DNY59

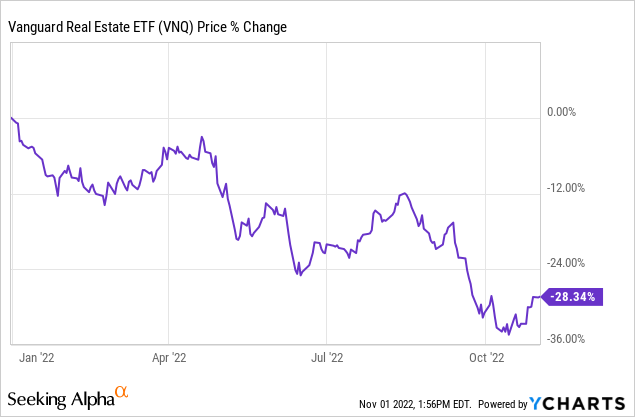

REITs (VNQ) have dropped a lot lately.

They’re down 28% year-to-date and this is largely because investors fear that rising interest rates will have a significant negative impact on them.

But are these fears really warranted?

We believe that they aren’t.

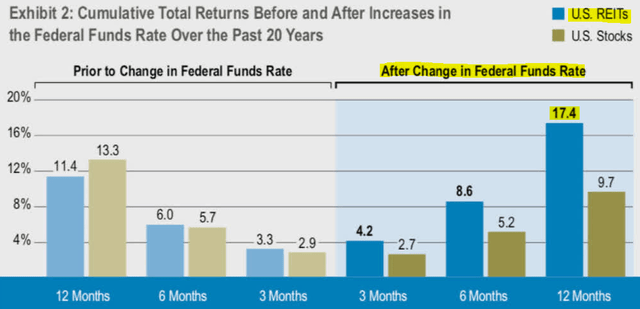

Based on history, REITs actually outperform and generate strong returns during most time periods of rising interest rates. Historically, they have earned a 17% total return in the 12 months following a rate hike:

Cohen & Steers

And especially today, we think that the fears are overblown because of the five following reasons:

Reason #1: Leverage Is Low

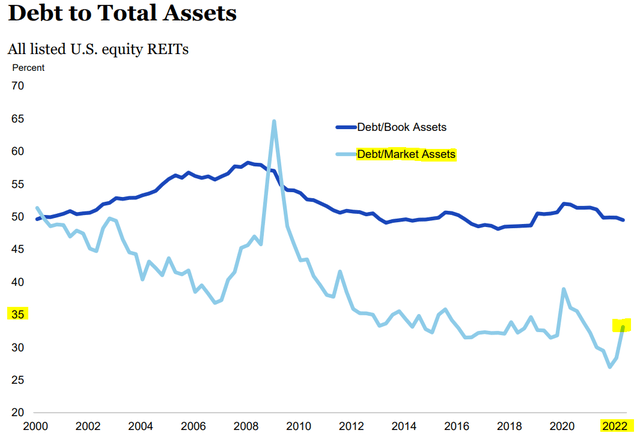

REITs have historically generated strong returns during times of rising rates and that’s despite having been a lot more heavily leveraged in the past.

Today, REIT balance sheets are the strongest ever with leverage at an all-time low. The average loan-to-value is only around 35%, which compares very favorably to the ~60-70% LTVs commonly seen in private equity.

NAREIT

Therefore, all else held equal, REITs should do even better in today’s cycle of rising interest rates. Leverage is a lot lower, and therefore, the impact of rising rates also should be less significant.

Why is leverage so low? REITs learned their lesson from the 2008-2009 financial crisis and have since then focused on strengthening their balance sheets.

Reason #2: Maturities Are Long

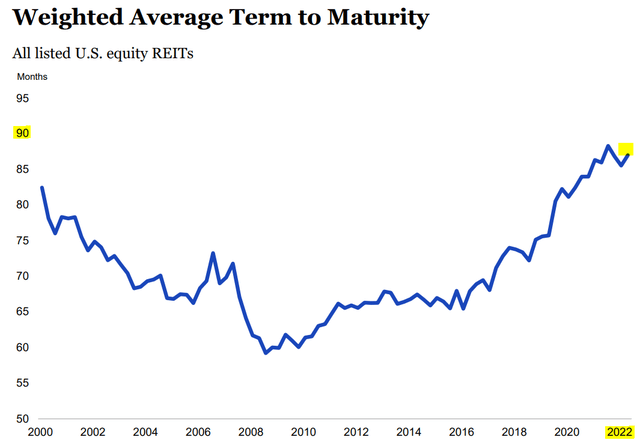

Leverage is low and on top of that, maturities also are historically long. Since most of the debt is fixed rate, this means that most REITs won’t feel any impact from rising rates for years.

