gesrey/iStock via Getty Images

Article Thesis

In times of market turmoil, Dividend Aristocrats, with their reliable income and proven resilience, can be good investments. However, not all of these companies are necessarily a buy at the same time. Instead, some of them usually tend to be better value picks than others at any specific time, while risks to their business models also change over time. In this report, we’ll highlight 5 Dividend Aristocrats that are attractive right here, and 5 others that may be better avoided for now.

Better Than Most In Times Of Crisis

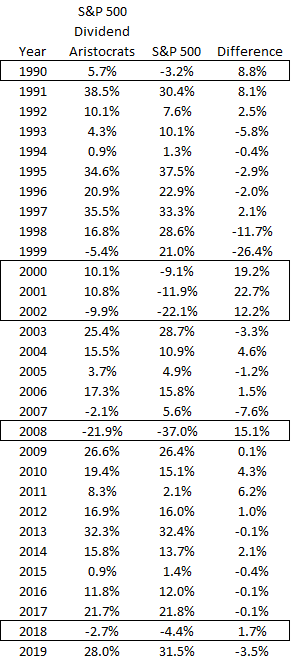

The world is currently battling several crises, among them a war in Ukraine, lockdowns in China, supply chain issues and disruptions around the globe, and inflation, driven in part by high energy prices. Equity markets have dropped quite a lot so far this year, which is why investors may want to search for safe-haven assets that have a history of outperforming during market crashes. The Dividend Aristocrats, as a group, have done exactly that in the past:

Article from Seeking Alpha author Ploutos

In the above table, we see that the Dividend Aristocrats as a group have outperformed the broad market in many years, with the outperformance oftentimes being particularly strong during times when the market dropped. This includes the dot.com crash, where Dividend Aristocrats rose in the 2000-2022 time frame, and the 2008 crash when the Dividend Aristocrats handsomely outperformed the market. As a group, Dividend Aristocrats thus have merit as a below-average risk choice for times when markets are experiencing headwinds.

Investors can go with the Dividend Aristocrats ETF (NOBL), or they can opt for individual stocks in this group, which has the benefit of avoiding stocks that are too expensive. Usually, some of the stocks in this group trade above fair value at any given time, while others are trading below fair value. When one buys the ETF, one naturally buys both undervalued and overvalued stocks, whereas opting for individual stocks allows investors to be pickier with what they buy at a specific time.

5 Dividend Aristocrats That May Better Be Avoided Today

1: Walmart

Walmart (WMT) is not a bad company at all. It has delivered compelling returns for those that have bought early on, and it is resilient versus recessions. The company also was resilient during the pandemic, which isn’t too surprising, as consumers still needed to buy food and other staples even during the lockdown phase.

But in the current environment, with inflation hurting consumer spending, while transportation costs for Walmart are soaring, the company is seeing its profitability come under pressure.

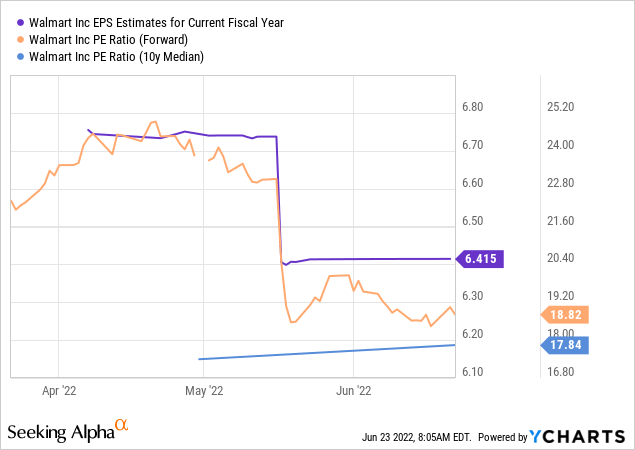

Walmart’s forecasted earnings per share have declined in recent months, and more downward revisions could be coming if shipping rates, wages, etc. continue to increase Walmart’s expenses. At the same time, Walmart is currently trading at a premium relative to the long-term median earnings multiple, which makes me believe that now is not yet a great time to enter a position.

2: Target

Target (TGT) is, like Walmart, a quality retailer. Like Walmart, it faces hefty headwinds from inflation, as it has had trouble passing on higher expenses to consumers. With wages rising, trucking becoming more expensive, and consumers potentially cutting back on some of the discretionary item purchases done at Target, 2022 will likely not be a great year for the retailer.

