strelov/iStock via Getty Images

1H/22 is nearly done so we look ahead to the next six months in US cannabis with five predictions for the 2H. The outlook is bearish for investor returns in the near term as the key catalyst on everyone’s’ mind, federal legislation, is unlikely to come, and thus valuations will remain depressed for the remainder of this year with further stock declines likely in connection with broader market weakness.

With that said, we are confident that news around company fundamentals and state level development will be positive the remainder of the year which combined with a return of more normalized strong growth levels in 2023 and 2024 on new state openings, the possibility of a Republican led push for banking legislation and limited better investment alternatives elsewhere in the economy will bring long-awaited institutional investment and improved returns next year.

Our five predictions for 2H/2022 in US cannabis are:

- Federal legislation will not happen.

- Valuations will remain depressed.

- Companies will finally meet (or beat) expectations with earnings.

- CA consolidation will accelerate and MSOs will enter.

- Stocks of smaller and mid-sized companies will outperform larger peers.

Federal Legislation Will Not Happen

There will be plenty of noise around federal legislation in the coming months. First, headlines will focus on Chuck Schumer’s proposal which is set to come in August. Next news will shift to a stand-alone push for SAFE and finally hopes will fall on a banking language attachment to the 2023 Defense Spending Bill. Ultimately, progress with each is unlikely. There is insufficient bi-partisan support for Chuck Schumer’s full legislative proposal to pass (requiring 10 Republican votes and full Democrat support) and, as we have said before, the timing is too tight for a stand- alone SAFE Act to be possible this year given that Democrats will first await the Schumer proposal to make the rounds. Possibly had Chuck Schumer’s proposal come out in April as planned, there would be time for Democrats to release that and then pivot back to banking specific legislation as a priority, but as of now the full legislative proposal will come with likely too little time before the mid-terms. During the lame duck, non-cannabis issues will likely be prioritized.

Meanwhile, attaching SAFE language to the 2023 Defense Spending Bill is again the most viable path to legislative progress this year, but that brings problems for Democrats ahead of the 2024 election. Republicans can attack Democrats by saying that they left other priority issues on the table and unfairly pushed cannabis banking at a time when the country has much bigger issues at hand. President Biden would likely agree and/or at least will not want that political headwind for an issue he is not even in favor of. In the end, we believe he would step in front of an attachment by pressuring senior Democrats in the Senate.

Importantly in a change from prior periods, a lack of passage this year does not end the opportunity for near-term legislative progress even with an anticipated party flip in the mid-terms. Republicans can steal the issue next year or in 2024 and we believe there is good motivation to do so. We expect Nancy Mace, fresh off participation at industry conferences this Spring and her primary win earlier this month, with a campaign that was in part funded by MSO management teams, to be front and center leading the charge in part as a way of broadening her national exposure.

Rep Mace’s banking legislation proposal from last fall could likely garner significant bipartisan support in the Senate today and will be more of interest in 2023 if social equity opportunities are off the table. Meanwhile Mitch McConnell, who is likely to resume his leadership position if Republicans take the Senate, could be motivated to take cannabis reform as a win for his party and is likely to be more agreeable given that his home state of Kentucky is now pushing initial cannabis reforms with wide- spread voter support. No-longer does cannabis reform opposition directly align with Senator McConnell’s voting base.

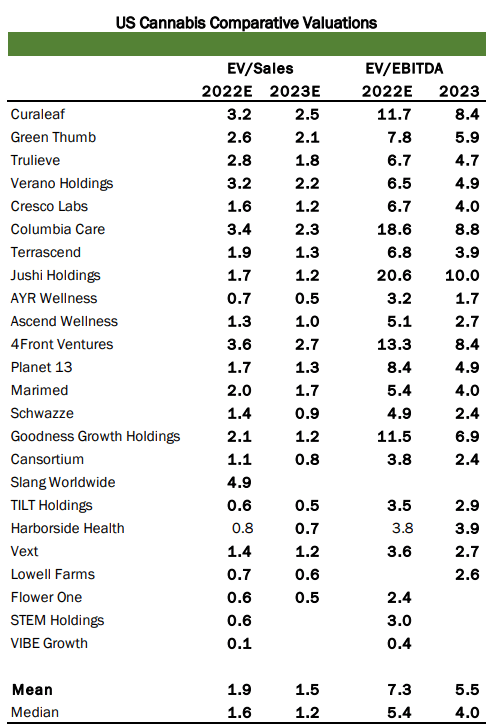

Valuations Remain Depressed

Given a lack of federal legislative progress this year, we do not expect there is a catalyst to change the discounted valuations for US cannabis companies and in fact we expect some further tightening of multiples particularly if broader market stock declines continue in light of rate hikes and recession fears. Wide-spread stock market declines are going to bring a risk off trade while concerns over rate hike impacts on capital availability and recessionary pressures at least in the near term will weigh on investors.

