tamaya

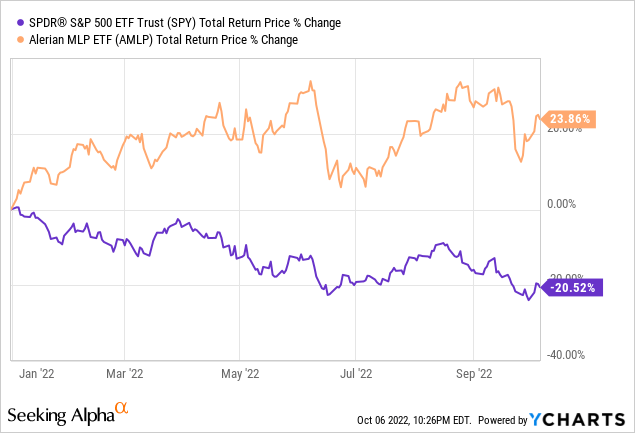

The markets are in turmoil right now, but energy midstream (AMLP) is weathering the storm quite well:

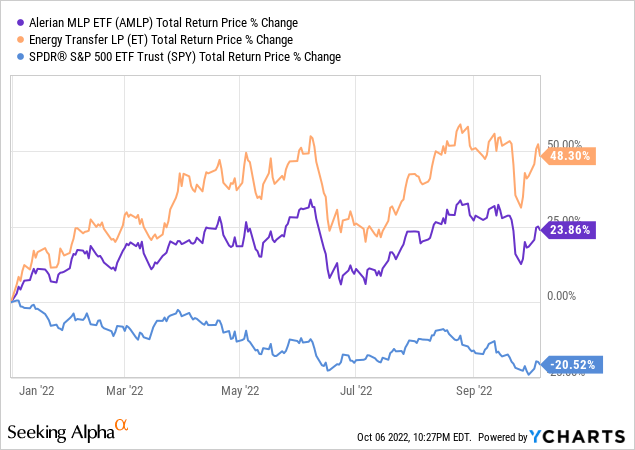

Energy Transfer (NYSE:ET) is performing particularly well this year, generating a total return of nearly 50% year-to-date:

In this article, we share three reasons why we think it will continue to outperform moving forward.

#1. Strong Stagflation Resistance

The biggest reason why we are bullish on midstream businesses like ET right now is that they are structured to weather stagflationary environments like the current one quite well. This is due to the following aspects of ET’s business model:

- It has a very stable cash flow profile, that makes it quite recession resistant. With 85-90% of its 2022E adjusted EBITDA expected to come from fee-based contracts, ET is quite resistant to commodity price and volume demand swings in the near term. This is why the business has generated relatively stable cash flow through previous economic downturns. For example, its distributable cash flow per unit went from $0.40 in 2007 to $0.55 in 2009, while its EBITDA also increased from $1 billion in 2007 to over $1.4 billion in 209. Similarly, during the energy price crash of 2018, ET performed quite well. In 2017, its EBITDA was $7.3 billion and in 2019 its EBITDA has grown to $11.2 billion, while its DCF per unit continued to grow at a robust pace as well. In 2020 – the worst energy market crash seen in a long time – its EBITDA did decline by 6.1%, but within a year it had soared higher, increasing from $11.2 billion in 2019 to over $13 billion in 2021.

- It is also quite inflation resistant, given that many of its pipeline contracts have inflation-related escalators attached to them. Furthermore, inflation has proven over time to push energy prices higher (similar to what we are seeing in the current environment). While in the short-term, ET is mostly immune to commodity price swings, it does see a small boost from rising energy prices in the short-term and in the long-term it benefits them by strengthening the balance sheets of their counterparties and ultimately driving higher demand for their services over the long-term.