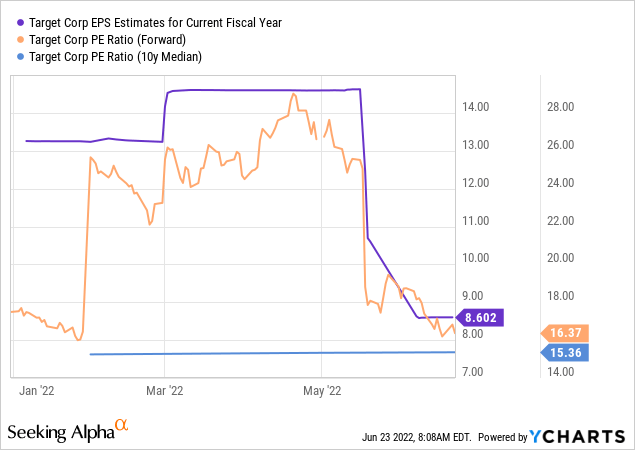

Earnings per share estimates have dropped like a rock in recent months, from north of $14 to below $9, and there is no guarantee that there won’t be further guidance cuts. The company is not really expensive in absolute terms but does still trade at a premium compared to the longer-term average. I thus do believe that waiting for EPS estimates to bottom out and/or for the valuation to drop to the longer-term average is a better idea compared to buying now.

3: Clorox

Clorox (CLX) operates with a resilient business model. Demand for cleaning products isn’t very cyclical, although consumers may opt for cheaper non-brand products during a recession or when inflation leads to higher living expenses. Clorox did perform reasonably well during the pandemic, but from a valuation perspective, shares are far from an enticing buy today.

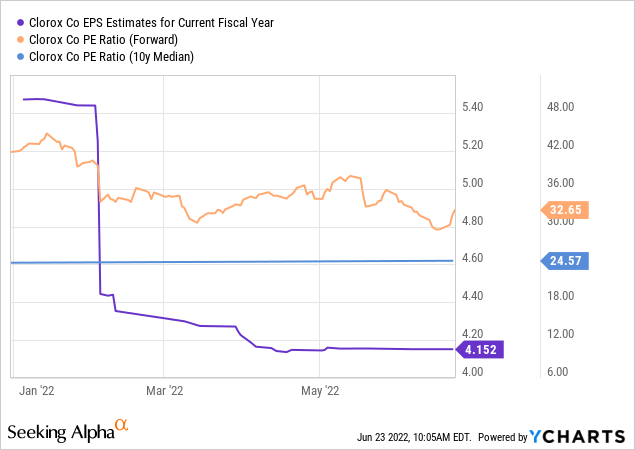

Looking at earnings estimates for the current year and the valuation relative to the longer-term median, there are good reasons to avoid Clorox for now:

Issues when it comes to passing on higher costs have resulted in steep earnings per share estimate cuts, and Clorox has become quite expensive as a result of that. Today, shares are valued at 33x net profits, around 30% higher than the longer-term median. Waiting for a better entry price seems like an opportune move for those that are interested in owning this company.

4: McDonald’s

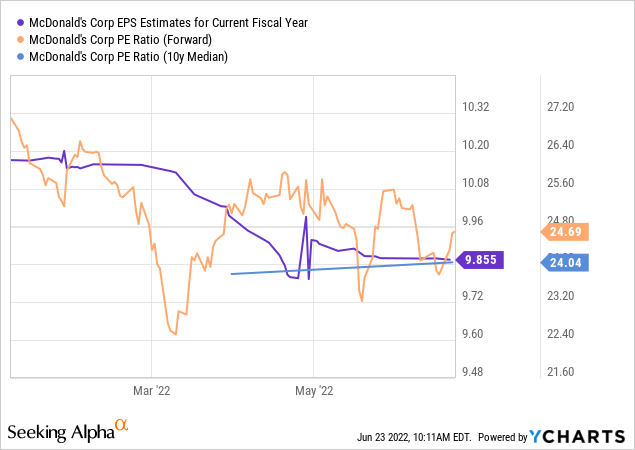

McDonald’s (MCD) is one of the best restaurant operators in the world and has been a strong long-term investment in the past. But with a recession becoming more likely, it is doubtful whether 2022 will be a strong year for the company, especially since a significant portion of its customers will likely feel the pinch from rising gasoline and energy prices especially hard. This will limit their ability to spend on dining out. At the same time, rising food prices, e.g. for beef or wheat, will lead to higher expenses on McDonald’s side. The recovery from the pandemic that investors hoped for may thus be underwhelming this year.

Earnings per share estimates have pulled back this year due to the aforementioned headwinds from inflation and a potential recession. At the same time, McDonald’s trades slightly above the historic valuation norm, and at 25x net profits, its shares are also far from cheap in absolute terms. Waiting for a better entry point could pay off, I believe.