With that said, we believe catalysts will come in 2023 possibly in the form of Republican led legislation but first by some institutional investors pressuring traditional banks (particularly ones on the periphery that are dipping their toes in the space with conferences and industry-oriented research) to make markets for trading and guarantee custody of assets. In exchange for assistance with cannabis trading, the promise from these institutional investors will be participation in other non-cannabis opportunities through which the banks can make money. Cheap valuations, coupled with a return to higher anticipated growth levels next year on new market openings and pessimism elsewhere in the economy will drive many institutional investors to push the issue for the first time. The interest is there (just look at the institutional ownership levels of non-plant touching ancillary services plays or Canadian cannabis companies), but in the past uncertain execution and the looming overhang of legislative progress this year likely kept institutional investors from pushing their banks.

While far from all institutional investors being able to make investments in cannabis, we expect the enhanced participation from those that do will meaningfully reduce the gap in institutional investment as a percentage of market cap between cannabis companies and traditional industry entities and thus bring significant upside in valuations without anything changing with fundamentals.

Companies Will Meet or Even Exceed Expectations with 2H/22 Reporting

First half headwinds were real. Headwinds stemmed from challenging Y/Y comparisons against a COVID boost, wholesale price declines in newly maturing rec markets such Arizona, Illinois and Massachusetts and integration challenges for companies that brought on new assets in 2021. In addition to operational challenges, companies by and large were unprepared from an investor communication standpoint and the Q4 earnings cycle was disappointing with most companies cutting expectations meaningfully.

Macro headwinds are subsiding, albeit with some lingering pressure around what inflation will do to consumer spending levels. We are confident that strong growth on both the top and bottom line is achievable for most operators in the 2H. While Y/Y growth rates will be modest by cannabis standards for the full year, we fully expect a return to meaningful growth in the third and fourth quarters both on reduced macro pressure and execution.

Importantly, expectations are now set to a realistic level whereby there is no real macro catalyst necessary for companies to hit targets and many companies have now had time to integrate assets. Regarding state openings, New York which will obviously be a key future growth driver is already eliminated from 2022 expectations for those involved in the state. Meanwhile, for New Jersey, which is a growth market this year, the opening of rec sales in April actually offers an outperformance opportunity for exposed companies as for most the estimated start date within targets was and continues to be summer. Within our coverage, strong sales to date in New Jersey favors Ascend and AYR while overall Terrascend is the likely winner from exposure to the state this year.

The industry lacks a history of proven reporting consistency, but we are confident that investors can trust 2H earnings expectations and full year expectations for companies. This is important as a lack of negative surprises over the remainder of the year should protect against further underperformance for the stocks in the near-term while also giving would be institutional investors greater confidence in entering the space.

Consolidation and MSO Entry Will Bring Gains for California Investors

The proposed elimination of the California cultivation tax, which we expect to take effect next month, is a game changer for California cannabis companies reducing the cost of production on outdoor growers by as much as 50%. The tax change by no means eliminates all challenges for companies in the state and favors larger operators which can garner higher wholesale prices to begin with and were in more stable capital position. On the enhanced favor, we expect further consolidation is coming for existing larger operators in the state. These operators will now have more cash available for transactions and even greater motivation to scale through M&A. Of public California-centric names, we expect 4front, Glasshouse, Harborside Lowell, Parent Company and Planet 13 are likely buyers of smaller players in the near term.

The lower break-even threshold and seemingly more accommodating regulatory environment is also likely to be the catalyst that finally brings the biggest MSOs into the market. To date, none of the largest MSOs have a meaningful presence in California.