- Perhaps the most underappreciated aspect of ET’s business model is the fact that its balance sheet is in an excellent position to weather the current market turmoil. While its credit rating of BBB- could be higher, in terms of its capital needs and cash flow profile, it is in excellent condition. The partnership is generating enormous sums of free cash flow, with $1.17 billion in excess cash flow after distributions generated in Q2 2022 alone. As a result, it can literally pay off its debt as it matures while also funding its CapEx requirements and pay a hefty distribution to unitholders. As a result, it has no dependency on the debt or equity markets and can ride out this period of rising interest rates and plunging equity valuations without concern.

#2. Significant Distribution Growth Ahead

While distribution growth may be somewhat stunted given the challenging nature of the debt markets at the moment (thereby motivating management to prioritize incremental debt reduction over incremental distribution growth), ET still enjoys excellent distribution growth prospects. As management has reiterated several times, restoring the quarterly distribution to its $0.305 level is a top priority and is also very achievable given their cash flow profile. In 2023, ET is expected to generate $2.57 per unit in distributable cash flow, which would cover a $1.22 annualized distribution by more than 2x, leaving plenty of cash flow for CapEx and some debt reduction.

The only two reasons that we can see why they would not pay out this amount next year are:

1. They choose to aggressively pay down upcoming debt maturities in order to reduce the risk that they would need to pay high interest rates on refinanced debt and also further de-risk the business’ long-term standing. We think this is prudent reasoning and would be fine with a slower distribution growth trajectory if this route was pursued.

2. They choose to make some aggressive acquisitions. As we noted in a previous piece, management made the following comments on its latest earnings call:

[We] expect our strong coverage and balance sheet strength to allow us to further prioritize growth within our capital allocation strategy…We also continue to evaluate opportunities in the petrochemical space, which would include developing a project along the Gulf Coast as well as potential M&A opportunities.

Kelcy gave us the directive that we need to step in to petchem, we certainly are doing that…from an M&A perspective, anything that’s for sale, we’ll take a look at pretty much like anything in the industry

Clearly, M&A is on their radar, so the need to pour cash into acquisitions will likely detract from distribution growth. Still, compared to their current $0.23 quarterly payout level, $0.305 implies ~33% upside, so even if they take two years to get there, that still implies a 15.2% distribution CAGR over the next two years. Coming off of a 7.8% yield, that is an excellent distribution growth rate.

It is also worth noting that in the case of either paying down debt and/or investing in M&A and other accretive growth projects, this should fuel greater DCF per unit growth over the long-term, which would only further strengthen their long-term distribution growth profile. No matter how you slice it, it looks like ET has double-digit annualized distribution growth in store for the foreseeable future.

#3. Deeply Undervalued

Last, but not least, ET remains deeply undervalued compared to peers as well as its own history despite its strong performance this year:

| MLP | P/DCF 23E | EV/EBITDA | EV/EBITDA (10-Year Average) |

| ET | 4.49x | 7.78x | 11.29x |

| EPD | 7.12x | 9.11x | 12.82x |

| PAA | 4.54x | 8.91x | 10.78x |

| MPLX | 6.56x | 9.17x | 12.36x |

| MMP | 8.33x | 10.36x | 11.06x |

The only company that comes even close to ET on the P/DCF metric is PAA, but ET is trading at a much steeper relative and historical discount on an EV/EBITDA basis on top of being much better diversified than PAA.

Investor Takeaway

While ET has already crushed the S&P 500 (SPY) this year, with near 50% total returns compared to the SPY’s ~20% decline year-to-date, it appears poised to continue delivering exceptional risk-adjusted value to investors. Between its stagflation resistant business model, strong cash flow position, double-digit annualized distribution growth outlook, and incredibly cheap valuation, it is hard to imagine underperforming over the long-run with this pick.

As a result, ET stock is a Top Buy for us at High Yield Investor, and we expect it to continue helping our Core Portfolio deliver a delicious combination of market-beating returns and dependable and growing high single digit income.

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger×

If you want access to our Portfolio that has crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with ~1,400 members on board and a perfect 5/5 rating from 145 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered.

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger×

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger×

Be the first to comment