Khanchit Khirisutchalual

This article was originally published to members of the CEF/ETF Income Laboratory members on November 1st, 2022.

October ended up being a particularly strong month for the market. That was encouraging to see after such a weak September. That being said, we are still in negative territory for the year.

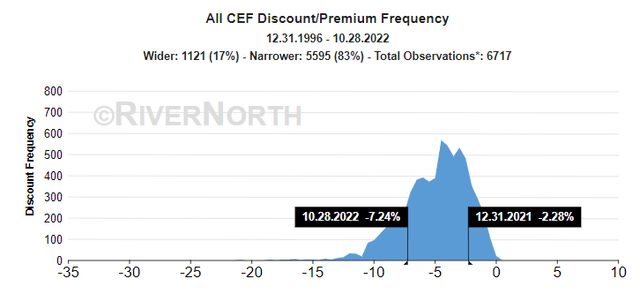

There were also still opportunities to continue to add to positions in the closed-end fund space. Discounts on closed-end funds are still looking attractive today. During volatile times, this is something that we often see in these investment vehicles.

CEF Discount/Premium (RiverNorth)

Though after a ton of buying last month, I was running a bit low on ammo. Instead, I focused on adding to already held positions in relatively smaller quantities for the month of October. In fact, I added two positions last month that made another appearance this month.

Every month I add to my holdings to grow my income. My approach is to snowball my income over time so it grows and grows off of itself. That would be despite any trims or cuts. During down years, this works out exceptionally well.

For the most part, despite 2022 being an even more challenging year, CEF distributions have remained resilient with very few cuts. That’s impressive, given the fact that most equity funds generate their coverage through capital gains. The longer the downturn, the more amount of time I have to add to positions at a more depressed price.

On the other hand, the reliance on capital gains from equity funds also increases the chances for distribution cuts. So there is definitely a balance here between a downturn being good and a downturn being too long, which ends up being destructive to payouts.

Invesco Senior Income Trust (VVR)

VVR is a name I added to last month and makes another appearance here. As a reminder, this is a specific play on the increasing interest rates in the market.

It is a senior loan fund. Thus, with interest rate increases, the income generated by the fund is also increasing. In the last annual report, the fund reported $0.26 in NII.

With a new semi-annual report we for the six months that ended August 31st, 2022, we see an NII of $0.17. Annualize that, and we arrive at what would be $0.34 annually – except this is only set to go higher as interest rates continue and are expected to continue going higher. Additionally, since it is a six-month report, that includes several months where interest rates were even lower.

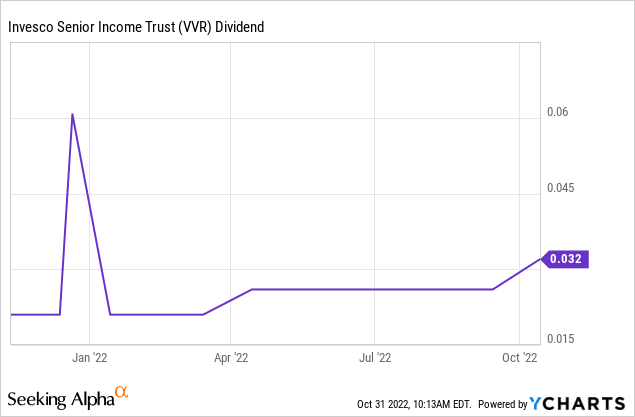

We’ve been seeing this happen, and it has been benefitting the payout of the fund with a couple of increases this year so far. I expect even more increases going forward as this annualized rate comes to just $0.384.

Ycharts

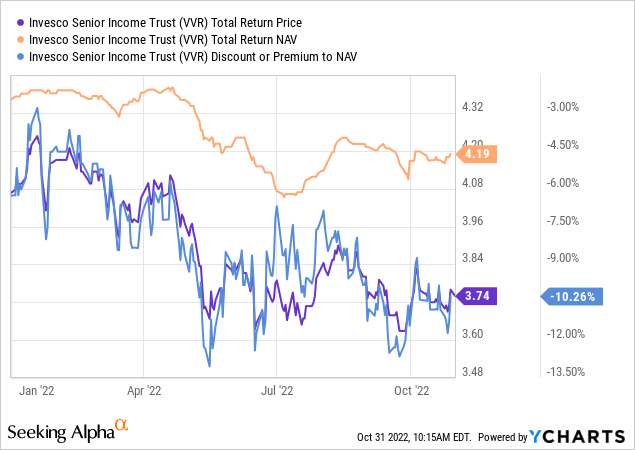

On the other hand, credit risks for a junk-rated portfolio have kept investors shy as the Fed could easily be too aggressive. A too-aggressive Fed could push us deep into recession in 2023. That, in turn, would definitely hit the income generation ability of the fund if defaults ticked up. This has resulted in the fund’s price falling quite materially, even while the fund’s NAV has held up quite well. This also results in the fund’s discount widening out significantly on a YTD basis.

Ycharts

Will VVR ultimately result in positive returns? I’m not so sure at this point, but I do know that the increasing distribution has offset the cuts from another name on this list.

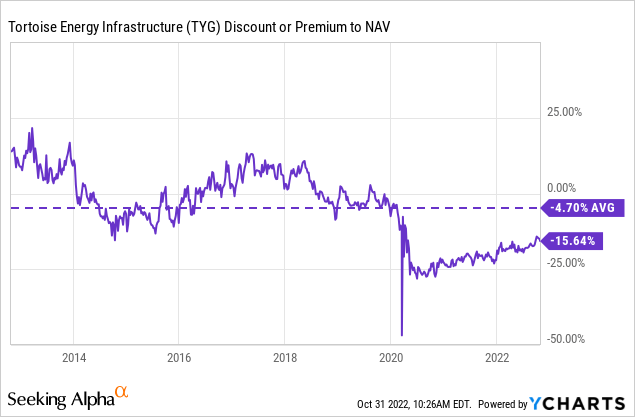

Tortoise Energy Infrastructure Corp (TYG)

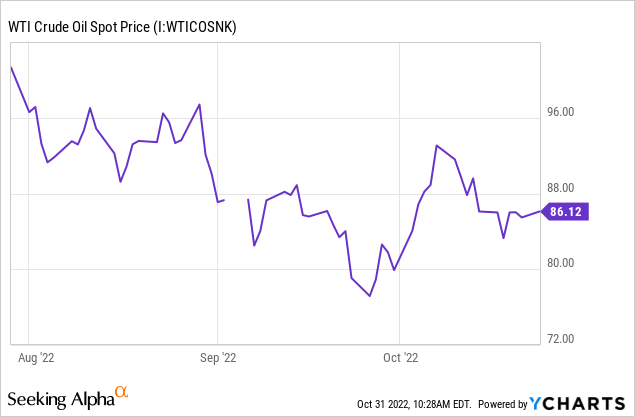

TYG was a fund I wasn’t originally going to add to. The reason being is that I felt that further gains in energy could be limited, especially with a recession looming. However, after OPEC announced a cut in the production of oil starting in November, I felt that added more support to the entire sector. It helped support a bump in the price of WTI crude, but it also quickly went lower before appearing to level out.

Ycharts

Of course, the sector is still susceptible to a downturn. Depending on how bad the downturn is will determine exactly how hard this sector gets hit. On the other hand, TYG isn’t necessarily as energy-focused as it once was. Once they diversified the fund to include more utilities and other infrastructure investments, it opened up the flexibility that the fund has. That also meant reduced returns relative to a pure-play energy investment, but that’s okay; I’m comfortable with how the fund is positioned.

To help further add to my optimism of adding to TYG was the tender offer they had initiated. It was a tender offer based on a specific trigger. And don’t worry if you missed it this year; they are also employing the same trigger-based tender offer for next year too.

The attractive discount earlier this month, and that remains, also made it a no-brainer to participate. The discount remains well below the levels we saw previous to the COVID crash.

Ycharts

With the proceeds of this tender offer, I expect to repurchase the shares.

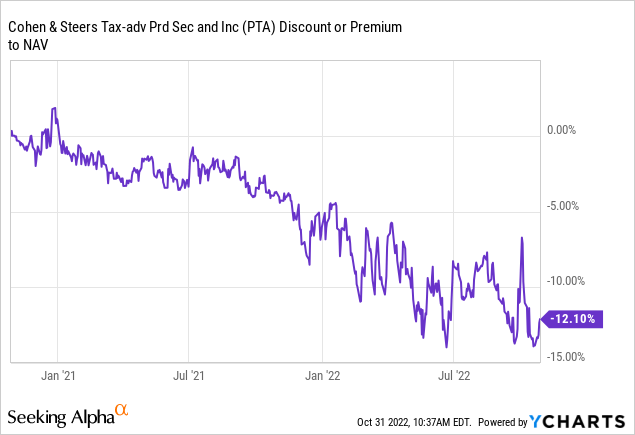

Cohen & Steers Tax-Advantaged Preferred Securities & Income Fund (PTA)

PTA is the other name that I also added in September. In fact, I also added to this position in July. The discount on this fund remains quite attractive. Rising interest rates have been the biggest hit on this fund for the year. Which has really been the whole 2022 dilemma as the Fed remains dedicated to fighting inflation.

Ycharts

The fund’s discount was hitting near the lows since it launched. So I’ve taken this chance to continue to average down in PTA after initially starting to purchase this fund in mid-2021 and then adding in November and December of 2021. In hindsight, that was way too early to be buying. But the additions to this name in 2022, so far, have been holding up relatively well. In fact, the latest batch of shares are even in the green – meaning there is now evidence that gains are possible.

This could ultimately prove to continue to be too early if the Fed bumps rates up further than expected at this point. I believe the interest rate expectations are for around 5% eventually. I believe the Fed is projecting 4.5 to 4.75%, but I think the market is expecting a bit higher. So I think it is trying to look at what is priced.

If expectations climb to 6 or 7%, then we will again be heading lower. Again, not just PTA would take a hit but the entire market, especially fixed-income type investments.

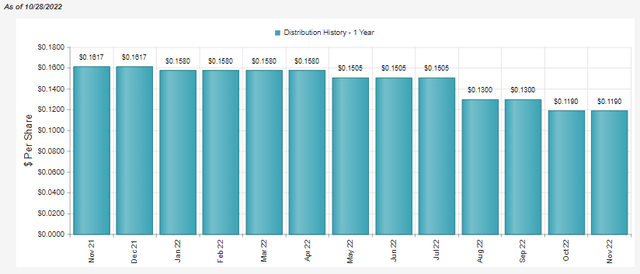

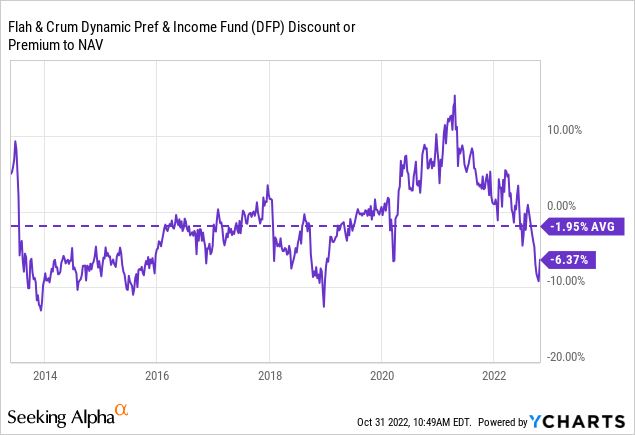

Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP)

DFP was picked up for similar reasons. However, their approach is a bit different. Instead of PTA just paying out a level distribution – even though the coverage is coming in shy – DFP and the other Flaherty & Crumrine funds look to payout only income generated. That typically means they will adjust their distributions more frequently. That’s exactly what we have seen, too, as the fund has reduced its distribution on several occasions through 2022.

DFP Distribution History (CEFConnect)

They are earning less because the costs of their leverage are also rising. It isn’t because the preferreds are paying less. They aren’t hedged with interest rate swaps that could have been keeping some of their leverage expenses fixed. As a side note, PTA is leveraged but largely hedged through interest rate swaps.

With increasing rates come increasing yields. However, the leverage expenses hit the fund first. Then over the coming years, their portfolio can adjust to higher yields. This would come from turnover in their portfolio, and fixed-to-floating rate preferred kicking in.

While all this is happening, the fund has been pushed to quite an attractive discount. This is especially true relative to the last couple of years when the fund traded at a premium regularly. Prior to the COVID crash, the fund was even trading near parity with its NAV.

Ycharts

In a different interest rate environment, it perhaps is trading at a deserved discount. I definitely concede that, but that doesn’t make it any less appealing to pick up for a longer-term income-focused investor. At the end of the day, preferreds aren’t going away. They’ll continue to pump out dividends, and DFP will continue to invest in preferreds and pass that income along to investors through distributions.

Tekla Healthcare Opportunities Fund (THQ)

THQ has been a steady position in my portfolio for several years now. I’d even venture to consider this a core-type holding. It is a leveraged fund, but it is invested in healthcare-related names. These are some of the world’s largest healthcare-related names too.

Those are the types of companies that can be profitable no matter the current economic state. Looking to add further to healthcare, this is now my second batch of shares that I’ve picked up this year. The first time was in June.

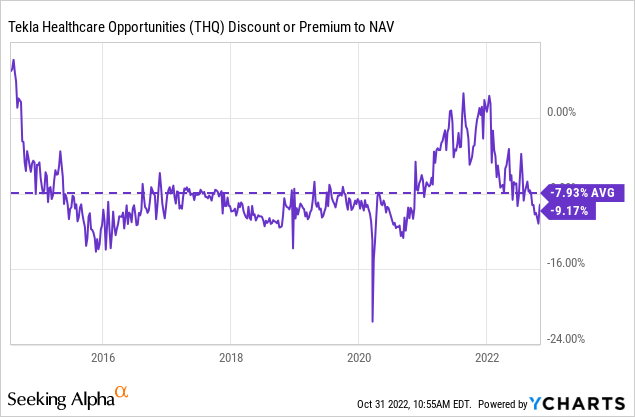

Similar to DFP, the fund seemingly benefited from trading at a higher relative valuation through 2020 and 2021. This has now been reversed but is still below its longer-term average.

Ycharts

A similar point for THQ that is relevant, as it was for DFP and PTA, is that the current environment will make its leverage more expensive to utilize. On the other hand, they also use a rather modest amount.

Conclusion

I wasn’t as aggressive with buying in October as I was in September. However, that was because when we reached new lows in September, I just put everything I could to work. Now, I was looking to rebuild my cash position to take advantage of new potential lows if they come. At the same time, every month, I buy at least something. For October, that included only names that were already in my portfolio. It also included two names that I have now bought in back-to-back months.

Be the first to comment