tofumax/iStock Editorial via Getty Images

Introduction

I’m long McDonald’s Corporation (NYSE:MCD) with an average price per share of $133, closely monitoring its development as I’m keen to add additional stocks to my position. A brand known in any household across the globe, I’m confident in McDonald’s being with us looking several decades down the road. People will always need access to food on the go, or the easy alternative on a busy day, and that is exactly what McDonald’s can provide its customers with, while also having enriched its offerings, catering more to the café type customer within selected restaurants in larger cities. Carrying an incredibly strong and well-known brand, I’m feeling safe having the stock as one of my consumer discretionary positions.

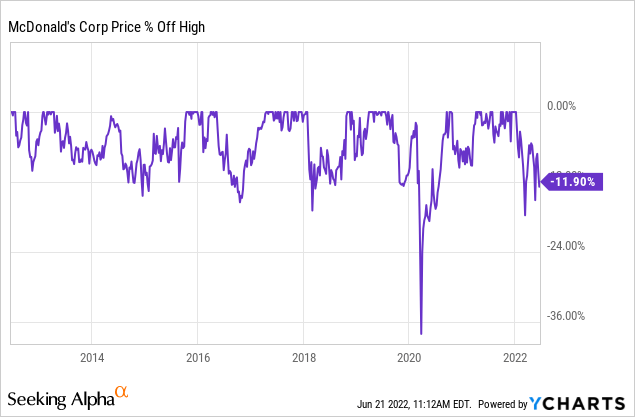

Despite being one of the most recognised and stable brands around the globe, I will not add to my position at any price during a pullback, and we still aren’t in buy territory as far as I see it. Here I’ll highlight three reasons as to why I’m still being patient despite the stock being down almost 12% YTD.

A pullback as the one we are witnessing right now, historically constitutes a buy opportunity, as the stock rarely experiences a drawback larger than the one, we are witnessing right now. However, there are reasons why I believe the stock could decline further, presenting a more interesting opportunity.

Reason Number 1: The Financials & Dividend

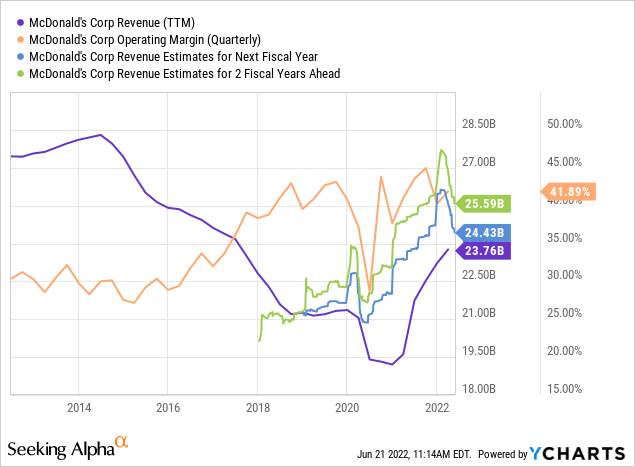

McDonald’s is in an interesting spot when it comes to its financials. The company has managed to increase its operating margin drastically in the recent decade, with it having appeared to stabilise just above the 40% mark. Perhaps, McDonald’s is in its prime financial condition when observed from a margin standpoint. With its “Accelerating the Arches” strategic plan, McDonald’s has managed to improve its operational efficiency by focusing on maximising its brand, committing to its core products and pushing digitalisation, drive thru and delivery. This has resulted in McDonald’s having become a very well-run and lean business, where cash flow conversion has seen unprecedented levels, for the benefit of shareholders.

The number of McDonald’s restaurants globally continues to grow, having crossed the 40,000 mark, but naturally, growth isn’t massive at this point, as the company is considered a mature business. Forward looking revenue estimates show low to mid-single digit revenue growth in the coming years, and the company is already at very high-income levels, suggesting the financial machinery can’t be fine-tuned much further.

McDonald’s will have strong leverage with suppliers due to its products and packaging being standardized globally, but at peak financial condition, it’s questionable if the company can continue to meet forward looking consensus earnings and revenue expectations, if a recession is awaiting around the corner, not to mention inflation. When companies are faced by recessions, they typically have to adjust their operating setup, meaning they don’t immediately bump back to prior profitability levels, but that it’s a gradual grind transitioning back to previous levels, while trying to balance the new demand picture up against an old cost structure.