The debt maturities are today ~8 years long on average:

NAREIT

This means that if maturities are well staggered, only ~12% of the debt matures each year. This is not much since most REITs use low leverage to start with. If you have a 35% LTV and 12% of that matures in any given year, that’s 3%-4% of your capital stack.

REITs can use retained cash flow and/or property dispositions to pay that off if they don’t want to accept higher rates. And even if they refinance at a materially higher rate, what’s really the impact since this higher rate only applies to 3%-4% of the capital stack? It really isn’t significant.

Lots of REITs have zero maturities for many years to come. To give you an example: Prologis (PLD) has no major maturities for many years to come. By then, the interest rate environment will be different again. Today, rates are high and rising because inflation is temporarily high due to supply chain issues caused by the pandemic and the war in Ukraine. But as these things get worked out, interest rates will likely return lower.

There are strong deflationary forces that have caused interest rates to decline for 40-plus years. Those are the aging population, excessive debt, and technology. During these 40 years, we have had many short periods that caused interest rates to rise. Yet, each time, the surge was only temporary.

Reason #3: Rates Are Rising Because of Inflation

Investors focus on the rising rates but forget to consider why they’re rising, and yet, the reason is very important.

Today, rates are rising because of inflation, and this matters because inflation is very beneficial to REITs. It leads to higher rents and property values. It impacts 100% of the capital stack, whereas rising interest rates only impact 3%-4% of the capital stack each year.

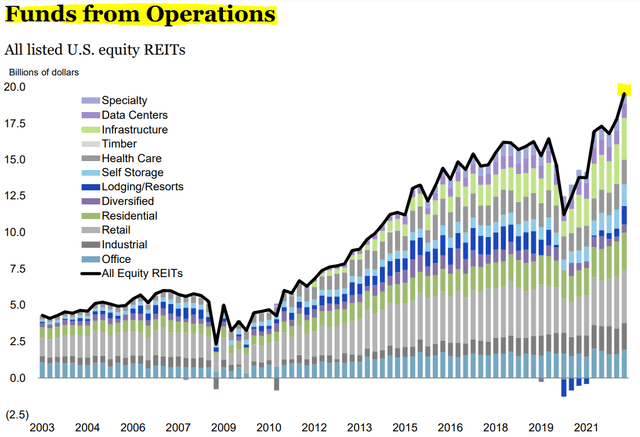

Clearly, the positive impact of inflation is greater than the negative impact of rising interest rates, and this explains why REIT cash flow keeps growing and most REITs have hiked their dividend in 2022:

NAREIT

Blackstone (BX), the biggest private equity real estate investor in the world, recently made the following comment:

“I guess I’d step back and say the reason my hard assets are interesting in an environment like this is because the replacement cost goes up pretty significantly. In an inflationary environment, the cost to build the labor cost, which is a big component has gone up and probably the largest input cost of money goes up significantly. And the yield on cost that you need to build a new project goes up. So I was talking to a major apartment developer who builds 15,000 units he has under construction today. He said next to cut his budget to 4,000 units, a 75% decline in terms of his new construction. So what you see happen in an environment like this is you start to see a reduction in new supply, which is obviously helpful in the long-term and these hard assets are beneficial because they don’t have much exposure to input costs, and there’s going to be a few of them, as I said, built. So that argument for investing into hard assets.

The challenge, of course, is in a rising rate environment, if you own a hard asset feels like a bond, or worse an older office building, then I think you’re going to see a challenge to value because the income is not growing much and rates have gone up. On the other hand, if you’re in rental housing and you have pricing power or logistics, where we’re still seeing in the U.S., 30% increases in rents. In Europe, nearly 20% increases in rents, the duration of [indiscernible]. Even as the cap rates go up, you can still see value appreciation, albeit at a lower rate.”

So in short, the surge in rents and property values is more significant than the rise in interest rates, and this is particularly true for REITs since most of them own high-quality Class A properties and use little debt.

Reason #4: Higher Rates Lead to Less New Supply

Blackstone touched on this topic already in the quote above.

