Page Light Studios

There’s a restaurant in my hometown of Spartanburg, South Carolina, you may have heard of. Some call it world famous, and to some degree it is.

It’s definitely famous in my neck of the woods.

Here’s how it describes itself online:

“Welcome to the Beacon Drive-In, a famous Southern landmark since 1946! We’re known for our Chili-Cheese A-Plenty, a chili-cheeseburger buried underneath piles of sweet onion rings and French-fried potatoes.

Other favorites at the Beacon include our Sliced Pork A-Plenty, BBQ hash, and The Pig’s Dinner, a loaded banana split.

We’re also home to the ‘World Famous’ Beacon Iced Tea – “Southern Style”: generously sweetened, with a splash of lemon, served in a cup packed with shaved ice. We sell more tea than any other single restaurant in the U.S.A.!

The Beacon Drive-In is one of the few remaining legends that offer curb service. Cruise on in and let one of our friendly curb hops take your order.”

If that sounds something less than healthy, let me point you to their salad menu. They have seven of them, all told:

- Chef salad

- Small chef salad

- Grill chicken salad

- Fried chicken finger salad

- Homemade fresh chicken salad on a garden salad

- Garden salad

- Small garden salad

Admittedly, I don’t know why they offer those options. I don’t think I’ve ever gone there before and asked for a salad.

Why bother when I can get a salad from anywhere… but there’s only one place to go for “A-Plenty.”

Exactly What to Order (Every Once in a While)

Being at least somewhat health conscious, I can’t say I eat at Beacon Drive-In – which incidentally has seated options – too often. But I have been there more than once.

I’ll leave my count at that, especially considering the following review by Randall S. on Trip Advisor… which I completely agree with:

“If you’re visiting Spartanburg from just about anywhere… your trip is not complete without a visit to the Beacon. Classic hamburger shrine known around the world. In it its prime, they were shipping this stuff out from a helicopter pad that was across the street.

Although the original owners have sold it, it’s still a great place for a burger, fries, onion rings, their signature super sweet lemon tea, or whatever have you… WARNING… the “A-Plenty” plates are A LOT to eat… you can just about feed two people with one of these.”

I’ll also agree with the less flattering reviews about how greasy the food is.

But in my opinion, it’s delicious enough to eat every now and then. Sometimes, a man (or woman) just needs a little culinary indulgence.

Sometimes, it’s actually healthy to choose the less healthy choice.

Sometimes.

With that said, I’m happy there are plenty of foods that I truly enjoy and are beneficial. Like oatmeal.

Hey, it might be a bit on the boring side, but it’s comforting and reliable, all while providing:

- Antioxidants

- Vitamins and minerals

- Blood sugar reduction

- Cholesterol relief (in preparation for when I have a Chili-Cheese A-Plenty).

And that’s the short list. There’s a lot more to like about oatmeal than that, as I’ll touch on further below.

Healthy and Delicious Dividends

In that regard, I have to compare the following “dividends a-plenty” picks more to oatmeal than to anything from Beacon.

Even the salads. Because I can’t think of a single legitimate salad that I’d call “comforting.”

In fact, I’d have to say that high-flying stocks – including the meme variety that are now making a comeback – make for an easy comparison to Beacon’s menu.

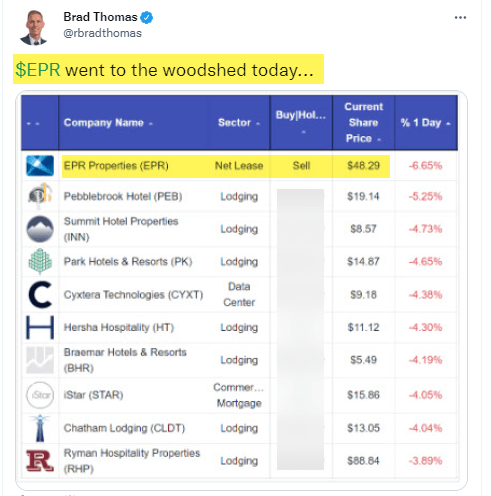

Note: Anyone jumping on EPR Properties (EPR) after the smackdown on Friday, as I posted on Twitter:

Twitter @rbradthomas

I’m not completely against speculating. When done in major moderation, they can satisfy your wild side and maybe even make you some money.

