko shares could test its 200-day MA of $12.44. But I would be prepared to back up the truck and buy more shares should such a pullback occur.

Be the first to comment