5: Brown-Forman

Brown-Forman (BF.A)(BF.B) is a leading alcohol/spirits company that has delivered attractive returns in the long run. But with inflation pressuring household spending, consumers will likely cut back on the purchases of higher-priced alcoholic beverages. At the same time, less dining out in a potential recession would lead to fewer alcohol sales at restaurants. Both of these trends aren’t positive for Brown-Forman. Sales and profits will not fall off a cliff, as shown by past recessions during which Brown-Forman has remained profitable. But the near-term outlook is far from great, and yet, Brown-Forman trades at a rather high valuation. Based on current forecasts, Brown-Forman is valued at 35x forward earnings, which seems like a pricey valuation to pay for a consumer goods company that has a solid but not spectacular growth outlook. For reference, high-growth, high-quality tech companies such as Microsoft (MSFT) or Alphabet (GOOG)(GOOGL) trade at lower valuations today. Would I like to buy Brown-Forman at 20x net profits? Absolutely. But I do not believe that buying shares at 35x net profits will be a great deal.

5 Dividend Aristocrats That Are Attractively Valued Today

1: AbbVie

AbbVie (ABBV) has seen its shares pull back from recent highs, which has made its valuation decline to a more attractive level and which results in a higher initial dividend yield for those buying today. At $147 per share, AbbVie is valued at just 10.5x forward earnings while offering a dividend yield of 3.8%. The biopharma company will experience some headwinds from the patent expiration on Humira in the US next year, but that does not hurt the long-term growth outlook too much. AbbVie guides for combined Rinvoq and Skyrizi — two drugs that seek to replace Humira — sales of more than $15 billion in 2025, and peak sales of these two drugs are forecasted to be higher than Humira’s peak sales. AbbVie points out that it has hit or beat its guidance for every quarter since the company went public, so investors can have some trust in what management is forecasting — the company has a history of underpromising, not overpromising. With shares having pulled back from $180 to below $150, now could be a good time to add to a position in this high-yielding biopharma Dividend Aristocrat.

2: Altria

Altria (MO) has dropped quite a lot in the very recent past, at least partially driven by the banning of JUUL vaping devices. Altria has a stake in JUUL, thus this will most likely result in an asset write-off on Altria’s side in the upcoming quarterly report. But since this will be a non-cash item, investors don’t have to worry about any danger to the company’s dividend at all. In fact, JUUL wasn’t profitable anyway, thus none of Altria’s earnings power has vanished.

The fact that Altria has dropped to the low $40s on this news, which results in an earnings multiple of just 8.5 and which makes for a hefty 8.7% dividend yield provides investors with a compelling buying opportunity, I believe. Even if Altria were to never grow its earnings or dividend ever again, the dividend yield alone would provide reasonably attractive total returns. But with a dividend increase likely coming up this August, and with Altria delivering extremely consistent earnings per share growth in the past and likely also in the future, total returns of more than 10% are definitely possible here.

3: Johnson & Johnson

Johnson & Johnson (JNJ) is one of the lowest-risk stocks anyone could ever invest in. The company is well-diversified across three different industries, and none of those industries are cyclical: Pharma, medical tech, and consumer staples all perform reasonably well under almost any circumstances. On top of that, Johnson & Johnson is one of only two companies in the world that has a triple-A rating, meaning financial risks are ultra-low here. If rating agencies are correct, risks are lower compared to lending one’s money to the U.S. government.

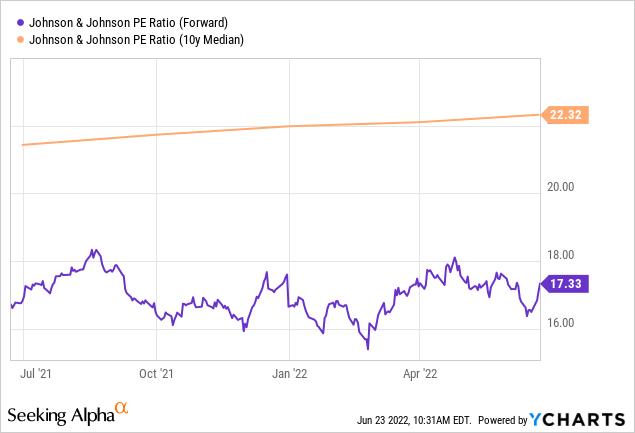

Quality usually has a price, which is why it is not too surprising to see that Johnson & Johnson has on average traded at a 22x earnings multiple over the last decade:

Today, however, shares trade at a meaningful discount to that, as investors can buy JNJ at a 17x earnings multiple. The company has just raised its dividend, and the dividend yield is now 2.6%. That’s not extremely high, but way more than what one can get from the broad market, while taking on way less risk at the same time — an attractive combination, I believe.