But they shouldn’t be the norm. Not even close.

The norm should be something that helps manage your weight (or weighting) so you’ve got the energy (or money) to do what you need to do. Something that encourages the good kind of bacteria throughout your digestive tract.

And something that (ahem) promotes proper waste removal as well.

I’m sure there are direct analogies to be made between healthy foods and healthy portfolio picks for those last two results. But you get the point regardless.

It’s important to make a habit of buying stocks that boost your financial abilities instead of weighing them down.

Both my research and experience tell me that means buying dividend stocks – including real estate investment trusts (REITs). The ones that keep rewarding their shareholders with extra income check after extra income check are worth it every time…

Even if they do mean your financial tastebuds aren’t quite so gratified in the moment.

Why Now?

The market is up approximately 17.8% from its lows.

Sure, the S&P 500 is still down 11.1% from its 52-week highs, but the fact of the matter is, a lot of the wonderful values that we saw a month or so ago have dried up.

That’s especially the case when we’re talking about blue chip REITs.

When it comes to macro sell-offs, the highest quality stocks are typically the last dominos to fall…and the first that the market props back up.

It wasn’t long ago that some of our absolutely favorite names, in terms of their iREIT IQ quality scores, traded below their fair value estimates.

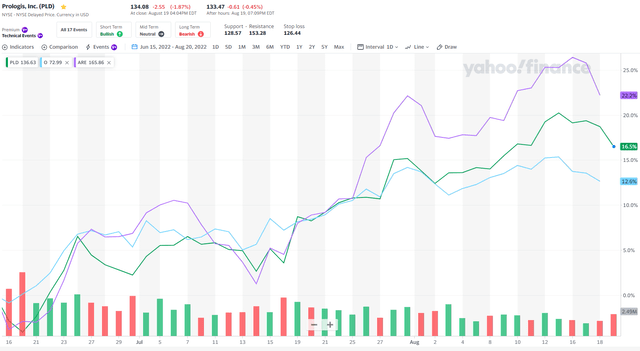

Alexandria Real Estate (ARE), Prologis (PLD), and Realty Income (O)…

…the only 3 stocks within the iREIT coverage universe with perfect 100/100 iREIT IQ scores were all cheap during the depths of the sell-off in early-to-mid-June.

Today, that’s no longer the case (spoiler alert, only one of these companies currently trades at an attractive margin of safety; we’ll discuss that opportunity below).

But, as the saying goes, the stock market is just that: a market of stocks.

Generally speaking, there’s always a deal to be had if you look hard enough.

Even though we’ve witnessed a macro rally over the last couple of months, there are still quality bargains for REIT investors to find.

This piece will focus on some of the highest quality stocks that we track that continue to trade with bargain price tags attached…and of course, they all have dividends-a-plenty!

