Grafner

I am presenting a bullish 3D Systems (NYSE:DDD) thesis based on technical and fundamental analysis. I follow several 3-D Printing companies and did exceptionally well with them in 2021 by following my trading plan, a mixture of Elliot wave and competitive strategy analysis. This trading plan continues to perform well even in the difficult periods we are experiencing: the plan suggests that the time is right to rebuy DDD and hold for the next year or two.

The Technicals

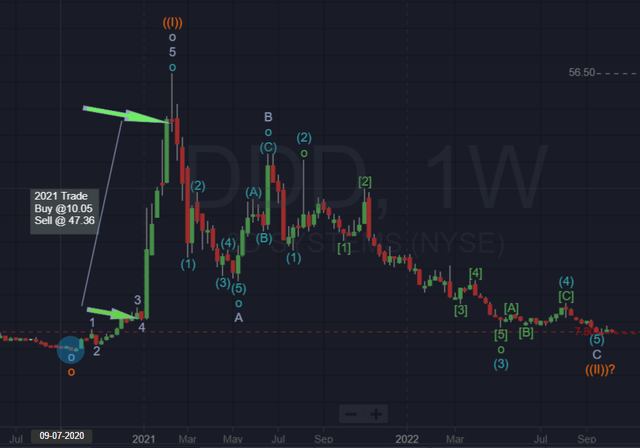

I use Elliott Wave theory to time the entry and exit of trades and as a way of confirming that the market agrees with my fundamental analysis. In the case of DDD, the technical chart is, in my view, quite compelling. The chart below suggests that a cycle-degree third wave higher is just beginning; the third wave is usually the strongest and most significant of the five waves in an impulsive move.

Weekly chart of DDD (Author)

This image shows the weekly DDD chart, highlighting my 2021 trade entry and exit points and the Elliott wave count I am using. The count suggests that wave ((ii)), an A-B-C corrective 5-3-5 Zig-Zag pattern, has, or is just about to, come to an end. If that is the case, the coming wave ((iii)) is likely to lead to a significantly higher price ( $119-$135); a price below $4.50 would suggest that the cycle degree pattern has failed and that a wave ((iii)) will not happen.

Wave ((iii)) may have already begun, and the subwaves of this impulsive move are beginning to form with wave 1?. A close below $7.8 would negate this view and mean that the correction is continuing, but it would not negate the entire pattern.

Daily chart of DDD showing subwaves (Author)

Technical analysis alone is not enough for me to take a trade. I need confirmation from both the competitive and valuation analysis.

Valuation Analysis

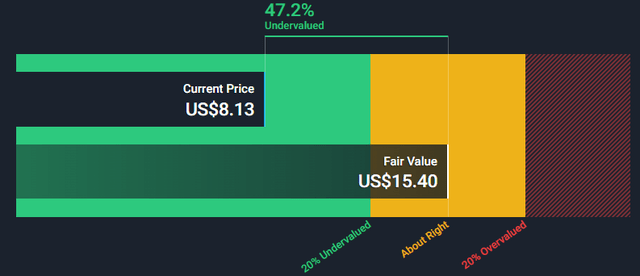

Four analysts provide forecast revenue and earnings for DDD; using their forecasts, Simply Wall Street calculated the following Fair Value price based on a two-stage DCF calculation.

DCF fair value of DDD (SimplyWall.st)

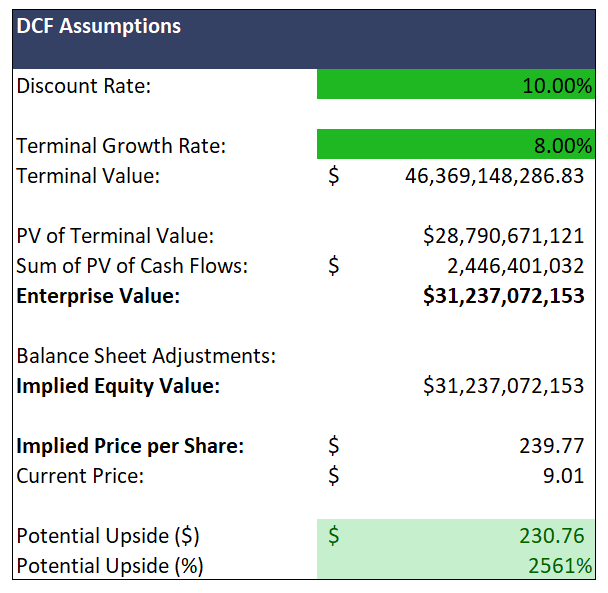

My own model gives the following value.

DCF Calculation (Author generated model)

That is a significant difference of $15 v $239 and reflects the value I place on the medical products DDD has recently announced; I will delve into this shortly.

Competitive Analysis

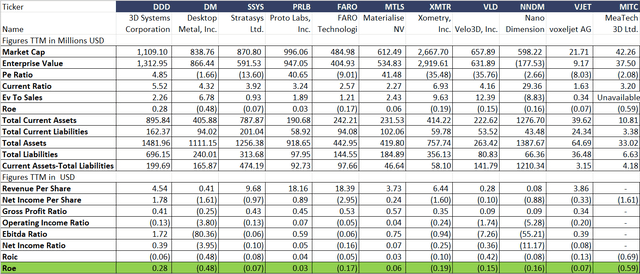

This table is a financial comparison of the 3D companies I follow; it is not an exhaustive list other 3D companies are available.

Key financial Comparison (Author (data SeekingAlpha))

It is clear from the table that DDD is in a strong position relative to these competitors; many have negative ROE, with just PRLB and MTLS just making it above the break-even line. The Ratio analysis adds some more weight to the technical analysis suggesting that DDD has a strong balance sheet and a profitable operation. However, it is not enough to take a trade.