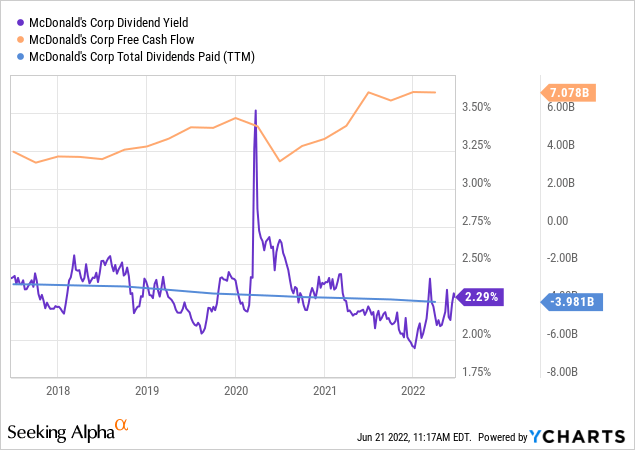

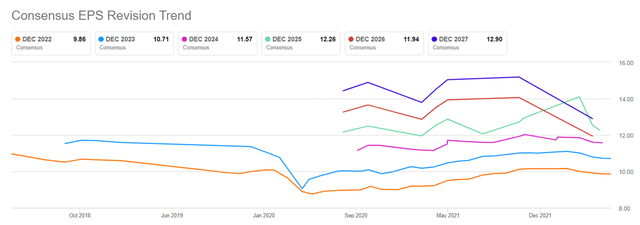

McDonald’s has managed to grow its free cash flow by an impressive 75% over the past decade, from $4 billion to $7.1 billion, as per the operational efficiencies already mentioned. This results in a payout ratio of 56% when measured on a free cash flow basis. The company currently has a dividend growth hiking streak of 13 years with a 5-year 7.9% CAGR, evidently committed to continuing the increases. However, if the operational efficiencies can’t be maintained or expanded, management will have to consider the dividend growth outlook in terms of balancing the hikes with the financial performance over time. Currently, the consensus EPS estimate for FY2022 is $9.85, and for FY2023 it’s $10.7, suggesting a continued expansion in earnings.

Given the uncertainty surrounding the global economy at this point, I’d like the stock price to reflect a substantial discount in regard to the initial yield. A forward yield of 2.36% doesn’t reflect an opportunity only experienced a few times during a decade. Personally, I have a requirement of only initiating a position with a company, if the dividend on a forward basis is 2.5% or better, with high growth dividend companies being the exception, and McDonald’s isn’t that exception given, where it is in its life cycle, as a mature company.

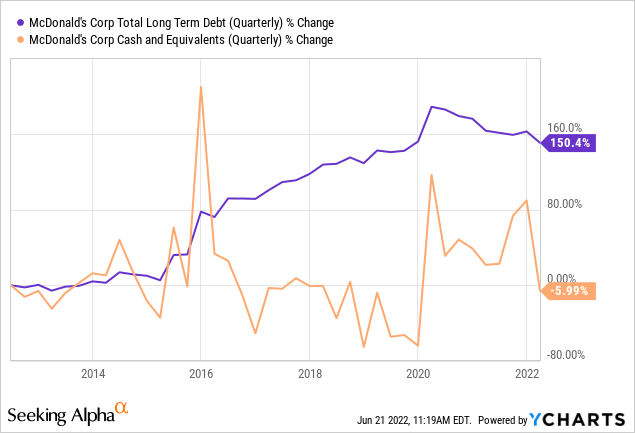

If I was to highlight one last point concerning the financials, it would be the development within the long-term debt, which has grown massively during the last decade, as management has taken advantage of the ample liquidity and low interest rates. Something that will also have to be dealt with at one point, typically as it becomes a growing headache due to rising interest rate levels.

Summarizing my financial observations, and while McDonald’s is a great brand that will remain relevant for decades, the stock price doesn’t currently reflect the discount I’d like to see in order to expand my position.

Reason Number 2: Being A Discretionary Company

I’ve already alluded to this point a bit, as McDonald’s is considered a consumer discretionary company. I don’t mind challenging that somewhat, as discretionary items typically would be durable goods, high-end apparel, vehicles, leisure activities and the like. However, McDonald’s is a restaurant chain with a substantial franchising business, and while restaurants may suffer somewhat during recessions, it’s probably not the $1 dollar cheeseburger of McDonald’s that suffers the greatest. On the other hand, consumer staples are notorious for holding up well during recessions, while discretionary companies lead the way out of the recession – McDonald is neither in pure form, so it’s sort of a grey zone, but at the end of the day, a recession doesn’t exactly do well for McDonald’s business overall.