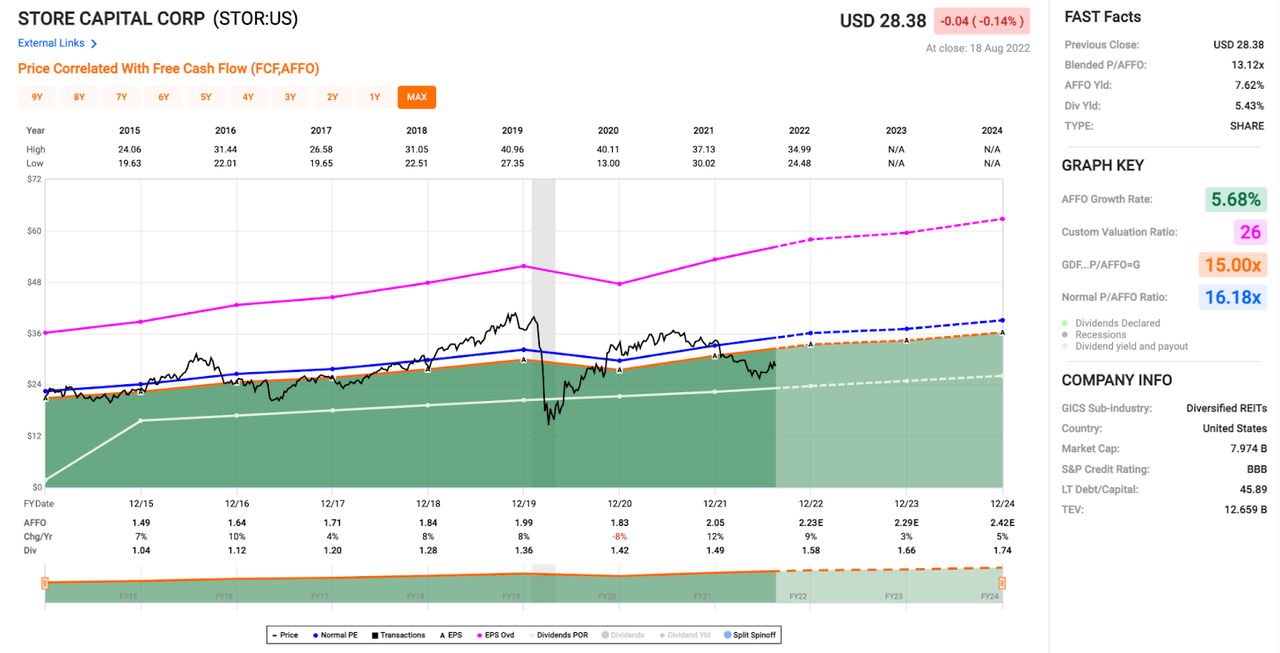

STORE Capital (STOR)

While STOR doesn’t hold the top spot in the triple net lease space (due to Realty Income’s 100/100) quality rating, it is definitely a blue chip stock.

STOR’s iREIT IQ rating is currently 92/100, meaning that it’s the 4th highest ranked REIT in the net lease subsector.

We recently covered the company’s operations in great detail in this 8/8/2022 report.

However, unlike its blue-chip peers in the space, STOR shares continue to trade at a discount.

Right now, STOR’s blended P/AFFO ratio is 13.1x.

On a forward basis, looking at 2022 full-year AFFO expectations, STOR is trading for approximately 12.8x.

As you can see below, both of these figures are below STOR’s historical P/AFFO average of approximately 16.2x.

FAST Graphs

This forward multiple is much lower than the 18.8x forward P/AFFO ratio attached to Realty Income, the 20.5x forward multiple attached to Agree Realty (ADC) shares, the 14.8x forward AFFO multiple attached to National Retail Properties (NNN) shares, and the 16.6x forward AFFO multiple attached to W.P. Carey (WPC) stock.

What’s most interesting about STOR’s discount is that the stock continues to boast some of the absolute highest AFFO growth prospects… and dividend growth prospects, in the net lease space.

STOR’s relative share price weakness has resulted in a 5.43% dividend yield (much higher than O’s 3.98% yield, ADC’s 3.44% yield, NNN’s 4.53% yield, and WPC’s 4.81% yield).

Furthermore, STOR’s relatively stronger fundamental growth over the last 5 years or so has resulted in higher dividend growth results than its peers as well.

STORE Capital’s 5-year dividend growth rate is 5.90%, higher than O’s 3.4% 5-year DGR, ADC’s NNN’s 3.4% 5-year DGR, and WPC’s 1.30% 5-year DGR.

Only Agree Realty beats STOR in the dividend growth department, with a 6.1% 5-year DGR.