California is the ultimate white whale for industry operators, given the size of the market and the fact that exposure can also be viewed as a hedge on future potential interstate sales. We are confident that the lack of exposure will change particularly if SAFE Banking does not pass this year and these companies are looking for ways to differentiate themselves and enhance interest from investors. Meanwhile, despite outperforming stock returns in recent months even the largest public operators in California trade at a meaningful discount to even the broader peer group so the exposure can be had cheap. Within our coverage, Lowell Farms for example, which we like on enhanced execution and strong brand positioning currently trades at just over 1x this year’s revenues. We believe the above mentioned public operators along with smaller public companies including: Body & Mind, Fiore, Unrivaled and Vibe are all in play to be acquired.

For investors, we expect the easier operating conditions and looming consolidation will result in outperforming returns for California-centric stocks in the second half and into next year.

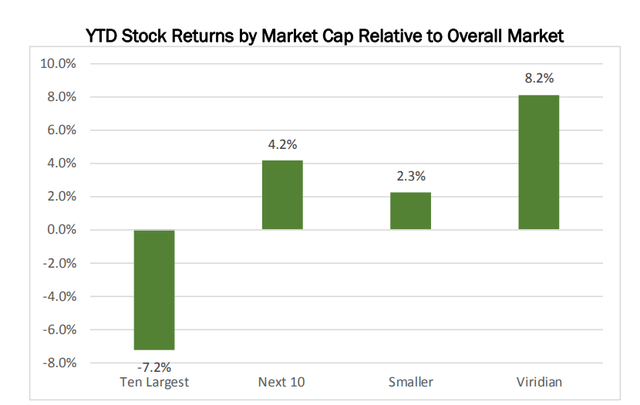

Outperforming Returns for Small and Medium Sized Stocks

Historically, the biggest MSOs garner the most attention and generate the top stock returns. We have and continue to believe that this performance correlation to market cap is misguided as many smaller well-positioned operators have more attractive fundamentals and future growth opportunities than larger peers. That US cannabis remains a state by state business makes a persistent valuation discount for smaller operators more appealing as it should not matter how widespread any company’s operations are across the country if they are not a leader in specific states. Scale does not necessarily equate to winning (whether that be through profitability or cash generation). Furthermore, on-going consolidation trends should also benefit smaller and medium sized stocks as these companies are more likely to be acquired.

First half stock returns, while poor overall, had medium and smaller sized operators outperforming significantly during the period. Based on average stock returns, the US cannabis stocks are down 47% YTD with the stocks of the ten largest MSOs declining by 55%. Meanwhile stocks for the next ten largest operators are down 43%. The stocks of the remaining smaller names declined by 45%. We expect the outperformance trend to continue and even be enhanced for the foreseeable future as smaller operators benefit from greater awareness amongst investors, outperformance and market share gains within key states and consolidation. Stocks of Viridian’s coverage which consists primarily of smaller and medium sized operators that we have deemed to be underappreciated by investors are down 39% on average YTD.

Our top picks for 2H investment fall within the category of smaller and medium sized companies. These names include: Ascend, AYR, Cansortium, Lowell Farms and Schwazze.

YTD Stock Returns by Market Cap Relative to Overall Market

Source: Viridian Cannabis Deal Tracker, FactSet

Source: Viridian Cannabis Deal Tracker, FactSet

Required Research Disclosures

|

Distribution of Ratings/IB Services |

||||

|

IB Services in Past 12 months |

||||

|

Rating |

Count |

Percent |

Count |

Percent |

|

Buy (BUY) |

15 |

100% |

0 |

0% |

|

Hold (HOLD) |

0 |

0% |

0 |

0% |

|

Sell (Sell) |

0 |

0% |

0 |

0% |

|

Not Rated (NR) |

0 |

0% |

0 |

0% |

Analyst Certification

The research analyst responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to Bradley Woods & Co. Ltd.; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in this report.

Meaning of Ratings

Bradley Woods & Co. Ltd.’s rating system of Buy, Hold, Sell, Not Rated reflects the analyst’s best judgment of risk- adjusted assessment of a security’s 24-month performance.

Buy: A Buy recommendation is assigned to stocks with low risk and approximately 10% expected return or stocks with high risk and approximately 25% expected return. The analyst recommends investors add to their position.

Hold: A Hold recommendation is assigned to stocks with low risk and less than 10% upside or less than 15% downside or to stock with high risk and less than 25% upside or less than 15% downside.

Sell: A Sell recommendation is assigned to stocks with an expected negative return of approximately 15%. The analyst recommends investors reduce their position.

Not Rated: A Not Rated recommendation makes no specific Buy, Hold or Sell recommendation.