But higher interest rates also lead to lower new supply of properties because it makes it more expensive and difficult to build new assets. The rapid surge in interest rates makes it more difficult to model returns and results in growing risks for real estate developers.

Less supply naturally then leads to higher rents, all else held equal. The value of existing properties only grows if there’s less supply and higher interest rates help with that.

Reason #5: Higher Rates Makes Renting a Better Alternative to Owning

Another consequence of higher interest rates is that relatively speaking, renting is becoming more affordable and attractive relative to owning.

If you were previously considering buying your home, now you are more likely to keep renting your apartment. It will grow the pool of renters, resulting in more demand, but as we noted previously, supply growth is now decreasing, so naturally, landlords can then hike rents.

Independence Realty Trust

But it’s not just apartments.

If you are a retailer like Walgreens (WBA), you can develop your own stores, or you can rent them. Now developing your own store is becoming a lot more expensive due to inflation and rising interest rates. Therefore, you would rather rent new existing properties.

Moreover, now that the cost of debt is a lot higher, you may also want to consider more sale-and-leasebacks to unlock capital via alternative sources. This provides more opportunities to more REITs and gives them more bargaining power since they now have more investment options.

To Recap:

-

REITs historically generate strong returns during times of rising rates.

-

Today, REIT leverage is at an all-time low.

-

Maturities are exceptionally long.

-

Inflation results in rapid rent growth and rising replacement cost.

-

Higher rates decrease the new supply of properties.

-

But higher rates also increase the pool of renters.

Therefore, you would expect the impact of inflation and higher rates to be positive for most REITs, especially those that use little debt and have significant upside in their rents.

Example of an Opportunity

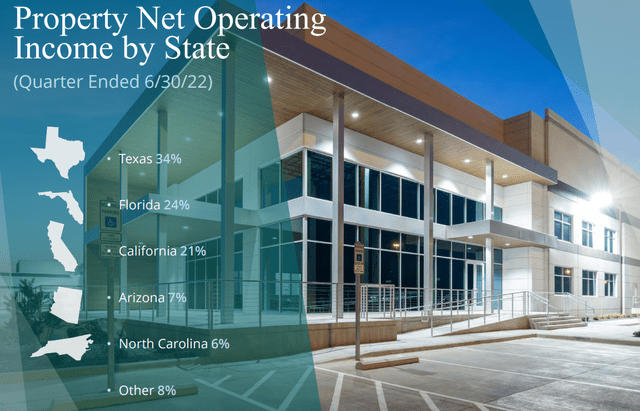

To give you an example, EastGroup Properties (EGP) owns a highly desirable portfolio of Class A urban, in-fill, industrial properties that’s mainly located in strong sunbelt markets in Texas and Florida.

EastGroup Properties

Its rents have not kept up with the market and are now deeply below market levels, which allows it to hike rents by 20%-plus as leases expire. Its occupancy rates are today already at 99%, an all-time high, which puts them in a strong position to keep growing rents at a rapid pace.

Moreover, they use very little debt with a low 20% LTV and have no maturities until 2026.

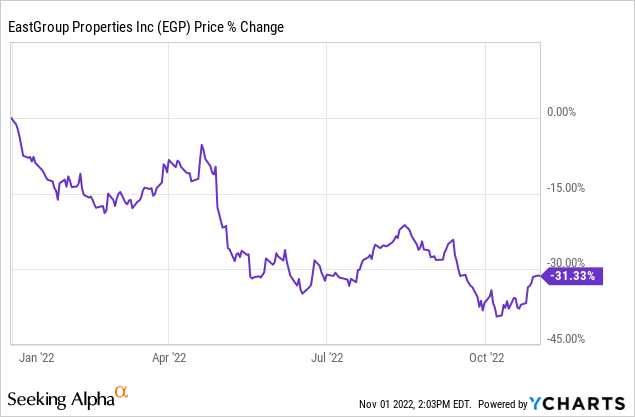

You would expect such a REIT to do well in today’s environment, and yet, it’s down heavily with the rest of the REIT market and now trades at a deeply discounted valuation:

Right now, EGP is priced at a 30% discount to net asset value. Put differently, buying shares of EGP allows you to buy an interest in its real estate at 65 cents on the dollar. This is truly exceptional given the quality of the real estate and its rapid rent growth prospects.

I think that the market has overreacted to fears of rising interest rates and this is why I’m now accumulating these opportunities.

Be the first to comment