As the stock market always looks towards the future, we can also see this effect in the forward EPS expectations, with twenty downwards revisions for EPS outlook in the most recent quarter, compared to six upwards revisions during the same period. Revenue wise, the situation is similar, the question then being whether we should expect further changes to the EPS and revenue outlook. That is not an unreasonable expectation, though I believe it’s worth keeping in mind McDonald’s grey-zone classification standpoint in the consumer category.

Ultimately, this ties back to the fact, that I’d like to see a substantial discount in the stock price, as disappointing earnings will come to impact the valuation, and again, the current stock price doesn’t reflect that discount.

Reason Number 3: The Valuation

McDonald’s is a mature business, with a stable outlook when it comes to how it’s revenue and earnings will behave – a natural valuation metric would therefore be the price to earnings multiple. Being a highly efficient machine with strong margins, that haven’t improved in recent years, carrying a substantial amount of debt in a rising interest environment while also belonging to the consumer discretionary category, I’m again emphasizing the need to require a substantial discount before being willing to go long the company. Potential downsides are lurking, and a reduced earnings outlook will result in an elevated price to earnings multiple.

The consensus stock price target amongst Wall Street analysts is $277 per share, representing a 18% potential upside, with the lowest price target coming in at $227, suggesting the stock shouldn’t have much further to go, as long as it can meet the current forward expectations when it comes to revenue and earnings.

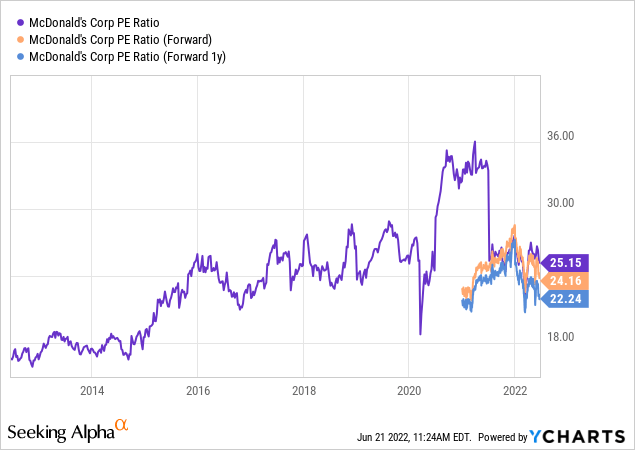

Currently, the P/E ratio comes in at 25.1, with the forward P/E being 24.2 and 22.2 when we are talking forward 1y P/E. Those levels are reserved for companies growing significantly, and McDonald’s isn’t it, at least not at the current time, while also potentially facing a slowing economy. It has been a very long time since McDonald’s traded at a P/E below 20, but that is where I’d like to see McDonald’s, in order for me to consider the drawdown substantial, ultimately suggesting a discount.

My Takeaway

McDonald’s is a great business, with an incredible global brand, and I’m long the company for a number of reasons, including those. We are told to be greedy during fearful times, but we still have to consider the business in question, as not every drawdown in an individual stock represents an opportune moment to go long.

From my personal standpoint, there are two metrics I’ll keep under observation, ultimately determining if it’s time for me to add to my position or focus elsewhere, and right now, we aren’t in buy territory.

First, depending on how the market develops in general, I’ll need to see the forward dividend cross 2.75%, which would require a stock price of $199 per share. Preferably, I’d like to see the stock cross 3% in forward yield, but in the current market environment I find that a bit too optimistic, but that would require a stock price of $183 per share.

Second, if I observe the situation from a price to earnings standpoint, my requirements become stricter. FY2022 EPS consensus expectations are $9.85, and FY2023 consensus expectations are $10.7, both of which I would expect to have a higher likelihood of experiencing a downside, than upside revision. For the stock to trade at a P/E of 20 for FY2022, it would require a stock price of $197, but for the stock to trade at a P/E of 18, it would require a stock price of $177, something that would require a significant sell-off in the broader index, beyond what we’ve already witnessed. Considering the outlook for McDonald’s over the long-term, I believe it is a mature company, meaning it shouldn’t trade at the P/E level it currently does, as those levels are reserved for high growth companies, and McDonald’s simply isn’t such a company. For the company to trade at a P/E of 18, when measured on FY2023 EPS expectations, it would require a stock price of $192.6.

My personal takeaway is, should the stock price find itself in the $190s, I would consider adding, depending on how the broader market is at the same time, as more interesting prospects could have turned up. However, at below $180 per share, I’d be very interested in adding to my existing position.

For now, McDonald’s doesn’t represent an interesting opportunity to go long, as there is a lacking margin of safety.

Be the first to comment