Compensation or Securities Ownership

The analyst(S) responsible for covering the securities in this report receives compensation based upon, among other factors, the overall profitability of Bradley Woods & Co. Ltd. including profits derived from investment banking revenue and securities trading and market making revenue. Unless noted in the Company Specific Disclosures section above, the analyst(S) that prepared the research report did not receive any compensation from the Company or any other companies mentioned in this report in the previous 12 months, or in connection with the preparation of this report. Unless noted in the Company Specific Disclosures section above, neither the analyst(S) responsible for covering the securities in this report, nor members of the analyst(S) household, has a financial interest in the Company, but in the future may from time to time engage in transactions with respect to the Company or other companies mentioned in the report.

For compendium reports (a research report covering six or more subject companies) please see the latest published research to view company specific disclosures.

Other Important Disclosures

This report is provided for informational purposes only. It is not to be construed as an offer to buy or sell a solicitation of an offer to buy or sell any financial instruments or to particular trading strategy in any jurisdiction. The information and opinions in this report were prepared by registered employees of Bradley Woods & Co. Ltd. The information herein is believed by Bradley Woods & Co. Ltd. to be reliable and has been obtained from public sources believed to be reliable, but Bradley Woods & Co. Ltd. makes no representation as to the accuracy or completeness of such information.

Bradley Woods & Co. Ltd. is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers.

Opinions, estimates, and projections in this report constitute the current judgment of the author as of the date of this report. They do not necessarily reflect the opinions of Bradley Woods & Co. Ltd. and are subject to change without notice. In addition, opinions, estimates and projections in this report may differ from or be contrary to those expressed by other business areas or group of Bradley Woods & Co. Ltd. and its affiliates. Bradley Woods & Co. Ltd. has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Bradley Woods & Co. Ltd. does not provide individually tailored investment advice in research reports. This report has been prepared without regard to the particular investments and circumstances of the recipient. The securities discussed in this report may not be suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Estimates of future performance are based on assumptions that may not be realized. Furthermore, past performance is not necessarily indicative of future performance. Investment involves risk. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Bradley Woods & Co. Ltd. salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Bradley Woods & Co. Ltd. may seek to offer investment banking services to all companies under research coverage. Bradley Woods & Co. Ltd. and/or its affiliates expect to receive or intend to seek investment-banking related compensation from the company or companies mentioned in this report within the next three months.

This research report (the “Report”) is investment research, which has been prepared on an independent basis by Bradley Woods & Co. Ltd., a member of FINRA and SIPC, with offices at 805 Third Avenue, 18th Floor, New York, NY USA, 10022. Electronic research is simultaneously available to all clients. This research report is provided to Bradley Woods & Co. Ltd. clients and may not be redistributed, retransmitted, disclosed, copied, photocopied, or duplicated, in whole or in part, or in any form or manner, without the express written consent of Bradley Woods & Co. Ltd. Receipt and review of this research report constituted your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion or information contained in this report (including any investment recommendations, estimates, or target prices) without first obtaining express permission from Bradley Woods & Co. Ltd. In the event that this research report is sent to you by a party other than Bradley Woods & Co. Ltd., please note that the contents may have been altered from the original, or comments may have been added, which may not be the opinions of Bradley Woods & Co. Ltd. In such case, neither Bradley Woods & Co. Ltd., nor its affiliates or associated persons, are responsible for the altered research report.

This report and any recommendation contained herein speak only as of the date of this report and are subject to change without notice. Bradley Woods & Co. Ltd. and its affiliated companies and employees shall have no obligation to update or amend any information or opinion contained in this report, and the frequency of subsequent reports, if any, remain in the discretion of the author and Bradley Woods & Co. Ltd.

Bradley Woods & Co. Ltd. may affect transactions in the securities of companies discussed in this research report on a riskless principal or agency basis. Bradley Woods & Co. Ltd.’s affiliated entities may, at any time, hold a trading position (long or short) in the securities of the companies discussed in this report. Bradley Woods & Co. Ltd. and its affiliates may

engage in such trading in a manner inconsistent with this research report. All intellectual property rights in the research report belong to Bradley Woods & Co. Ltd. Any and all matters related to this research report shall be governed by and construed in accordance with the laws of the State of New York.

This report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject Bradley Woods & Co. Ltd. and its affiliates to any registration or licensing requirements within such jurisdictions.

The Bradley Woods Form CRS, Client Relationship Summary, can be accessed here.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment