imaginima

A slowdown in housing prices will have myriad effects on today’s economy. Certainly, it is an indicator of slowed homebuying as mortgage rates rise. It also means destroyed household wealth, where real estate is where most of the household wealth is saved. It means a general fall in household spending, as mortgage rates rise and crimp on household incomes. It is usually a bad sign for the economy. But because of the interaction with supply chain issues and problems with economic productivity, there are some puts and takes, with new ways to play the housing slowdown besides getting very defensive. Therefore we offer four ideas connected to the slowdown in housing prices in order of speculative risk for investors to consider.

The Latest in Housing Markets

The latest in housing markets is that prices are finally getting cut, especially in places where the run-up was most aggressive. Rising mortgage rates are of course catching buyers in bad positions, and causing some shedding of investments as buyers re-assess their needs against affordability. Right now, it is unclear if what we are seeing is a correction or the beginning of a crash. With loan growth having accelerated these last couple of years, there is certainly a risk that LTVs are rising on a good proportion of loans that have been skewed towards recent originations. Currently, the corrections are amounting up to 15% in some major Californian markets, with other important US cities seeing a similar decline as well. No signs of a crash yet, but the interaction with household wealth is a concern, and is the reason why some are sounding the deleveraging alarm. If a deleveraging happens, no position is safe except for shorts against the market. We think a deleveraging can be avoided, but at the cost of cycles in the goods and housing markets, likely taking down inflation at the cost of economic growth. We don’t think there was much reason to raise rates, but it is happening, so how can investors position?

Income Ideas

While dividends, academically speaking, add nothing in terms of the return value, in a period like ours where we are dealing with complex economic forces that can be confounded by relatively fickle political forces, getting a head-start on returns with a dividend is a good idea. In order to do that successfully, we offer several stocks that produce dividends from an income base that is rather reliable over a bear market horizon of eight months to two years.

ING Groep (ING)

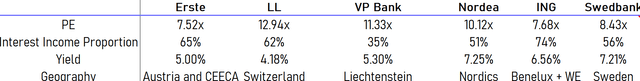

The first income idea is ING Groep. There are several things going for ING if you are considering it for an income play. The first is the size of the yield, which is at 7.5%. This somewhat closely mirrors the earnings yield, which is about 12% due to the very low PE multiple of 8.5x. The spread between those percentages represents the good earnings coverage of the dividend with a payout ratio that is not alarming.

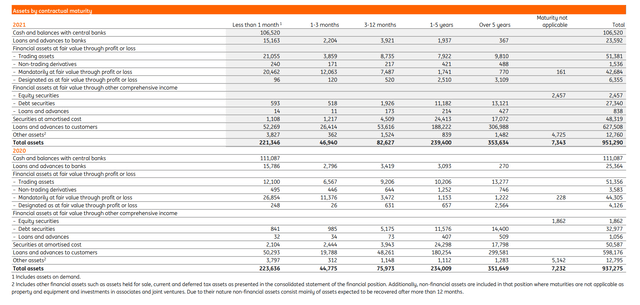

What are the forces undergirding the ING dividend? Firstly, consider that ING, compared to other European banks, benefits from a very high proportion of its income coming from interest as opposed to fee and commerce volume income.

This is preferable given recession concerns. The other thing that ING benefits from is that the loan growth of recent years, especially of mortgages, has been skewing toward longer-term assets. These assets are likely to be a substantially variable rate, although explicit disclosure is not given, so as rates rise in Europe as well, we should see an improving margin there. The risk to the thesis is slowing loan growth, but as said, the relatively healthy proportion of longer-term loans gives ING a runway before earnings direction becomes a concern.

ING Assets (Annual Report 2021)

Gaming and Leisure Properties (GLPI)

We go more into the thesis around GLPI in our other recent article, but it is worth mentioning here as a safe REIT income play in the current environment. With REITs typically outperforming in bear markets, and the regional casino footprint being particularly resilient in the US due to demographic, end-market and political factors, we think GLPI deserves quite a lot of credit as a safe haven. Rent adjustments annually keep it hedged from a degree of inflation as well as rate hikes. Moreover, the specialised assets have more of an asset value thesis than just the low-rate environment, for example, the need for online operators to partner with existing physical casinos and their associated licenses. It’s a good income idea for people that don’t want to take the risk of sitting on the sidelines, where REITs also outperform in the reversal of a bear market as well as in the down-cycle of the market. The 6% dividend yield is ample, and the history of paying it is great with the exception of pausing the dividend and making it a share dividend during the pandemic, but they can be excused for that given the exceptional exposure casinos had to that headwind.

Price Appreciation Ideas

While income is a good principle to weather a recession, we also offer some more speculative ideas that investors should consider that still relate to a housing price slowdown and higher rates.

Westlake (WLK)

The first is a building products idea. We continue to maintain that a cooling off of the goods market might end up being a good thing for building products companies. Interfor (OTCPK:IFSPF) has had to pause production, where sawmills used to be at maximum utilisation in 2021, because logistical bottlenecks made it impossible for customers to offtake the materials. Westlake, which provides finishing for houses, will also be hindered by logistical concerns. The added benefit that Westlake has over Interfor, where Interfor sells products into the earlier stages of the building cycle, is pent-up demand, because finishings are in short supply now because the building cycle is at the stage where it’s trying to complete inventory. With the housing shortage being a long-term secular problem in the US, exacerbated by zoning issues and politics, but also demographics such as late family formation by millennials, starting to kick in now, there will always be a demand sink for Westlake.

Westlake produces more specialised products as well as commodity materials for house finishings compared to total commodity building product companies like Interfor. Despite secular forces, they trade at less than a 5x PE multiple. We think this is an interesting opportunity for investors.

Dollar General (DG)

Dollar General is a very straightforward idea for the current environment. With a housing slowdown being inextricably connected with a hit to household wealth, since so much of households’ wealth is tied up in housing, discount retailers make sense for the consumer situation that is to come. Plummeting consumer confidence and the obvious onset of a recession is something that benefits Dollar General on two fronts. Firstly, its topline should be preserved if not a beneficiary from a decline in income. Moreover, its bottom line has been hurt by inflation. With rising rates eventually going to dent inflation, since the Fed has been clear that inflation cannot be allowed to continue (whether we agree or not), the bottom line should also incrementally improve.

Overall, DG finances are heading in the right direction given the economic environment.

Its financial profile is also quite strong. A 50% EBIT to FCF conversion is very respectable, especially nowadays where bloated inventories are a necessity given supply chain concerns and new supply chain management principles. These conversion rates are probably at a trough now and will only improve. The multiple is relatively full at 14x EV/EBITDA, but that is the price of getting a safe investment that in all likelihood will be one of the few equities that will grow in the current environment. With returns needing to outrun both rates and inflation in a stagflationary environment, the cost of growth assurances as well as incremental margin improvement will be elevated. But with 14x representing a relatively normal multiple in the risk-on environment preceding our current risk-off environment, it’s by no means a bitter price to pay.

Bottom Line

With the slowdown in housing prices coming together with higher rates and also destroying household wealth and disposable income, a recession is coming as well as a correction-turned-bear market in the stock market. Investors should be considering both technical protection from damaged returns in the choice of their securities, but also in the business models that underlie them. Income is a benefit now to get a head-start on returns where capital appreciation will be less reliable. REITs and interest-based income are attractive, as are inferior products. More speculatively, goods companies hampered by bottlenecks are a decent idea too, if they’re specialised to resist a commodity reversal with some pricing power. We offer an idea in each of these categories and think that among them are potential outperformers in a rather treacherous market environment.

Be the first to comment