All in all, when looking at STOR, we see a disconnect between the company’s operational results, its forward-looking growth projects, and the company’s recent share price movement.

These are the types of opportunities that we’re looking for in the market.

We recently launched 2 new portfolios at iREIT… the iREIT Total Return portfolio and the iREIT High Yield portfolio. And, because of the irrationally low valuation currently being applied to this blue chip, STORE Capital was included in both portfolios.

At $28.38, STOR maintains its “Buy” rating; we feel comfortable accumulating the stock up to the $32.30 level.

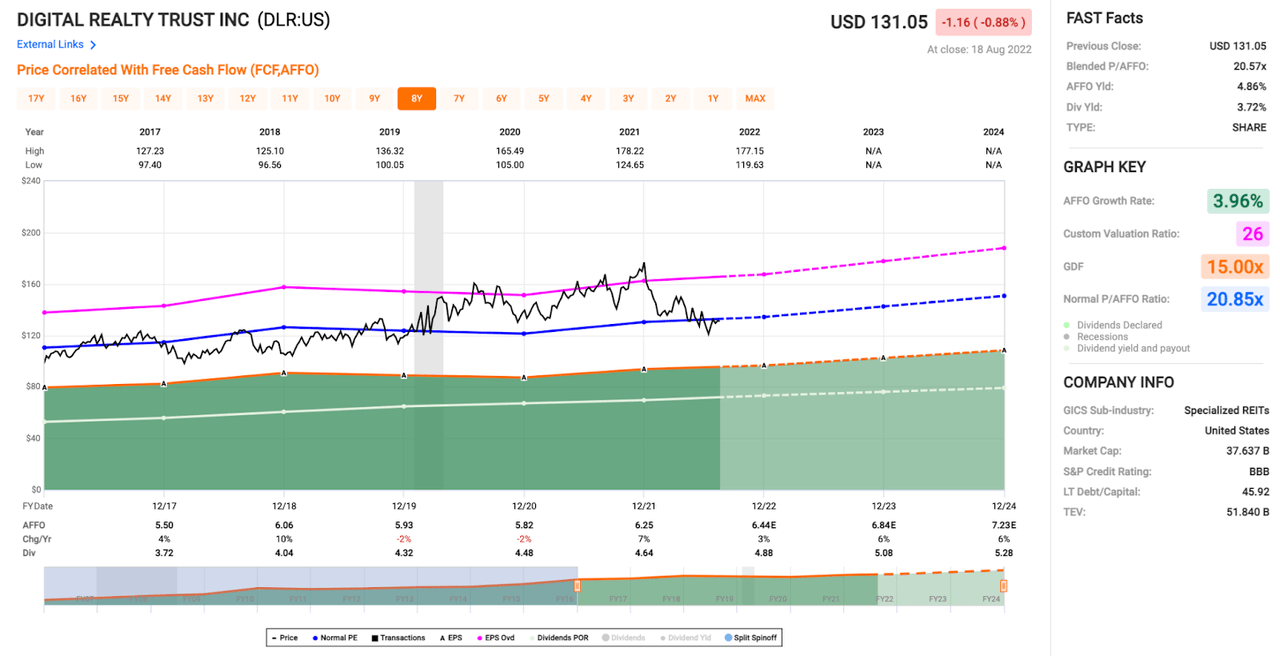

Digital Realty (DLR)

DLR is another blue chip REIT that we’ve covered extensively as of late, largely due to a recent short attack on the stock by famed investor, Jim Chanos.

We spilled a lot of ink debunking that short thesis.

We continue to be bullish on DLR’s growth prospects in the face of the hyperscaler threat. The company’s recent quarterly report showed strong demand in that area of its business. And, longer-term, even if leasing activity slows amongst some of the world’s largest cloud operators, we believe that broader data demand is going to propel DLR’s fundamentals, and therefore its share price, higher.