We need a compelling argument for a product or service that will provide a meaningful change to the financial position of DDD. A change large enough to push its share price well above the $14 suggested by wall street analysts and towards the $119 presented by my technical analysis or even towards the $230 proposed by my mathematical model.

3D Systems R&D

DDD continues to develop new materials and release new printers to serve its core industrial markets; this month, they announced two new materials, Tough Clear and DuraForm Pax. Both are engineered to provide long-lasting mechanical performance and stability in any environment. The list of materials that can be 3D printed covers the entire spectrum. Metals (steel, Titanium, Cobalt-chrome, aluminum, nickel, and many alloys), Plastics (more than 100 materials covering all applications), Casting, Jewelry, and Dental. It is by far the most comprehensive list of the companies I follow.

DDD also released a new printer the SLA 750, using the DDD-invented stereolithography method. It is a high-speed production-ready large format printer. DDD has more than 1000 patents protecting their inventions.

The range and quality of DDD printers and materials have led to them being the market leader worldwide and the most profitable of the 3d printing companies I follow.

Wall street analysts used these new products and the ongoing development of materials to give the fair value of $14 per share. But, It is still not enough for me to take a trade.

The Big Idea

In January 2021, DDD announced its intentions to make significant investments into its medicinal bio-printing division, stating

tremendous progress in the development of 3D printing organ scaffolds.

In collaboration with United Therapeutics (UTHR), DDD established its Print to Perfusion platform, which it hoped would be capable of printing organ scaffolds on a chip for use in the drug testing industry. During 2020 DDD invested heavily in its Figure -4 Technology, which is used to print hearing aids, by developing new materials and collaborating with several cell development companies, including CollPlant (Israel) and Antleron (Belgium), specialists in cell development and regenerative medicine.

In June this year, with its partner United Therapeutics, DDD presented the most complicated object ever printed, a complete human lung scaffold. The lung consists of 44 trillion separate droplets that produce 4,000Km of pulmonary capillaries. Research continues with this technology as the scaffold is perfused with human stem cells making it a key tool for research into lung disease.

Last month we learned the division was becoming part of a new subsidiary called “Systemic Bio.” Systemic Bio will include the Print to Perfusion program as well as Allevi, another subsidiary of DDD that concentrates on providing BioPrinting for research organizations worldwide and currently has more than 500 Labs using its products.

With the $15 million of capital provided by DDD, Systemic Bio intends to utilize its products and its ability to print vascularized organ models from human cells and has stated that it expects $100 million in annual revenue from these products by 2027.

It takes three weeks to print a lung scaffold which DDD intends to cellularize with a patient’s own stem cells reducing if not eliminating the possibility of rejection when these organs are transplanted into the patient.

Initially, Systemic Bio will be selling its organ on a chip platform to help drug discovery companies. The new printers and gel materials represent a ten-fold improvement on what is currently available. They will be infused with human cells from specific organs allowing companies to look in detail at the pharmacological changes brought about by any new compounds they wish to test. This will likely both speed up the drug discovery programs of large bio companies and improve the safety of new compounds.

The company is already involved in the lung transplant industry, providing ex-vivo lung perfusion, which extends the life of donor lungs by several hours. The 3D-printed and perfused lung has enormous potential, and animal models are currently demonstrating gas exchange.

3D Printed Human Lung Transplants

DDD has suggested that, with this technology, they are close (within five years) to 3D printing human organs for transplants.

DDD intends to have a clinical trial of 3D-printed lung transplants by 2025. At present, 2,500 American people receive a lung transplant each year, 1000 are on a waiting list, and around 130,000 Americans die each year from Lung Cancer. Three million people die each year of chronic pulmonary disease, making it the third largest cause of death worldwide.

The income from this potential product accounts for the difference between the fair value produced by my mathematical model and that of Simply Wall Street.

Risks

The whole 3D printed lung might not materialize, we have heard the 3D organ printing in 5 years claim once before Organovo claimed they were within five years of this goal back in 2018, but they failed to generate definitive proof of concept statistics and in 2021 shelved the plan.

In this case, my $230 DCF target would fail, and the next target would be the $119 technical forecast. I would never trade on a technical signal alone, so we would revert to the $15.40 target derived by Simply Wall Street from Analyst forecasts. These forecasts rest on the solid financial position of the now profitable DDD. Will DDD achieve this if the world continues to move towards high inflation and a recession economy? It is challenging to say supply issues support 3D printing parts and tools rather than buying them from other companies and countries. However, it is an expensive technology that requires a highly skilled workforce to operate.

3D Bioprinting Competitors

Bioprinters (by this, I mean printers capable of printing living cells) are being used in pre-clinical drug testing and academic research institutes. The market leaders are Cellink (Boston), founded in 2016, offering a wide range of materials and six different printers. Advanced Solutions Life Sciences, founded in 2010, offers high-end and basic bioprinters. The DDD subsidiary Allevi is probably the market leader, offering a wide range of printers and materials.

At present, only DDD has formerly committed to the attempt to 3D print full lungs as the competition concentrates on supplying the drug discovery industry with specific cells.

Conclusion

I am buying DDD. The technical analysis provides a compelling risk-reward trade on an industry-leading company that has achieved profitability with an outstanding product range. The potential of the new bio-printing subsidiary is transformational. We could see the share price take off from these levels, and I have taken a significant position. I exited my positions in (LRN) and (FREY), which have been excellent trades this year, to fund this new position.

Be the first to comment