4: Chevron

Chevron (CVX) is one of the global supermajors in the oil and gas industry. It owns vast upstream/production and downstream/refining & marketing assets. With significant exposure to liquified natural gas production and sales, the company benefits a lot from ultra-high natural gas prices in many markets around the world, such as Europe or parts of Asia.

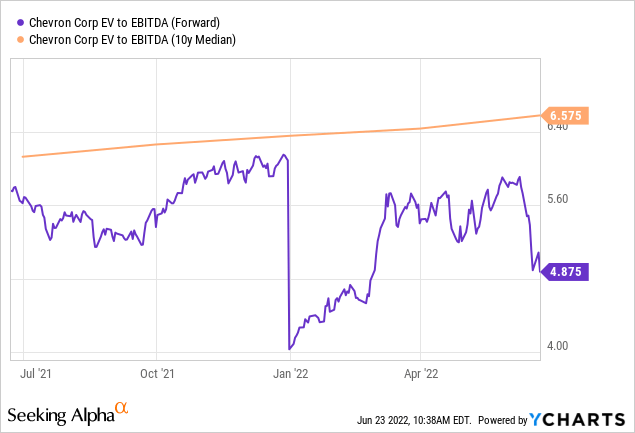

Shares are up so far this year but have recently pulled back meaningfully from the highs around $180. Earnings will explode upwards this year, as high natural gas prices, high oil prices, and hefty refining margins make for a perfect combination to drive up profits at Chevron and its peers. From a valuation perspective, Chevron seems far from expensive:

Shares have actually become less expensive over the last year, now trading at an enterprise value to EBITDA ratio of less than 5. This is also 30% below the longer-term median, suggesting that a big profit decline is already baked into the share price today. But if experts from Goldman Sachs (GS) and others are right and we are only in the early stages of a commodity supercycle, then profits may actually rise further in 2023 and beyond. In that case, Chevron could continue to deliver impressive returns between earnings growth, buybacks, and a 3.9% dividend yield.

5: Essex Property Trust

Essex Property Trust (ESS) is a residential real estate company that primarily invests in multifamily properties in major West Coast markets. Rising mortgage rates have made it much costlier for Americans to acquire homes, which should be a positive for rent demand. At the same time, Essex Property Trust has locked in cheap rates for many years, which means that high inflation helps it cut down debt in real terms, even before factoring in debt payments. Real estate prices have not yet declined meaningfully in the US, and it is not a sure thing whether that will happen as demand and input costs remain high. But ESS has already seen its shares drop from $360+ to the $250s, meaning investors are already pricing in a major real estate market decline without such a decline materializing so far.

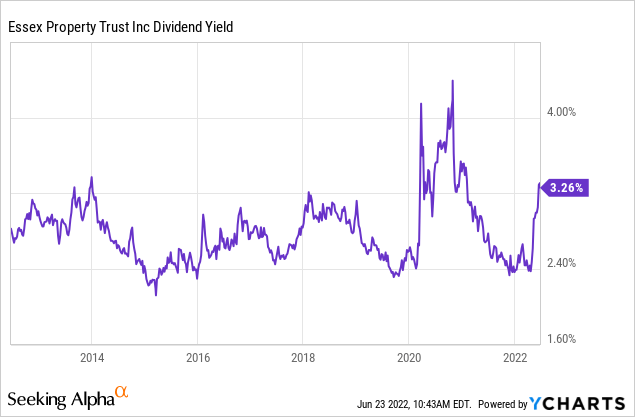

Essex Property Trust’s dividend yield is also at the upper end of the historic range when we back out the once-in-a-lifetime sale during the pandemic.

From a valuation perspective, Essex Property Trust thus looks like a better-than-average buy today. This is underlined by the 18x FFO multiple, which is not expensive for a residential property REIT such as ESS. Locking in a 3.3% yield with dividends that will in all likelihood continue to rise does not seem like a bad investment proposition at all.

Takeaway

Dividend Aristocrats can be a nice addition to a portfolio, as they tend to outperform the broad market during times of trouble. It looks like that could come in handy in the coming months, as inflation, a potential recession, interest rate worries, and supply chain disruptions make for a tough macro environment.

Investors should not buy all Dividend Aristocrats before factoring in their exposure to these themes and their valuation, however. I do believe that some Dividend Aristocrats are more attractive than others today. I’d be keen to hear what you think about these picks or other ones with similar benefits and risks in the comment section.

Be the first to comment