Like STOR, DLR is not the highest rated company in its subsector. The title of best-in-breed in the data center space currently goes to Equinix (EQIX). EQIX’s iREIT IQ rating is currently 95/100. However, DLR’s 90/100 score is definitely strong, putting the company firmly into the blue chip category

EQIX’s growth is quicker than DLR’s, hence the higher quality rating. However, DLR’s 3.63% dividend yield is well above EQIX’s 1.74% yield. Furthermore, DLR has the more impressive dividend growth history as well, with an 18-year annual dividend growth streak compared to EQIX’s 8-year dividend growth streak.

EQIX’s 5-year dividend growth rate of 10.4% is much higher than DLR’s 5.5% figure. However, even if this discrepancy persists, it will take quite some time for the compounding process to result in EQIX’s forward yield surpassing DLR’s.

In short, we suspect that income oriented investors will be drawn towards DLR, and at present valuations, we think that’s the right call.

FAST Graphs

After recent weakness (DLR has not yet recovered from the dip associated with the Chanos short), Digital Realty trades for 20.5x blended AFFO. DLR’s forward P/AFFO ratio, based upon full-year 2022 estimates, is 20.3x. This forward multiple is in-line with DLR’s 10-year average P/AFFO premium of 20.27x.

Furthermore, DLR’s forward multiple in the present is below the stock’s 5-year trailing average P/AFFO ratio of 20.85x.

And, with growth expected to accelerate in 2023 and 2024, we feel comfortable paying a historical premium for DLR shares at the moment (in the face of the Chanos short).

iREIT’s “Buy Up To” threshold for DLR is currently $155.00, implying a margin of safety of approximately 15%.

With that in mind, we believe that DLR has double-digit upside potential in the short-term. Any time we have the opportunity to accumulate a blue chip like DLR with a double-digit discount attached, we’re happy to do so. Therefore, it shouldn’t come as a surprise that iREIT gives DLR a “Strong Buy” rating at current valuations.

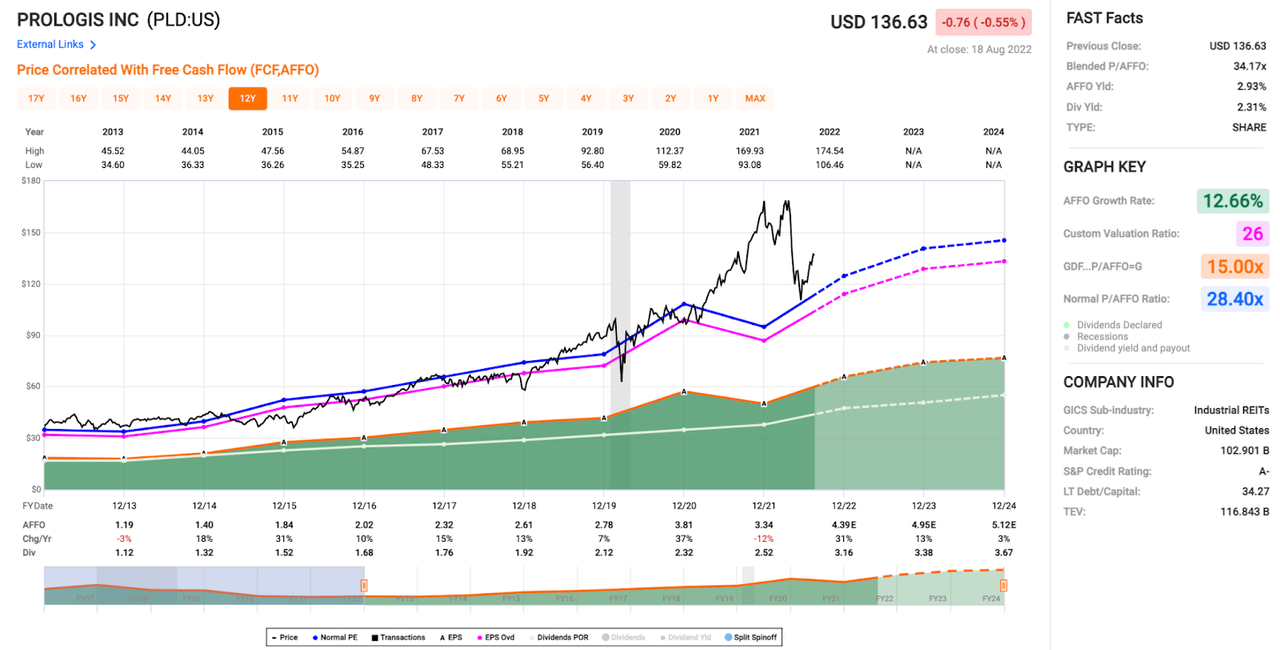

Prologis (PLD)

Finally, in terms of blue-chip holdings, we arrive at a true best-in-breed player: Prologis.

As previously stated, PLD’s iREIT IQ quality rating is a perfect 100/100.

PLD has been one of the biggest beneficiaries of the growth of the eCommerce industry over the last 5 years or so, and moving forward, we don’t expect to see that trend change.

In recent quarters, PLD has clearly shown the incredibly strong demand for its properties with unprecedented net effective rent growth of nearly 50% (during Q2, PLD’s U.S. net effective rent growth came in at 54%).

PLD also recently increased its 2022 occupancy ratio range, once again, proving strong demand for its industrial assets.

Even with such strong results in mind, we expect to see same-store NOI growth continue to rise here.

Negative headlines regarding retailers, their margins, and their abilities to cope well with the inflationary environment that we’re currently operating in has soured the sentiment surrounding PLD throughout 2022.

However, we’re more than happy to look past these short-term economic issues and instead, focus on PLD’s high quality operations and the company’s long-term growth prospects.

PLD shares are down more than 17% on a year-to-date basis, meaning that they’ve underperformed the broader market (and the real estate sector). This relative underperformance has created an attractive buying opportunity, in our estimation.

After its recent weakness, PLD trades with a blended P/AFFO ratio of 34.17x. Admittedly, this is a lofty premium; however, due to PLD’s strong growth history, the stock typically trades at a strong premium to the market.

PLD’s trailing 5- and 10-year average P/AFFO multiples are 28.1x and 28.0x, respectively.

Therefore, you might be thinking to yourself, why is iREIT so bullish on PLD if the stock is trading at a premium to its own historical averages?

Well, the simple answer is forward growth prospects.

FAST Graphs

In 2022, we expect to see PLD post AFFO growth north of 30%.

Therefore, on a forward basis (looking at 2022 estimates), PLD’s P/AFFO ratio is 31.1x.

We believe that PLD’s double digit growth trajectory will continue into 2023 as well, and with that in mind, our forward (looking at 2023 estimates) P/AFFO ratio here is just 27.6x.

PLD shares are up nearly 11% during the past 30 days which has diminished the margin of safety attached to shares a bit.

Yet, even after this double-digit rally, PLD offers a 9% discount to iREIT’s “Buy Up To” threshold of $150.00.

Looking back throughout PLD’s history…and especially during the post-2013 eCommerce boom where PLD has posted very consistent double digit growth…discounts here are relatively rare.

With that in mind, we remain pleased with the opportunity to accumulate this incredibly strong stock at a discount and certainly want to put it on investors’ radars (because frankly, we don’t expect for the sale to last).

Burger on me!

As I told members at iREIT on Alpha, whenever you get to Spartanburg, I will take you to the world-famous Beacon and buy you a Cheeseburger-A-Plenty.

For those of you who read my article today, I hope you enjoyed it, and perhaps I even inspired you to stay disciplined with your investment strategy and to focus on owning high-quality dividend stocks.

The takeaway focus is to always stay disciplined – whether its eating, investing, or driving your car to the grocery store. Ben Graham summed it up as follows,

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go. In the end, what matters isn’t crossing the finish line before anybody else but just making sure that you do cross it.”

See you soon at The Beacon!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment